Xero vs QuickBooks 2025 Comparison Guide

If you run a small business or help with money, it’s important to keep good records. You need to know how much you earn, what you spend, and what you still owe. Accounting Softwares keeps all your money details in one safe place. In this blog, we will show you the basic difference between Xero and QuickBooks.

Two big names people trust are Xero and QuickBooks. They both help you track bills, sales, and spending. But you may ask, which one should I use? In this easy guide, we will show you the basics of Xero vs QuickBooks. You will learn what each one does, how they are not the same, and how to choose the best one for your small business in 2025.

What Are Xero and QuickBooks?

Xero and QuickBooks are two top tools that many small and medium businesses use. They are types of accounting software that help you keep track of your money. You can see how much you earn, what you spend, and what bills you need to pay. With Xero or QuickBooks, you don’t have to guess where your money goes. These tools show you a clear picture of your business. When it comes to Xero vs QuickBooks, the best one for you depends on what your business needs in 2025.

Features of Xero and QuickBooks

Both Xero and QuickBooks help you handle your business money. They let you send invoices, check reports, connect with banks, and more. But each tool has its own style and set of features.

Features of Xero

- Invoicing:

Xero lets you create and send invoices to your customers. You can also set reminders if someone forgets to pay. - Bank Connections:

Xero links to your bank. It pulls in your bank activity and helps you match it with your records. - Reports and Charts:

You can view your profit and loss, spending trends, and balance sheets in a clear way. - Multi-Currency Support:

If you deal with people in different countries, Xero’s higher plans allow you to work with multiple types of currency. - App Integration:

Xero can work with over 1,000 apps. This includes apps for payment, sales, time tracking, and more. - Project Tracking:

If you want to track the cost of a project, Xero lets you do this in its more advanced plans. - Mobile App:

Xero has a mobile app so you can check your business details even when you’re not at your desk.

Features of QuickBooks

- Invoicing and Payments:

QuickBooks helps you create custom invoices and accept online payments. - Bank Sync:

QuickBooks also connects to your bank and brings in all your bank activity. You can match it with your bills and receipts. - Reports and Insights:

You can generate many types of reports like income statements, balance sheets, and spending charts. - Payroll Tools:

QuickBooks has built-in payroll tools in some of its plans. You can pay workers and even calculate payroll taxes. - Time Tracking:

You can track how long a job takes, which helps if you bill by the hour. - Phone and Chat Support:

QuickBooks provides different types of support that also includes chat support. - Mobile App:

The QuickBooks app lets you create invoices, snap photos of bills, and review reports from your phone.

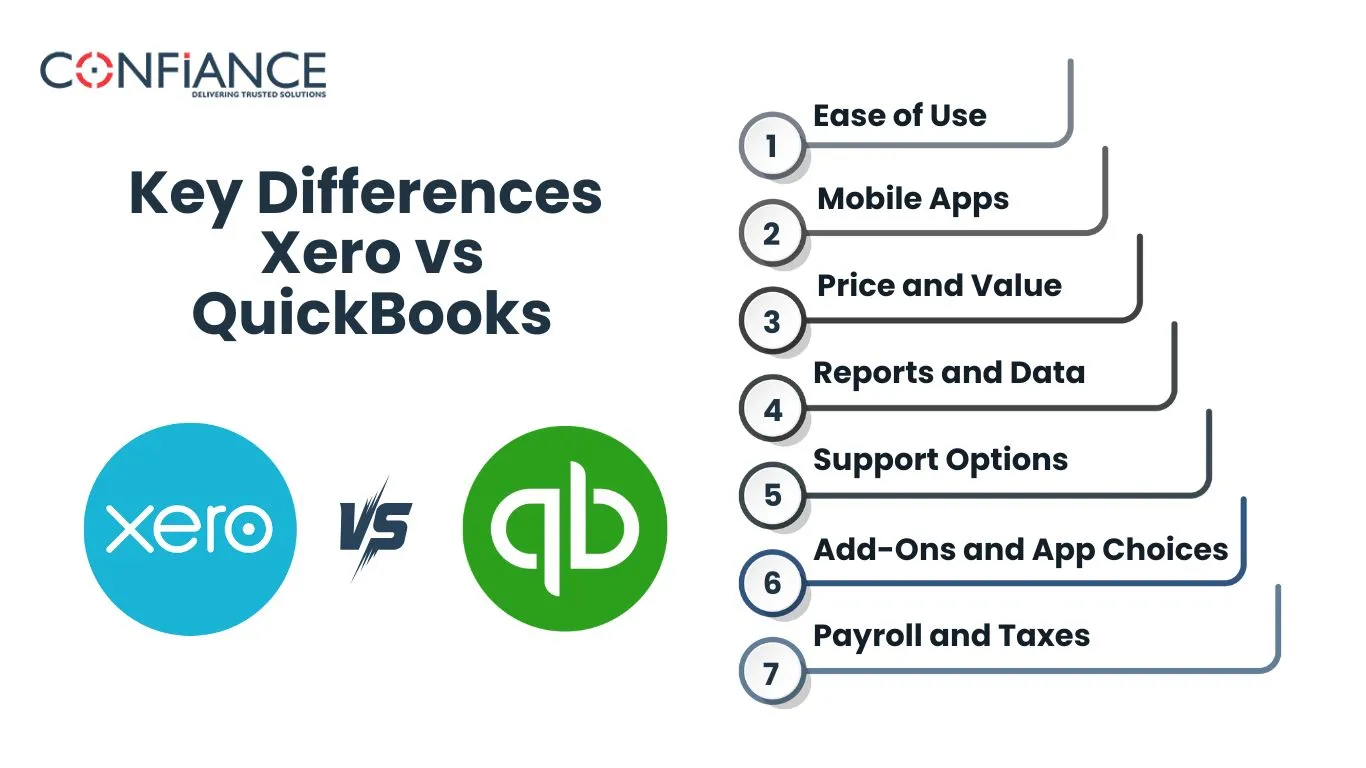

Key Differences: Xero vs QuickBooks

Now that we have looked at what each software offers, let’s look at how they are different. These key differences will help you understand which tool works best for your needs.

1. Price and Value

Xero- Xero starts at a lower monthly price than QuickBooks. It is a great option for solo business owners or small teams who don’t need all the advanced tools. However, many features, like project tracking and multi-currency, are only in the more expensive plans.

QuickBooks- QuichBooks costs more from the start, but even the basic plans offer more features. This makes it good for businesses that are growing or need more tools right away.

Verdict:

If you want to save money and don’t need advanced tools, choose Xero. If you want more built-in features, go with QuickBooks.

2. Ease of Use

Xero- Xero has a clean and simple design. Many people find it easy to learn, even if they don’t have accounting experience.

QuickBooks– QuickBooks has more features, so the screen can look busy. It may take more time to learn, but once you get used to it, it is very powerful.

Verdict:

Xero is better for beginners, while QuickBooks works well for people who need more features and can handle a learning curve.

3. Mobile Apps

Both companies offer mobile apps, but they work a bit differently.

Xero- Xero is easy to use but doesn’t always get updates as often. It covers all the basics like invoicing and checking bank info.

QuickBooks- QuickBooks app is very strong. You can do almost everything from your phone, including taking photos of receipts, sending invoices, and viewing detailed reports.

Verdict:

QuickBooks has the better mobile app.

4. Reports and Data

Xero- Xero offers good basic reports that show income, spending, and taxes.

QuickBooks- QuickBooks gives more types of reports and more control. You can set date ranges, sort by customer, and even compare past months or years.

Verdict:

QuickBooks is better for detailed reporting.

5. Support Options

Xero– Xero offers support through email and chat. You can also find help on their website.

QuickBooks- QuickBooks gives support through phone, chat, and online. You may reach help faster when using QuickBooks.

Verdict:

QuickBooks wins for better customer support options.

6. Add-Ons and App Choices

Xero- Xero connects with over 1,000 apps. If you want to use a third-party tool for time tracking, payroll, or payments, Xero likely supports it.

QuickBooks – QuickBooks also supports many apps but not as many as Xero.

Verdict:

Xero wins if you use many outside tools and apps.

7. Payroll and Taxes

QuickBooks- QuickBooks has built-in payroll in many of its plans. It can help you file taxes, pay workers, and follow tax laws.

Xero- Xero can do payroll too, but you may need to add other apps depending on your location.

Verdict:

QuickBooks offers better payroll tools.

How to Choose Xero vs QuickBooks

Now you know the features and the differences. But how do you choose the best one between Xero vs QuickBooks

Here are a few things to think about:

Your Business Size

If you are a freelancer, solo worker, or small shop, Xero may be all you need. It’s simple, clean, and easy to start with. If you have many clients, team members, or need payroll, QuickBooks may serve you better.

Your Budget

If you want to keep costs low, Xero’s lower plans will help you save money. But if you don’t mind paying a bit more for more tools, QuickBooks gives you more value.

Your Skills

If you are new to bookkeeping and want something simple, Xero is a friendly start. If you or your team already know accounting or plan to grow fast, QuickBooks is ready to grow with you.

App Needs

Do you want your accounting software to work with other tools like PayPal, Stripe, or Shopify. Both work with many apps, but Xero has more options in its app store.

Both Xero and QuickBooks are great tools for small businesses. You can choose either one and still do well. But each one works better for different people. Pick Xero if you want a simple, low-cost tool that is easy to use and works well for small teams. Pick QuickBooks if you want more tools, a strong phone app, and more help as your business grows. Still not sure which one is best? That’s okay.

Confiance knows what small businesses need. We can help you choose the right tool, set it up, and keep your books in order. Let Confiance guide you in choosing between Xero vs QuickBooks in 2025 so your business can stay safe, smart, and stress-free.

FAQs

- Can I switch from Xero to QuickBooks later?

Yes, you can. You may need help from an expert or accountant to move your data safely. - Are Xero and QuickBooks safe?

Yes. Both use strong safety features like encryption and login protection. - Do I need to be an accountant to use these tools?

No. Both are made for small business owners with no accounting background. - Can I use these tools for personal finance?

They are made for business use, but some people use them for personal tracking. - What if I need help setting up Xero or QuickBooks?

You can contact companies like Confiance that help with setup, training, and ongoing support.