An Ultimate Guide to Accounting for Medical Practice

Managing a medical practice means more than giving care. Each clinic, hospital, or private office needs a system to track income and spending. These include billing, payroll, taxes, and insurance claims. Without strong systems, money slips through unnoticed. Accounting for medical practice is not the same as accounting in other fields.

Clinics must follow strict rules, manage complex billing, and deal with many payers. These tasks take time, focus, and care. This guide breaks down the steps and tools needed to manage money in a medical setup. It also explains why accounting for medical professionals needs its own method.

Why Medical Accounting Matters

Healthcare deals with services, not fixed products. Payments come from patients, insurers, or public schemes. Some pay upfront, while others pay later. The mix causes delays and errors if records are weak.

Missed bills or wrong entries can lead to revenue loss. Ignored expenses can create budget gaps. Over time, these hurt the clinic. A practice that tracks its money stays healthy and can grow.

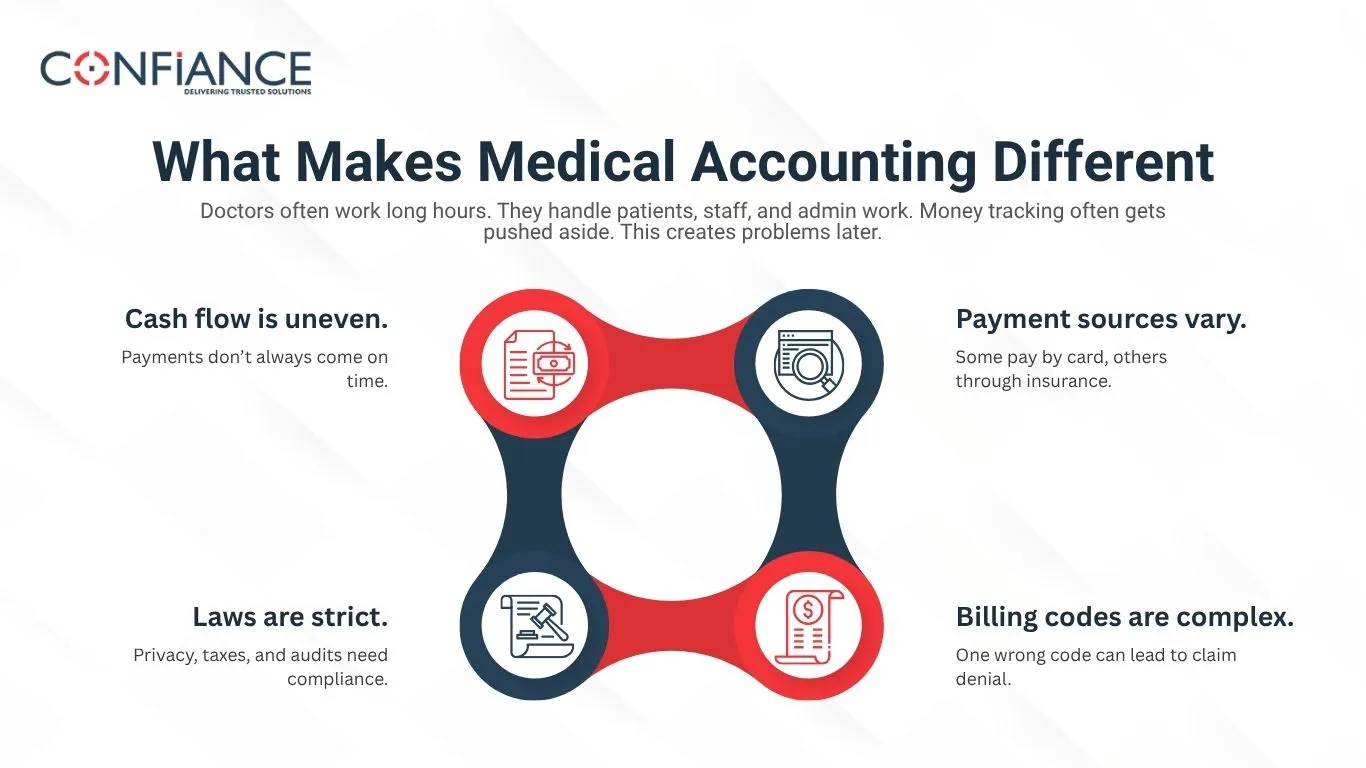

What Makes Medical Accounting Different

Doctors often work long hours. They handle patients, staff, and admin work. Money tracking often gets pushed aside. This creates problems later.

Here are reasons medical accounting is different:

- Payment sources vary. Some pay by card, others through insurance.

- Billing codes are complex. One wrong code can lead to claim denial.

- Laws are strict. Privacy, taxes, and audits need compliance.

- Cash flow is uneven. Payments don’t always come on time.

Because of this, accounting for medical professionals requires accuracy and speed.

Bookkeeping: The First Step

Bookkeeping is the base of all records. Every clinic, large or small, needs to record each payment and expense.

You must:

- Log patient payments

- Record insurance claims

- Note staff wages and rent

- Track every supply and service used

Use software built for clinics. It saves time and avoids errors. Paper records are not enough. Digital books are safer and easier to review.

Accounts Payable and Receivable

Receivables are the amounts due from others. These include unpaid bills or insurance claims.

Payables are what the clinic owes. This includes rent, wages, and vendor bills.

Late receivables affect cash flow. Delayed payments hurt credit and trust. You need reports that show what’s pending and for how long. A follow-up system helps clear dues on both ends.

Payroll and Staff Pay

Staff includes doctors, nurses, cleaners, and front desk workers. All must be paid on time. Pay includes salary, bonuses, leave, and taxes.

Use payroll software or hire services that know the rules. This cuts down errors and meets tax deadlines. Time logs, shift records, and leaves must be tracked clearly.

Supply and Inventory Control

Clinics use gloves, syringes, tools, and paper every day. Supplies must be stocked but not wasted. Shortage delays care. Excess leads to spoilage.

Track:

- What you order

- What you use

- What you throw out

Link supply use to patient services. Good supply tracking saves money and improves service.

Tax Filing and Deductions

Clinics pay taxes on income, staff, and services. Each has deadlines and forms.

You must:

- File income tax

- Pay staff-related taxes

- Track service-related dues

Go for an expert who knows accounting for medical practice. Some costs, like equipment or training, may get deductions. Missing them may raise your tax bills.

Claim Filing and Tracking

A big part of clinic income comes from insurance. Claims must be filed with the right codes and patient data.

Watch for:

- Claim denials

- Missing patient data

- Rejected codes

Rejected claims waste time and money. Train your team or use services that handle claims for clinics. Claims must be tracked till paid.

Bank Reconciliation

Match your bank record with your books every month. This helps spot:

- Duplicate entries

- Missed payments

- Wrong deposits

Use accounting tools that link to your bank. They update records and send alerts for mismatches. Always check the report before finalizing.

Set Up a Chart of Accounts

A chart of accounts is a list of every account in your system. This includes income and expenses.

For a clinic, it includes:

- Consultation income

- Insurance payments

- Staff wages

- Medical supplies

- Rent and tools

Each entry must be sorted right. Reports based on these help in planning and filing taxes.

Pick a Method: Cash or Accrual

While accounting for medical professionals, two methods are common.

Cash basis tracks money when it moves. You record income when received and expenses when paid.

Accrual basis tracks money when it’s due. You record income when earned and expenses when billed.

Small clinics often use cash basis. Larger ones choose accrual for better tracking. Pick one and use it for all entries.

Use the Right Accounting Software

Choose software made for clinics. It should offer:

- Billing

- Payroll

- Claim tracking

- Supply logs

- Custom reports

Some popular names include QuickBooks, Xero, and Kareo. Look for options that suit your clinic size and staff strength. Cloud tools are easy to use and safe.

Build a Budget

Set a monthly budget and track it. A budget shows what you plan to earn and spend.

Break down income by:

- Type of service

- Patient group

- Payment source

Break down costs into:

- Fixed (rent, salary)

- Variable (tools, paper, repairs)

Review it every quarter. Compare plans with actual results. Change plans based on need.

Track Key Reports

Use reports that show the full picture. These include:

- Profit and loss

- Cash flow

- Balance sheet

Profit and loss shows how much you earn after costs. Cash flow shows how money moves. Balance sheet shows what you own and owe.

Check these reports each month.

Use Financial Metrics

Some numbers help you check clinic health. These include:

- Revenue per patient

- Claim rejection rate

- Time to payment

- Cost per visit

- Net profit margin

Review them every month. Use trends to fix billing, reduce waste, or increase savings.

Keep Accounting In-House or Outsource?

Some clinics keep books in-house. Others use outside services. Each has pros and cons.

In-house gives more control. You see every entry. But it needs time and skill.

Outsourcing saves time. Firms that know accounting for medical professionals handle taxes, payroll, and claims better.

You can also use a mix—handle daily work in-house, outsource complex parts.

Prepare for Seasonal Shifts

Clinics often face busy and slow months. Some services peak during winter. Others rise in summer.

Track past years to:

- Plan stock levels

- Adjust staff shifts

- Control extra spending

Prepare ahead to avoid pressure during peak months.

Plan for Retirement or Exit

Many doctors own their practice. You must plan for retirement early.

Start by:

- Knowing your clinic’s value

- Saving in retirement plans

- Training someone to take over

Keep clean records. A buyer or new partner checks your books first. Good records make the deal smooth.

Avoid Common Errors

- Don’t mix personal and clinic money

- Don’t skip receipts

- Don’t delay claim follow-ups

- Don’t ignore taxes

- Don’t rely on memory for bills

Use checklists. Set time each week to review records. Errors grow fast if left alone.

Why Experts Help

Not every accountant knows how clinics work. Go for those with real experience in accounting for medical practice.

They know:

- Medical billing codes

- HIPAA laws

- Deduction rules

- Claim cycles

Their advice saves time and avoids mistakes.

Final Tips for Smooth Medical Practice Accounting

- Use software that matches your clinic’s work

- Keep daily records

- Track all claims

- Review reports monthly

- Pay taxes on time

- Train your staff on billing

With strong systems in place, you avoid panic during audits or tax season. Accounting supports every part of a medical practice. It tracks how much you earn, what you spend, and what you save. It reduces errors and builds trust.

Accounting for medical professionals must be clear, simple, and accurate. With the right tools, habits, and advice, your clinic can run better and plan for the future. Good care begins with good records. When your books are strong, your practice becomes stronger. If you want clear and reliable medical bookkeeping services for your practice, reach out to Confiance. We offer simple, accurate solutions for medical professionals.

FAQs

- What is the best way to track income in a medical clinic?

Use a system that links patient services with payments. Record each payment by type—cash, card, or insurance. Log income daily to avoid missing entries. - How do doctors keep personal and clinic expenses separate?

Open a separate bank account for clinic use. Pay clinic bills only from that account. Avoid using personal cards for clinic purchases. - Can small medical clinics manage accounting without an accountant?

Yes, if they use simple tools and stay consistent. Basic tasks like logging payments and filing taxes can be done in-house with training. - What are common red flags in medical accounting audits?

Missing receipts, late tax filings, and sudden changes in income raise concerns. Incomplete claim records can also lead to audits. - How often should a clinic review its financial reports?

At least once a month. Review cash flow, unpaid bills, and income trends. Quarterly reviews help adjust plans and budgets. - Why do some clinics still lose money despite high patient numbers?

Poor billing, untracked expenses, or slow claim processing can reduce profit. Volume alone does not guarantee financial health.