New Federal Corporate Tax Rates – 2025 Updated

The corporate tax rate in the United States has changed. Starting in 2025, the federal government replaced the flat tax rate with a new tiered system. This update affects how corporations plan and pay taxes. It matters to small and large businesses alike, especially those who are subject to tax under the new rules.

What Is the Corporate Tax Rate?

The corporate tax rate is the percentage a business pays on taxable income. This rate applies only to C-corporations. These are limited liability companies taxed as separate legal entities. C-corporations pay taxes on net income. Net income is what remains after subtracting business expenses, wages, and other deductions. The tax rate is fixed nationwide, though state rates differ. The corporate tax system is designed to ensure that businesses contribute to the tax base while accounting for their gross receipts

2025 Federal Corporate Tax Rate Brackets

Before 2025, all C-corporations paid a flat 21 percent federal tax on corporation income. That rate now depends on how much taxable income the business earns.

Here is the new structure for 2025:

- $0 to $50,000 is taxed at 18 percent

- $50,001 to $100,000 is taxed at 21 percent

- $100,001 to $250,000 is taxed at 24 percent

- Over $250,000 is taxed at 28 percent

This is the current Federal Corporate Income Tax Rate structure. The new rate applies only to income earned in the fiscal year starting January 1, 2025.

Why the Federal Corporate Tax Rate Changed

The government needed more tax revenue. It also wanted to give smaller companies some relief. The flat 21 percent rate placed a heavier burden on lower-income businesses. The tax cuts and jobs act aimed to balance tax reform by reducing the burden on smaller companies. With this new model, businesses that earn less pay a lower tax rate. Companies with higher profits pay more as their income grows.

Example: Small Business Tax Savings

Let’s say a small business earns $60,000 in taxable income. Under the old system, it would pay:

- $60,000 × 21% = $12,600

Under the new 2025 structure:

- First $50,000 × 18% = $9,000

- Next $10,000 × 21% = $2,100

- Total tax = $11,100

That’s a savings of $1,500. This amount can now be used for operational costs. This new structure aligns with the objectives of tax cuts and jobs reform by offering tax relief to small businesses.

Example: Larger Corporation Pays More

Now consider a company with $500,000 in taxable income. Under the old rate:

- $500,000 × 21% = $105,000

Under the 2025 brackets:

- First $50,000 × 18% = $9,000

- Next $50,000 × 21% = $10,500

- Next $150,000 × 24% = $36,000

- Final $250,000 × 28% = $70,000

- Total tax = $125,500

That is an increase of $20,500. Businesses at this level will need to adjust forecasts and plan for the higher rate.

What remains unchanged in the New Federal Corporate Tax Rate of 2025?

Deductions and credits still apply. Businesses can lower taxable income using qualified expenses, such as:

- Equipment depreciation

- Health insurance for workers

- Office rent

- Business travel

- Software or service subscriptions

- Charitable contributions

Credits reduce the tax owed. Popular ones include:

- Research and development credit

- Clean energy investment credit

- Veteran hiring credit

These tools help lower the effective tax rate. That means a company may still pay less than the stated bracket amount after applying for these benefits.

State Corporate Income Tax Still Applies

Most states also charge a corporate income tax rate. Some use flat rates, while others use their own brackets. A few states, like South Dakota and Wyoming, charge no corporate tax. Businesses must also consider how state taxes affect their overall tax liability, as these are still subject to tax at the state level.

Here are examples of current state rates:

- California: 8.84%

- New York: 7.25%

- Texas: 0% (franchise tax applies instead)

Businesses must pay both state and federal taxes unless located in states with no corporate tax. The combined total can reach 30 percent or more in some places.

How the IRS Handles the Change

The IRS updated forms and software to match the new tax brackets. Corporations need to make sure they use the latest tax returns tools for calculating estimated payments. It’s also important to track gross receipts and report them accurately. The IRS has become more vigilant, especially when large corporations attempt to reduce their tax liability in ways that may raise red flags.

Planning Tips for Businesses

Companies should take action now to stay on track:

- Estimate your 2025 taxable income

- Use the correct bracket for each income tier

- Apply all eligible deductions and credits

- Adjust estimated payments for the higher or lower rates

- Keep records clear and organized

Meeting with a tax advisor may help. Every business has different income patterns, deductions, and needs.

Even after the 2025 change, the United States does not have the highest corporate tax rate. Some countries tax corporations at a lower rate, but many others go higher when local taxes are added.

The combined federal and state corporate tax rate in the US now ranges from 25 percent to 32 percent, depending on location. This keeps the US in line with other major economies.

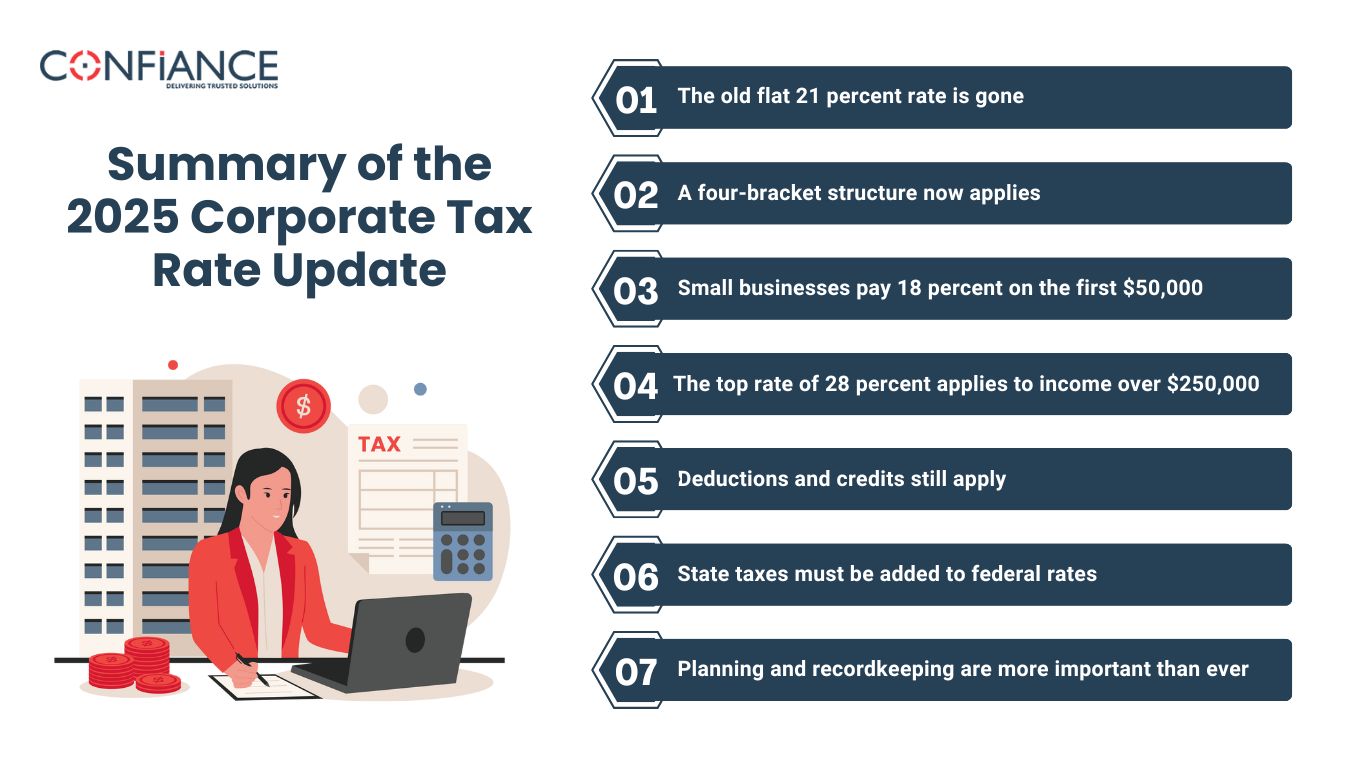

Summary of the 2025 Corporate Tax Rate Update

- The old flat 21 percent rate is gone

- A four-bracket structure now applies

- Small businesses pay 18 percent on the first $50,000

- The top rate of 28 percent applies to income over $250,000

- Deductions and credits still apply

- State taxes must be added to federal rates

- Planning and recordkeeping are more important than ever

Businesses should not wait until year-end to review their tax position. Knowing where your income falls under the new system can help protect cash flow and avoid penalties.

Every dollar saved on taxes can support your business in more useful ways. Plan now, track your numbers, and keep your filings accurate. If you need help with your US tax filing, Confiance is ready to help with tax filing and return services.

FAQs

What is the federal corporate tax rate in 2025?

The federal corporate tax rate in 2025 is based on income brackets. It starts at 18 percent and goes up to 28 percent.

How is the new corporate tax rate structured?

The rate depends on how much income the business earns. Lower income is taxed at lower rates. Higher income is taxed at higher rates.

Who pays the federal corporate income tax rate?

Only C-corporations pay the Federal Corporate Income Tax Rate. Other business types are taxed under personal tax rules.

Does the new tax rate help small businesses?

Yes. Smaller corporations pay less tax on their first $50,000 of income. This lowers their total tax bill compared to the old flat rate.

Did the corporate tax rate increase in 2025?

Yes. The top rate increased to 28 percent. It only applies to income above $250,000. Lower income is taxed at lower rates.

What is the corporate income tax rate for large companies?

Large C-corporations pay more under the new structure. Income over $250,000 is taxed at 28 percent. Lower brackets still apply to the earlier income.

Can companies reduce their corporate tax rate?

Yes. Companies can lower their corporate income tax rate by using deductions and credits allowed by law.

Do state tax rates change in 2025?

No. The federal corporate tax rate changed, but state corporate tax rates stay the same. Each state sets its own rate.