Bookkeeping 101: Small Business Accounting and Bookkeeping Fundamentals

Running a small business is exciting, but it also comes with big financial duties. Small Business Accounting is the foundation of smart money management. It helps owners track cash, record income, and control costs. Without a solid plan, it is easy to lose track of where the money goes. Bookkeeping fundamentals provide the structure and clarity needed to stay on top of finances.

In this guide, we will explore the basics of accounting and bookkeeping. We will break down tasks, tools, and tips to keep records clean and simple.

Why Small Business Accounting Matters

Money is the heart of every business. If you do not track it, you risk poor cash flow and stress at tax time. Proper Small Business Accounting helps in three key ways:

- It shows where your money comes from.

- It keeps costs under control.

- It prepares you for taxes and growth.

When records are in order, owners can make smart choices. Bookkeeping is not just about numbers; it is about guiding your business forward.

Core Bookkeeping Fundamentals for Small Business

Understanding bookkeeping fundamentals is the first step in solid financial management. Clear records let small business owners make smart choices and stay organized.

| Category | Definition |

| Assets | Resources your company has that can bring value, such as money, tools, or property. |

| Liabilities | Debts or obligations the company must pay to vendors, banks, or suppliers. |

| Owner’s Equity | What is left after paying all debts? |

| Revenue | The money your business earns. |

| Expenses | Costs you pay to run the business. |

| Profit | What remains after all costs are paid. |

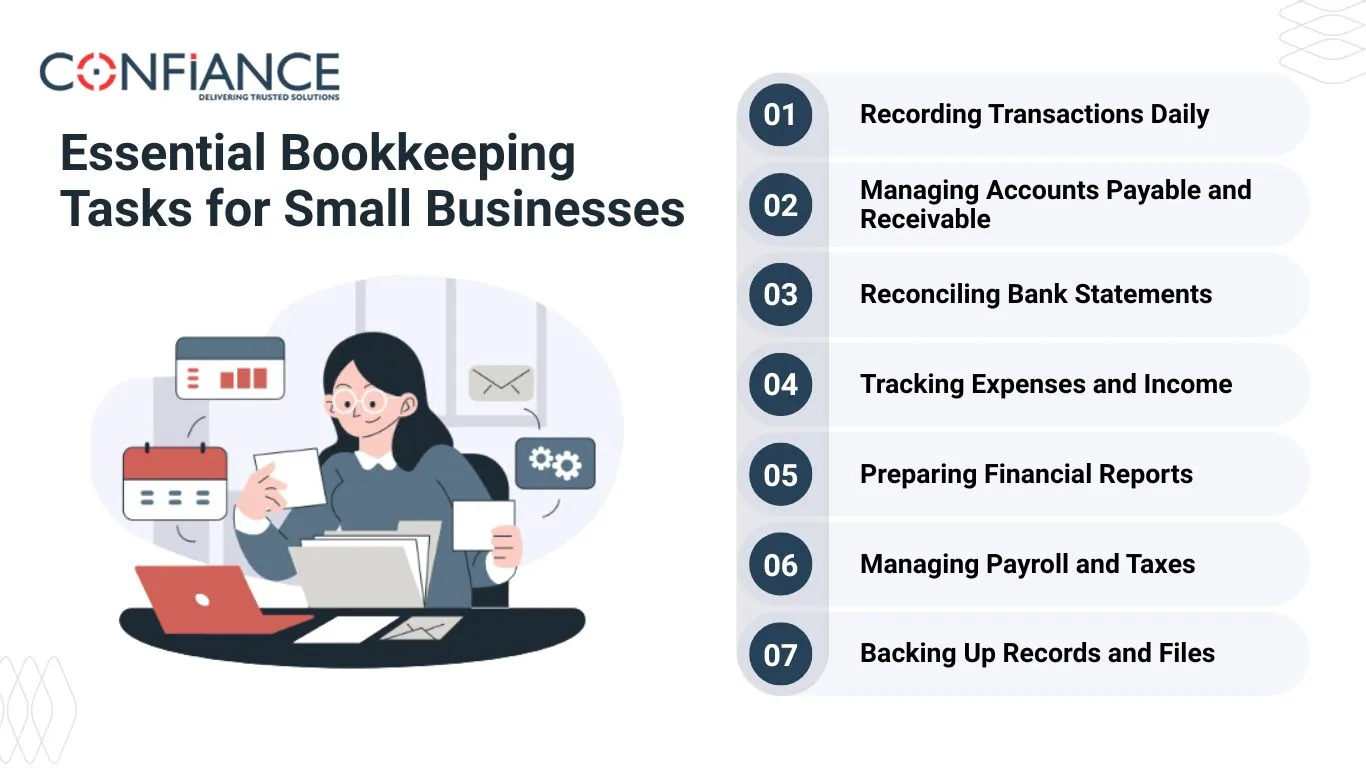

Essential Bookkeeping Tasks for Small Businesses

Every business must handle daily tasks to keep numbers right. Bookkeeping fundamentals guide these tasks:

Recording Transactions Daily

Record all sales and costs each day. Even small receipts matter. Missing one can cause errors later. Track cash, cards, and invoices to stay on top of your money.

Managing Accounts Payable and Receivable

Accounts payable is money you owe vendors. Pay on time to avoid fines.

Accounts receivable are money your clients owe. Track who owes what. Watching both keeps your cash flow smooth.

Reconciling Bank Statements

Each month, match your books with bank records. Check deposits and withdrawals. This catches mistakes, prevents fraud, and keeps your records true.

Tracking Expenses and Income

Keep a log of all income and costs. Group them by type: rent, supplies, or sales. Knowing where money comes from and goes helps you plan and grow..

Preparing Financial Reports

Make simple reports: profit and loss, balance sheet, or cash flow. These show your business's health. Reports help you make smart choices and prepare for taxes.

Managing Payroll and Taxes

Track wages and tax deductions for staff. Pay taxes on time to avoid fines. Keep clear records to stay ready for audits.

Backing Up Records and Files

Save all files in a safe place. Use cloud storage or external drives. Backups prevent loss from accidents or tech issues.

Types of Bookkeeping Systems

Not every business needs a complex system. The method depends on your size and goals.

Single-Entry Bookkeeping

This simple method records each transaction once. It works for very small firms with low activity.

Double-Entry Bookkeeping

This method records each transaction twice: once as a credit, once as a debit. It is more accurate and is common in Small Business Accounting.

Cash Flow Tracking: Avoiding Shortages

Cash flow is the fuel of your business. Even if sales are strong, poor flow can harm growth.

Good bookkeeping tracks:

- When cash comes in

- When bills are due

- Seasonal ups and downs

Clear records show the best time to spend and save.

Choosing the Right Bookkeeping Software

Modern tools make small business accounting easy. Programs like QuickBooks, Xero, and Wave automate tasks such as:

Invoice Creation Made Simple

Small business software lets you make invoices fast and correctly. QuickBooks and Xero record each sale instantly, cutting time spent on manual work.

Easy Expense Tracking

Track every cost in real time. Sort expenses, check cash flow, and create reports automatically. Good tracking keeps records correct and prevents missed transactions.

Payroll Reports Without Hassle

Software can calculate payroll and make employee reports. This saves time, lowers mistakes, and keeps your records neat.

Fit Software to Your Business Size

Pick software that fits your needs. Too simple, and you may miss key features. Too complex, and you waste time. The right choice keeps bookkeeping smooth.

Generate Financial Reports Quickly

Modern tools make balance sheets, profit and loss reports, and cash flow statements fast. These reports help owners make smart choices.

Access from Anywhere

Cloud-based programs let you access your records from any device. This keeps business running even when you are away.

Pick software that fits your size. Too complex wastes time; too simple risks missing features.

Frequent Bookkeeping Mistakes to Avoid

Even small errors cost money. Avoid these common traps:

Keep Personal and Business Funds Separate

Mixing personal and business money causes confusion. Use separate accounts to keep records clear.

Always Save Receipts

Keep a record of every purchase. Digital copies work fine and make audits and month-end checks simple.

Perform Monthly Reconciliations

Compare your records with bank statements each month. This stops errors and keeps records correct.

Stay Compliant with Tax Rules

Bookkeeping that follows rules ensures all sales, costs, and deductions are recorded for tax time.

Don’t Ignore Small Transactions

Even small purchases matter. Record every transaction to keep a full financial picture and avoid mistakes later.

Following basic bookkeeping rules cuts errors and saves time.

Bookkeeping for Taxes: Staying Audit-Ready

Tax season is stressful for small firms. Clean records make it easy. Keep files for:

Track Sales and Revenue Accurately

Record every sale to track profits and taxes. Regular tracking makes year-end reporting simple.

Maintain Payroll Reports

Keep payroll info for all employees. Reports are key for taxes and audits.

Document Deductions and Receipts

Collect and organize all receipts. Proper files help ensure correct tax filings and reduce audit stress.

With accurate small business accounting, handling taxes is simple, not stressful.

Practical Tips to Stay Organized

Simple habits help you stay in control:

Use Digital Folders for Receipts

Sort receipts by month or type on your computer. This makes records easy to find.

Schedule Weekly Bookkeeping Time

Set aside time each week to check transactions and update records. Weekly habits prevent last-minute stress.

Back Up Records to the Cloud

Store all financial files in the cloud. Backups protect your data.

Review Reports Monthly

Check income, costs, and cash flow every month. This helps you stay in control and make better choices.

Use Checklists for Daily Tasks

Make a daily list for sales, costs, and payments. This ensures nothing is missed.

How Outsourced Bookkeeping Helps Small Businesses

Many owners spend too much time on books instead of growth. Outsourcing solves this. A pro handles records while you focus on clients. Benefits include:

Ensure Accurate Books

Bookkeeping pros manage records carefully, cut mistakes, and keep strong financial practices.

Reduce Stress During Tax Season

Organized records ready for taxes lowers stress. Pros make sure filings are complete and correct.

Minimize Risk of Errors

Skilled bookkeepers stop mistakes and keep your records correct. Outsourcing lets owners focus on growth.

Save Time on Daily Tasks

Outsourcing frees owners from daily entries, so they can spend time on work that grows the business.

Get Expert Financial Advice

Outsourced teams guide you on cash, budgets, and costs. They help you make smart choices for your business.

Scale Easily as You Grow

Pro services grow with your business, helping with expansion without extra costs.

With expert help, small business accounting is smoother and more cost-effective.

Running a small business is hard, and managing money can feel tough. Many owners struggle to keep books right, track taxes, and manage cash flow. Professional support plays a vital role in ensuring these tasks are managed with accuracy and consistency.

At Confinace, we help small firms handle accounting and follow good bookkeeping rules. Our team gives services that fit your size and goals. From daily transactions to tax-ready reports, we make your records clear, correct, and easy to read. With Confinace keeping your records clear, accurate, and easy to understand, you can focus on growing your business without worrying about missed deadlines or costly mistakes.

FAQs

- What is small business accounting?

Small business accounting is how you track money in and out. It helps you see cash, costs, and profit. It also makes taxes and bills easy to handle. - Why is bookkeeping important?

Bookkeeping shows where money comes from and goes. It helps stop cash flow problems and guides smart choices. - What are basic bookkeeping tasks?

You should record all sales and costs daily. Track money owed and money due. Check bank statements each month to avoid errors. - What types of bookkeeping exist?

Single-entry bookkeeping records each sale once. Double-entry records each sale twice for more checks and balances. - How can software help?

Software like QuickBooks or Wave makes invoices, tracks costs, and gives reports fast. Cloud tools let you see records from any device. - Can outsourcing help my business?

Yes. Outsourced bookkeeping keeps records right, saves time, and lowers tax stress. It lets you focus on work that grows your business. - How to avoid bookkeeping mistakes?

Keep personal and business money separate. Save all receipts. Check records each month and follow tax rules.