Step-by-step guide for creating Balance Sheet from a Trial Balance

Creating a master balance sheet from a trial balance is an essential task for any business. A balance sheet represents a company's financial standing. It helps business owners, investors, and stakeholders make smart financial decisions. This guide will take you through the steps of preparing a balance sheet from a trial balance. It ensures accuracy and makes the process easy to understand.

What is a Trial Balance?

A trial balance is a list of all the accounts in your general ledger. A trial balance displays the balances of all accounts at a specific point in time. It helps verify that your books are balanced by ensuring that total debits match total credits.

Purpose of a Trial Balance:

- Ensures that debits and credits are balanced, verifying the accuracy of accounts.

- Identifies errors in journal entries and ledger postings.

- Acts as the foundation for preparing financial statements, such as the balance sheet.

What is a Balance Sheet?

A balance sheet is a basic financial statement that shows a company's financial position at a specific time. It consists of three key components:

- Assets – The resources owned by the company, including cash, accounts receivable, inventory, and fixed assets.

- Liabilities – The company’s financial obligations, such as accounts payable, loans, and other debts.

- Equity – The owner's interest in the company, calculated as assets minus liabilities, representing the net value of the business.

This structure ensures that the balance sheet remains balanced, following the fundamental accounting equation:

Assets = Liabilities + Equity.

Why Create a Balance Sheet?

Creating a balance sheet is crucial for multiple reasons:

- Evaluate Financial Health: Offers a comprehensive view of a company's assets, liabilities, and equity.

- Facilitates Decision-Making: Helps business owners make informed decisions about growth, investments, and cost management.

- Attracts Investors and Lenders: Essential for securing loans or attracting investors who assess financial stability.

- Regulatory Compliance: Ensures compliance with financial reporting standards and tax regulations.

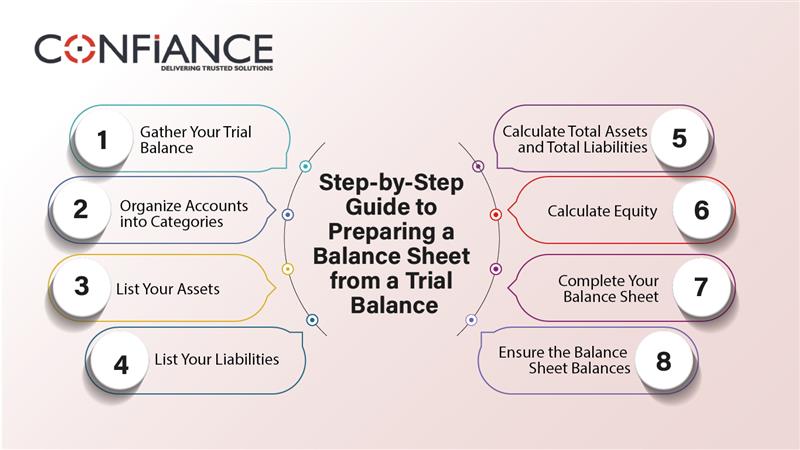

Step-by-Step Guide to Preparing a Balance Sheet from a Trial Balance

Step 1: Gather Your Trial Balance

Start by obtaining the trial balance, which lists all accounts and their balances. Ensure that:

- The trial balance is up to date.

- Total debits equal total credits.

- All transactions for the reporting period have been recorded.

Step 2: Organize Accounts into Categories

Categorize all accounts from the trial balance into three main sections: assets, liabilities, and equity.

- Assets: Comprise cash, accounts receivable, inventory, property, and equipment.

- Liabilities: Consists of accounts payable, short-term loans, long-term debts, and accrued expenses.

- Equity: Encompasses common stock, retained earnings, and additional paid-in capital.

Step 3: List Your Assets

Start with the assets section by listing them in order of liquidity (how quickly they can be converted into cash):

- Current Assets (Short-term assets that are expected to be converted into cash within one year):

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

- Non-current assets (Long-term assets that cannot be easily converted into cash):

- Property, plant, and equipment (PP&E)

- Intangible assets (patents, trademarks, goodwill)

- Long-term investments

Step 4: List Your Liabilities

Next, include all company liabilities, categorizing them based on their due date:

- Current Liabilities (Obligations due within one year):

- Accounts payable

- Short-term loans

- Accrued expenses (wages, taxes, utilities, etc.)

- Unearned revenue

- Long-Term Liabilities (Obligations due beyond one year):

- Mortgage payable

- Bonds payable

- Long-term lease obligations

Step 5: Calculate Total Assets and Total Liabilities

Add up all the asset values to get the total assets. Similarly, sum up all liabilities to determine the total liabilities.

Step 6: Calculate Equity

Calculate the equity using the accounting equation.

Equity represents the portion of the company owned by shareholders or owners after liabilities are deducted. It includes:

- Common stock

- Retained earnings

- Additional paid-in capital

Step 7: Complete Your Balance Sheet

Now, put everything together. Your balance sheet should have the following format:

Assets

- Current Assets

- Non-Current Assets

- Total Assets

Liabilities

- Current Liabilities

- Long-Term Liabilities

- Total Liabilities

Equity

- Total Equity

Step 8: Ensure the Balance Sheet Balances

The final step is to verify that: If the balance sheet does not balance, double-check your calculations for errors.

Common Mistakes to Avoid

- Omitting Accounts: Ensure that all accounts from the trial balance are included in the balance sheet.

- Misclassifying Accounts: Double-check that assets, liabilities, and equity are placed in the correct categories.

- Calculation Errors: Use software or double-check calculations manually to prevent errors.

- Failing to Update Entries: Always update financial records before preparing the balance sheet.

Tips for Creating a Balance Sheet Efficiently

- Use Accounting Software: Programs like QuickBooks, Xero, or Wave can generate a balance sheet automatically.

- Review Regularly: Prepare balance sheets at regular intervals (monthly, quarterly, annually) to monitor financial health.

- Consult an Accountant: If unsure, seek professional assistance to ensure accuracy and compliance with accounting standards.

Conclusion

Creating a balance sheet from a trial balance is a straightforward yet crucial task in financial management. By following these steps, businesses can gain valuable insights into their financial position, helping in strategic decision-making.

Understanding and maintaining a properly structured balance sheet ensures transparency, attracts investors, and promotes long-term financial stability. By regularly updating and reviewing financial statements, businesses can stay ahead in their financial planning.

FAQs

- What is the first step when making a balance sheet from a trial balance?

You start by checking if all debits and credits in the trial balance are equal. - How should you group trial balance accounts in a balance sheet?

Place each account under assets, liabilities, or equity based on its nature. - Why do assets appear in order of liquidity on a balance sheet?

It shows how fast the business can turn items into cash. - What errors can ruin a balance sheet?

Skipping entries, wrong groupings, or wrong totals can all cause problems. - How can you tell if your balance sheet is correct?

It is correct when assets equal the sum of liabilities and equity. - What does equity mean on a balance sheet?

It shows what the owners have after all debts are paid. - How often should you prepare a balance sheet?

Do it monthly or quarterly to stay updated on the business health. - Do accounting tools help with balance sheet creation?

Yes. Tools like Xero or QuickBooks reduce manual work and save time.

Landing Page

This will close in 100 seconds