US Tax Brackets 2025 and Federal Income Tax Rate

The United States uses a marginal tax system. Income is split into parts, and each part is taxed at its own rate. You do not pay one rate on your full income. Lower rates apply to the first dollars earned. Higher rates apply only to the upper portion. This keeps the system fair. It also helps with planning since you can see what rate applies to each part of your income.

Each year, the IRS adjusts tax brackets for inflation. This stops bracket creep, which happens when rising costs push you into a higher bracket without a real gain in income. For 2025, bracket limits went up. That means more of your income may stay in lower tax ranges. Knowing how these changes work can help you time income, plan withdrawals, and avoid tax surprises.

What Is Taxable Income

Before applying tax rates, you subtract certain amounts from your income. The most common deduction is the standard deduction. This amount depends on your filing status. Once you subtract it from your gross income, the rest becomes taxable income.

This taxable amount is what goes through the tax brackets. It includes wages, interest, business income, dividends, and capital gains. But it’s reduced by things like the standard deduction, student loan interest, and retirement contributions. Knowing what reduces your gross income gives you a better sense of what you’ll pay in tax.

The IRS sets the standard deduction each year. For 2025, the amounts are:

- $15,000 for single filers

- $30,000 for married couples filing jointly

- $22,500 for head of household

These numbers reduce how much income is taxed. If your total income is $80,000 and your deduction is $15,000, you will be taxed on $65,000.

The standard deduction applies without needing proof. It’s automatic if you don’t itemize. For many taxpayers, it gives a better deal than listing out expenses. But if your expenses are high enough, itemizing might reduce your tax more. This is why it’s worth comparing both methods.

Tax Brackets 2025: Single Filers

Here are the brackets for those filing as single:

| Rate | Income Range |

| 10% | $0 to $11,925 |

| 12% | $11,926 to $48,475 |

| 22% | $48,476 to $103,350 |

| 24% | $103,351 to $197,300 |

| 32% | $197,301 to $250,525 |

| 35% | $250,526 to $626,350 |

| 37% | Over $626,350 |

Let’s say your taxable income is $90,000. You don’t pay 22 percent on the full amount. You pay:

- 10 percent on the first $11,925

- 12 percent on the next portion up to $48,475

- 22 percent only on the amount from $48,476 to $90,000

Each range is taxed on its own. This reduces the total tax bill. Most people fall into three or four brackets, depending on their income. The top rate applies only to the last slice of your income. The rest is taxed at lower rates. This method brings balance to tax bills across income levels.

Tax Brackets 2025: Married Filing Jointly

Here are the brackets for couples filing together:

| Rate | Income Range |

| 10% | $0 to $23,850 |

| 12% | $23,851 to $96,950 |

| 22% | $96,951 to $206,700 |

| 24% | $206,701 to $394,600 |

| 32% | $394,601 to $501,050 |

| 35% | $501,051 to $751,600 |

| 37% | Over $751,600 |

Married couples benefit from wider ranges. This means more income is taxed at lower rates.

These wider brackets are designed to prevent married people from paying more tax than two single people with the same income. This is called the marriage penalty. While it still exists at higher incomes, these wider brackets ease the issue for most households.

Tax Brackets 2025: Head of Household

This status applies to people who pay for more than half of household costs and support a dependent. It allows more income to be taxed at lower rates.

| Rate | Income Range |

| 10% | $0 to $17,000 |

| 12% | $17,001 to $64,850 |

| 22% | $64,851 to $103,350 |

| 24% | $103,351 to $197,300 |

| 32% | $197,301 to $250,500 |

| 35% | $250,501 to $626,350 |

| 37% | Over $626,350 |

Choosing the right status matters. Head of household can reduce your tax more than filing single if you qualify.

Many people miss this option. If you support a child or another relative and cover over half of the home costs, you may qualify. This status gives a higher standard deduction and wider brackets than single status. It rewards those supporting dependents on one income.

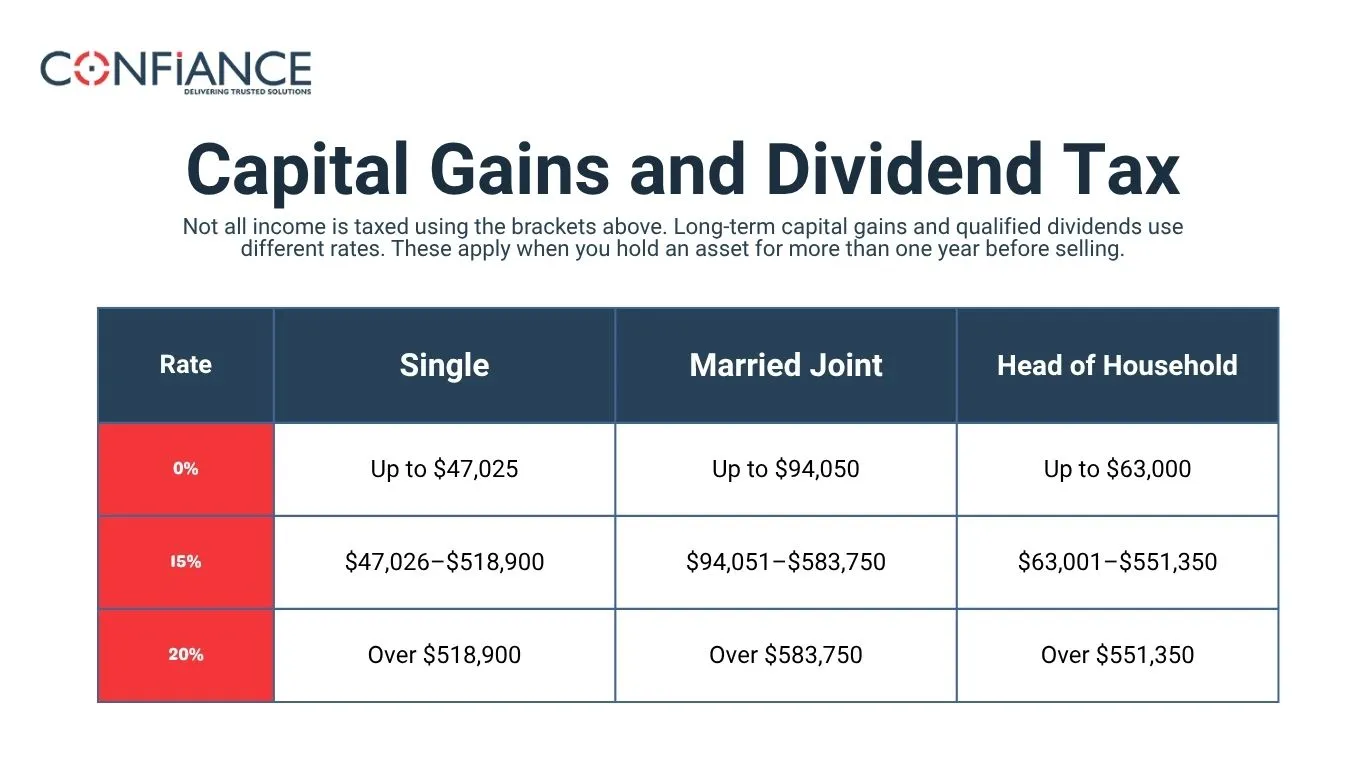

Capital Gains and Dividend Tax

Not all income is taxed using the brackets above. Long-term capital gains and qualified dividends use different rates. These apply when you hold an asset for more than one year before selling.

Here are the 2025 long-term capital gains brackets:

| Rate | Single | Married Joint | Head of Household |

| 0% | Up to $47,025 | Up to $94,050 | Up to $63,000 |

| 15% | $47,026–$518,900 | $94,051–$583,750 | $63,001–$551,350 |

| 20% | Over $518,900 | Over $583,750 | Over $551,350 |

These rates apply only to capital gains. They are often lower than regular income tax rates.

Dividends from most large companies also qualify for these rates. To meet the holding period rules, you must hold stock for more than sixty days around the dividend payout date. This reduces tax on investment income and supports long-term investing.

How Brackets Affect Tax Bills

Each bracket only applies to income within that range. This keeps your tax rate from rising on your whole income just because you earn more. This structure is what makes the system fairer.

Let’s look at an example.

A single filer has $110,000 in taxable income. Their tax bill breaks down like this:

- $11,925 taxed at 10%

- $36,549 taxed at 12%

- $54,875 taxed at 22%

- $6,650 taxed at 24%

The last portion of income falls into the 24 percent range. But the average tax rate is lower because most of the income was taxed at 10, 12, or 22 percent.

This distinction between marginal and average tax rate is important. The marginal rate tells you what tax you pay on each new dollar. The average rate is your total tax divided by your total income. Planning should focus on both.

Bracket Planning Strategies

Knowing your bracket helps you plan smarter. It lets you time income and expenses to stay in lower ranges.

Here are simple strategies:

- Delay bonuses to the next year if it keeps you in a lower bracket

- Sell investments in years when your income is lower

- Make large donations in high-income years to lower taxable income

- Combine deductions into one year to take advantage of itemizing

- Adjust retirement withdrawals to avoid jumping brackets

These small steps can lower tax bills without changing how much you earn.

You can also shift income using retirement accounts. Contributions to a traditional IRA or 401(k) reduce taxable income now. Roth accounts work differently, but withdrawals are tax-free later. Choose based on your future income level.

Withholding and Estimated Payments

Employees have tax withheld from pay. This is based on IRS tables and your W-4 form. If your situation changes during the year, you should update your W-4. This helps match your tax payments to your actual bill.

Self-employed workers or those with side income must make estimated payments. These are due quarterly. Use your tax bracket to estimate how much to send each time.

The IRS requires that you pay at least ninety percent of what you owe during the year, or one hundred percent of last year’s total (one hundred ten percent if your income is high). Missing payments can result in penalties. Keeping up quarterly avoids surprises in April.

Retirement and Bracket Control

Brackets matter after retirement too. If you take money from a traditional IRA or 401(k), it counts as income. This can push you into a higher bracket.

You can manage this by:

- Using Roth accounts for tax-free withdrawals

- Taking smaller amounts each year

- Delaying withdrawals to age 73 but not beyond

- Spreading out distributions evenly

- Using charitable distributions if age 70½ or older

Even in retirement, timing still matters. Small changes in withdrawals can affect not just tax, but also Medicare premiums and Social Security taxes.

Final Summary

- Tax brackets apply to taxable income only

- Seven rates apply for 2025: 10 through 37 percent

- Standard deduction reduces your taxable income

- Filing status changes the income range of each bracket

- Capital gains and dividends use their own rates

- Planning helps keep you in lower brackets

- Brackets are adjusted yearly to reflect inflation

- Tax law may change after 2025

Track your income. Know your bracket. Small steps can lower tax. The 2025 tax brackets show how income is taxed in parts. This helps you plan when to earn, save, or withdraw. Wages, business income, or retirement payouts all count. The bracket you fall into decides what you pay. Use this to act with purpose and stay ready for changes.

FAQs

- Do tax brackets use gross income or taxable income?

Tax brackets apply to taxable income. This is your income after subtracting deductions. - Can a retirement contribution change my tax rate?

Yes. Putting money into a traditional IRA or 401(k) lowers your taxable income, which can place you in a lower bracket. - Are federal brackets different by state?

No. Federal brackets stay the same in every state. States may add their own taxes with different rules. - Why do tax brackets change each year?

The IRS adjusts brackets to match inflation. This keeps your tax rate from rising if prices go up but your income stays the same. - Is all income counted for federal tax?

No. Some income is not taxed. Roth withdrawals, gifts, and some Social Security payments may not be included. - Will higher income raise my whole tax bill?

No. Only the part of your income in a higher bracket is taxed more. The rest stays at lower rates.