Understanding the Chart of Accounts: Meaning, Categories, and Functionality

Running a business means knowing where money comes from and where it goes. A chart of accounts is a clear list of all accounts a business uses to track cash, costs, what it owns, and what it owes. It shows the full picture of money in the business.

In this blog, we will explain what a chart of accounts is, its main categories, and how it works. You will learn why this is important. You will also get tips on how to set it up correctly. We will cover mistakes to avoid. Finally, you will see how it helps you make smart money choices.

What is a Chart of Accounts?

A chart of accounts (COA) is a tool that lists all the accounts a company uses to manage money. Each account has a unique code. These codes make it easy to record transactions and make reports.

Key Features of COA

- Clear List: Every account is listed with a unique code.

- Grouped Accounts: Accounts are grouped by type, like assets, debts, income, and costs.

- Easy to Read: Helps find transactions fast.

- Flexible: Works for small, medium, or big firms.

Charts of accounts give a clear view of money flow in a business.

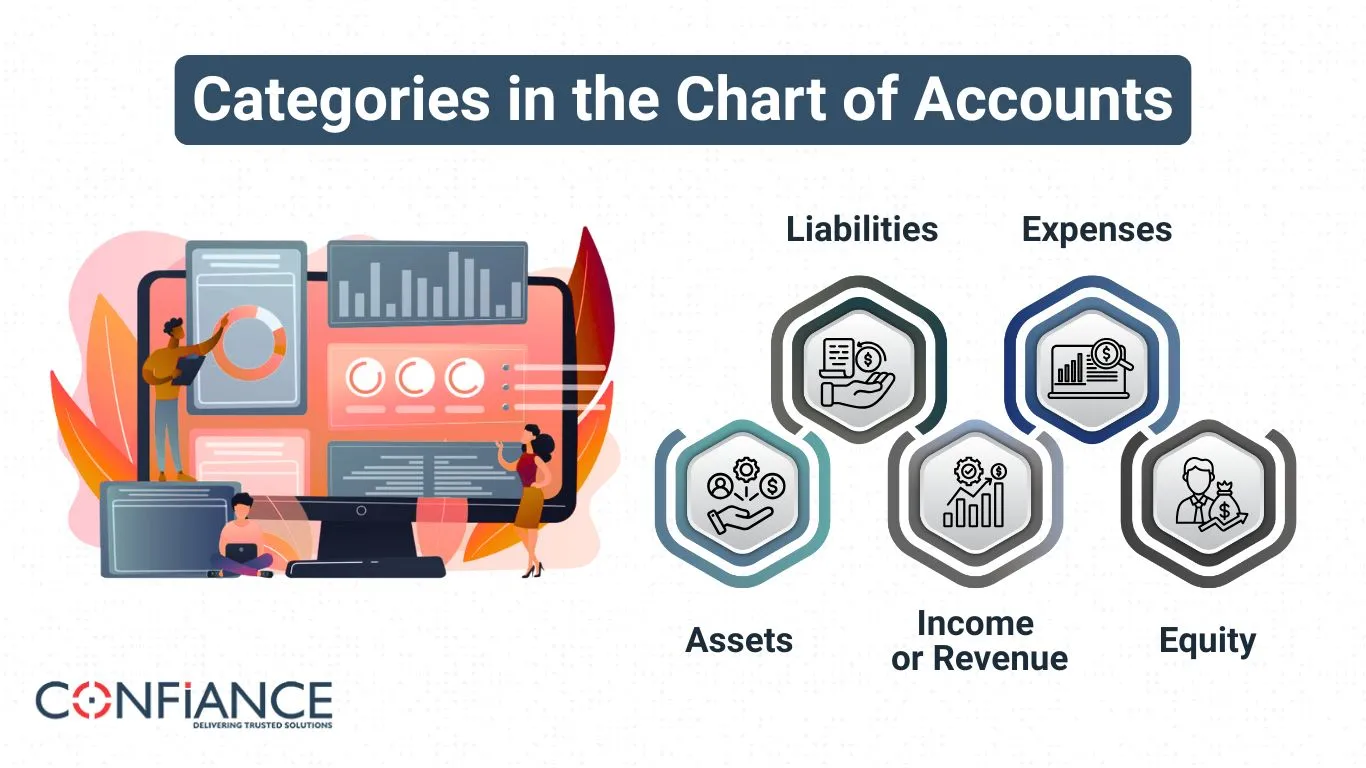

Categories in the Chart of Accounts

A chart of accounts groups accounts into main types. This helps track business health and plan better.

1. Assets

Assets are what a business owns. They include cash, stock, land, and tools.

- Current Assets: Cash, accounts receivable, and stock. It can turn into cash in one year.

- Fixed Assets: Land, buildings, and machines used for the long term.

- Other Assets: Investments or long-term loans.

Tracking assets shows what the firm owns at all times.

2. Liabilities

Liabilities show what a business owes. These include loans, unpaid bills, and taxes.

- Current Liabilities: Bills and short-term loans due in one year.

- Long-term Liabilities: Loans or mortgages due after one year.

Properly recording liabilities helps manage payments and avoid fines.

3. Equity

Equity is the owner’s share in the business. It is what remains after debts are paid.

- Owner’s Capital: Money put in by owners.

- Retained Earnings: Profits kept in the business.

Equity accounts track owner investment and growth.

4. Income or Revenue

Income accounts show money earned from sales or services.

- Operating Income: From the main business work.

- Non-Operating Income: From other sources, like interest.

Charts of accounts help track which items make the most money.

5. Expenses

Expense accounts record money spent to run the business.

- Operating Costs: Rent, salaries, and utilities.

- Non-Operating Costs: Interest or losses not from the main work.

Expense tracking helps control costs and improve profit.

How Charts of Accounts Work

A chart of accounts makes managing money simple. Every transaction goes under a specific account. This keeps data correct and ready for reports.

Recording Transactions

Every cash flow is recorded under a chart account. Examples:

- Paying electricity → Utilities Expense

- Receiving payment → Accounts Receivable

This reduces mistakes and keeps records clear.

Generating Financial Reports

With a COA, you can make:

- Income statements

- Balance sheets

- Cash flow statements

Reports are clear, correct, and useful for decisions.

Benefits of Charts of Accounts

- Organized Records: Easy to find and check transactions.

- Track Money: Know where cash comes and goes.

- Better Choices: Helps owners and managers act wisely.

- Audit Ready: Makes audits smooth and easy.

Monitor Cash Flow

Use the chart to track money coming in and going out. This helps spot shortfalls early and avoid problems with bills or payroll.

Spot Trends

Charts of accounts let you compare months or years. Seeing patterns in sales or costs helps plan growth and cut waste.

Support Decisions

A clear chart helps managers and owners choose where to spend or save. It makes business planning faster and more reliable.

Guidelines for Building an Easy-to-Use Chart of Accounts

Creating a chart of accounts is simple with planning.

Keep It Simple

Avoid too many accounts. Stick to the main types and add sub-accounts only if needed.

Use a Logical Number System

Assign codes that make sense:

- 1000–1999 → Assets

- 2000–2999 → Liabilities

- 3000–3999 → Income

- 4000–4999 → Expenses

This helps find accounts fast and record them correctly.

Review and Update Often

Check your chart at least once a year. Add or remove accounts as the business changes.

Align With Reports

Make a chart that helps create income statements, balance sheets, and cash flow reports easily.

Use Clear Account Names

Choose short, clear names for each account. Avoid complex or long phrases. This makes it easy for anyone to read and understand.

Group Similar Accounts

Keep related accounts together. For example, all sales accounts are in one group and all expense accounts are in another. This helps track money more easily.

Plan for Growth

Leave space for new accounts. As your business grows, you can add accounts without changing the whole chart.

How to Use Charts of Accounts to Make Smart Decisions

It is a tool that can guide better financial choices. Here is how you can use it effectively:

1. Track Income and Costs

Use the chart to see where money comes from and where it goes. This helps spot high costs and low-income areas.

2. Plan Your Budget

Check account trends to set budgets. Use past income and spending to plan for the future.

3. Compare Time Periods

Look at monthly or yearly reports to see trends. This helps identify growth or problem areas quickly.

4. Identify Problem Areas

Accounts with high costs or low revenue can show where changes are needed. Early spotting saves money and avoids losses.

5. Make Reports Clear

The chart makes income statements, balance sheets, and cash flow reports simple to read. Clear reports help in fast and smart decisions.

6. Support Growth

Use insights from the chart to decide where to invest or cut costs. It helps the business grow steadily and stay financially healthy.

Common Mistakes to Avoid

Even with charts of accounts, errors can happen. Avoid:

- Too Many Accounts: Leads to confusion.

- Missing Accounts: Important items must be included.

- Unclear Names: Keep account names simple and clear.

- Not Updating: Old charts may not fit the current business.

- Wrong Codes: Using the wrong numbers can make tracking and reports hard.

- Mixing Account Types: Don’t put income with expenses or assets with liabilities; it can cause errors in reports.

How Charts of Accounts Help Businesses

Charts of accounts are useful for all business sizes. They help:

- Track income and spending

- Plan budgets and manage cash flow

- Make reports clear and accurate

- Reduce mistakes and save time

Advanced Tips for Better Use

Use Sub-Accounts

Add sub-accounts for detailed tracking:

- Under Salary Expense → Admin Salary, Sales Salary

- Under Sales → Product A, Product B

Sub-accounts help see detailed performance.

Keep Codes Consistent

Use the same code structure each year. It avoids confusion and keeps reports consistent.

Use Software

Accounting software can manage charts of accounts automatically. This reduces human error and speeds up reports.

Charts of accounts are the basis of business accounting. They organize all financial data, making it easy to track income, costs, assets, and debts. A clear COA helps create reports, make decisions, and grow the business. Both small and large businesses gain from a well-set chart of accounts.

At Confiance, we help businesses manage their chart of accounts through our outsourced accounting, bookkeeping, and other financial services. We set up clear lists of accounts for income, expenses, assets, and liabilities, so every transaction is tracked in the right place. Our services also make it easy to create reports like income statements, balance sheets, and cash flow reports. By using our service, businesses save time, reduce errors, and keep their financial data organized.

FAQs

- What is a Chart of Accounts?

It is a list of accounts used to track income, spending, assets, and debts. It helps keep all the money records clear and easy to check. It shows where each dollar goes and comes from. - Why do I need charts of Accounts?

It helps organize money, track cash, and make reports fast. It also shows which parts of the business bring in money and which cost too much. - Can Small Businesses Use It?

Yes. Even small firms get help from clear accounts. It helps them see cash flow and plan small or big moves with ease. - How Often Should I Update It?

Check it at least once a year or when the business changes. Regular updates keep the chart right and reports correct. - Can I Customize It?

Yes. You can add or remove accounts to fit your business. Customizing helps track the items that matter most to you. - How Does It Help With Reports?

It makes income sheets, balance sheets, and cash flow reports easy. It also makes the numbers clear and simple to read. - What Mistakes Should I Avoid?

Too many accounts, missing accounts, unclear names, or not updating often. Avoid these to keep records neat and easy to use. - How Does Reading Accounts Help Make Smart Decisions?

Reading each account shows where money comes in and goes out. This helps cut waste, plan well, and make better moves. It also helps spot weak areas in the business.