Decoding Your Profit and Loss Statement for Better Financial Decisions

A Profit and Loss Statement shows how your business works. It records sales, costs, and the profit or loss over a set time. Learning how to read this report gives you a clear view of your business. It helps you plan with ease, spot new ways to grow, and avoid costly errors. With clear insight, numbers turn into strong business choices.

This guide explains what a Profit and Loss Statement is. It shows you how to read it step by step. You will learn common mistakes to avoid. It also learn you how to use it for smart business decisions.

What Is a Profit and Loss Statement?

A Profit and Loss Statement (also called an income statement) is a record of income, costs, and profit for a set time. It may cover a month, three months, or a year. For most firms, it is the key tool to track health and growth.

Why You Need It

Without a clear statement, you cannot tell if your business makes money or loses it. With it, you can:

- See where sales grow or drop

- Find out if costs are too high

- Track profit trends

- Plan for tax season with less stress

Main Parts of the Statement

The report has a few main parts:

- Revenue – all money from sales or services

- Cost of Goods Sold (COGS) – costs linked to making goods or services

- Gross Profit – revenue minus COGS

- Operating Costs – rent, wages, bills, ads, and daily spend

- Net Profit or Loss – what is left when all costs are paid

How to Read Your Profit and Loss Statement

If you know the steps, the report is easy to read.

Step 1: Check the Top Line

The top line is revenue. Is it up or down from last month? From last year? If sales rise, you are on the right path. If sales fall, you need to find out why.

Step 2: Look at COGS

High COGS can lower overall profit. If COGS is high compared to sales, you need to change. You can seek new suppliers, change prices, or cut waste.

Step 3: Review Gross Profit

Gross profit is the heart of your business. It shows if sales cover your core costs. If gross profit is low, your business may not last long.

Step 4: Track Operating Costs

Operating costs are the costs you pay each day. Rent, bills, staff pay, ads, and tools fall here. Check if costs rise too fast.

Step 5: Check Net Profit

Net profit is the last line. It shows whether your firm makes money or not. A strong net profit means room to save, grow, or pay debt. A loss means you must act quickly.

Common Mistakes in Reading the Statement

Even with a clear Profit and Loss Statement, many owners make mistakes.

Ignoring Time Trends

Sales may shift with seasons or events. If you miss these trends, you may think sales are weak when it is just a slow season.

Mixing Personal and Business Spend

This makes the report messy. Always split personal and business spend. It keeps numbers clean.

Missing Small Costs

Bank fees, late charges, and small spending may not seem big, but they add up. Track them, or you will miss the true cost.

Overlooking Non-Cash Items

Some reports include items like depreciation or amortization. Ignoring them can distort profit. These numbers affect taxes and valuations, so they must be understood and reviewed carefully.

Not Comparing Periods

Looking at one report alone limits insight. Compare across months or years to see growth, trends, and risks. Without comparison, you cannot plan or measure progress effectively.

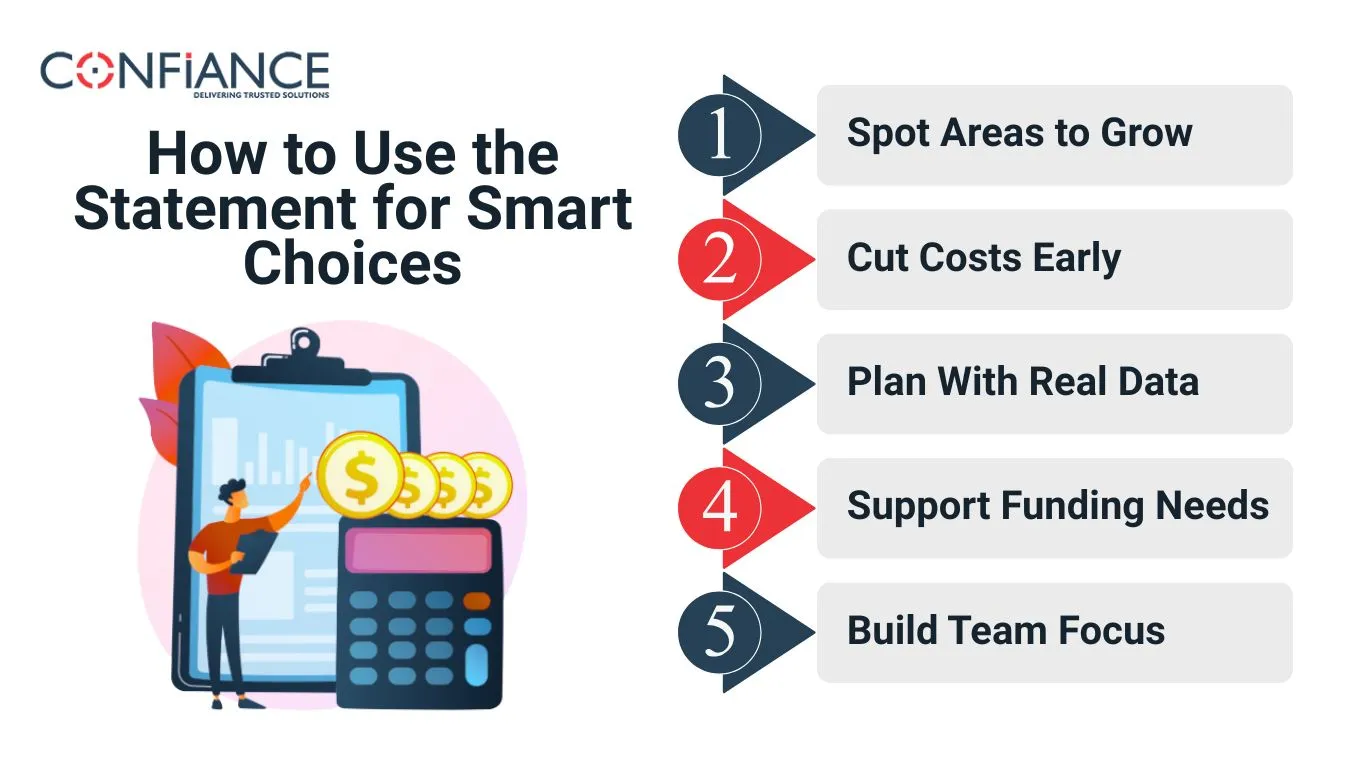

How to Use the Statement for Smart Choices

Your Profit and Loss Statement is more than a financial sheet. It is a decision tool. It guides choices that help you cut costs, grow sales, and strengthen profit.

Spot Areas to Grow

Look for high-margin products or services. Invest more resources there. Growth comes from focusing on what works best and cutting areas that drain effort without fair returns.

Cut Costs Early

Watch costs. If wages, rent, or materials rise, act before they damage net profit. Reducing waste and finding cheaper options builds a stronger, more sustainable business foundation.

Plan With Real Data

Use numbers to guide your goals. If the profit margin is 10%, aim for 12%. These are clear, real targets, not guesses, and they improve focus and performance.

Support Funding Needs

Banks and investors need proof. A clear statement builds trust. When numbers show steady growth, it is easier to secure loans, attract funds, or expand your business safely.

Build Team Focus

Share insights with your team. When staff know which areas earn the most, they align their work with growth goals. Clear data helps the entire business work smarter together.

Tips to Make Your Statement More Useful

Improving your Profit and Loss Statement makes it more than a record, but it becomes a map for better management. Small steps in tracking, review, and expert help add real value.

Update Books Often

Don’t wait for year-end. Update weekly or monthly. This habit helps catch issues early and ensures you always have true numbers when making quick financial choices.

Use Simple Tools

Apps like QuickBooks, FreshBooks, or Xero simplify tracking. They create statements with fewer errors, saving time and effort. Automation improves accuracy and reduces manual bookkeeping stress.

Work With an Expert

Numbers can be hard. Accountants explain results, highlight risks, and guide tax planning. Expert support ensures your Profit and Loss Statement leads to clear, smart, and timely actions.

Compare Periods Regularly

Check results across different months or years. Comparing helps you see trends, assess growth, and measure progress. It reveals which strategies work best and what needs to change.

Focus on Key Ratios

Look beyond totals. Ratios like gross margin and net margin give quick insight into efficiency. Tracking them ensures you know the true health of your business.

Real Stories: How Owners Use Their Statements

Stories help show how this tool works in real life.

Example 1: The Cafe Owner

Mia owns a cafe. Each month, she checks her P&L Statement. She saw:

- Coffee sales stayed strong.

- Food sales fell in the summer.

- The costs of flour and milk rose.

She raised menu prices by 5% and cut waste in the kitchen. Her gross profit rose 12% in three months.

Example 2: The Online Shop

Raj runs a small online store. He saw that ads cost too much compared to sales. By cutting weak ads and focusing on top products, he raised net profit by 20%.

Example 3: The Consultant

Sara ran a small service firm. Her reports showed travel spend was too high. By shifting to online meetings, she cut costs by 15% and improved her net profit margin.

Example 4: The Manufacturer

A factory owner saw a high COGS reduction in margins. By finding a new supplier and reducing waste, gross profit grew. Small changes revealed by the statement created lasting gains.

Example 5: The Start-Up

Tom’s start-up used statements to pitch investors. Showing steady growth and control of costs, he secured funding. Clear data helped prove the firm was worth the investment.

How a Profit and Loss Statement Shapes Strategy

A P&L Statement is not just about money in and out. It shapes how you plan for the future.

Forecasting Growth

Past reports help you predict future sales. If sales rise 5% each year, you can plan with more trust.

Securing Funds

Banks and investors ask for your statement before they lend or invest. A clear report builds trust and makes deals easier.

Managing Risk

By spotting weak sales areas or high costs, you can reduce risk. It helps you act before small issues turn into big ones.

Building Long-Term Strategy

When you review reports, you set clear goals. Plans for hiring, marketing, or new products rest on true numbers. Strategy is stronger when backed by accurate financial data.

Supporting Leadership

Leaders need facts to decide. Sharing statement insights with your team builds trust and direction. Data-driven leadership improves morale and drives focus on growth and profitability.

Your Profit and Loss Statement is not just for tax time. It is your map to profit and growth. Read it often, learn from it, and act on it. With expert support, you can turn data into clear action and give your business the best chance to grow strong.

At Confiance, we make your P&L easy to read and act on. We show each part of your report so you see where sales rise, where costs go up, and what needs care. Our team has certified experts who turn numbers into clear steps, like how to cut waste, set goals, and plan growth. Confiance provides complete financial management services designed for smarter decisions and stronger business performance. Partner with us for lasting success.

FAQs

- What is a Profit and Loss Statement?

It is a report that shows money in, money out, and what is left. It tells you if your firm makes a profit or runs at a loss.

- Can I make one by myself?

Yes. You can use a sheet or easy apps to build it. For big or complex firms, an accountant can check the work and make sure it is right.

- How often should I check it?

Most small firms check once each month. Bigger firms may track each week. When you check often, you can fix cost or sales issues fast.

- Why does it matter for growth?

It shows which goods or services bring more profit. It also shows where costs rise. With this, you can cut waste and put cash where it works.

- Do banks and investors need it?

Yes. They use it to judge if your firm is strong. A clear report builds trust, shows you are stable, and helps you get funds with ease.

- How long should I keep old ones?

Keep past reports for at least three to five years. They help with taxes, give proof to banks, and show trends that guide future plans.

- What mistakes should I avoid?

Do not mix home and work spending. Do not skip small fees or bills. Do not read one report alone, but always compare more than one period.