How to Set Up and Manage QuickBooks for Small Businesses Effectively

QuickBooks for Small Businesses is a tool that helps owners track cash, bills, and pay. It keeps books clear and easy to read. When set up right, it saves time, cuts mistakes, and shows the state of the firm. Owners can see cash flow, match bank accounts, and make reports fast. The tool helps small firms stay on track, plan growth, and make smart choices. With the right setup and habits, QuickBooks is a guide to run the business well and keep accounts in order.

Why QuickBooks Matters for Small Businesses

QuickBooks helps small firms keep track of cash. It shows all costs and sales. Owners get a clear view of their business and can make smart moves with ease.

Built for Growing Firms

Unlike sheets, QuickBooks grows with the firm. It works for new shops, solo owners, or small teams, and it adapts as the business grows.

Helps Save Time

QuickBooks makes invoices, reports, and taxes fast. This cuts long work and lets owners spend more time on sales and clients.

Keeps Records Clear

With every transaction stored, QuickBooks ensures small businesses have accurate data at all times. This helps avoid confusion and builds trust with banks, investors, and even tax bodies.

Reduces Stress

With built-in reports and tasks done by the tool, owners face less stress. They can focus on staff, sales, and growth.

Easy Access Anywhere

QuickBooks Online runs on any device. Owners can check books at work or on the move.

How to Set Up QuickBooks for Small Businesses

For small business owners, getting started with QuickBooks may seem tricky, but it is simple if you follow the steps one by one.

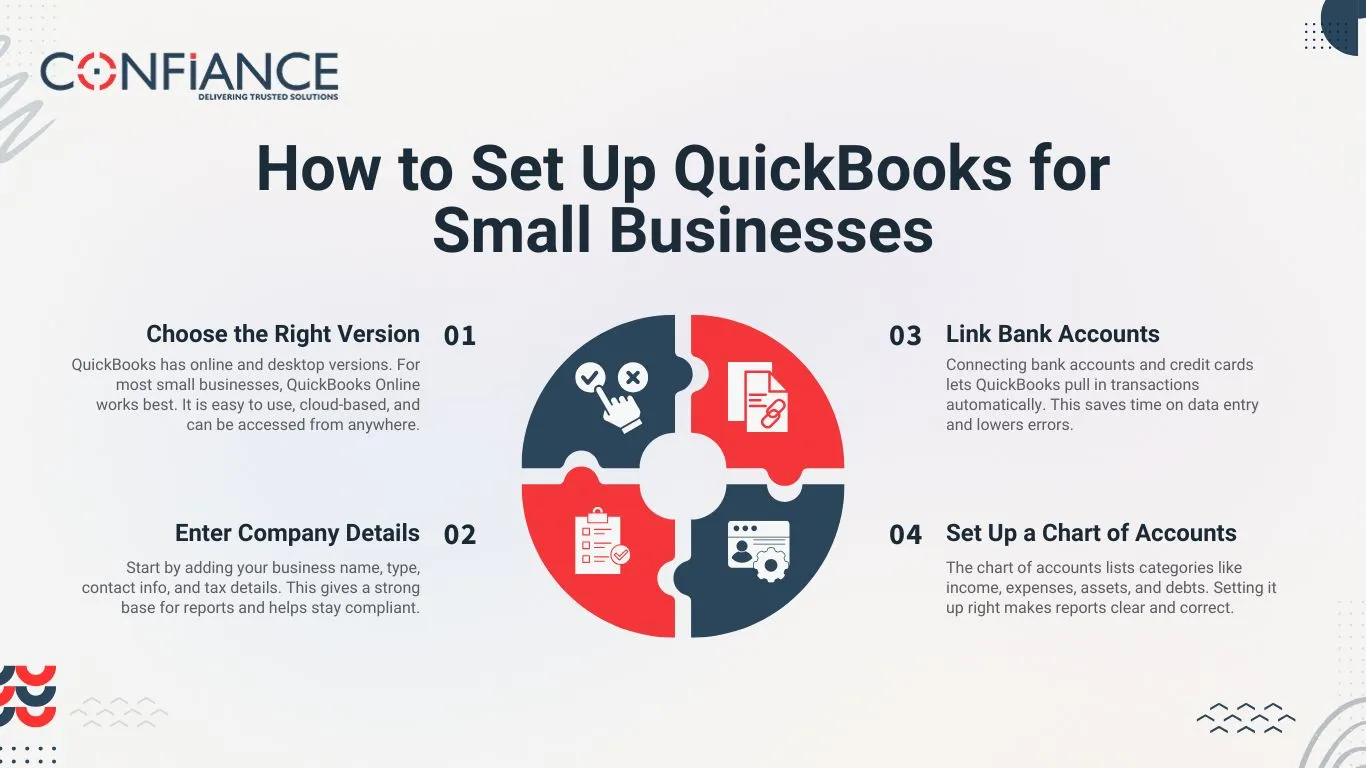

Choose the Right Version

QuickBooks has online and desktop versions. For most small businesses, QuickBooks Online works best. It is easy to use, cloud-based, and can be accessed from anywhere.

Enter Company Details

Start by adding your business name, type, contact info, and tax details. This gives a strong base for reports and helps stay compliant.

Link Bank Accounts

Connecting bank accounts and credit cards lets QuickBooks pull in transactions automatically. This saves time on data entry and lowers errors.

Set Up a Chart of Accounts

The chart of accounts lists categories like income, expenses, assets, and debts. Setting it up right makes reports clear and correct.

Managing Daily Tasks in QuickBooks

Once QuickBooks is set up, daily management is the key to success.

Tracking Income and Expenses

Business owners can record sales, bills, and expenses. With linked accounts, this often happens automatically. Each entry is placed in the right category for easy tracking.

Creating and Sending Invoices

QuickBooks lets owners design branded invoices and send them in minutes. It also tracks overdue payments and sends reminders, reducing delays in cash flow.

Reconciling Accounts

At the end of each month, reconciling bank statements with QuickBooks records ensures that no errors are missed. This step keeps the books accurate.

Advanced Features That Boost Growth

QuickBooks has more than just basic bookkeeping.

Payroll Management

QuickBooks can handle payroll for small teams, including taxes and cuts. This makes sure staff are paid on time and records stay correct.

Tax Reports

It makes instant tax logs from pay and costs. This makes filing easy and cuts stress during tax time.

Insightful Analytics

QuickBooks makes logs of profit, loss, cash flow, and trends. These insights help users plan and make smart picks for growth.

Project Tracking

For firms with projects, QuickBooks tracks pay and costs by job. This helps keep prices right and plan for profit.

Custom Dashboards

Users can see data in simple dashboards. These dashboards show key numbers like revenue, costs, and profit.

Common Challenges in Using QuickBooks

While QuickBooks is powerful, some challenges may arise.

Learning Curve

For new users, it may take time to learn the features. Online guides, courses, or hiring a QuickBooks expert can ease this process.

Data Entry Errors

If accounts are not linked or categories are set up wrong, errors can slip in. Regular checks help avoid this.

Cost Concerns

Some owners see QuickBooks as costly. But the value it adds through saved time and accuracy often outweighs the price.

Integration Issues

QuickBooks may not always sync well with other tools. Careful setup avoids most issues.

Overlooking Updates

Missing updates can cause problems. Staying current keeps features secure and smooth.

Misuse of Reports

Reports may be ignored by busy owners. But using them often improves decisions and growth.

Tips to Manage QuickBooks Effectively

QuickBooks can help track money and cut errors, making it easier for small businesses to stay organized and grow.

Update Regularly

Keep QuickBooks updated to use the latest features and security tools.

Use Automation

Enable automated invoice reminders, bank feeds, and recurring bills. This reduces manual work and keeps books current.

Review Reports Often

Check reports each week to stay informed. This makes it easier to spot trends, manage costs, and plan for the future.

Keep Records Current

Enter data daily or link accounts. This ensures records are never outdated.

Use Bank Reconciliation

Monthly reconciliation ensures books are correct. This builds trust in reports.

Back Up Data

Keeping backups prevents loss of data and ensures safety.

Seek Expert Help

If tasks feel complex, hiring a QuickBooks expert ensures proper use and fewer mistakes.

QuickBooks for Small Businesses vs. Manual Bookkeeping

Many small firms still use manual records or spreadsheets. Here is how QuickBooks compares.

| Feature | QuickBooks for Small Businesses | Manual Bookkeeping |

| Accuracy | High, with linked accounts and automation | Low errors are easy to miss |

| Time Needed | Fast, with many tasks automated | Slow, manual entry for every transaction |

| Reports | Instant insights into cash flow and profit | Limited and often unclear |

| Scalability | Works for startups and grows with the firm | Hard to scale as business expands |

| Cost | Monthly fee, but saves time and errors | Low upfront, but high risk of mistakes |

Key Advantages of QuickBooks for Small Businesses

Using QuickBooks brings clear benefits for small firms.

Saves Time and Reduces Errors

Automation cuts hours of work and ensures accuracy.

Builds Trust

Accurate records help build trust with banks, tax bodies, and investors.

Supports Growth

With reports and insights, QuickBooks helps small businesses plan and expand with confidence.

Advanced QuickBooks Strategies for Small Businesses

QuickBooks can do more than daily tasks. It has tools that help small firms grow, save time, and get clear insights. These tools help owners stay ahead and manage growth with ease.

Automate Recurring Entries

Set up bills and invoices to repeat automatically. This cuts repeat work, keeps data right, and saves hours each month while cash flow stays steady.

Use Class and Location Tracking

Track income and costs by class or place. This shows which parts of the business do best and helps owners make smart plans.

Build Custom Reports

Owners can make reports that fit their needs. Custom reports show trends, risks, and chances that normal reports might miss.

Integrate with Third-Party Apps

QuickBooks works with apps for payroll, stock, and CRM. These links boost its power, cut extra work, and lower manual data entry.

Forecast with Budget Tools

Use budget tools to plan. Owners can match real results with budgets to adjust fast and keep goals on track.

Secure Data and Access

Set roles and limits for each user. This keeps data safe while team members see only what they need for their work.

Confiance offers expert help to set up and run QuickBooks for small firms. We make sure your QuickBooks is set up right, smooth, and fits your firm’s needs. Our services include setting up accounts, automating tasks, making clear records, and checking money, helping you save time and cut errors.

Confiance also offers ongoing QuickBooks help to support growth, improve cash flow, and help with smart money choices. With clean records and trusted facts, your firm can focus on success while Confiance keeps your books strong, right, and ready for your future plans.

FAQs

- What is QuickBooks and how can small firms use it?”

QuickBooks is an accounting tool that helps manage money, log costs, and handle invoices efficiently for small businesses. It shows a clear view of the firm in real time. - Is QuickBooks hard for small firms to use?

No. QuickBooks is made for small firms. Menus are simple, and guides help users do daily work without deep money skills. - Can QuickBooks save time for small firms?

Yes. It can make bills, pull bank data, and make logs. This cuts work and lets users focus on sales, buyers, and growth. - Which version of QuickBooks is best for small firms?

Most small firms pick QuickBooks Online. It works on the cloud, can be used from anywhere, and updates on its own. - Does QuickBooks help with taxes?

Yes. QuickBooks can make tax logs from pay and cost data. This makes filing easy and keeps the firm in line with tax rules. - Can QuickBooks grow with my firm?

Yes. QuickBooks can grow with your firm. You can start small and keep using it as the firm grows. - Can QuickBooks track payments and bills?

Yes. QuickBooks shows who owes money and who has paid. This keeps cash flow steady and cuts missed payments. - Can QuickBooks help with choices?

Yes. QuickBooks gives charts and logs that show trends, costs, and pay. This helps users make smart picks fast.