How to Reconcile Bank Statements for Accurate Accounting

Running a small business means keeping track of money each day. One way to do this is to reconcile bank statements with accurate accounting. This process is simple but powerful. It is not just about matching numbers. It gives a clear view of cash and builds trust in your records. When you match your books with the bank, you can see errors fast and fix them. You may catch missed pay, double charges, or other small slips. A steady check also shows the true cash at any time. With this habit, bank checks guide good money use and help the business grow strong.

What Does Bank Statement Reconciliation Mean?

Bank statement reconciliation means you check your records with the bank. You make sure each deposit, bill, and fee in your books matches the bank list. Small slips can grow into big issues if they are not fixed on time.

Why Reconcile Bank Statements with Accurate Accounting Matters

Reconcile Bank Statement with Accurate Accounting helps you:

- Keep track of money clearly

- Make smart choices for spending

- Avoid fees or fines

- Spot fraud fast

- Prepare taxes with ease

Regular checks make your books clean and reduce surprises at month-end. You also gain a clear view of what money is available, which is important when planning for business growth.

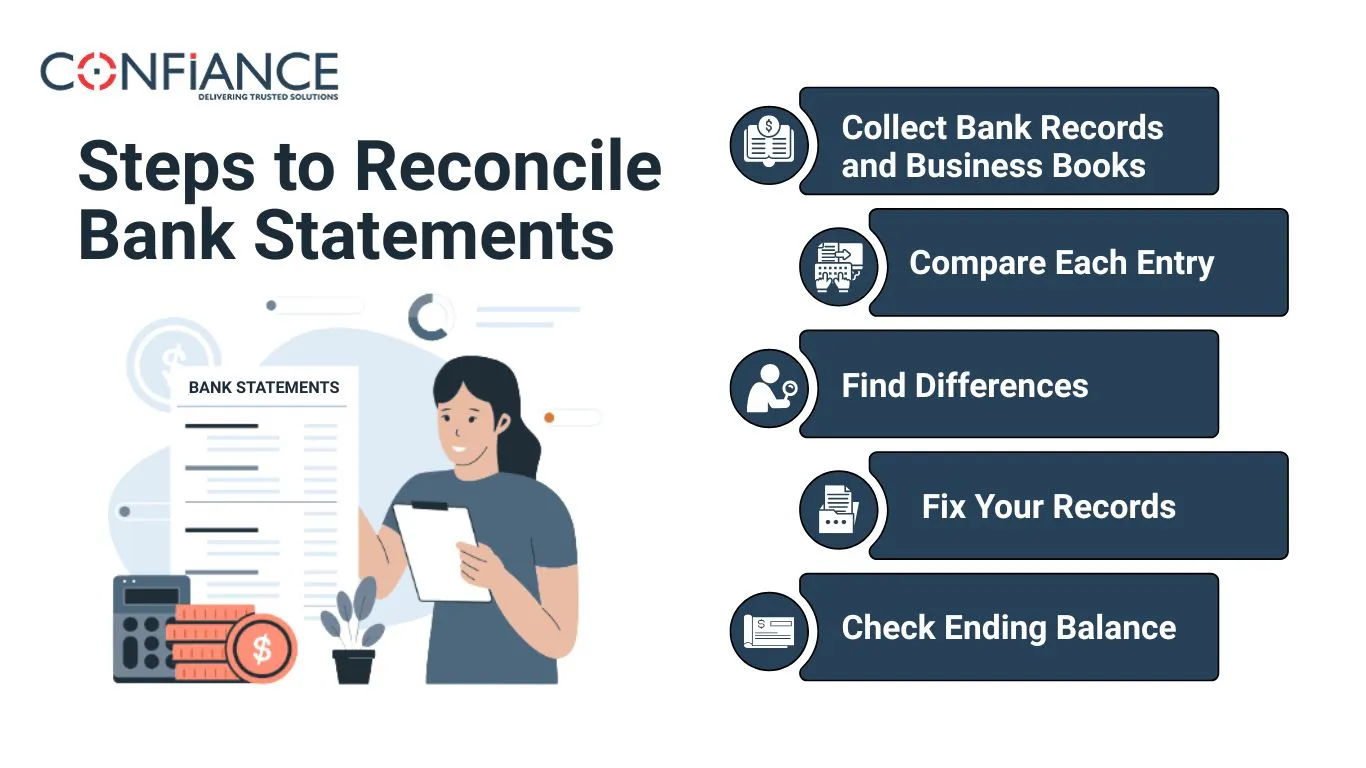

Steps to Reconcile Bank Statements

Reconcile bank statements with accurate accounting to keep your books clean and clear. When you match each entry with the bank, you spot mistakes fast and keep track of your money with ease. Reconciling a bank statement is simple when you follow the right steps.

Step 1: Collect Bank Records and Business Books

Bring all bank statements for the period you want to check. Also, have your books ready. This may include:

- Cash books

- Accounting software logs

- Receipts and invoices

Keeping all records together makes the process simple. Make sure your documents are complete and up to date. Missing statements or invoices can cause errors.

Step 2: Compare Each Entry

Look at each line on the bank statement and match it to your records. Make sure every deposit and payment is recorded in your books.

Tips:

- Check for spelling errors in names

- Look for missing deposits or payments

- Mark items you match

For large businesses, it helps to do this step in batches. Checking 10–20 entries at a time can reduce mistakes and make reconciliation faster.

Step 3: Find Differences

Some differences are normal. They may happen due to timing or bank fees. Common mismatches include:

- Checks not cleared yet

- Deposits still in transit

- Bank fees or interest not logged

Other differences may signal mistakes in data entry. Always investigate unmatched entries to ensure your books stay correct.

Step 4: Fix Your Records

After spotting differences, update your books. This step ensures your records are correct and ready for accurate accounting.

For example:

- Add missing deposits

- Record bank fees that were not noted

- Correct incorrect entries

This step keeps your books ready for accurate accounting.

Step 5: Check Ending Balance

After all adjustments, your book balance should match the bank statement’s end balance. If it does, your reconciliation is complete. Always double-check totals and ensure all adjustments are noted in your records.

Tips to Make Bank Reconciliation Simple

Keep Books Updated

Do not wait till the month-end. Update books often. This makes reconciliation fast and reduces mistakes. Daily or weekly logging is best for active small business accounts.

Use Accounting Software

Software like QuickBooks, Xero, or Wave can match entries automatically. They flag mismatched transactions and reduce manual work. For a small business, software saves hours each month.

Double-Check

Even with software, check records manually. Small mistakes can grow if not fixed. Always review bank fees, interest, or unexpected charges.

Track Outstanding Items

Keep a list of checks or payments that are not cleared yet. This helps explain differences and keeps books correct. You can use a simple spreadsheet or a software list.

Common Errors in Bank Statement Reconciliation

Missing Entries

Sometimes deposits or payments are not logged. Cross-check all receipts and invoices.

Bank Charges

Banks may add fees or pay interest you haven’t recorded. Add these to your books.

Duplicate Entries

Do not log the same payment twice. Duplicate entries can cause mismatched balances.

Timing Differences

Some payments take time to show up in the bank. Track these to avoid confusion.

Incorrect Categorization

Recording an expense in the wrong account can cause discrepancies. Always categorize entries correctly.

Avoiding these errors ensures your books stay clean and ready for accurate accounting.

How Regular Reconciliation Helps Small Businesses Grow

Regular bank checks are more than a task in books. They give small firms a clear view of cash and guide smart steps.

Benefits include:

Better Spending Decisions

When you check your bank account often, you see where most cash goes. This makes it easy to cut waste and use funds where they help the most.

Plan for Growth

Clean books give you the facts you need to plan. With clear cash flow, you can hire staff, buy gear, or open new spots with less risk.

Spot Fraud Early

Bank checks help find strange or fake charges. When you catch them fast, you stop loss and keep your money safe.

Improve Credit Score

Banks and lenders like to see neat and right books. When your records are clear, you build trust and boost your chances of getting loans.

Build Trust With Partners

Clear books make it easy to show proof to staff, clients, or investors. This builds trust and helps keep good ties in the long run.

Reduce Stress at Tax Time

Bank checks keep your books clean all year. When tax time comes, you have less stress since all the work is done.

By keeping a steady plan for checks, small firms can spot trends, plan, and keep strong control of cash.

Tools to Help Reconcile Bank Statements

Accounting Software

Tools like QuickBooks, Xero, and Wave can match deals on their own. They save time and cut errors for small business owners.

Bank Tools

Most banks give online tools to make checks easy. You can get bank files, download them, and match deals with your books.

Spreadsheets

Some small firms use Excel or Google Sheets to track and match items by hand. Sheets are easy to change and can fit the needs of many types of businesses.

Mobile Apps

Many banks and apps now give live alerts on spend and pay. This helps spot errors fast and keeps cash in check.

Cloud Storage

Safe cloud tools let you store and share files with your team. This makes sure all records are in one place and easy to reach.

Audit Trail Tools

Some tools keep a log of all edits made to books. This trail helps owners check past steps and build trust in their data.

Best Practices for Bank Reconciliation

Check Often

Monthly reconciliation is standard, but weekly checks work best for active accounts.

Keep Records Neat

Neat records make errors easy to spot and reconciliation faster.

Review Before Closing

Always check your accounts before closing monthly or quarterly books.

Train Staff

If someone helps with finances, teach them how to check bank statements correctly. Clear procedures reduce errors and save time.

Quick Checklist for Reconciliation

Here is a simple checklist for small businesses can use to reconcile bank statements:

- Collect all bank statements for the period.

- Collect all receipts, invoices, and accounting logs.

- Match deposits and payments with bank entries.

- Mark matched items.

- Find differences and adjust your books.

- Check ending balances.

- Note outstanding checks or deposits in transit.

- Review and save a copy for records.

Using a checklist ensures nothing is missed and makes the process faster.

Accrual accounting records money coming in and going out when it happens, not just when cash moves. This way, business owners see a true view of money and costs. For small businesses, keeping track of income, bills, and pending payments can be hard.

At Confiance, we help small businesses by setting up clear systems to log all money in and out correctly. We can also set up recurring bills and invoices to enter on their own, cutting errors and saving time. Accounts are checked often to make sure the books match the bank. We make simple reports on cash flow, profit, and costs. This helps owners plan, make smart choices, and keep the business stable.

FAQs

- What is bank statement reconciliation?

Bank statement reconciliation means you check your books with the bank statement. You make sure each deposit and bill matches, so your books stay correct. - How often should I reconcile my bank accounts?

It is best to check at least once each month. Busy firms with many deals can check each week. - What if my bank statement and books do not match?

Look for time gaps, missed notes, or bank fees. Fix your books so they match the bank list. - Can reconciliation help prevent fraud?

Yes. Regular checks make it easy to spot wrong or fake charges before they cause harm. - Should I use software for reconciliation?

Yes. Tools like QuickBooks or Xero make checks fast. They also cut errors by matching deals for you. - What is the difference between cash and accrual accounting?

Cash style notes money when it is paid or received. Accrual style notes income and costs when they take place, even if cash has not moved. - How does reconciliation help with tax filing?

Clean books from steady checks make tax filing smooth. They also lower the risk of errors or fines. - Can reconciliation improve money planning?

Yes. When your books and bank match, you see the real cash on hand. This helps plan, spend, and save for growth.