How to Hire Offshore Tax Accountant for Your Business Success

Running a business brings many tasks. Tax work is one of the most important. Tax work needs accuracy, clear plans, and strict legal compliance. Many firms now hire offshore tax accountant professionals to handle this load. Offshore accounting reduces cost. It also gives access to skilled experts who handle complex tax needs.

This blog shows how to hire offshore accountant services the right way. It covers why firms hire offshore help, how to pick the right provider, and how to set up a safe and productive relationship.

Why Businesses Choose to Hire Offshore Tax Accountant Services

Outsourcing tax work to offshore teams is common. Firms of every size use offshore tax help to meet deadlines and keep cost under control. Below are the main benefits that attract firms to offshore tax accountant services.

Lower costs – Local payroll and benefits add up fast. Offshore tax accountants often work at lower rates. This cut in cost does not mean lower quality. You can save on payroll while keeping strong tax support.

Access to more talent – Offshore teams include certified and experienced tax staff. They often know multiple tax systems and tools. This wider talent pool fills gaps that are hard to fill locally.

Faster task turnaround – Offshore teams can take on time heavy tasks like tax filing and audits. This frees your local staff to focus on core business tasks. Work moves faster when tasks are split well.

Work across time zones – If your offshore team works while you sleep, tasks get done overnight. This creates a steady flow of progress and tighter deadlines.

Scalable support – You can add or reduce hours as needs change. This helps during busy seasons and quiet months. Your cost stays tied to real need.

Understanding the Role of an Offshore Tax Accountant

An offshore tax accountant handles many tax related duties. Each task has clear value for your business.

- They prepare and file tax returns on schedule.

- They spot and apply deductions and credits.

- They keep your filings compliant with local and foreign laws.

- They advise on ways to reduce tax legally.

- They support audits and financial reviews.

- They work with your team to fit tax plans into wider business plans.

A skilled offshore accountant works as an extension of your finance team. They follow your processes and use your systems.

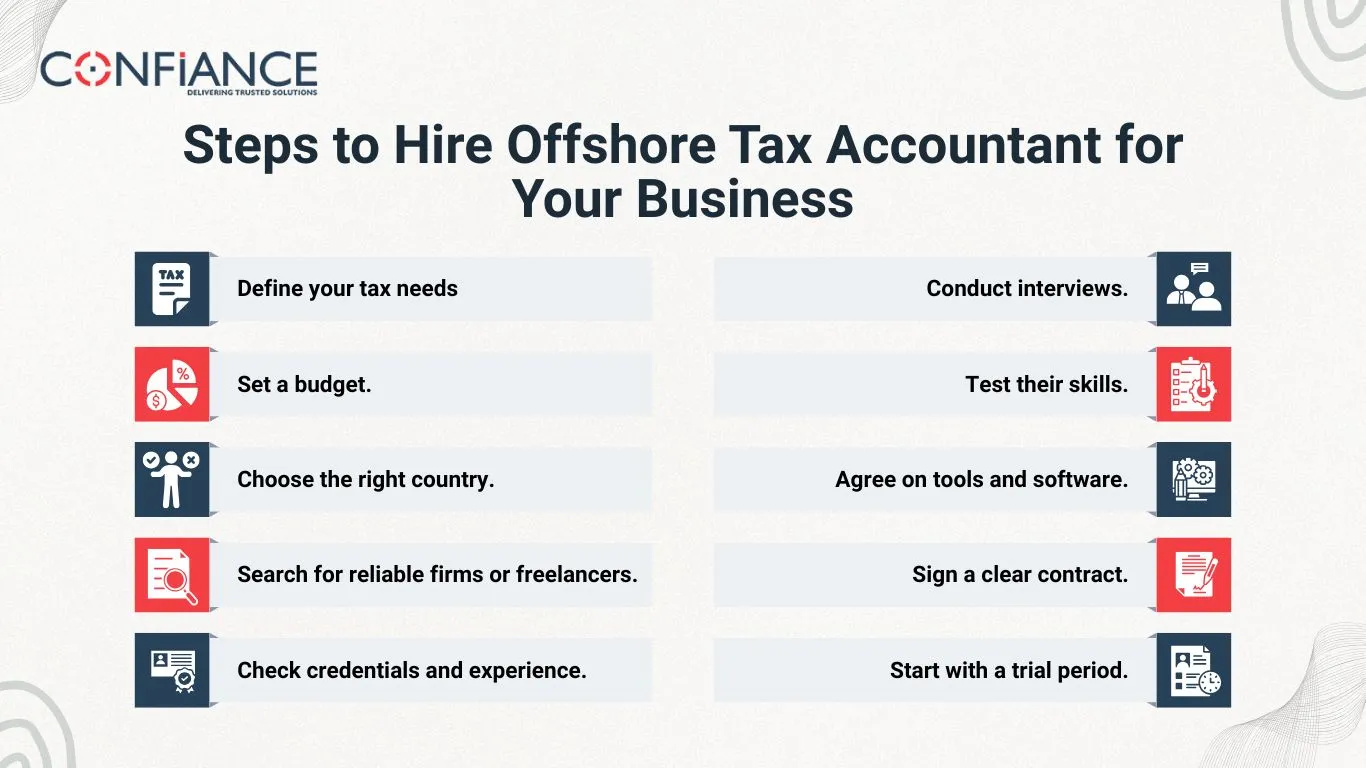

Steps to Hire Offshore Tax Accountant for Your Business

Hiring offshore tax talent needs a clear plan. Follow these steps for a smooth hire and fast ramp up.

Step 1: Define your tax needs.

List the services you need in plain terms. Note if you need help with corporate tax, sales tax, payroll tax, or all of them. Also state if you need annual filings, quarterly work, or daily support. Clear needs make selection faster.

Step 2: Set a budget.

Decide how much you can spend each month or per project. Compare rates across countries and service levels. A clear budget helps you shortlist candidates quickly.

Step 3: Choose the right country.

Different countries offer different skills and cost levels. Common choices include India, the Philippines, and Eastern Europe. Pick a country that matches your needs for language, skills, and time zone overlap.

Step 4: Search for reliable firms or freelancers.

Use trusted platforms, referrals, and specialist firms. Read reviews and ask for samples of past work. Shortlist those with proven tax experience and good client feedback.

Step 5: Check credentials and experience.

Ask for certifications, client references, and sample filings. Confirm they know your country tax rules and can work with cross border issues if needed.

Step 6: Conduct interviews.

Use video calls to assess clarity and confidence. Ask specific tax questions. Test their ability to explain complex matters in simple terms.

Step 7: Test their skills.

Give a small paid task that mirrors real work. Check if they meet the deadline and follow your instructions. Use this test to judge quality and fit.

Step 8: Agree on tools and software.

Decide which accounting system and file sharing tools you will use. Ensure both sides can access the same documents and reports.

Step 9: Sign a clear contract.

Document the scope of work, payment terms, deadlines, and confidentiality rules. Include data security steps and liability limits.

Step 10: Start with a trial period.

Begin with a short term contract to build trust. Use the trial to refine processes and set clear deliverables.

Qualities to Look for When You Hire Offshore Accountant

Look for traits that matter in remote tax work.

Technical skill – They must know relevant tax law and accounting standards. They must also handle the software you use.

Clear communication – They must explain tax issues in plain language. Regular updates must be part of their work style.

Strong attention to detail – Small mistakes can cost large fines. They must be careful and methodical.

Good problem solving – They must propose legal ways to save tax and to fix filing issues.

Professional conduct – They must meet deadlines and follow confidentiality rules.

Common Mistakes to Avoid When Hiring Offshore Tax Accountants

Many firms lose time or money by making simple errors. Do not repeat these mistakes.

- Hiring on price alone. Low cost often hides poor quality.

- Skipping reference checks. Past performance predicts future work.

- Missing local law checks. Confirm they know rules for your jurisdiction.

- Not setting clear communication channels. Define how and when you will meet.

- Ignoring data security. Make sure they follow strong protocols.

Avoid these mistakes and you will cut risk.

How Offshore Tax Accountants Improve Business Success

The right offshore tax accountant does more than file papers. They create value.

Better compliance – Accurate filings reduce risk of audits and fines.

Greater tax savings – They find credits and deductions you might miss.

Stronger planning – They help shape tax plans that fit future growth.

Less stress for owners – You can focus on the business while they handle tax tasks.

These outcomes add to both profit and operational stability.

Data Security When You Hire Offshore Tax Accountant

Protecting financial data is urgent. Follow these steps.

- Use secure file sharing with encryption.

- Require a signed non disclosure agreement.

- Grant access on a need to know basis only.

- Use strong passwords and two factor access where possible.

- Ask for background checks and past client references.

- Prefer firms that follow global data protection rules.

Take these steps before you share any sensitive files.

Payment Models for Offshore Tax Accountants

Choose a payment model that fits the work.

Hourly rate – Best for flexible tasks and sporadic needs.

Fixed price – Works well for defined projects with clear deliverables.

Retainer – A monthly fee suits ongoing work and steady support.

Match the model to the type of work and your cash flow.

Building a Long Term Relationship with Your Offshore Accountant

A steady partnership improves results. Do these things.

- Give regular feedback on work and process.

- Keep communication clear and short.

- Pay on time and honor terms.

- Share changes in business that affect tax.

- Review performance on a set schedule.

Good care leads to strong trust and better outcomes.

Case Example: How a Small Business Gained from Offshore Tax Accounting

A retail store in the US hired an offshore tax accountant from India. The accountant handled quarterly tax filings and payroll taxes. They found extra deductions the store had missed. The store cut its cost by forty percent compared to local hires. It also avoided fines for late filings. The store used the cost savings to invest in store upgrades and staff training.

The Future of Offshore Tax Accounting

Offshore tax services will grow as tools improve. Cloud based accounting, video calls, and secure file tools make remote work simple. Firms that plan well will gain steady support and lower cost.

Hiring offshore tax accountant services is a practical choice for many firms. With careful planning you get skilled help at lower cost. Define your needs. Check credentials. Set clear terms. Protect your data. Start with a trial and build a steady partnership. This approach will help you save money, follow rules, and focus on growing your business.

FAQs

- What tasks can an offshore tax accountant handle for my firm?

They prepare and file tax returns, identify legal savings, and support audits for your firm.

- How should I test an offshore tax accountant before hiring?

Assign a short paid task that mirrors real work, then check quality and timeliness.

- Which checks prove an offshore tax accountant is reliable?

Verify professional certificates, speak to past clients, and review sample filings.

- How do I keep my data safe with an offshore tax firm?

Use encrypted file tools, limit access by role, and require a signed confidentiality agreement.

- What pricing models do offshore tax accountants use?

They bill by the hour, on fixed project fees, or on monthly retainers.

- When is offshore tax work most helpful for a business?

It helps during busy filing seasons, for routine tasks, and when you need extra skills.

- What hiring mistakes should I avoid with offshore tax staff?

Avoid hiring for price alone, skipping reference checks, or ignoring local tax rules.

- How can I build a strong long term relationship with my offshore tax accountant?

Give clear timely feedback, hold short regular reviews, pay on time, and share key business changes.