Real-Time Bookkeeping – A Modern Way to Grow Your Business

Bookkeeping used to be slow. You gathered receipts, matched invoices, and waited weeks to see where your money went. By the time you saw the full picture, it was old news. Today, that no longer works. Real-time bookkeeping changes this. It gives you live access to your financial data. You can act fast, avoid errors, and make decisions backed by facts.

This service is not just for large companies. Small and growing businesses also benefit. Real-time bookkeeping helps you stay on track, avoid surprises, and take control of your cash. It also supports better planning. You can spot problems early, fix them fast, and use real data to grow with confidence.

This page explains what real-time bookkeeping is, how it works, and why your business needs it now.

What Is Real-Time Bookkeeping?

Real-time bookkeeping means your financial records update as soon as a transaction happens. It captures sales, purchases, and expenses without long waits. Instead of seeing your books once a month, you can check them every day. You always know where your money stands.

It uses cloud-based tools to connect with your bank, invoicing system, and payment apps. The data flows into your accounting software in real time. You get live reports, dashboards, and alerts. This keeps your numbers fresh and accurate.

Unlike traditional methods, real-time bookkeeping is ongoing. It does not rely on manual updates or batch uploads. It keeps your accounts alive and active.

Why Real-Time Bookkeeping Matters

Running a business means handling many moving parts. You deal with customers, vendors, payroll, taxes, and cash flow. If your books are out of date, you risk missing warning signs. Real-time bookkeeping gives you instant clarity. It keeps you informed without delays.

Here is why it matters:

- You can track daily sales and expenses without guessing

- You avoid errors caused by missed entries or lost receipts

- You get alerts when things go wrong, like bounced payments or low cash

- You make choices based on live data, not outdated reports

- You save time by cutting manual tasks and rework

This approach keeps you in control. You do not wait for the month to end. You act when it matters most.

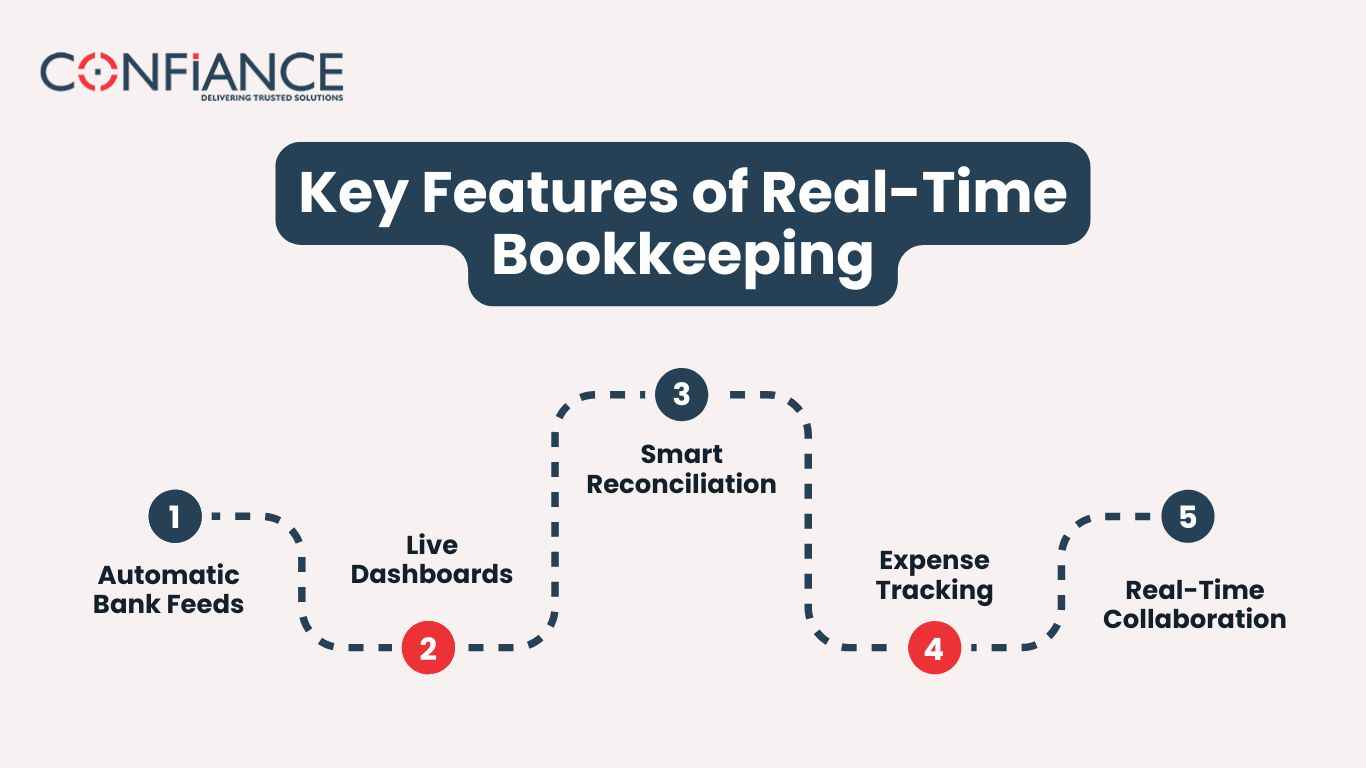

Key Features of Real-Time Bookkeeping

Real-time bookkeeping is more than fast updates. It includes tools and workflows that support clean, accurate books all year long.

1. Automatic Bank Feeds

- Your bank connects with your accounting system

- It pulls in transactions as they happen

- No need to download statements or enter items by hand

- You match records quickly and stay current

2. Live Dashboards

- You see your finances at a glance

- Income, spending, profit, and cash flow are always visible

- You can drill down into details or stay high level

- These dashboards guide your next steps

3. Smart Reconciliation

- Modern tools match your data with bank entries

- If something is missing or wrong, it flags it

- This makes it easy to find gaps and fix mistakes on time

4. Expense Tracking

- Receipts, bills, and payments can be uploaded with a snap

- You can tag items, assign categories, and track spending with less effort

- It keeps your books clean and ready for tax time

5. Real-Time Collaboration

- Your bookkeeper, accountant, and team can access the same records

- No need to email files or wait for updates

- Everyone works from the same page, with less back and forth

Benefits of Real-Time Bookkeeping

The biggest gain is control. You always know what is happening with your money. But that is not all. Real-time bookkeeping also helps your business grow in smarter ways.

Better Cash Flow

- You do not need to guess how much money you have

- You can see your balance, plan payments, and avoid overdrafts

- You know what is coming in and going out at all times

Faster Decisions

- You can respond to market changes, customer trends, or supply issues without delay

- Live reports tell you what works and what does not

- You can cut costs or invest more based on the facts

Lower Risk

- Late entries, missing receipts, and errors are common in old systems

- Real-time bookkeeping reduces these risks

- You get alerts when things go wrong

- You can correct them early

Time Saved

- No more manual entries, file uploads, or bank downloads

- You can automate most tasks

- This frees up time for high-value work

- Your team can focus on growth, not cleanup

Year-Round Compliance

- You do not have to wait until tax season

- Your records stay clean all year

- Your accountant gets what they need without delay

- This makes audits easier and filings smoother

Real Growth Tracking

- As you grow, your books show it

- You can track trends, measure progress, and test ideas

- Real-time bookkeeping gives you the full picture as it happens

Who Needs Real-Time Bookkeeping?

Any business that wants to stay sharp can benefit. But certain types gain the most:

- Retailers who deal with daily sales and returns

- Ecommerce sellers who need to track stock, payments, and fees

- Service providers with many small clients and projects

- Startups that burn cash and need tight control

- Contractors who deal with job costs, invoices, and quotes

- Consultants who bill by time and need to track hours closely

If you often wonder where your money went, real-time bookkeeping can help. If you want to grow without losing track, this service is for you.

How Real-Time Bookkeeping Works

It starts with a clean setup. Your accounting system is connected to your bank and payment platforms. We then automate key tasks and set up alerts. Once running, it keeps your records fresh every day.

1. System Setup

- We choose the right software for your needs

- We connect your bank, payment tools, and invoice apps

- We also import past data for a full view

2. Process Design

- We map out your daily flow

- This includes how you record sales, pay bills, and approve expenses

- We then build a system that captures this in real time

3. Ongoing Monitoring

- We watch your books daily

- If something breaks or looks wrong, we fix it fast

- This keeps your records clean and your reports accurate

4. Monthly Review

- Each month, we go deeper

- We match records, close books, and share insights

- You get reports that show how you are doing and what needs to improve

Real-Time Bookkeeping vs Traditional Bookkeeping

Let’s compare the old way with the new:

| Feature | Traditional Bookkeeping | Real-Time Bookkeeping |

| Update Frequency | Weekly or monthly | Daily or live |

| Bank Reconciliation | At month end | Ongoing |

| Access to Reports | After period closes | At any time |

| Error Detection | After it affects totals | Immediate alerts |

| Collaboration | File sharing, slow updates | Live, cloud-based access |

| Use for Planning | Limited by delay | Supports instant decisions |

The change is clear. Real-time bookkeeping is faster, more accurate, and far more useful.

Why Real-Time Bookkeeping Helps You Grow

Growth brings more sales, more costs, and more risks. You need a clear view to stay ahead. Real-time bookkeeping supports this by giving you live numbers. You can act fast and avoid bad surprises.

Here is how it helps you grow:

- You spot what products or services bring in the most profit

- You control spending so profit stays up as you grow

- You manage staff, projects, and costs with clear records

- You plan better and avoid poor cash timing

- You keep investors or lenders happy with fresh reports

Growth needs structure. Real-time bookkeeping gives you that structure. It gives you the data you need to move forward with confidence.

Real-Time Bookkeeping for Outsourced Teams

Many businesses now use remote bookkeepers. Real-time bookkeeping works well with this model. It supports online access, live updates, and shared workflows. You can work with experts no matter where they are.

With outsourced teams, you get:

- Expert help without hiring full-time staff

- A full team working on your books while you run the business

- Better cost control as you scale

- Strong systems without high setup costs

The setup is simple, and the results are clear. You get clean books without the stress.

Tools We Use for Real-Time Bookkeeping

We work with proven software tools that support live updates and smart workflows. These include:

- QuickBooks Online for core accounting

- Xero for clean design and strong reporting

- Hubdoc or Dext for receipt capture

- Gusto or Rippling for payroll

- Stripe or PayPal for payment tracking

- Bank feeds for live cash monitoring

Each tool works with others to keep your data clean. We tailor the stack to your needs.

Our Real-Time Bookkeeping Services

Here is what you get when you choose our service:

- Daily transaction updates

- Bank feed setup and tracking

- Live dashboards with key reports

- Expense and receipt management

- Monthly close with full reports

- Alerts for issues or trends

- Custom support for taxes or audits

- Cloud access for full team visibility

We work with you to build a clean, fast, and simple system. We keep your books ready every day.

Why Choose Us

We understand real-time bookkeeping. We do not just update your books. We build systems that run daily, support decisions, and grow with you. Our team is trained in cloud tools, automation, and business support. We stay in touch and fix problems before they grow.

We believe in simple pricing, clear work, and helpful service. We do not waste your time or flood you with jargon. We just keep your books right.

Get Started Today

You do not have to keep guessing where your money went. You do not have to wait weeks for your books. Our Real-time bookkeeping services give you the data you need in real-time. It helps you grow without chaos.

If you want to stay in control and grow, Confiance is here to help. Get in touch today to see how our real-time bookkeeping services can change how you run your business.

FAQs

1. What is the difference between real-time and daily bookkeeping?

Real-time bookkeeping updates your records instantly as transactions occur, while daily bookkeeping processes entries once a day. Real-time systems offer faster insights and better accuracy.

2. Can small businesses afford real-time bookkeeping services?

Yes, many real-time bookkeeping services are priced for small businesses. Cloud tools make it cost-effective by reducing manual work and improving efficiency.

3. Is real-time bookkeeping suitable for freelancers and solo business owners?

Absolutely. Real-time bookkeeping helps freelancers track income, manage expenses, and stay tax-ready without delays or complex systems.

4. What tools are needed for real-time bookkeeping?

Real-time bookkeeping often uses cloud-based accounting software, automated bank feeds, digital receipt capture, and payment integration tools.

5. How does real-time bookkeeping help with financial forecasting?

Since data is always current, real-time bookkeeping allows for accurate short-term and long-term forecasts based on live trends and real cash flow.

6. Does real-time bookkeeping reduce the need for a full-time bookkeeper?

Yes, real-time systems often reduce manual tasks, which means businesses can either scale down their bookkeeping hours or outsource efficiently.