Outsourcing Payroll – Know Its Benefits and Impacts

Payroll is a routine task of a business. It takes time and demands accuracy. Even small mistakes can lead to fines, delays, or unhappy staff. Many businesses are now outsourcing payroll to avoid these problems and run operations more smoothly, giving owners greater peace of mind. This blog explains what it means, how it helps, and what impacts to expect.

What Is Payroll Outsourcing?

Outsourcing payroll means hiring an outside firm to handle your entire payroll process. This includes wage calculations, tax withholdings, filing of forms, and payment processing. Some providers also manage employee benefits, track hours, and offer support with compliance, especially staying updated with changing tax regulations. These firms cover all basic payroll functions, from tracking hours to issuing pay stubs.

You just need to provide the basic data. The firm handles the rest of the payroll process for you.

Why Companies Choose It

Payroll involves more than just processing payments/salaries. You must follow tax rules, track deductions, send reports, and file returns. The rules can change often and vary by state.

Mistakes cost money and time to the business. They can damage trust with employees or lead to audits. That is why many businesses prefer to leave payroll in expert hands.

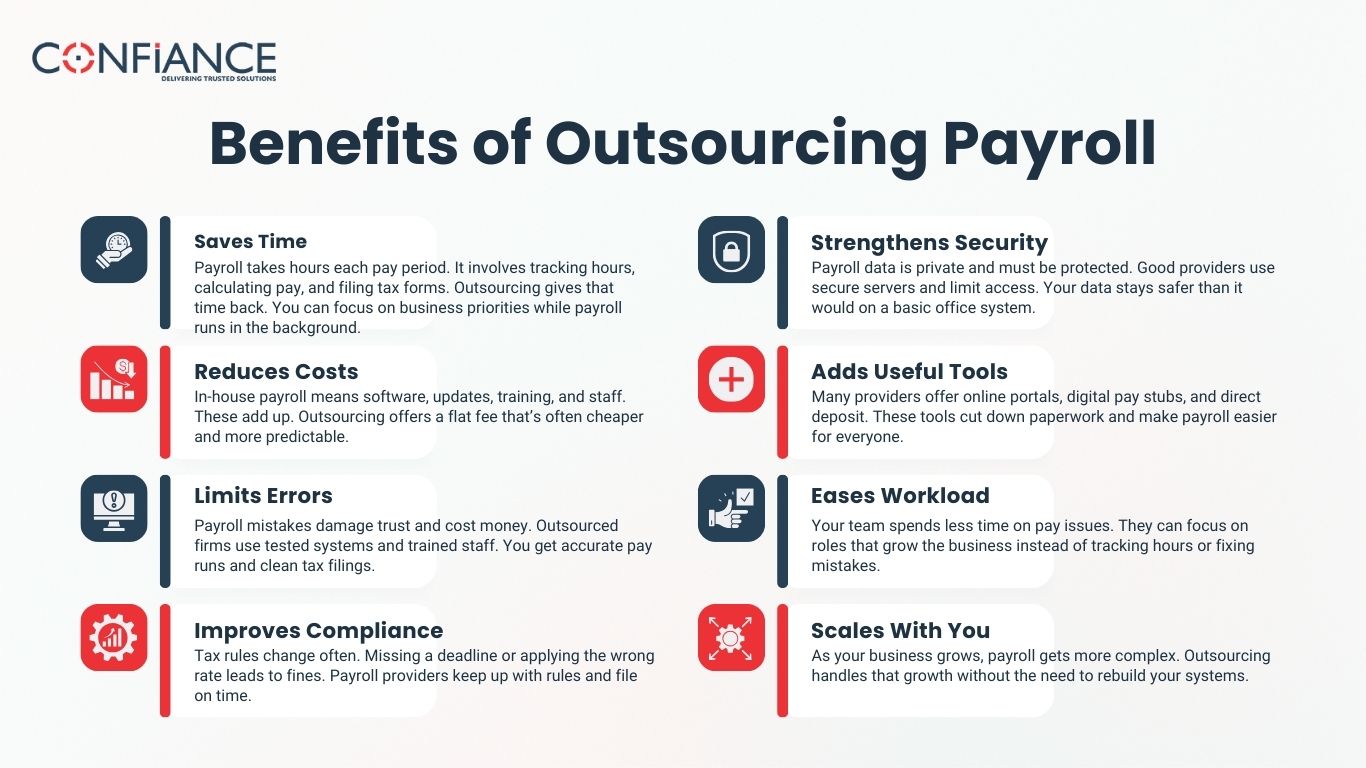

Benefits of Outsourcing Payroll

Outsourcing saves time, cuts costs, improves accuracy, and helps you stay compliant. Many small businesses find that outsourcing payroll services helps them stay focused on operations while reducing compliance stress. Here are some key benefits of outsourcing payroll:

1. Saves Time

Payroll takes hours each pay period. It involves tracking hours, calculating pay, and filing tax forms. Outsourcing gives that time back. You can focus on business priorities while payroll runs in the background.

2. Reduces Costs

In-house payroll means software, updates, training, and staff. These add up. Outsourcing offers a flat fee that’s often cheaper and more predictable.

3. Limits Errors

Payroll mistakes damage trust and cost money. Outsourced firms use tested systems and trained staff. You get accurate pay runs and clean tax filings.

4. Improves Compliance

Tax rules change often. Missing a deadline or applying the wrong rate leads to fines. Payroll providers keep up with rules and file on time.

5. Strengthens Security

Payroll data is private and must be protected. Good providers use secure servers and limit access. Your data stays safer than it would on a basic office system.

6. Adds Useful Tools

Many providers offer online portals, digital pay stubs, and direct deposit. These tools cut down paperwork and make payroll easier for everyone.

7. Eases Workload

Your team spends less time on pay issues. They can focus on roles that grow the business instead of tracking hours or fixing mistakes.

8. Scales With You

As your business grows, payroll gets more complex. Outsourcing handles that growth without the need to rebuild your systems.

Common Payroll Mistakes to Avoid

Handling payroll in-house may seem simple, but small errors can lead to serious issues. Here are common mistakes businesses make:

- Misclassifying employees as independent contractors

- Missing tax filing deadlines

- Using the wrong tax rates

- Misreporting payroll tax amounts

- Skipping required reports

- Forgetting to send W-2s or 1099s

- Not keeping clear payroll records

These problems often lead to penalties or audits. Outsourcing helps prevent payroll errors by relying on professionals who follow current rules.

Who Uses Payroll Outsourcing?

Payroll outsourcing works for all types of businesses. Each industry has unique needs that payroll providers understand:

- Retail stores – Track hourly shifts, manage tips, and handle overtime

- Tech startups – Keep lean teams focused on product instead of admin

- Construction companies – Manage job site shifts and union rules

- Healthcare providers – Handle complex benefits and licensing compliance

- Franchises – Sync payroll across locations and meet multi-state rules

No matter your industry, outsourcing can adapt to your payroll needs.

In-House Payroll vs Outsourced Payroll

A simple comparison helps show what you gain by switching:

| Feature | In-House Payroll | Outsourced Payroll |

| Time Spent | High | Low |

| Cost Predictability | Variable (staff, tools) | Fixed or tiered pricing |

| Compliance Risk | Higher | Lower |

| Security | Depends on setup | Professionally managed |

| Scalability | Limited | Easily scales with growth |

Working with a payroll company can save time, control costs, and reduce compliance risks.

Impacts of Outsourcing Payroll

Outsourcing payroll brings long-term value beyond saving time and money. It reshapes how your business handles core tasks. It also improves overall payroll management by making the process more structured and reliable.

Shifts Focus to Growth

Handing payroll to experts lets you focus on what matters. You spend less time on checks and forms and more on sales, service, and strategy.

Adds Professional Support

You get access to payroll professionals who handle complex rules and deadlines. This is especially useful for businesses with complex payroll, such as multiple pay schedules or varying tax rates. Their support reduces stress and builds confidence in your process.

Improves Transparency

Most providers give access to real-time reports and dashboards. You can check your payroll status anytime. This helps you stay informed without managing each step.

Enhances Security Standards

Reputable providers offer stronger security than most in-house systems. Your team no longer needs to manage sensitive data on local drives or shared folders.

Encourages Smarter Workflows

As payroll moves out, your internal process gets leaner. Staff can shift to roles that need judgment and communication, not just data entry.

Eases Scaling

Outsourcing grows with your business. Whether you add staff or expand to new states, your provider adjusts without adding strain to your team.

How To Choose a Payroll Provider

Not all payroll firms offer the same service or tools. Choosing the right one matters. Here’s how you can make the right choice of a payroll provider:

Check experience: Look for a firm with proven success and positive reviews. They should understand your business size and needs.

Ask about features: Make sure they handle tax filings, direct deposit, reporting, and employee access. Avoid firms that charge extra for basic services.

Review pricing: Understand what is included. Ask about any hidden fees. Compare costs with the value offered.

Check support: Ask how support works. The provider should offer strong customer service so you get quick help when issues come up.

Understand security: Ask how your data is stored, who can access it, and what happens during outages.

Test the tools: If possible, try a demo. Make sure the software is easy to use for both you and your team.

Look for flexibility: Your needs may change. Choose a provider that can grow with you without adding pressure or high costs.

Red Flags When Choosing a Payroll Provider

Not all payroll companies deliver the same quality. Watch out for these warning signs:

- Hidden fees not shown upfront

- Poor customer service or slow response times

- Limited security protocols

- No experience with your industry

- Outdated or hard-to-use software

Avoiding these red flags ensures you choose a reliable partner.

Is Outsourcing Payroll Right for You?

Not every business needs to outsource payroll. But for many, it offers strong benefits. Ask yourself the following:

- Are you spending too much time on payroll?

- Have you had issues with tax filings or missed deadlines?

- Are you unsure about payroll laws or changes in tax rates?

- Do you plan to grow and need a scalable solution?

- Do you want fewer errors and stronger security?

If you said yes to even one, it is worth considering. It helps you work smarter and avoid risks that come from doing everything alone.

Future Trends in Payroll Outsourcing

Payroll is evolving with technology. Some trends to watch include:

- AI-driven payroll automation for faster and error-free processing

- Cloud-based payroll platforms offering real-time access

- Self-service employee portals with pay history and tax documents

- Data-driven insights to forecast labor costs and optimize workforce planning

Businesses that adapt to these trends will stay ahead and operate more efficiently.

Payroll is such a part of the business that must be handled with care. Late payments or wrong tax forms lead to trouble. Benefits of outsourcing payroll include fewer errors, better tools, and more efficient use of your time and resources. Choose a provider who knows your needs, offers real support, and keeps your data secure. At Confiance, we have been providing payroll services for years. Our payroll services follow best practices using industry-standard tools.

FAQs

- How do I choose the right payroll provider?

Look for a provider with proven experience, strong security, clear pricing, and responsive support. Check if they serve businesses your size and know local tax laws. - Is outsourcing payroll secure?

Yes, if you choose a reliable provider. They use encryption, access controls, and secure servers to protect sensitive employee information. - How does payroll outsourcing work?

You provide employee and pay data. The provider runs payroll, calculates taxes, files forms, and issues pay. You review reports and track progress through a portal. - Is outsourcing payroll cost-effective for small businesses?

Yes. It removes the need for in-house staff or software and helps avoid fines for tax errors or late filings. - Can payroll outsourcing scale with my business?

Yes. Good providers handle added employees, new locations, and complex pay rules without slowing your operations.