Common Mistakes to Avoid When Filing a T2 Tax Return

Filing a T2 tax return is required for all corporations in Canada, except registered charities. It shows the Canada Revenue Agency (CRA) how much tax your business owes. While the form itself is clear, errors happen often. These mistakes can lead to penalties, delayed processing, audits, or reassessments. Understanding where businesses go wrong helps you avoid stress later.

This guide lists common mistakes when filing the T2 Tax Form. It also explains what each error means and how to avoid it. Whether you use accounting software or file manually, following these points will keep your T2 tax return clean and compliant.

1. Filing Late

One of the most frequent mistakes is missing the T2 tax return deadline. The form is due six months after the end of your fiscal year. Many businesses forget that the T2 Tax Form must be filed even if they owe no tax or have no income.

Failing to file on time results in a late-filing penalty. The CRA charges 5% of the unpaid tax plus 1% for each full month the return is late, up to 12 months. If you’ve been late before, the penalty can double.

How to avoid:

- Mark your fiscal year-end clearly.

- Set calendar alerts for your filing date.

- File early if possible.

2. Using the Wrong Year’s Form

CRA updates forms often. If you download the T2 Tax Form from an old source or reuse last year’s software version, you might file with outdated rules or rates. This leads to errors or rejection.

How to avoid:

- Use CRA-certified tax software that pulls the latest forms.

- Check the CRA website before downloading the form.

3. Not Reporting All Income

Failing to report all sources of income is a serious issue. Some businesses forget interest, investment gains, or income from related companies. Omitting these will cause problems if the CRA finds a mismatch.

How to avoid:

- Keep detailed records from all sources.

- Match your bank records and accounting books with your return.

- Include foreign income if it applies.

4. Incorrect Business Number or Name

Even small errors like spelling the company name wrong or using the wrong business number can delay your T2 tax return. The CRA uses these details to match your return with their records.

How to avoid:

- Double-check your business number.

- Make sure the legal name on the T2 Tax Form matches your CRA account.

5. Claiming Ineligible Deductions

Some businesses try to reduce taxes by claiming deductions that do not apply. For example, meals, entertainment, or personal expenses are often over-reported or misclassified.

How to avoid:

- Know the rules for what counts as a business expense.

- Keep all receipts.

- Use accounting software that helps tag expenses properly.

6. Not Filing All Required Schedules

The T2 tax return comes with several schedules. Each one captures details for specific cases, like capital gains, manufacturing credits, or investment income. Some businesses skip these, thinking they’re not needed.

How to avoid:

- Review your activities during the year.

- Include all relevant schedules.

- Let an accountant check if you are unsure.

7. Misreporting Capital Cost Allowance

Claiming capital cost allowance (CCA) wrong is a common issue. Some claim it on assets that are not eligible or apply the wrong rate. Others claim it too early, which triggers adjustments later.

How to avoid:

- Track each asset’s class and purchase date.

- Use CRA tables to get the correct rate.

- Wait until the asset is available for use.

8. Ignoring Loss Carryforwards

Businesses that lose money in a year can carry that loss forward to reduce future taxes. Some companies forget to report this, which means they miss the chance to save later.

How to avoid:

- Track losses in prior years.

- Use Schedule 4 to report loss carryforwards.

- Update your tax file each year with this information.

9. Missing the GIFI Codes

General Index of Financial Information (GIFI) codes are part of the T2 tax return. They are used to classify financial data. Wrong or missing GIFI codes make your return hard to read and can trigger CRA reviews.

How to avoid:

- Use GIFI codes from the CRA’s official list.

- Make sure your codes match your financial statements.

10. Not Reconciling With Financial Statements

Some returns show different numbers than the financial statements filed with them. This happens when the T2 Tax Form is filled manually or with software not tied to your accounting system.

How to avoid:

- Reconcile the T2 form with your year-end financials.

- Keep a trail of all adjustments.

- Use software that links the tax return and financials.

11. Failing to Pay the Balance on Time

Filing the T2 tax return does not mean the tax is paid. The payment is due two months after your year-end, or three months if your corporation qualifies for the extended deadline. Late payment causes interest charges, even if the form was filed on time.

How to avoid:

- Mark both dates: filing deadline and payment due date.

- Set reminders.

- Pay electronically to avoid mail delays.

12. Overlooking Tax Credits

There are many federal and provincial tax credits available to corporations. These include SR&ED, apprenticeship credits, and training incentives. Failing to claim them leaves money on the table.

How to avoid:

- Review all business activities.

- Research credits that apply to your industry.

- Use schedules like T2SCH31 for SR&ED or consult a tax expert.

13. Incorrect Transfer Pricing Details

If your company deals with related entities outside Canada, transfer pricing rules apply. Failing to report or document related-party transactions can lead to audits and penalties.

How to avoid:

- Maintain clear records of all intercompany deals.

- File Schedule 25 and other required reports.

- Follow arm’s length pricing methods.

14. Forgetting to File Nil Returns

Even if your corporation did not do any business during the year, you must still file a T2 tax return. Many inactive corporations forget this and end up with non-filing penalties.

How to avoid:

- Track all corporate accounts, even if dormant.

- File a nil return if required.

15. Poor Recordkeeping

Sloppy or missing records are at the root of most T2 tax return errors. They make it hard to support your claims and easy to miss key entries.

How to avoid:

- Keep all source documents: receipts, invoices, bank statements, and contracts.

- Use accounting software to stay organized.

- Keep records for at least six years as per CRA rules.

16. Not Updating CRA Records

Your T2 Tax Form may be rejected if your contact details, address, or directors list is outdated. The CRA needs current info to reach you with questions or notices.

How to avoid:

- Update CRA records through the My Business Account portal.

- Notify them when major business details change.

17. Relying Only on Software

Tax software helps, but it cannot replace judgment. Some users assume the software will flag every mistake or select every required form. It does not.

How to avoid:

- Understand what the software does.

- Cross-check entries manually.

- Get a second review if you’re unsure.

18. Not Keeping Audit-Ready Files

Your T2 tax return must be backed by records. If the CRA audits you, you’ll need to show proof of income, deductions, and tax credits. Many small businesses are not ready for this.

How to avoid:

- Keep records sorted by category.

- Store digital backups.

- Keep CRA correspondence filed with each year’s return.

19. Ignoring CRA Notices

If the CRA finds an issue with your T2 Tax Form, it sends a notice. Ignoring these letters causes further problems. Interest keeps growing, and you miss the chance to respond or fix the error.

How to avoid:

- Check your CRA mailbox regularly.

- Read each notice in full.

- Reply before the deadline.

20. Not Asking for Help

Some businesses try to handle everything in-house, even if no one knows how to file a T2 tax return. Errors made from lack of knowledge end up costing more than professional help.

How to avoid:

- Ask a certified accountant or tax advisor if unsure.

- Consider a review before submission.

- Keep learning the rules if you plan to file on your own.

Filing a T2 tax return is not optional for corporations in Canada. The T2 Tax Form must be filled out with care, accuracy, and full understanding. Mistakes lead to penalties, audits, or interest that could have been avoided with better planning.

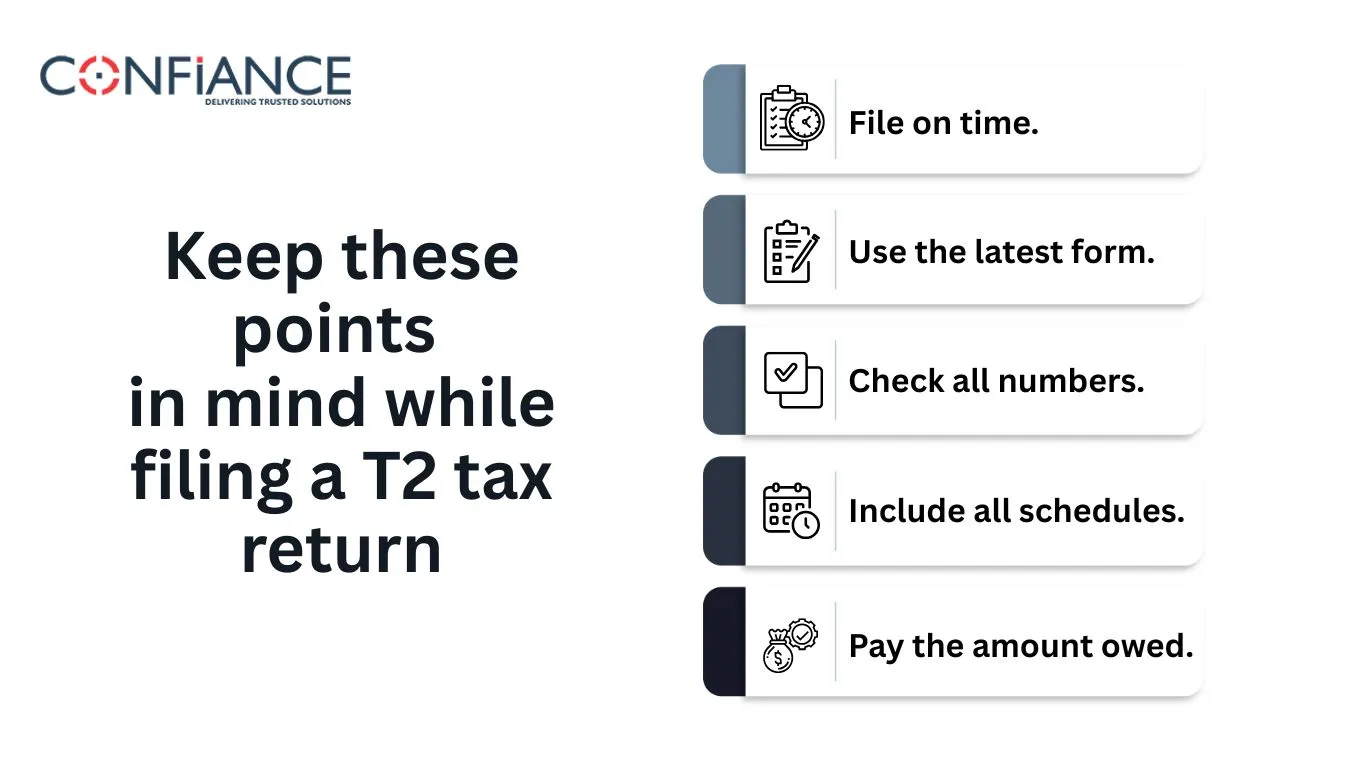

Keep these points in mind while filing a T2 tax return:

- File on time.

- Use the latest form.

- Check all numbers.

- Include all schedules.

- Pay the amount owed.

Good records and attention to detail are your best tools. Use tax software wisely, keep your financials up to date, and do not hesitate to get expert help. Avoiding these common mistakes will help you stay clear of problems and focus on growing your business.

FAQs

1. Who is responsible for filing a T2 tax return in a corporation?

The directors or officers of a corporation are responsible for ensuring the T2 tax return is filed accurately and on time, even if a tax professional prepares it.

2. Can a newly incorporated company skip its first T2 tax return?

No. Every corporation must file a T2 tax return, even if it has not started operations or earned income during the fiscal period.

3. Is it mandatory to file a T2 tax return electronically?

Yes, if your gross revenue exceeds $1 million. The Canada Revenue Agency requires electronic filing for most corporations above this threshold.

4. Does a corporation need to file a T2 tax return if it was dissolved during the year?

Yes. A final T2 tax return must be filed covering the period from the start of the fiscal year to the date of dissolution.

5. What happens if I file an incomplete T2 tax return?

An incomplete return may be rejected or flagged for review. This can result in delays, requests for more documents, or penalties for non-compliance.

6. Can I amend a T2 tax return after filing it?

Yes. You can file an amended return if you notice errors or omissions. This is done using the T2 Adjustment Request through CRA’s My Business Account or by mail.