Is Outsourced Bookkeeping Worthy for Your Business?

Bookkeeping keeps your business numbers in order. It tracks income, expenses, profits, and taxes. If the records are wrong, your decisions will be wrong too. Many business owners know this, but they still try to handle it on their own. That works in the beginning but not for long. As your business grows, financial records also increase, and so do challenges in managing cash flow. At that point, many businesses decide to go with outsourced bookkeeping with professionals.

Outsourced accounting and bookkeeping services give you an alternate option. Instead of hiring staff, you pay a service to do it for you. It can be cheaper, faster, and more accurate. In this blog, we will look at how outsourced bookkeeping works, what it offers, and if it fits your business.

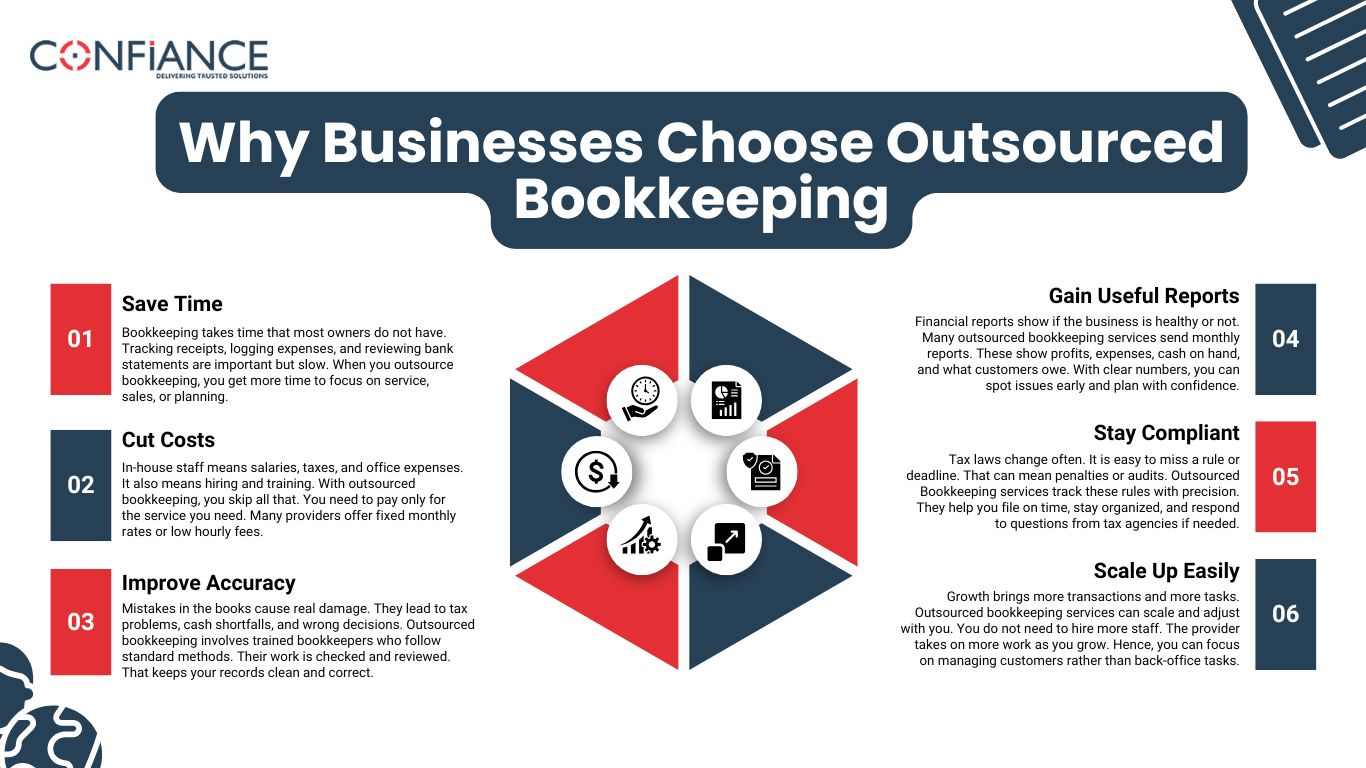

Why Businesses Choose Outsourced Bookkeeping

Bookkeeping can take hours each week. It requires accuracy, attention to detail, and knowledge of tax rules. If you do it incorrectly, the cost can go really high. That is why many small and growing businesses choose outsourced bookkeeping. It gives them time and improves the quality of their records.

1. Save Time

Bookkeeping takes time that most owners do not have. Managing these day to day tasks—tracking receipts, logging expenses, and reviewing bank statements—takes time. When you outsource bookkeeping, you get more time to focus on service, sales, or planning.

2. Cut Costs

In-house staff means salaries, taxes, and office expenses. An in-house accounting department comes with salaries, taxes, and office expenses. It also means hiring and training. It also means hiring and training. By outsourcing bookkeeping, you skip all that. You need to pay only for the service you need. Many providers offer fixed monthly rates or low hourly fees. A bookkeeping firm can offer services at lower rates than hiring someone in-house.

3. Improve Accuracy

Mistakes in the books cause real damage. They lead to tax problems, cash shortfalls, and wrong decisions. Outsourced bookkeeping services involve trained bookkeepers who follow standard methods. Their work is checked and reviewed. That keeps your records clean and correct.

4. Gain Useful Reports

Financial reports show if the business is healthy or not. Many outsourced services send monthly reports. These show profits, expenses, cash on hand, and what customers owe. With clear numbers, you can spot issues early and plan with confidence.

5. Stay Compliant

Tax laws change often. It is easy to miss a rule or deadline. That can mean penalties or audits. Outsourced services track these rules with precision. They help you file on time, stay organized, and respond to questions from tax agencies if needed.

6. Scale Up Easily

Growth brings more transactions and more tasks. Outsourced services can scale and adjust with you. You do not need to hire more staff. The provider takes on more work as you grow. Hence, you can focus on managing customers rather than back-office tasks.

Examples of Businesses That Use Outsourced Bookkeeping

Outsourced bookkeeping is not only for large firms. Many small and medium businesses use it to stay on track and grow without adding staff. Here are some clear examples:

- Local salons and spas

They track sales, tips, and costs each day. No need to hire a full-time in-house bookkeeper. - Online retail stores

They deal with many small sales each week. Outsourced help makes it easy to track stock, returns, and bank records. - Freelancers and consultants

They focus on client work. The service handles bills, costs, and tax tasks. - Startups and tech firms

These firms need reports to show to investors. Outsourced teams give clean records each month. - Service groups like HVAC or cleaning

They track client pay, job costs, and miles for tax use.

These types of firms gain time, avoid errors, and get clear books with outsourced help.

Pros and Cons of Outsourced Bookkeeping

Here are some pros and cons of that will help you decide its worth:

Pros:

- Saves time and money

- Reduces errors

- Improves reporting

- Helps with tax preparation and staying organized for filings

- Easy to scale

Cons:

- Less control over daily entries

- Some services may lack personal support

- Requires trust in outside provider

- May be time-consuming to set up at first

In-House vs. Outsourced Bookkeeping

Use this table to see how outsourced bookkeeping compares with doing it in-house.

| Feature | In-House Bookkeeping | Outsourced Bookkeeping |

| Cost | High – salaries, benefits, software | Lower – pay only for services used |

| Flexibility | Limited to staff hours | Scales with business needs |

| Accuracy | Depends on one or two people | Checked by trained teams |

| Speed | Slower during busy times | Faster with dedicated workflows |

| Software Tools | May use outdated accounting software | Uses cloud-based, secure tools |

| Training Needs | Requires hiring and training | No training needed on your side |

| Control | Full internal control | Shared control with regular reviews |

This comparison helps you weigh the true costs and benefits before deciding which setup fits your business best.

What Is Included in Outsourced Bookkeeping?

Most outsourced services offer:

- Income and expense tracking

- Bank and credit card reconciliation

- Accounts payable and receivable

- Monthly financial statements

- Payroll support

- Year-end reports for tax returns and filings

Some also offer budgeting, forecasting, and support during audits. You can often start small and add more as needed.

Who Should Choose Outsourced Bookkeeping?

Outsourced bookkeeping makes sense for many businesses, not just large ones. It is useful if:

- You are a small business owner having no in-house accountant

- You are spending too much time on books

- Your records are often behind or unclear

- You are missing tax deadlines or unsure about filings

- You want better insight into your numbers

Startups, online stores, service firms, and solo owners often outsource their bookkeeping. If numbers confuse you or stress you out, it may be time to outsource.

When Outsourced Bookkeeping May Not Fit

It may not be the best choice if:

- You already have a trusted full-time bookkeeper

- Your records are very simple and easy to manage

- You prefer to do everything in person

- You want full control over each step

Some businesses do both. They handle payroll or billing in-house and outsource the rest. Others outsource everything but still review reports closely each month.

How to Decide if you should outsource bookkeeping?

Not every business will see the same value from outsourcing bookkeeping. Here are questions that help you decide if it is worth it for you:

- Are your books often late or incorrect?

If you struggle to keep up or spot errors often, it may be worth it. - Do you spend more than three hours a week on bookkeeping?

That time could go to customers or planning. If yes, consider outsourced bookkeeping to better utilize your time. - Is bookkeeping causing stress or confusion?

If you are not accurate with managing your records, consider paying someone who is. - Can you afford the monthly cost?

Compare the cost to the time or salary you pay. In many cases, outsourcing costs less than hiring. - Do you need better reports to make decisions?

Clear monthly reports can help you manage cash, cut waste, and grow faster. - Are you facing fines or tax issues?

Outsourcing can help you avoid future problems with clean, on-time records.

If you answer yes to two or more of these questions, it is likely a smart move for your business.

Outsourced bookkeeping brings trained professionals, better reports, fewer errors, and more time for real work. If you want clear records, accurate financial data, better decisions, and fewer money mistakes, it may be the right move for your business. Confiance is one of the best choices to outsource your bookkeeping to. Get started with accurate bookkeeping that follows industry standards.

FAQs

- Is outsourced bookkeeping good for small businesses?

Yes. Small businesses benefit from it because it saves time, reduces errors, and keeps records accurate without hiring in-house staff. - Can I outsource only part of my bookkeeping?

Yes. Many providers let you outsource specific tasks like bank reconciliation or payroll while keeping others in-house. - Is outsourced bookkeeping secure?

Reputable services use encrypted software and follow strict data security practices to protect your financial information. - When should a business consider outsourcing bookkeeping?

If bookkeeping takes too much time, causes stress, or leads to errors, it may be time to outsource. - Does outsource bookkeeping help with taxes?

Yes. Outsourced bookkeeping keeps your records organized and tax-ready, helping you avoid missed deadlines or penalties.