Step-by-Step Process to Create and Analyze Trial Balances

Keeping track of money can be hard, but a trial balance makes it easy. This report lists all accounts in your books and shows the amount in each on a set date. It tells you where cash comes from and where it goes. Knowing how to create a trial balance helps spot mistakes, cut waste, and plan your budget with real numbers. Trial balances help businesses of all sizes, big or small. A clear list of accounts also makes reports easy to read, such as income sheets, balance sheets, and cash flow sheets.

This guide will show a step-by-step way to make and check your balances. You will learn how to record transactions, total amounts, find errors, and use the report to plan and grow your business.

What is a Trial Balance?

A trial balance shows all balances from your ledger. It lists debits and credits and checks that the books are correct. It is usually done at month-end, quarter-end, or year-end before making financial statements.

Why Trial Balances Matter:

- Check Accuracy: Make sure debits equal credits

- Spot Errors: Find mistakes in accounts.

- Plan Money: See cash flow clearly.

- Easy Reports: Helps make income statements and balance sheets.

Key Components of a Trial Balance

Trial balances show several key parts. Understanding these parts makes it easy to review accounts and keep records accurate.

- Account Names: Lists all ledger accounts clearly. Each name shows the type of account, which makes it easier to find and track money in the books.

- Debit Balances: Shows amounts for assets and expenses. Checking debits helps ensure money spent or owed is recorded properly and helps spot errors quickly.

- Credit Balances: Shows amounts for liabilities, equity, and income. This part ensures funds owed or earned are correct and balances the books accurately.

- Totals: Sum of all debits and credits. Totals must match, which confirms that all entries are correct and the books are ready for reports.

- Date: Marks when the trial balance is prepared. The date helps track financial periods and compare accounts across months or years for better planning.

Types of Accounts Included

A trial balance shows all accounts in the ledger. This keeps records full and easy to read.

- Assets: Cash, tools, or land the business owns. Assets show what the firm has and help plan buys and track growth.

- Liabilities: Loans, bills, or debts. Liabilities show what the firm owes and help plan payments to avoid money issues.

- Equity: Owner’s money or saved profit. Equity shows the owner’s share and helps check the firm’s health.

- Income: Money received from sales or services. These accounts track what the business earns, help plan budgets, and show how well it is doing.

- Expenses: Rent, salaries, bills, or other costs. These accounts track money spent, help reduce waste, and improve profit.

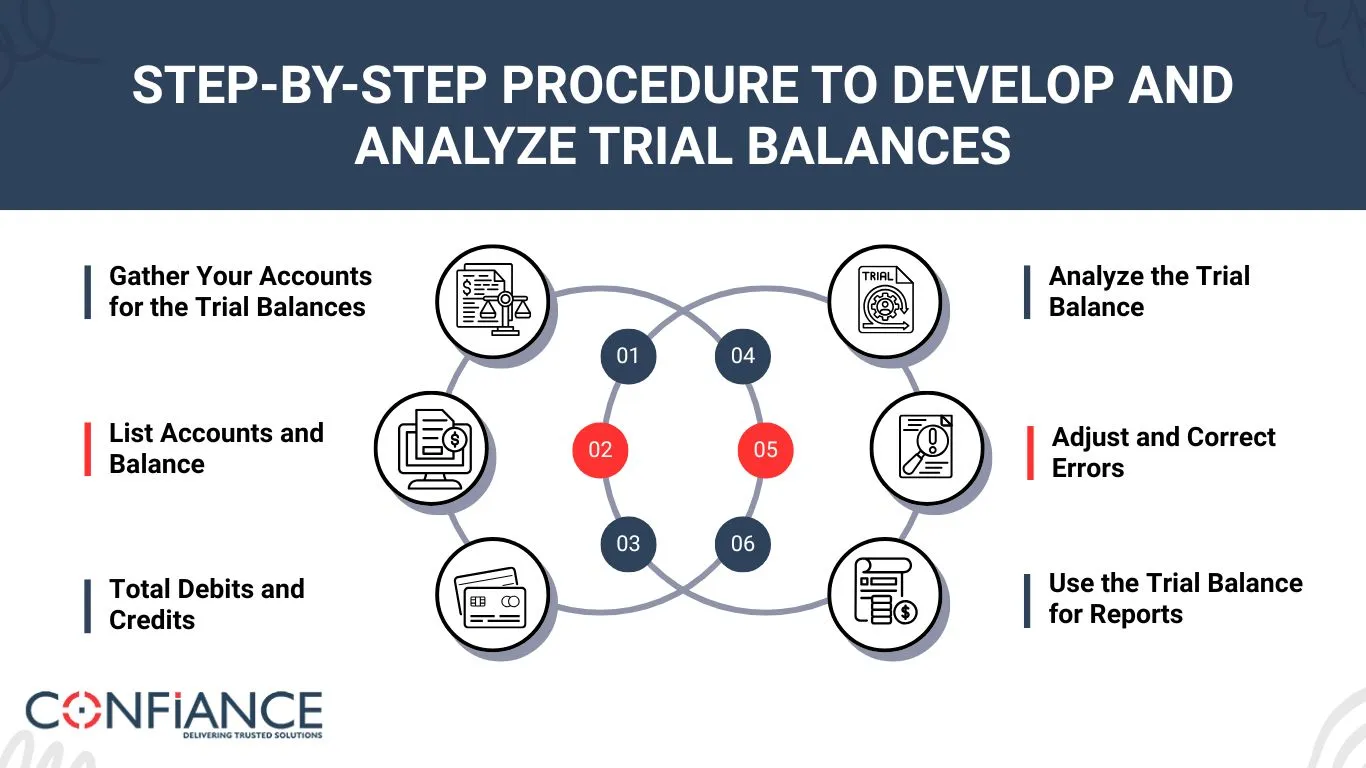

Step-by-Step Procedure to Develop and Analyze Trial Balances

Trial balances show all account totals and check that debits equal credits. This section will walk you through each step to create, check, and use them for clear, correct reports.

Step 1: Gather Your Accounts for the Trial Balances

Collect all ledger accounts. Make sure each account has a final balance. Group accounts by type: assets, debts, owner’s share, income, and expenses. This makes the trial balance easy to read and check.

Tips for Organizing Accounts

- Group Similar Accounts: Keep the same type of accounts together. This makes it easy to read and check.

- Use Clear Names: Give each account a short and simple name. Clear names help you find accounts fast.

- Use Codes: Give numbers to accounts to avoid mix-ups. Codes make recording and reporting faster.

- Keep It Simple: Only list accounts you use. Avoid extra accounts to keep your books neat and easy to check.

Step 2: List Accounts and Balances

Write each account on the trial balance sheet. Enter the debit or credit balance for each. Make sure all accounts are included.

How to Record Balances

- Debits: Usually for assets and expenses.

- Credits: Usually for debts, owner’s share, and income.

- Check Numbers: Double-check each amount to make sure it is correct.

Step 3: Total Debits and Credits

Add all debit balances in one column and all credit balances in another. Both totals must match. If the totals do not match, an error exists and must be found.

What to Do if Totals Don’t Match

- Check for missing accounts.

- Verify each amount is correct.

- Look for errors in addition or posting.

Step 4: Analyze the Trial Balance

Once totals match, review balances closely. Look for unusual amounts. Compare past months to find trends in income, costs, or assets.

Key Points for Analysis

- Spot unusual balances.

- Check accounts that rise or drop fast.

- Track trends to plan better.

Step 5: Adjust and Correct Errors

If errors exist, make journal entries to fix them. Update balances and recalculate totals. Repeat until correct.

Common Errors to Watch

- Wrong account used.

- Missing accounts or balances.

- Debit entered as credit or vice versa.

Step 6: Use the Trial Balance for Reports

A correct trial balance is the base for reports like income statements, balance sheets, and cash flow. It keeps reports right and useful for decisions.

By knowing how to create a trial balance, you can check accounts, stay organized, and make smart financial decisions.

Benefits of Using a Trial Balance

Accurate Reports

A proper check of your accounts helps catch errors. It keeps reports clear and correct, so you can trust the numbers for daily use and quick decisions.

Better Planning

Seeing where money comes and goes lets you plan budgets and goals. You can spend and save wisely and know what to expect each month.

Audit Ready

Keeping accounts updated makes audits fast and smooth. Small mistakes are fixed early, so there is less stress and fewer last-minute changes.

Track Growth

Compare past months to spot gains or drops. This shows how your business grows or slows and helps guide the next steps.

Detect Errors Early

Regularly checking books helps spot mistakes quickly. Fixing them early avoids big problems and keeps your records neat and correct.

Common Mistakes to Avoid

Missing Accounts

Include all ledger items in your records. Leaving out accounts can give a wrong view of finances and confuse later.

Wrong Balances

Check that debits and credits match. Wrong balances can create errors in totals and make reports unreliable.

Skipping Updates

Keep your books current. Skipping updates can hide problems and make it hard to plan or compare periods.

Addition Errors

Check totals in both columns carefully. Small addition mistakes can change reports and affect decisions if left unchecked.

Mixing Types

Keep debits and credits in the right column. Mixing them can mislead readers and cause errors in reports.

Unclear Names

Use short, simple names for accounts. Confusing or long names make it hard to read reports and track money accurately.

Tips for Preparing an Effective Trial Balance

Keep Accounts Neat

Group accounts by type and name so you can find items fast. Clear lists help avoid mistakes and make checking totals simple and quick.

Double-Check Balances

Check that every ledger account is listed. Make sure debits and credits are the same. This stops errors, keeps books right, and makes reports clear and easy to trust.

Update Often

Look over accounts each month or every few months. Regular checks catch mistakes fast and keep records up to date. This shows true cash flow, costs, and assets for smart planning.

Compare Periods

Look at past months to see trends in income, spending, and assets. Comparing old and new numbers helps spot growth, loss, or change and guide wise choices.

Make Reports Simple

Use short, clear names and simple numbers for each account. Reports that are easy to read save time, cut errors, and help anyone see the books fast and clearly.

Knowing how to create a trial balance keeps accounts correct. Trial balances help find mistakes, track money, and prepare accurate reports. Following these steps ensures your books stay neat, errors are low, and decisions are smart. Using trial balances regularly gives a clear view of your business’s financial health.

At Confiance, we record each transaction correctly and group accounts correctly. We make sure that debit and credit totals always match. We create reports like income statements, balance sheets, and cash flow reports. This cuts errors, saves time, and shows a clear view of your money. Businesses can stay organized, spot problems early, and make smart financial choices. We make trial balances simple, even for small firms without an in-house accounting team.

FAQs

- What is a Trial Balance?

A trial balance lists all account totals to check if debits and credits match. It gives a clear view of money and helps make sure all entries are correct.

- Why Do I Need a Trial Balance?

It finds mistakes, tracks cash, and keeps reports correct. Using it often helps spot errors early and shows how money moves in the business.

- How to create a trial balance?

Make a trial balance each month, quarter, or year, based on your needs. Checking often helps find mistakes fast and plan budgets well.

- Can Small Businesses Use Trial Balances?

Yes. Even small firms can use it to check books and plan spending. It helps owners keep accounts neat and make smart choices.

- What Mistakes Should I Avoid?

Do not leave out accounts, enter wrong amounts, or mix debit and credit. Also, update regularly to prevent errors from growing.

- How Do Trial Balances Help in Decision-Making?

They show money trends, flag problems, and guide choices. Checking balances helps see which areas earn money and which need cost cuts.

- What is the Best Way to Record Balances?

Use short, clear names. Write debits and credits right and check all numbers. Doing this keeps reports neat and cuts mistakes.