Accounting in Property Management: A Comprehensive Overview

As the saying goes, “Accounting is the language of business.” For smooth and efficient business operations, maintaining robust accounting is inevitable. CONFiANCE is a one-stop solution for all the accounting and bookkeeping services. A well-qualified, seasoned team provides an exhaustive, customized solution that can help save up to 40 percent on your current in-house accounting costs.

For any business to operate efficiently, accounting is pivotal, especially in the real estate business, where financial management plays a vital role. Real estate business is more about building a sustainable and profitable business rather than just about collecting rent or paying bills. It’s a specialized branch of accounting that performs various accounting tasks such as bookkeeping, collecting rent payments, tracking expenses, budgeting, and preparing financial statements.

Managing such tasks can be a challenge in itself, which can be fulfilled with ease by opting for the professional services. CONFiANCE not only provides property management accounting but also understands the intricacies of the real estate market. So With the seasoned team of experts and utter transparency, you get premium services for cash flow management, fixed assets management, cost or project accounting, inventory management, and merchant account reconciliation. Premium services at an economical rate make CONFiANCEone of the best property management companies in Texas, Arizona, Massachusetts, and New York.

Importance of Accounting in Property Management:

Accurate accounting is the crucial aspect of property management accounting for various reasons, such as:

- It provides the track of finances.

- It helps in identifying areas of cost-cutting and thereby maximizing the profitability and efficiency.

- Avoiding unnecessary hefty penalties and fines by ensuring compliance with tax laws and regulations.

- Diligent accounting provides in-depth analysis of the business, bringing clarity and helping in making informed decisions.

- Prediction of cash inflows and outflows by analyzing various parameters to ensure an adequate pool of liquidity.

- Property management accounting helps in the creation of budgets and financial forecasts.

Importance of Property Accountant in Property Management:

Property accountants either prepare or examine and analyze accounting records to prepare financial statements and ensure they comply with tax regulating authorities. They assist in making financial decisions and budget setup by providing the factual information on the basis of analytical data.

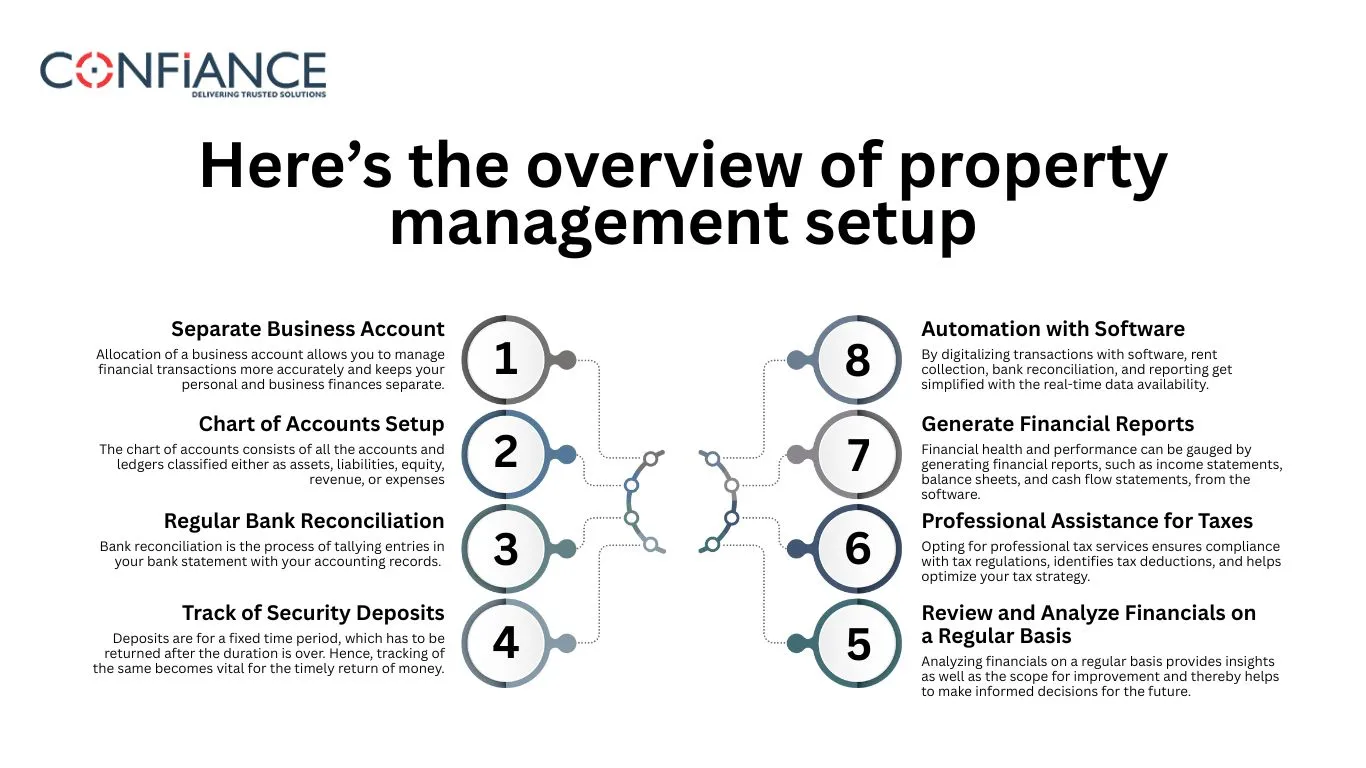

Here’s the overview of property management setup:

- Separate Business Account: Allocation of a business account allows you to manage financial transactions more accurately and keeps your personal and business finances separate.

- Chart of Accounts Setup: The chart of accounts consists of all the accounts and ledgers classified either as assets, liabilities, equity, revenue, or expenses. To ensure subaccounts are all organized in the corresponding master account, a number system, usually a block numbering system, is used.

- Regular Bank Reconciliation: Bank reconciliation is the process of tallying entries in your bank statement with your accounting records. Any discrepancies, such as missing payments or unrecorded expenses, can be spotted by the practice of regular reconciliation.

- Track of Security Deposits: Deposits are for a fixed time period, which has to be returned after the duration is over. Hence, tracking of the same becomes vital for the timely return of money.

- Automation with Software: By digitalizing transactions with software, rent collection, bank reconciliation, and reporting get simplified with the real-time data availability.

- Generate Financial Reports: Financial health and performance can be gauged by generating financial reports, such as income statements, balance sheets, and cash flow statements, from the software.

- Professional Assistance for Taxes: Opting for professional tax services ensures compliance with tax regulations, identifies tax deductions, and helps optimize your tax strategy.

- Review and Analyze Financials on a Regular Basis: Analyzing financials on a regular basis provides insights as well as the scope for improvement and thereby helps to make informed decisions for the future.

Challenges in Property Accounting:

- Misallocation of Costs: A thorough understanding and maker-checker system should be implemented to prevent any misallocation of costs.

- Paper Invoices and Receipts: Initiating the use of accounting software to digitalize the invoices improves efficiency and helps in getting rid of paper piles.

- Returning Security Deposits on Time: It’s a challenging aspect of accounting in property management that can be mitigated by tracking and automating it with the help of software.

- Account Reconciliation: With the use of software, reconciliation can be performed expeditiously.

By laying a strong foundation of property management accounting setup, a successful, sustainable, and profitable real estate business can be operated

FAQs

- What is the role of accounting in property management?

Accounting in property management helps track rent, expenses, budgeting, and financial reporting, ensuring efficient business operations. - Why should property managers separate business and personal accounts?

Keeping a separate business account avoids confusion, ensures accurate financial tracking, and simplifies tax filing. - How does a chart of accounts help in property management accounting?

It organizes all financial transactions into clear categories like assets, expenses, and revenue for better tracking and reporting. - What are the benefits of using accounting software in property management?

Software automates rent collection, bank reconciliation, report generation, and makes real-time data available for faster decisions. - Why is regular bank reconciliation important for property managers?

It detects missing or incorrect transactions early and ensures records match the actual bank statement. - What challenges do property managers face with security deposit tracking?

Delays and mismanagement often occur, but software can help automate and monitor deposit timelines. - How do property accountants support financial decision-making?

They prepare reports, analyze data, ensure tax compliance, and offer insights to shape budgets and strategy. - What common accounting issues affect property management businesses?

Misallocated costs, paper-based processes, and delayed reconciliations can hurt efficiency without proper systems in place.