How to Improve Cash Flow with Outsourced Accounts Receivable Services

Cash flow is the fuel that keeps a business alive. Businesses can improve it when they outsource accounts receivable services, ensuring steady payments on time. One way to boost cash flow is to use outsourced accounts receivable services. When experts handle invoices, calls, and follow-ups, firms save time, cut stress, and get paid faster.

In this blog, we look at how accounts receivable works, why weak control can drain cash, and how outsourcing can fix these issues. We will also share the best tips and key use cases from the field.

Understanding Accounts Receivable and Its Role in Cash Flow

What Is Accounts Receivable?

Accounts receivable (AR) is the money owed to a business by its customers for products or services delivered but not yet paid for. It represents the pending cash that a company expects to collect in the future.

For example, if a company issues an invoice with 30-day terms, that unpaid invoice becomes part of accounts receivable. When managed well, AR ensures a steady income. When managed poorly, it can create big gaps in cash flow.

The Role of Accounts Receivable in Cash Flow

AR plays a key role in keeping a business running:

- Ensures timely cash inflow for operations

- Helps pay bills, meet payroll, and fund growth

- Provides insight into customer payment behavior

- Supports planning and financial forecasting

Effective AR management strengthens cash flow and reduces financial stress. If a business lacks resources or expertise, outsourcing accounts receivable services can be a smart solution.

How Poor Accounts Receivable Management Affects Cash Flow

Delayed Payments

One of the biggest threats to cash flow is late pay. If invoices go out late or reminders are missed, customers may delay pay. Even a two-week hold can leave a business short on cash for pay or daily costs. When pay is not sent on time, cash flow slows. This can stop work and harm the business.

Increased Bad Debts

Without a strong process in place, unpaid invoices often turn into bad debts. Once accounts go too far past due, it becomes harder and costlier to collect. This can drain profits and weaken the company’s ability to stay competitive.

Strained Business Operations

When firms outsource accounts receivable services, they spend less time chasing money and more time focusing on sales and operations. This creates a cycle of financial stress. Teams spend more time chasing money than focusing on sales, service, or innovation.

Impact on Business Credit Rating

Missed cash flow targets may also damage the company’s credit score. Lenders and suppliers look at financial health before offering credit or better terms. Weak AR management can reduce trust and limit growth opportunities.

What Does It Mean to Outsource Accounts Receivable Services?

Outsourced AR services mean hiring a skilled outside team. They handle invoices, track payments, and bill your customers. They send reminders and follow up on late payments. They also prepare clear reports for your business. Experts use proven methods and modern tools. This helps ensure payments arrive on time. Outsourcing AR saves you time and effort. Your team can focus on growth while receivables are managed well.

Why Businesses Choose Outsourcing

Companies outsource AR for many reasons:

- Reduce Costs: You avoid the cost of hiring a full-time AR team. Training and salaries are also saved.

- Save Time: Staff can focus on core tasks. They spend less time chasing late payments.

- Increase Accuracy: Experts follow clear steps. This lowers errors and missed payments.

- Access Skilled Professionals: Get help from experts in credit control, collections, and disputes. They know the best methods.

- Improve Cash Flow: Timely invoices and reminders keep money coming in on schedule.

- Lower Risk: Outsourcing teams stay updated with rules and laws. This reduces legal and financial risk.

Key Benefits of Outsourced Accounts Receivable Services for Cash Flow

Faster Payment Collections

When you outsource accounts receivable services, bills go out on time and reminders are sent automatically, speeding up cash flow.

Lower Costs and Overheads

Instead of adding new staff, outsourcing gives firms access to trained experts at a lower cost.

Higher Accuracy and Compliance

AR teams check that invoices are correct, records are current, and rules are met.

Stronger Focus on Core Tasks

When firms don’t have to chase payments, leaders can spend time on sales, growth, and service.

Better Customer Relations

Outsourcing partners send clear and polite reminders to customers. This keeps the process smooth and protects ties with clients while ensuring payment.

By using outsourced accounts receivable services, businesses can secure steady cash flow, reduce stress, and focus on growth with confidence.

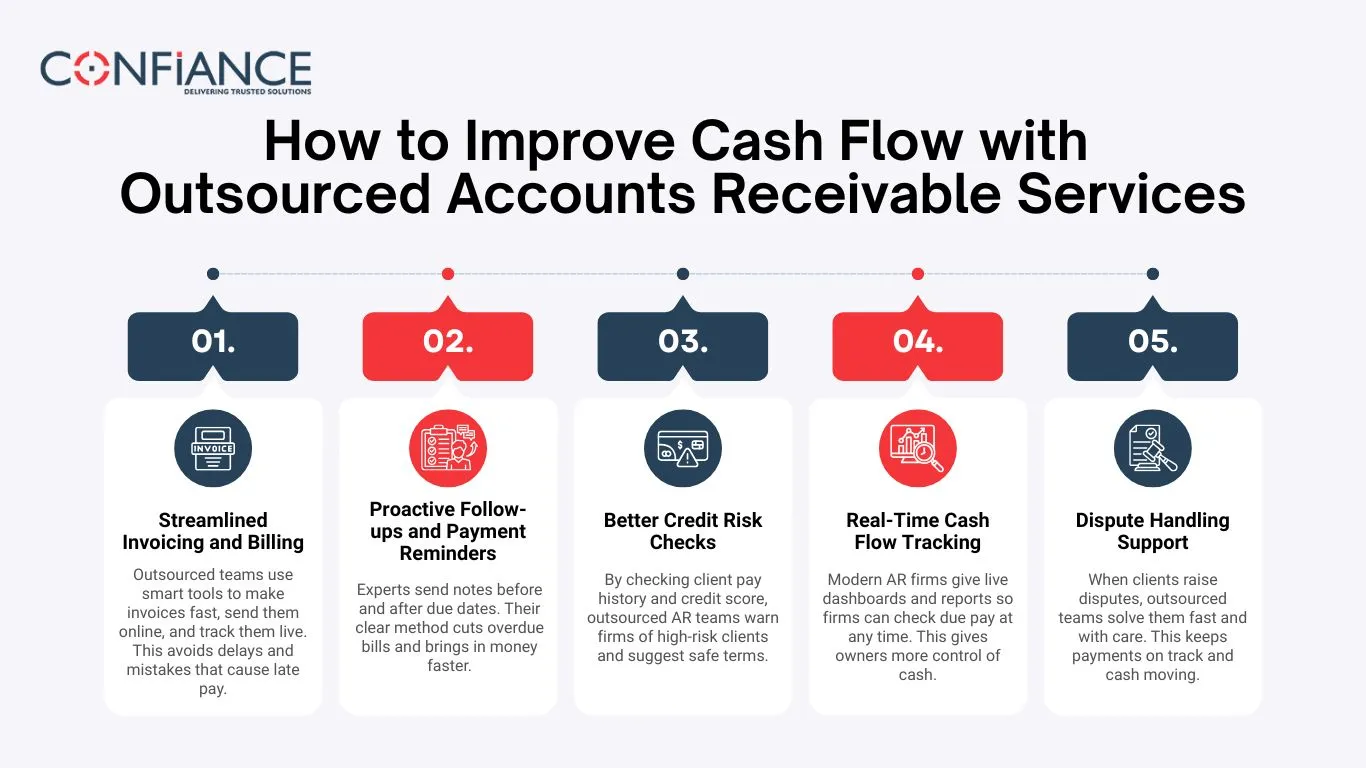

How to Improve Cash Flow with Outsourced Accounts Receivable Services

Streamlined Invoicing and Billing

Outsourced teams use smart tools to make invoices fast, send them online, and track them live. This avoids delays and mistakes that cause late pay.

Proactive Follow-ups and Payment Reminders

Experts send notes before and after due dates. Their clear method cuts overdue bills and brings in money faster.

Better Credit Risk Checks

By checking client pay history and credit score, outsourced AR teams warn firms of high-risk clients and suggest safe terms.

Real-Time Cash Flow Tracking

Modern AR firms give live dashboards and reports so firms can check due pay at any time. This gives owners more control of cash.

Dispute Handling Support

When clients raise disputes, outsourced teams solve them fast and with care. This keeps payments on track and cash moving.

Key Features of Outsourced Accounts Receivable Services

End-to-End Invoicing

One big gain of outsourcing is full invoice support. This covers making invoices, checking info, and sending on time. By avoiding errors, firms boost cash flow.

Automated Payment Reminders

Outsourced teams use online tools to send notes before and after due dates. These alerts cut overdue bills and keep cash steady.

Dispute Management

Errors and disputes slow down pay. Outsourced AR teams fix issues fast and with care, so firms get funds on time.

Clear Reports and Insights

Firms get live, clear reports on receivables. These show client habits, overdue trends, and cash forecasts to guide smart choices.

Flexible and Scalable Services

Outsourced AR solutions can scale with business growth. Whether a company has 50 clients or 5,000, the outsourced team adjusts to handle the workload with ease.

Industries That Benefit Most from Outsourced Accounts Receivable Services

Small and Medium Businesses

SMBs often lack time or staff for AR work. Outsourcing lets them get expert help without the cost of a full-time hire.

Healthcare and Medical Practices

Health firms deal with tough billing, claims, and late pay. AR outsourcing cuts errors and keeps cash flow smooth.

Professional Services and Consulting Firms

Consultants and service firms face slow pay on projects. Outsourced AR gives steady follow-up and professional collections.

Manufacturing and Supply Chain Businesses

Firms with many clients often face late pay. Outsourcing keeps receivables clear, cutting cash flow gaps.

Steps to Get Started with Outsourced Accounts Receivable Services

Assess Your Current AR Process

Start by checking how you handle receivables now. Review invoice speed, follow-ups, overdue accounts, and dispute fixes. This shows what needs to improve.

Define Your Business Goals

Set clear goals for outsourcing. Do you want faster pay, lower cost, or more accuracy? Knowing your goals helps you pick the right service.

Choose the Scope of Services

Not all firms need full AR outsourcing. Some need just billing, while others want end-to-end work. Decide if you want partial help or a full solution.

Plan the Transition

The move from in-house to outsourced must be smooth. Work with the partner to set dates, share client data safely, and define flows to avoid gaps.

Monitor and Review Performance

Once outsourcing starts, track results with reports. Compare pay cycles, overdue bills, and cash flow gains. This proves that the deal works well.

How to Select the Right Outsourcing Partner

Industry Experience and Expertise

Pick a partner with clear skills in AR for your field. Industry know-how means they get your clients and billing rules.

Use of Technology

The right team uses cloud tools, reports, and automation. These tools boost speed, cut errors, and give live data on receivables.

Security and Compliance

Money data is sensitive. Check that the provider follows strict rules and meets all laws to keep your info safe.

Transparency and Communication

Clear communication is key to success. Choose a firm that shares updates, gives clear reports, and is responsive to your inquiries.

Flexible Pricing Models

Strong partners give flexible rates, like pay-per-invoice or monthly fees. This keeps outsourcing cost-smart as you grow.

Best Practices for Businesses Outsourcing Accounts Receivable Services

Choosing the Right Outsourcing Partner

Pick a partner with skill, field know-how, and a sound record. Ask about their tools, steps, and reports.

Setting Clear Policies and Processes

Set rules at the start: due dates, late fees, follow-up steps, and reports. Clear rules make AR run smoothly.

Using Tech for Clarity and Speed

Partners that use cloud, AI, and auto tools give fast and clear AR work. This keeps firms in control with a full view.

Regular Reviews and Feedback

Hold routine meetings with the partner to check results. Open feedback drives gains and long-term growth.

Cash flow can make or break a business. Firms that outsource accounts receivable services ensure that revenue turns into cash faster. Outsourcing accounts receivable is a smart step to keep cash flow steady, cut stress, and focus on growth.

At Confiance, we know cash flow keeps your business alive. Our team handles AR fast and with care. We do not use one plan for all. We make AR solutions that fit your size and needs. Small or large, clients trust Confiance to collect payments, speed up cash flow, and ease their stress.

FAQs

- How does outsourcing accounts receivable improve cash flow?

When you outsource AR work, experts send bills, reminders, and track pay. This cuts hold-ups and keeps money coming in on time. A smooth cycle means better cash flow and less stress. - Is outsourcing accounts receivable cost-effective for small businesses?

Yes. Small firms often can’t hire full AR staff. Outsourcing gives expert help at a low cost. It saves cash, improves collections, and lets staff focus on core work. - Will I lose control if I outsource accounts receivable services?

No. A good partner acts as part of your team. You still set rules and terms. They share reports so you always see your AR status. - What tasks are included in outsourced accounts receivable services?

Key tasks are billing, reminders, follow-ups, credit checks, dispute fixes, and reports. Some firms give insights to help plan cash flow. - How secure is outsourcing accounts receivable management?

Trusted partners use safe systems, lock data, and follow strict rules. Pick a partner who values data safety and shows proof of security. - How soon can I see results after outsourcing AR?

Many firms see gains in a few months. Fast billing, steady reminders, and fewer late payments lead to strong cash flow.