Comparing In-House vs. Outsourced Bookkeeping Services in California

Running a business means keeping track of money. Many business owners in California face a choice: have bookkeeping services in California in-house, or outsource them. Both options have benefits and costs. The right choice depends on your size, budget, and growth plan.

In this blog, we will compare in-house and outsourced bookkeeping, look at costs, benefits, and risks, and help you make the right choice.

Why Bookkeeping Matters for California Businesses

Good bookkeeping shows where money comes from and where it goes. It is not just about paying bills or taxes. It helps owners see if the business is doing well.

How Bookkeeping Helps

- Tracks all cash coming in and going out

- Makes sure taxes are paid correctly and on time

- Shows which parts of the business make a profit or lose money

- Helps plan for the future with clear numbers

For California businesses, with rules that can often change, bookkeeping is even more important. Using proper records prevents mistakes, fines, and confusion.

Understanding In-House Bookkeeping

In-house bookkeeping means you hire staff to do the books at your office. They work each day and check accounts. This keeps your money working closely and lets you see it and guide it fast.

Benefits of In-House Bookkeeping

- Direct control: You can watch work each day and fix small mistakes fast. This keeps cash flow clear and lets you see all money in and out without waiting or guessing.

- Quick answers: Staff are there for questions or quick updates. You can get info fast, solve small problems fast, and make sure records are right each day.

- Familiarity: Staff know your firm and how it works. They see daily steps and your rules, so they can do work right and give simple advice that fits your shop.

Drawbacks of In-House Bookkeeping

- High costs: Pay for wages, perks, and training can grow fast. Small firms may find it hard to keep staff paid and still save cash for other work.

- Limited skills: Staff may not do all jobs, such as tax forms or tricky accounts. You may need to hire more help or train staff to do the work right.

- Growth limits: When the firm grows, staff may fall behind. You may need to hire more people, which adds pay and work to manage, and more space in the office.

In cities like Los Angeles or San Francisco, in-house bookkeeping can cost a lot. Staff pay is high, and it takes time to guide them. Small firms must weigh cost versus daily control.

Exploring Outsourced Bookkeeping Services in California

Bookkeeping Services in California let businesses manage accounts without in-house staff. Firms hire outside companies to do the books. Local providers know state rules and taxes, so many California firms trust them to handle money right.

Benefits of Outsourced Bookkeeping

- Lower costs: No salaries or benefits needed

- Skilled staff: Teams have wide experience

- Easy to scale: Services grow with your business

- Focus on growth: Owners can spend time on sales and clients

Drawbacks of Outsourced Bookkeeping

- Less control: Work is off-site

- Data sharing: You share financial information

- Possible delays: Updates may take a little longer

For many California businesses, outsourcing gives access to skills and tools without large overhead.

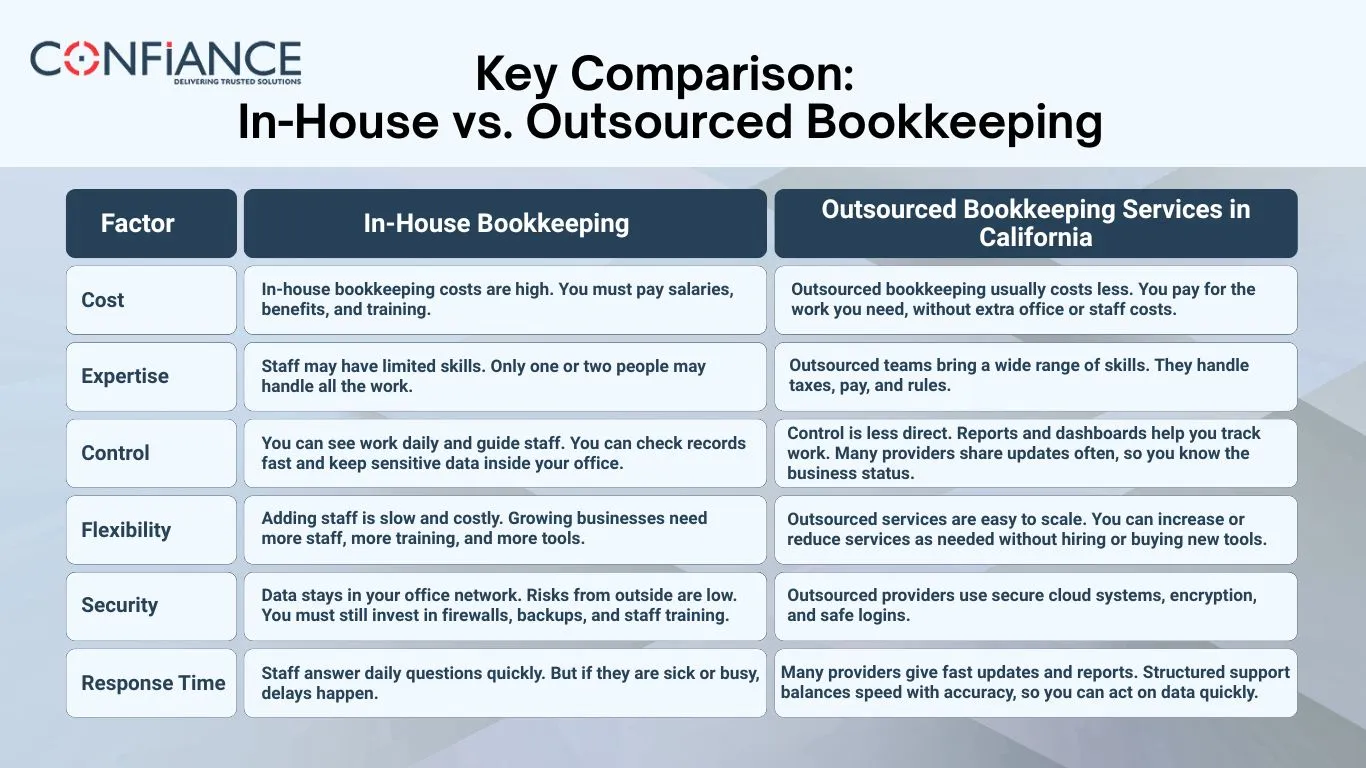

Key Comparison: In-House vs. Outsourced Bookkeeping

| Factor | In-House Bookkeeping | Outsourced Bookkeeping Services in California |

| Cost | In-house bookkeeping costs are high. You must pay salaries, benefits, and training. Software and office space add more. Small businesses may spend a large part of the budget on these costs. | Outsourced bookkeeping usually costs less. You pay for the work you need, without extra office or staff costs. Flexible plans let businesses save money and scale services with growth or slow months. |

| Expertise | Staff may have limited skills. Only one or two people may handle all the work. Learning new rules takes time and money for training. | Outsourced teams bring a wide range of skills. They handle taxes, pay, and rules. They stay updated and give accurate results. Businesses get expert work without hiring or training extra staff. |

| Control | You can see work daily and guide staff. You can check records fast and keep sensitive data inside your office. | Control is less direct. Reports and dashboards help you track work. Many providers share updates often, so you know the business status. |

| Flexibility | Adding staff is slow and costly. Growing businesses need more staff, more training, and more tools. | Outsourced services are easy to scale. You can increase or reduce services as needed without hiring or buying new tools. |

| Security | Data stays in your office network. Risks from outside are low. You must still invest in firewalls, backups, and staff training. | Outsourced providers use secure cloud systems, encryption, and safe logins. Data leaves your office, but strong contracts and systems keep it safe. |

| Response Time | Staff answer daily questions quickly. But if they are sick or busy, delays happen. | Many providers give fast updates and reports. Structured support balances speed with accuracy, so you can act on data quickly. |

How California’s Business Climate Shapes Bookkeeping Choices

California has many types of businesses: tech startups, shops, farms, and large firms. Each needs bookkeeping in different ways. Some use staff inside, some hire outside help, and some mix both to save time and money.

Startups

Startups often hire outside bookkeeping to cut costs. This helps them avoid extra staff while getting expert help fast. They can focus on growth, customers, and products instead of spending too much time on finance tasks.

Family Shops

Small family shops may hire staff in-house. Owners like to watch the work daily. They can keep data private and control finances closely, making sure records match the way they run their business and serve their customers.

Large Firms

Big firms often use both in-house staff and outside help. They keep control of key work but save money by outsourcing routine tasks. This mix helps them manage finances well while staying efficient and flexible.

Technology and Bookkeeping Trends

Bookkeeping now uses digital tools. Cloud software, simple automation, and AI make work faster and reduce errors. Businesses can check records anytime, save time, and make better decisions with accurate and up-to-date information.

Advantages of Modern Tools

Tools let you see money flow in real time. Reports are easy to read and share on phones or computers. Automation cuts mistakes from manual entry and saves hours each week, making financial work simpler and faster.

Automation and Outsourced Providers

Automation reduces mistakes and saves time. Outside providers use these tools quickly because they serve many clients. This helps businesses get expert work without extra staff and stay up-to-date with the newest software and methods.

Making the Right Decision

There is no one best choice. Think about budget, growth plans, and daily needs. Pick what fits your money, time, and business size. The right choice helps you stay on top of finances without stress.

When In-House Works Best

In-house work, if you need daily control, can pay salaries, and have steady work. It keeps finances inside the business, builds staff skills, and gives owners direct oversight of all money matters.

When Outsourcing Works Best

- Want to save costs

- Needs change with growth or season

Tips for Choosing Outsourced Bookkeeping Services in California

- Check local expertise and tax knowledge: Make sure they know California rules well and apply them correctly.

- Make sure data security is strong: Your financial data must stay private and protected.

- Look for clear pricing, no hidden fees: Understand what you pay for and avoid surprise bills.

- Read reviews for quality and reliability: See what other clients say about service speed and skill.

- Test communication speed: Check how fast they respond to questions or provide updates.

Both in-house and outsourced bookkeeping are valuable. In-house gives control, but costs can be high. Outsourcing gives skills, lower costs, and flexibility. At Confiance, we help businesses in California manage finances with ease and accuracy. Our bookkeeping services provide skilled support, secure data handling, and flexible solutions to match your business needs.

Partnering with Confiance gives you access to dedicated experts. Our team handles taxes, payroll, and financial records with accuracy and care. This reduces your administrative burden and allows you to focus on growth and client relationships. With cloud-based tools and structured processes, we ensure your accounts remain accurate, up to date, and fully compliant with California regulations. Confiance helps businesses save money, minimize stress, and make confident, well-informed financial decisions.

FAQs

- Why is bookkeeping important for California businesses?

Bookkeeping tracks income, costs, and taxes. In California, rules change often. Clear records help avoid mistakes, fines, and confusion. Many businesses use bookkeeping services to keep accounts simple and see how well they do.

- What is the main benefit of outsourcing bookkeeping?

Outsourcing cuts costs and brings skilled help. Teams track pay, taxes, and rules without extra hiring. Many small and mid-sized firms use bookkeeping services to save money and get expert support easily.

- Are outsourced bookkeeping services secure?

Yes. Providers use cloud systems, encryption, and secure logins. These keep data safe and allow easy report access. Firms in California often choose bookkeeping services to protect records while saving time.

- Do outsourced services cost less than in-house staff?

Yes. In-house staff need pay, benefits, and training. Outsourcing avoids these costs. Flexible plans let you pay only for what you need. Many businesses pick bookkeeping services to save money and get skilled help.

- Can small businesses benefit from outsourcing?

Yes. Small businesses need accurate records, but cannot hire large teams. Outsourced providers give expert help at a lower cost. Bookkeeping services let small shops and startups stay tax-ready and grow without stress.

- How fast do outsourced bookkeepers respond?

Response depends on the provider. Many offer same-day updates and clear reports. With bookkeeping services in California, business owners get fast answers and updates to make decisions on time.

- What should I look for when choosing a provider?

Choose a provider with tax know-how, fair rates, safe systems, and trusted reviews. They must give clear reports, talk well, and keep your books neat and on time.