Reconcile QuickBooks Like a Pro: Tips for Small Businesses

Small business owners have many tasks, and one of the most key tasks is to keep money records correct. To avoid mistakes and track funds well, you must reconcile QuickBooks regularly. This means checking that your QuickBooks records match your bank statements. Doing this step right keeps accounts clean, helps you make better decisions, and saves time. In this guide, we show how to reconcile QuickBooks like a professional and use simple tips to make the process fast and correct.

Understanding QuickBooks Reconciliation

Reconciliation in QuickBooks means checking your records against your bank or card statements. This makes sure all money in and out is logged. Small businesses benefit greatly from checking accounts often.

Track Every Dollar Clearly

When you reconcile, you can see where all the money comes from and goes. You can track spend, sales, and payments. This clear view helps plan daily tasks and avoid missing payments or deposits.

Spot Errors Early

Checking your records weekly helps spot mistakes fast. If a payment or deposit is wrong or missed, you can fix it before it causes bigger errors. Early action keeps records correct.

Keep Reports True

Books that are checked often show real numbers. Profit and loss, balance, and cash flow reports stay true. This helps owners make choices based on facts, not guesses.

Make Tax Filing Easy

Correct books make taxes simple. All income and spending are logged. This cuts mistakes and stress when filing tax forms.

Step-by-Step Guide to Reconciling QuickBooks

Following clear steps makes the process simple and smooth. You can save time and lower stress when you learn to reconcile QuickBooks with a routine method that works for your business needs.

Prepare Bank Statements

Start with your bank or card statement for the period. Check the end balance. Download a file for QuickBooks if possible. This helps speed up the match process.

Compare Transactions in QuickBooks

Open the Reconcile page in QuickBooks. Check each record with the bank statement. Make sure dates and amounts match. If some are missing, add them before moving on.

Fix Mismatches Fast

If numbers do not match, act fast. Look for duplicate entries, missing deposits, or bank charges. Fix errors before finishing. This keeps accounts correct and clear.

Common Challenges Small Businesses Face While Reconciling QuickBooks

Even small tasks can be hard for owners.

Hard-to-Match Transactions

Some records do not match the statement easily. Small differences in date or amount can cause mix-ups. Careful review helps match all entries properly.

Late Payments or Deposits

Banks may process payments slowly. Entries may appear late in QuickBooks. Watching pending transactions helps keep records correct.

Missing Bank Charges

Banks charge fees that may not be logged in QuickBooks. Missing charges can cause errors. Adding them keeps the balances true and prevents mismatches.

Entry Mistakes Happen

Typing wrong numbers or dates is common. These errors cause mismatches. Checking entries often keeps books right and prevents issues later.

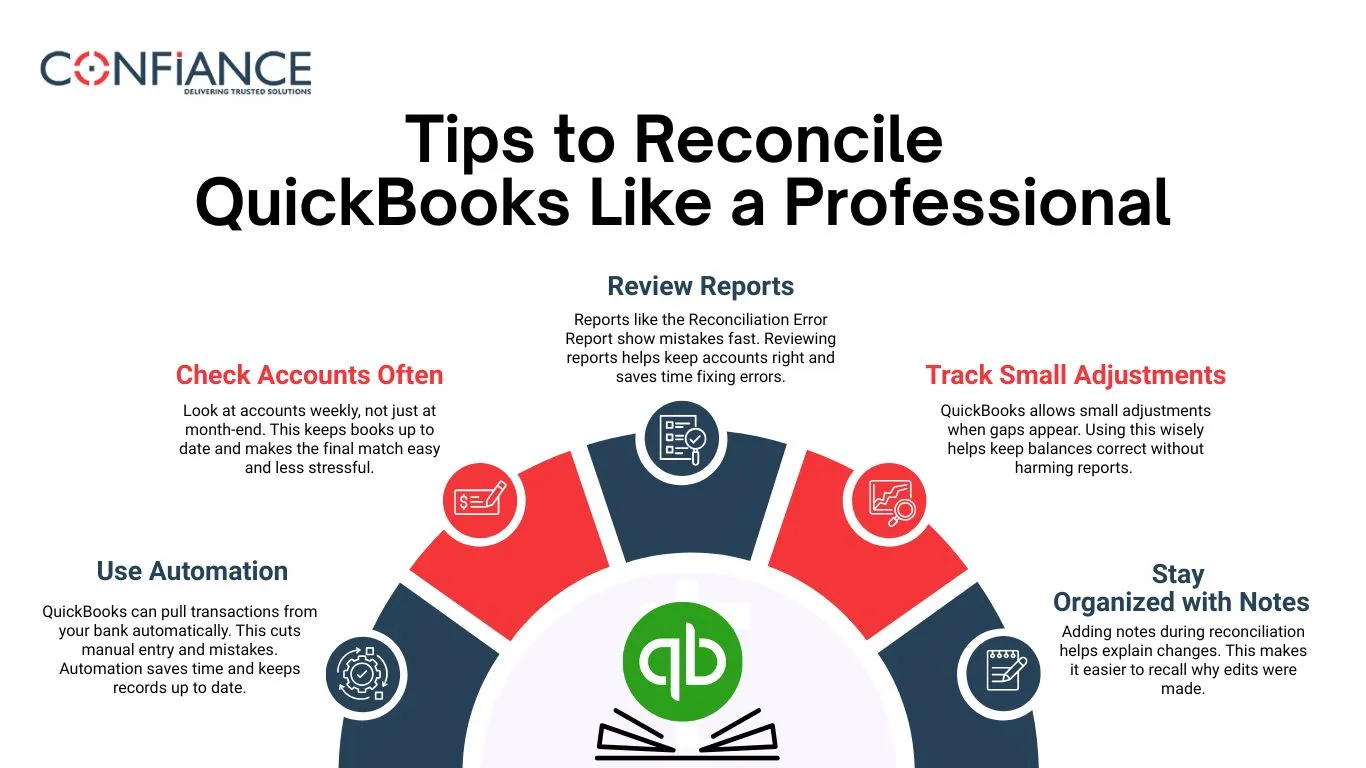

Tips to Reconcile QuickBooks Like a Professional

Simple tips make reconciliation smoother and more reliable. By using the right steps, you save time, lower errors, and build trust in your books. These habits help both small firms and large businesses stay ready to reconcile QuickBooks with ease.

Use Automation

QuickBooks can pull transactions from your bank automatically. This cuts manual entry and mistakes. Automation saves time and keeps records up to date.

Check Accounts Often

Look at accounts weekly, not just at month-end. This keeps books up to date and makes the final match easy and less stressful.

Review Reports

Reports like the Reconciliation Error Report show mistakes fast. Reviewing reports helps keep accounts right and saves time fixing errors.

Track Small Adjustments

QuickBooks allows small adjustments when gaps appear. Using this wisely helps keep balances correct without harming reports. Tracking minor fixes ensures accuracy and gives a clear trail of actions, which is useful during tax season.

Stay Organized with Notes

Adding notes during reconciliation helps explain changes. This makes it easier to recall why edits were made. Organized notes save time for future checks and provide proof if questions come from banks or auditors.

How Regular Reconciliation Helps Business Decisions

Reconciliation affects business choices and growth.

See Cash Flow

Books that match the bank show real cash flow. Knowing cash in and out helps plan payments and manage costs.

Plan Budget Right

Accurate records make budgeting easy. You can set money for departments, save, or spend wisely. This stops overspending.

Avoid Fees and Overdrafts

Reconcile QuickBooks often to confirm your real balance. This prevents late fees and overdrafts, keeping your business safe.

Know True Profit

The right books show real profit. Owners can see if the business grows or needs to change. Decisions are based on real numbers.

Common Mistakes to Avoid When Reconciling QuickBooks

Ignore Small Errors

Reconcile QuickBooks carefully to catch small gaps. Fixing these errors keeps reports and accounts correct.

Wait Too Long

Don’t wait until month-end. Reconcile QuickBooks weekly or biweekly to keep accounts clear and reduce stress.

Miss Bank Fees

Bank fees may be missed. Forgetting charges causes mismatches. Always add fees to keep balances right.

Enter Duplicate Records

Duplicate entries throw off totals. Check and remove repeats before finishing reconciliation. Books stay correct this way.

Tools and Features in QuickBooks That Help

QuickBooks has smart tools that make daily work easy. These tools save time, cut errors, and keep your books in good shape. With the right use, you can trust your numbers every day.

Bank Feeds

Bank feeds pull transactions into QuickBooks in real time. This saves time and reduces errors from typing by hand. Linked bank data also means records stay current, giving owners clear insight into daily cash flow.

Matching Rules

QuickBooks can set and apply rules to match records. This speeds up work by pairing entries with bank data. Less manual work means fewer errors, smoother books, and better focus on tasks that drive growth.

Small Adjustments

QuickBooks allows users to make small changes to fill in gaps. These adjustments keep balances correct without breaking reports. With quick fixes, accounts remain smooth, giving you clean books to share with tax teams or business partners.

Reports to Review

Review reports after you reconcile QuickBooks. This helps spot mistakes early and keeps data accurate. Owners can track balances, confirm data with banks, and stay confident that records reflect true financial activity.

Reconciliation Tools

QuickBooks offers built-in tools for bank reconciliation. These features highlight gaps, suggest matches, and show progress. With clear steps, even small firms can keep accounts in line, making compliance and reporting tasks less stressful overall.

Alerts and Reminders

QuickBooks can send alerts when issues arise. These reminders ensure entries are not missed and deadlines are met. With alerts, you reduce risk, avoid late filings, and keep your business on the right track.

QuickBooks tools make bookkeeping simple, fast, and safe. From feeds to reports, each feature works to cut errors and save time. Using them well helps owners stay ready for growth and meet compliance needs.

QuickBooks Reconciliation and Compliance

Reconciliation helps meet rules and avoid problems.

File Taxes Right

Books that match bank data make taxes simple. All income and spending are recorded. Fewer mistakes mean fewer fines. This makes filing smooth and stress-free.

Keep Audit Trail

A clear match shows a history of all records. This helps in audits and proves your reports are true. It also gives proof if questions come later.

Prepare Reports

Balanced books show true performance. Reports help with choices, lenders, and investors. Good reports guide growth and better plans.

Meet Rules

Correct books meet legal rules. Following the steps cuts the risk of penalties and builds trust. It shows your firm runs with care and order.

How Experts Help Simplify QuickBooks Reconciliation

Professional help saves time and errors.

Save Time

Experts help reconcile QuickBooks quickly. They check and match records correctly, saving hours for owners.

Keep Books Correct

Professionals spot errors fast. Fixing mistakes keeps records accurate.

Find Problems Early

Experts see mismatches quickly. Early detection stops bigger issues later.

Get Good Advice

Professionals teach ways to keep records right. Their tips lower mistakes and make work faster.

Reconciliation is key to small business success. It keeps books right, aids decisions, and meets rules. By following steps, using QuickBooks tools, avoiding errors, and seeking help, you can reconcile QuickBooks like a professional.

Confiance helps small businesses reconcile QuickBooks quickly and right. Our team checks records, fixes errors, and keeps balances true. Owners save time and focus on growth while finances stay safe.

FAQs

1: What does it mean to reconcile QuickBooks?

To reconcile QuickBooks means you match your books with bank records. This step makes sure all deposits, fees, and payments are in place, so your accounts stay true and easy to trust.

2: How often should I reconcile QuickBooks?

Small firms should reconcile QuickBooks at least once a month. Weekly checks help track cash flow, spot small gaps, and make the month-end match quick and stress-free.

3: What mistakes should I avoid when reconciling QuickBooks?

Do not skip bank fees, add records twice, or ignore small errors. These slips cause wrong books and reports. Regular checks stop gaps and keep books neat.

4: Can I reconcile QuickBooks without an accountant?

Yes, QuickBooks has bank feeds, reports, and easy tools. With care, owners can do the match on their own, keep books in line, and avoid extra cost for an accountant.

5: How does regular reconciliation help my business?

Regular checks keep books right, track cash flow, and stop errors. They also help you plan, build budgets, and make smart money moves without fear of wrong data.

6: What tools in QuickBooks help with reconciliation?

QuickBooks has bank feeds, match rules, reports, and small adjust tools. These help cut slips, save time, and give a clear view of how your firm is doing.

7: Why should small businesses reconcile QB regularly?

Regular checks stop errors, keep books true, and avoid tax or bank risk. They also guard against overdrafts and build trust in your firm’s money records with staff and banks.