Benefits of Using QuickBooks Online for Small Businesses

Small business owners need reliable accounting software for small businesses to track money, record expenses, and send invoices efficiently. Many still use spreadsheets or paper, which leads to errors. QuickBooks Online solves this with simple but effective tools. It helps manage money, send bills, view reports, and stay on top of day-to-day tasks. These features have already helped millions of QuickBooks customers simplify financial management. In this blog, we will go through the benefits of using QuickBooks Online for Small Businesses and how it can save time, cut errors, and help owners stay in control.

You can send invoices, check cash flow, and run reports without needing an accountant. It gives you a simple way to manage money and keep your records in order. You do not need to know accounting. The software is built for people who run their own business and need a clear system to stay organized.

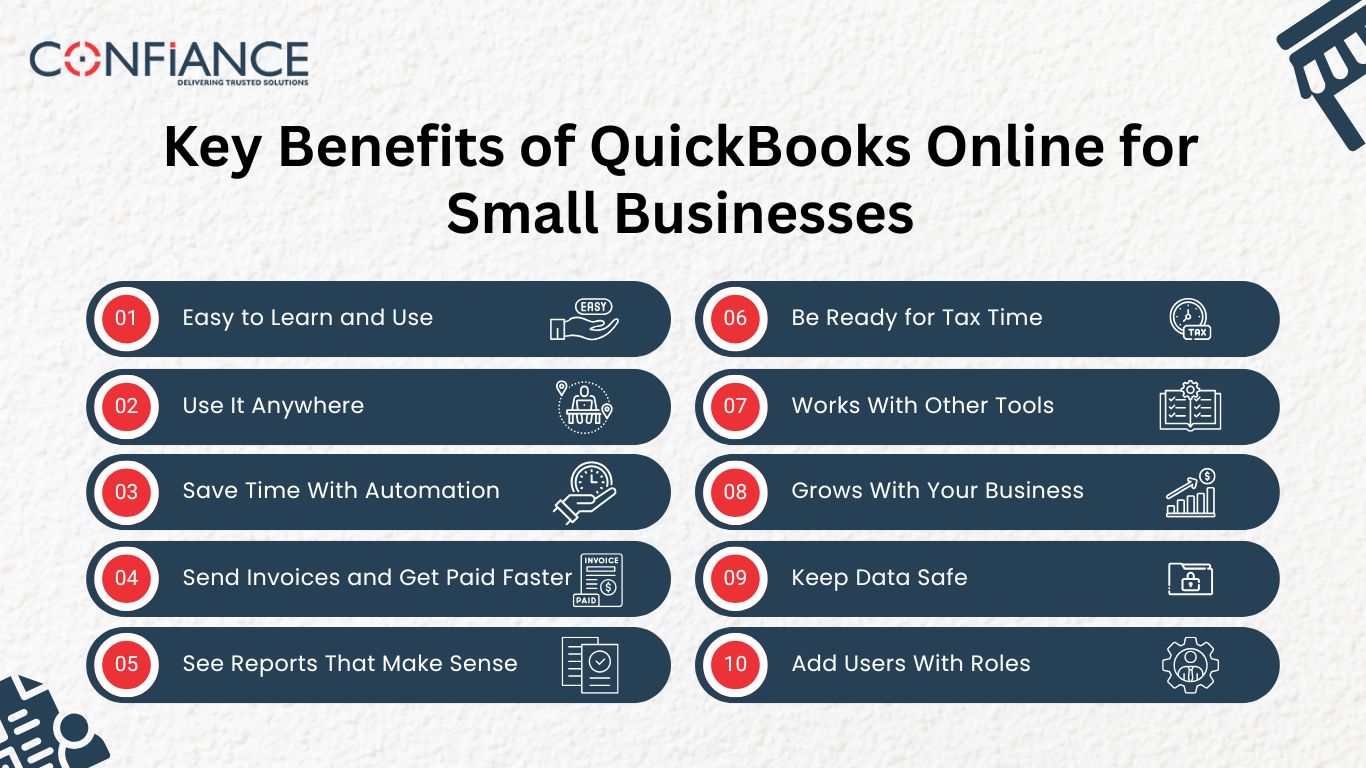

Key Benefits of using QuickBooks Online (QBO) for Small Businesses

Small business owners use QuickBooks Online because it simplifies their daily money tasks. It is not made for large firms. It is built for owners who manage books while also running the rest of their business. Here are some main benefits of using QuickBooks Online for Small Businesses:

Easy to Learn and Use

QuickBooks Online does not need advanced training. The layout is clean and simple. Buttons and menus are clear. Most new users can understand the basic features in a few hours.

The software guides you through tasks like creating invoices, linking bank accounts, and viewing reports. Even those with no accounting background can manage their business books.

Use It Anywhere

QuickBooks Online is cloud-based, so you are not tied to an office. This is a major advantage over QuickBooks Desktop, where access is limited to the device it is installed on. You can log in from a phone or laptop and view real-time data. This is useful if you travel, visit clients, or work from home.

Accountants and bookkeepers can access the same records without asking you to send files.

Save Time With Automation

You can automate many tasks. QuickBooks Online links with your bank and imports transactions. It sorts them by category. You can also set up recurring invoices for regular clients and automatic reminders for unpaid bills.

These features reduce the need for manual entry and cut down on errors. The time saved each month adds up.

Send Invoices and Get Paid Faster

You can easily create and send invoices in just a few clicks. Add your logo, payment options, and due dates. Customers can pay online using a card or bank transfer. QuickBooks shows you when an invoice is viewed or paid.

It also sends reminders if the customer forgets to pay. This improves your cash flow and reduces the need to chase payments.

See Reports That Make Sense

QuickBooks Online offers reports that explain where your money goes. You can view profit and loss, balance sheet, and cash flow reports. You can also run custom reports based on your business needs.

These reports help you understand what works, what costs too much, and what brings in the most profit. You do not need to do the math by hand.

Be Ready for Tax Time

Tax season is easier with clean books. QuickBooks Online records income, tracks expenses, and stores digital copies of receipts. Some plans even let you tag expenses by tax category.

When it is time to file taxes, you or your accountant can pull all the data from one place. This avoids missed deductions and reduces the risk of mistakes.

Works With Other Tools

QuickBooks Online connects with tools many small businesses already use. These include PayPal, Square, Shopify, and payroll or time-tracking apps. This helps you keep your records updated without extra steps.

Instead of entering the same numbers twice, QuickBooks pulls the data in automatically. This saves time and avoids confusion.

Grows With Your Business

You can get started with a basic plan and upgrade to premium as your needs grow. QuickBooks Online has several pricing levels. This scalability is consistent across QuickBooks products, which are designed to grow with your business. If you hire staff or need inventory tracking, you can switch to a higher plan. Plan features and pricing are options subject to change without notice, so always review the latest details before upgrading.

There is no need to learn new software or move your data. The features just expand when you upgrade.

Keep Data Safe

QuickBooks Online uses bank-level encryption to keep your data safe. It also performs regular backups. Your records are stored in the cloud, so if your computer fails or is lost, your data stays safe.

This is important for small businesses that cannot afford to lose financial records.

Add Users With Roles

You can add users and give each one access to specific areas. A staff member might only view sales. Your bookkeeper can enter expenses. Your accountant can access reports and settings.

This keeps your business secure while allowing others to help manage it.

Make the most out of QuickBooks Online for small businesses

1. Set Up Your QuickBooks Online Account

- Choose the Right Plan

- QuickBooks Online offers several pricing plans. Basic plans include features like expense tracking and invoicing. Advanced plans support inventory, time tracking, and full-service payroll. Choose one based on your business size and needs. Be sure to review the terms and conditions for each plan before subscribing.

- Create Your Company Profile

- After sign-up, add your company details. Enter your business name, address, tax info, and industry type. This helps QuickBooks Online tailor the setup for your business.

- Customize Your Chart of Accounts

- QuickBooks uses a “Chart of Accounts” to track money movement. It includes categories like income, expenses, assets, and debts. Review the list and edit it to match how you track your business finances.

2. Connect Bank and Credit Card Accounts

- Link Your Financial Accounts

- QuickBooks Online allows you to connect your business checking, savings, and credit card accounts. Once linked, it automatically imports your transactions. This reduces manual entry and ensures no expenses get missed.

- Categorize Transactions

- After transactions are imported, review and assign each one to the correct category. Transactions from all your accounts and credit cards are automatically categorized, so you always know where your money is going. QuickBooks Online suggests categories, but you can change them. This keeps your records clean and reports accurate.

3. Create and Send Invoices

- Build Professional Invoices

- QuickBooks Online helps you create invoices with your logo and branding. Add customer details, product or service descriptions, prices, and due dates.

- Send and Track Invoices

- Email invoices directly from QuickBooks. You can see when a client opens it and track unpaid invoices. QuickBooks also lets clients pay online, which speeds up collections.

- Use Recurring Invoices

- For ongoing services, set up recurring invoices. QuickBooks will send them automatically based on the schedule you choose.

4. Track Expenses and Manage Bills

- Record Bills and Receipts

- Add expenses that don’t appear in your bank feed by entering them manually. You can also take pictures of receipts and upload them. QuickBooks will read and organize the data for you.

- Pay Bills on Time

- Enter due dates for bills and track them inside QuickBooks. You can pay directly from your linked bank account and mark bills as paid. This helps avoid late fees.

5. Manage Sales and Products

- Add Products or Services

- List all the items you sell, including prices and types (product or service). You can track quantities and set reordering alerts for physical goods.

- Track Sales by Item or Customer

- Run sales reports to see which products or clients bring in the most money. This helps you focus on what works best for your business.

6. Handle Payroll and Contractor Payments

- Set Up Payroll

- QuickBooks Online for Small Businesses includes an optional payroll feature. You can pay employees, calculate tax withholdings, and file payroll taxes. Choose a payroll plan that matches your needs.

- Pay Contractors

- Send payments to contractors and generate 1099 forms at year-end. You can track how much each contractor has earned through QuickBooks.

7. Run Financial Reports

Key Reports to Use

QuickBooks Online generates real-time reports that show how your business is doing. Common reports include:

- Profit and Loss Statement

- Balance Sheet

- Cash Flow Report

- Expense by Vendor

- Sales by Customer

Customize and Schedule Reports

You can adjust reports by date, customer, or product. Save report templates and schedule them to be emailed automatically.

8. Reconcile Accounts Monthly

- Why Reconciliation Matters

Reconciling means checking your QuickBooks records against your bank statements. Do this monthly to spot missing entries or errors. This ensures your books are accurate.

- Fix Differences Easily

If amounts don’t match, use QuickBooks tools to find and correct the issue. You may have an extra transaction or one recorded with the wrong date.

9. Track and File Sales Tax

- Set Up Sales Tax

If you collect sales tax, enter your state and local tax rates in QuickBooks. The system calculates sales tax for each sale and keeps a running total.

- Stay Compliant

QuickBooks Online shows how much sales tax you owe and when to pay it. You can also run reports to prepare for tax filings.

10. Use the Mobile App

- Work From Anywhere

Download the QuickBooks Online app to track money, send invoices, and view reports on the go. You can also snap pictures of receipts and log expenses in real time.

- Sync Automatically

Any updates made in the app sync with your main account. This keeps your data current without extra steps.

Tips for First-Time Users of QuickBooks Online

- Start with a tutorial. QuickBooks offers built-in guides and help articles.

- Check your dashboard daily. It gives a snapshot of your income, expenses, and bank balance.

- Use tags or classes. These help you sort and group transactions for better tracking.

- Back up your data regularly. Though QuickBooks stores data in the cloud, keep offline records for peace of mind.

What Makes QuickBooks Online Different from Others

Intuit QuickBooks has been a market leader for years, making it a top choice for small business owners. QuickBooks Online has been used by small business owners for many years. Many choose it because it is reliable, easy to learn, and fits both new and growing businesses. Here are some reasons it continues to be a top choice:

- Reliable support and tutorials

- Regular updates based on user feedback

- A strong network of trained accountants

- Useful for many types of small businesses

- Clear pricing with different levels

Most business owners want a system that is easy to use and does not get in the way. QuickBooks Online meets those needs.

QuickBooks Online helps small businesses keep their books in order. It shows where your money goes, saves time on daily tasks, and makes tax season easier. You can use it from anywhere and share access with your team or accountant.

If you need a simple way to track income and expenses, QuickBooks Online can help. It keeps your records clear and saves time without making things harder. Confiance offers QBO services that are accurate, reliable, and cost-effective. You can get exclusive help with our QuickBooks Online services for your small business.

FAQs

1. Is QuickBooks Online good for new business owners?

- Yes. It is simple to set up and easy to use. You do not need accounting experience to get started.

2. Can I use QuickBooks Online on my phone?

- Yes. You can use it on your phone, tablet, or computer. Your data stays synced across all devices.

3. Does QuickBooks Online back up my data?

- Yes. It saves your data online and keeps it safe with regular backups. You do not need to do anything extra.

4. Can more than one person use the same account?

- Yes. You can add users and choose what each person can see or do.