The Framework of General Ledger Accounts in Business Accounting

General ledger accounting is a key part of running any business. It helps track all the money coming in and going out. General ledger accounts record each transaction. They show how a business earns and spends money. If a business wants to know its real financial health, the general ledger is the best place to look.

Understanding General Ledger Accounting

What is General Ledger Accounting?

General ledger accounting is the method of keeping all financial records in one place. It shows what a business owns, owes, earns, and spends. Each general ledger account records a type of money activity.

Importance of General Ledger Accounts

Ledger books are key to good business accounting. Here’s why:

- Correct Records: Every transaction is written down, which lowers mistakes.

- Better Choices: Owners and managers use the right data to plan and act.

- Follow Rules: Good accounting keeps the business in line with tax and law.

- Easy Audits: A neat ledger makes audits and checks simple.

Knowing the value of general ledger accounts helps businesses stay in control of their money and grow steadily.

Structure of General Ledger Accounts

Ledger books form the base of all business work. This guide will show the parts, structure, and types of these accounts. It will help owners track money and plan well.

Components of General Ledger Accounts

A ledger has five main parts:

- Assets: Things the firm owns, like cash, stock, or tools. Tracking assets helps you use what you have and plan to grow.

- Liabilities: Money the business owes, like loans, bills, or taxes. Tracking this helps pay on time and avoid fines.

- Equity: The owner’s share of the business after debt. Equity shows what the owner owns and what the business owes others.

- Revenue: Money from sales or work done. Tracking revenue shows how much money comes in and helps plan.

- Expenses: Money spent to run the firm, like pay, rent, or bills. Watching costs helps cut waste and save cash.

These parts form a clear plan for keeping records and making reports right.

Types of General Ledger Accounts

Accounts fall into two types:

1. Balance Sheet Accounts

These show the money state at a point in time. They include:

- Cash: Money on hand for daily use.

- Accounts Receivable: Money customers owe.

- Inventory: Goods for sale.

- Accounts Payable: Money owed to suppliers.

- Loans: Money borrowed that must be paid.

These accounts show what the business owns, owes, and the owner’s share.

2. Income Statement Accounts

These show the business’s performance over time. They include:

- Sales Revenue: Money from sales.

- Service Income: Money earned from work or services.

- Operating Expenses: Costs to run day-to-day work.

- Interest Expenses: Money paid on loans.

Splitting accounts this way helps track money in and out, see profit, and make smart choices. It also helps plan budgets and save money.

How Ledger Books Work

Recording Transactions

Every money movement starts as a journal entry. It then goes to the ledger accounts. Each entry shows:

- Date

- Account name

- Debit or credit

- Short note

Example: A customer pays cash for a service:

- Cash account is increased (debit)

- Revenue account is increased (credit)

This system keeps the ledger balanced.

Posting to Ledger Accounts

Posting moves journal data to the correct general ledger account. Good posting keeps records right. Many accounting programs do this automatically to save time and reduce mistakes.

How Technology Helps in General Ledger Accounting

Modern tools make general ledger accounting easier and more accurate. Software can post transactions automatically to the correct ledger accounts. It can also track money, create reports, and spot mistakes quickly.

Benefits of Using Technology

- Fast Posting: Money moves straight to the right account.

- Fewer Errors: The system checks debit and credit to keep accounts right.

- Simple Reports: See profit, loss, and cash flow in minutes.

- Audit Ready: All money moves are saved and easy to check.

Using tech with clear general ledger accounts saves time, cuts mistakes, and helps people make smart choices.

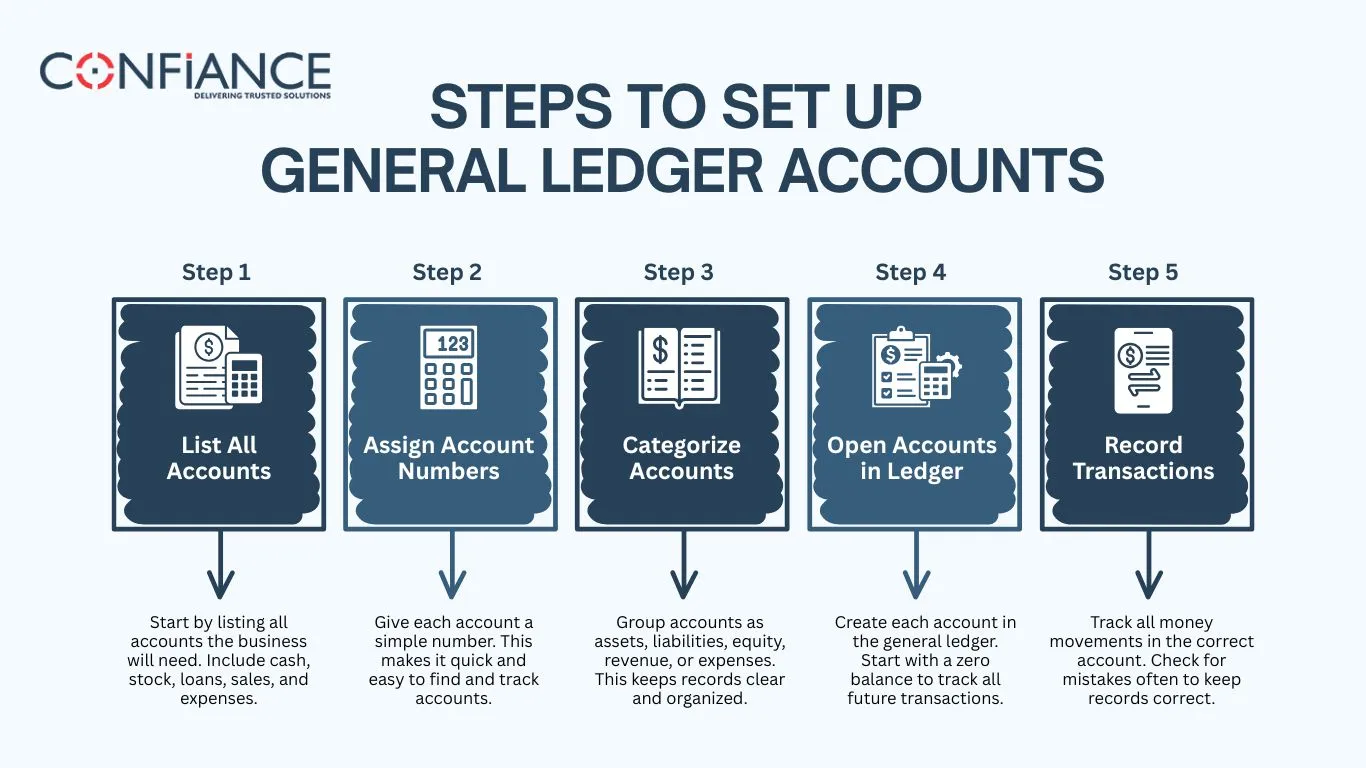

Steps to Set Up General Ledger Accounts

Setting up a general ledger the right way keeps firm money clear and easy to track. Follow these steps: Follow these steps:

- Step 1: List All Accounts

Start by listing all accounts the business will need. Include cash, stock, loans, sales, and expenses. - Step 2: Assign Account Numbers

Give each account a simple number. This makes it quick and easy to find and track accounts. - Step 3: Categorize Accounts

Group accounts as assets, liabilities, equity, revenue, or expenses. This keeps records clear and organized. - Step 4: Open Accounts in Ledger

Create each account in the general ledger. Start with a zero balance to track all future transactions. - Step 5: Record Transactions

Track all money movements in the correct account. Check for mistakes often to keep records correct.

By following these steps, a business can begin general ledger accounting properly, reduce errors, and maintain clear records.

Common Problems in General Ledger Accounting

Even with care, ledger accounts can have issues. Knowing these problems helps keep books correct and simple.

- Hard Transactions: Some transactions are tricky, like foreign money or bank transfers. Posting them wrong can cause confusion and errors.

- Errors in Records: Wrong entries or postings to the wrong account can lead to wrong totals. Checking the ledger often catches mistakes early.

- Late Updates: Not recording transactions on time can make the ledger out of date. Timely posting keeps numbers correct.

Missing Proof: Lost bills or notes make it hard to show a deal. Keeping all records helps avoid errors and audits. - Rule Breaks: Not following tax or book rules can cause fines. Using the ledger right avoids fees and extra work.

- Double Posts: Adding the same deal twice can make the totals wrong. Careful checks stop doubles and keep the books right.

Best Ways to Manage General Ledger Accounts

Managing ledger accounts well helps keep business records correct and easy to use. Here are some simple ways to do it:

- Check Accounts Often: Compare ledger accounts to bank records often. This stops mistakes and fraud.

- Keep Accounts Simple: Always put similar transactions in the same account. For example, all office supply costs go to “Office Expenses.”

- Review Accounts Regularly: Look at ledger accounts from time to time. This finds errors and unusual trends.

- Use Accounting Software: Software can record, post, and check accounts. This makes general ledger accounting fast and accurate.

- Reconcile Accounts Monthly: Match account totals with bank statements each month. This helps spot missing or wrong entries quickly.

- Track Changes Clearly: Write notes when you adjust accounts. This keeps records easy to follow for audits or reviews.

- Train Staff Properly: Make sure all staff know how to post transactions correctly. Proper training reduces errors and saves time.

Benefits of a Good General Ledger

A well-kept general ledger helps a business see and control its money. Here are the main benefits:

- Clear Money Picture: A good ledger shows money coming in and going out. You can see profits, costs, and cash flow at a glance.

- Better Decisions: Data from ledger accounts helps owners make smart choices on spending, saving, and planning for growth.

- Ready for Audits: Accurate accounts make audits fast. Each transaction is easy to check and verify.

- Save Time and Effort: Clear records and simple systems make ledger work quick and less tiring. Automation can help post and track entries easily.

- Track Growth: A good ledger shows trends over time, helping the business plan for new goals or expansions.

- Spot Problems Early: Errors or unusual transactions stand out quickly, so the business can fix issues before they grow.

At Confiance, we give full accounting and bookkeeping services. This covers setup, posting, balance check, tax, and daily books. Our team has certified experts who keep records clear and audit-ready. Confiance provides services that save time, speed work, and keep books right. Partner with us for a trusted full solution.

FAQs

- What is a general ledger account?

A general ledger account is a record of all money activity for a part of your business. It shows what the company owns, owes, earns, and spends. - Why is general ledger accounting important?

General ledger accounting keeps all financial records correct. It helps businesses track money, make reports, and plan for growth. - What types of general ledger accounts exist?

There are two main types: Balance sheet accounts and Income statement accounts - How do I record transactions in a general ledger account?

Each transaction starts in a journal. It is then posted to the correct general ledger account. Debits and credits keep the accounts balanced. - How can an accounting team help with ledger work?

An accounting team can set up ledger accounts, record deals, check account totals, and give bookkeeping support to keep records clear and correct. - How often should I review my ledger accounts?

Accounts should be reviewed regularly, at least monthly. This keeps errors low and ensures that general ledger accounting stays correct. - What common mistakes should I avoid in general ledger accounting?

Avoid mixing personal and business funds, misclassifying transactions, skipping entries, and not checking accounts. Correct ledger accounts help prevent these errors.