Save Time and Money with Outsourced Tax Preparation Services

Preparing taxes takes time, effort, and attention to detail. If you run a business or handle multiple clients, filing taxes can become a burden. Errors can lead to penalties or audits. Outsourced tax preparation services help you avoid these issues while saving both time and money.

This blog explains how outsourced tax preparation works, why it is cost effective, and how it can improve your process.

What Are Outsourced Tax Preparation Services?

Outsourced tax preparation services involve hiring an outside firm to handle your tax tasks. These services may include collecting documents, checking records, preparing tax returns, and filing with the tax authority. Outsourcing tax preparation services helps you reduce the load on your in-house team.

Many accounting firms and small businesses use this approach to manage deadlines, reduce costs, and improve accuracy. Outsourced tax preparation is used by CPAs, tax consultants, and firms serving multiple clients.

Why Time Matters in Tax Preparation

Tax filing has strict deadlines. When the workload increases, mistakes happen. You may miss due dates or file incomplete returns. This creates problems that cost you time and money.

Outsourced tax preparation services offer teams that focus only on tax work. They have systems to manage tasks on time. They also handle large volumes with fewer errors. With the right process, they can complete work in less time than an internal team.

Time savings increase during peak seasons. Outsourced teams are trained to manage urgent filings and short turnarounds. You also avoid wasting time training new hires or managing seasonal staff.

Save Money with Outsourced Tax Preparation

Hiring and training staff is expensive. You pay salaries, benefits, software costs, and overhead. With outsourced tax preparation, you pay only for what you need. This makes your cost structure more flexible.

Outsourcing tax preparation services allows you to scale up or down without extra hiring. You avoid fixed costs and reduce waste. For small firms, this helps stay within budget.

Many service providers use teams in locations with lower labor costs. This reduces overall fees. At the same time, they follow strict quality control to maintain accuracy.

Improve Accuracy and Compliance

Errors in tax filings can lead to penalties or audits. Small mistakes add up and damage your reputation. Outsourced tax preparation services use multiple checks to reduce these risks.

These providers follow updates in tax rules and forms. Their staff works across many tax scenarios, which improves their accuracy. Most firms use review systems that catch errors before submission.

Some use tax software and automation tools to check entries. This reduces manual work and boosts quality. You benefit from this without buying new tools.

Focus on Core Work

When you outsource tax tasks, your team can focus on core work. For firms, this means more time with clients. For businesses, this means attention to growth and daily tasks.

Tax work is seasonal and time heavy. It can pull attention from key roles. Outsourcing gives your staff the room to focus on what brings value. You avoid burnout and improve morale.

Outsourced tax preparation also improves the client experience. CPAs can offer better advice without rushing. Business owners can respond faster to needs and changes.

Scale with Less Risk

Growth brings more returns to file and more data to check. Scaling up with internal staff adds cost and risk. Outsourced tax preparation lets you grow without extra burden.

You can handle more clients or expand services without hiring more people. This makes growth smoother and less costly. It also avoids long hiring cycles or slow onboarding.

If you work in a niche industry, you can find providers with that knowledge. They bring skill without the need for extra training. You stay ready for more work with less risk.

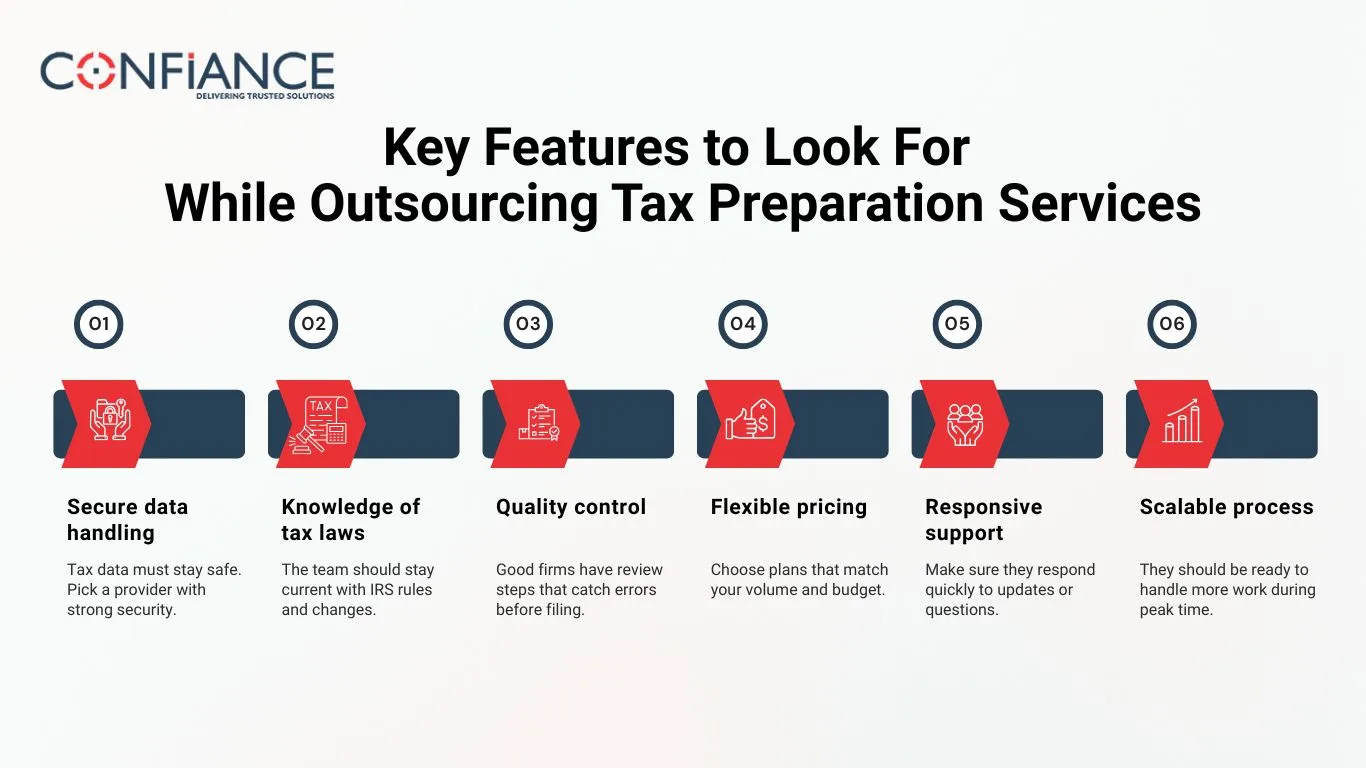

Key Features to Look For While Outsourcing Tax Preparation Services

Not all providers offer the same value. When choosing a firm for outsourced tax preparation, look for these features:

- Secure data handling: Tax data must stay safe. Pick a provider with strong security.

- Knowledge of tax laws: The team should stay current with IRS rules and changes.

- Quality control: Good firms have review steps that catch errors before filing.

- Flexible pricing: Choose plans that match your volume and budget.

- Responsive support: Make sure they respond quickly to updates or questions.

- Scalable process: They should be ready to handle more work during peak time.

Common Tasks Covered by Outsourced Tax Preparation Services

A good provider will handle most or all of the tax tasks you need, such as:

- Gathering and sorting tax documents

- Reviewing client data for missing items

- Preparing federal and state returns

- Filing electronic returns

- Responding to tax notices

- Updating prior year filings

Some firms also offer bookkeeping, audit support, and payroll help. You can build a package that meets your needs.

How to Start Outsourcing Tax Preparation Services

- Starting is simple, but you need a plan. Here is a step-by-step guide:

- List your current tax tasks and note what takes the most time.

- Set your goals for outsourcing. Do you want to save time, reduce cost, or handle more work?

- Research providers. Look for reviews, service range, and security measures.

- Ask about their team, software, and process.

- Start with a small project to test the service.

- Set clear deadlines, review steps, and contacts.

Once the test run is smooth, you can shift more work. Keep track of time saved and errors avoided.

Risks and How to Avoid Them

Outsourcing tax preparation services has many upsides, but also some risks. Be aware of these and know how to avoid them.

- Poor data security: Share only with trusted firms. Ask about their system access, storage, and backup plans.

- Low skill level: Work with providers who hire trained tax staff. Ask for sample work.

- Missed deadlines: Set clear delivery timelines and check progress often.

- Lack of control: Keep key tasks like final review in-house.

Choosing the right provider reduces these risks. Clear plans and regular checks help build trust.

Best Use Cases for Outsourced Tax Preparation

Some tasks fit better with outsourced tax preparation. These include:

- Seasonal spikes in workload

- Work overflow during tax season

- Complex returns that need experts

- Support for junior staff

- Help with client data prep

Outsourcing is also helpful when your firm is growing fast. It lets you add more clients without a full team expansion.

Who Should Use Outsourced Tax Preparation Services

Several types of users benefit from these services:

Small accounting firms: They can serve more clients without more staff.

- Solo CPAs: They can focus on advice and planning.

- Bookkeeping firms: They can add tax services through a partner.

- Small businesses: They avoid hiring full-time staff for tax work.

Outsourcing fits both small and mid-sized firms that want to stay lean and grow smart.

Cost vs Value

Look beyond just the price. Value comes from accuracy, saved time, and client trust. Outsourced tax preparation helps you avoid late filings, reduce audit risk, and serve clients better.

Compare your current costs to what you would pay a provider. Add the time saved and fewer errors. The total benefit is often much higher than the service fee.

Outsourced tax preparation services help you stay focused, reduce stress, and manage costs. You gain trained help without building a large in-house team. You reduce the risk of errors and missed deadlines.

If you want to work smarter and grow your business, this is a simple step that offers long-term value. Find a provider that fits your needs, start small, and scale when ready. The time and money saved can be used where they matter most.

FAQs

- What are outsourced tax preparation services and who uses them?

They are services offered by third-party firms to handle tax tasks like return preparation, filing, and document review. Small businesses, CPAs, and accounting firms often use them to save time and reduce cost. - How can outsourcing tax preparation save money for small firms?

You avoid fixed costs like salaries and software fees. You only pay for services you use, which keeps your budget under control. - Is it safe to outsource tax preparation tasks?

Yes, if you choose a provider with strong data security, encrypted systems, and limited access controls. - Can outsourcing help during peak tax season?

Yes. Outsourced teams are trained to handle large volumes quickly, so you meet deadlines without hiring extra staff. - What tax tasks can I outsource?

You can outsource return preparation, data review, e-filing, responding to notices, and updates to prior filings. - Who benefits most from outsourcing tax preparation services?

Solo CPAs, bookkeeping firms, and small businesses that want to manage costs and focus on core tasks benefit the most.