Why You Should Outsource Accounts Payable Services for Construction Companies

Managing accounts payable in the construction business can be messy. Between subcontractors, vendors, material invoices, and project timelines, things pile up fast. Paperwork gets lost, errors go unnoticed, and late payments hurt vendor relationships. That’s why many construction companies choose to outsource accounts payable services. Choosing to outsource accounts payable services for construction brings structure, speed, and accuracy to a process that often slows down operations.

Outsourcing brings order to a process that often feels disorganized. It saves time, cuts costs, and improves accuracy. Most important, it lets your team focus on running jobs instead of chasing invoices. In this guide, we explain why outsourcing accounts payable services for construction is not just helpful. It is smart business.

What Is Accounts Payable in Construction?

Accounts payable (AP) is the money a construction company owes to suppliers, vendors, subcontractors, and others. It includes material purchases, equipment rentals, labor costs, and utility bills. In short, it’s every bill that hasn’t been paid yet.

Unlike other industries, construction has more moving parts. Vendors change with every job. Subcontractors submit invoices in different formats. Payment terms vary. Some vendors want payment on delivery, while others accept 30 or 60 day terms. With so many variables, it’s easy to fall behind or make mistakes.

That’s where outsourcing helps. An experienced service provider handles the full AP process, from data entry and invoice tracking to approvals and payment scheduling.

Common AP Problems in Construction

Before we explain the benefits of outsourcing, it helps to see what usually goes wrong when AP is handled in-house.

1. Paper Based Processes

- Many construction firms still rely on paper invoices. This slows down the approval cycle. Invoices get stuck on desks or lost in trucks. Delays cause missed payment deadlines.

2. Lack of Staff Training

- Not every construction office has a full accounting team. Sometimes, office managers or project leads handle invoices with little training. Mistakes happen, like duplicate payments or wrong vendor info.

3. Missing Approvals

- Invoices often need sign off from project managers. If someone is on site or out sick, approvals get delayed. Without a system in place, the approval process becomes a bottleneck.

4. Disputes With Vendors

- Missing or incorrect payments lead to disputes. Vendors may stop delivering materials or delay services. This puts projects at risk and can damage business relationships.

5. Weak Audit Trails

- Audits are part of running a construction company. If your records are disorganized or incomplete, you could face penalties or miss out on future bids.

Outsourcing addresses these problems by creating a clear, reliable AP process.

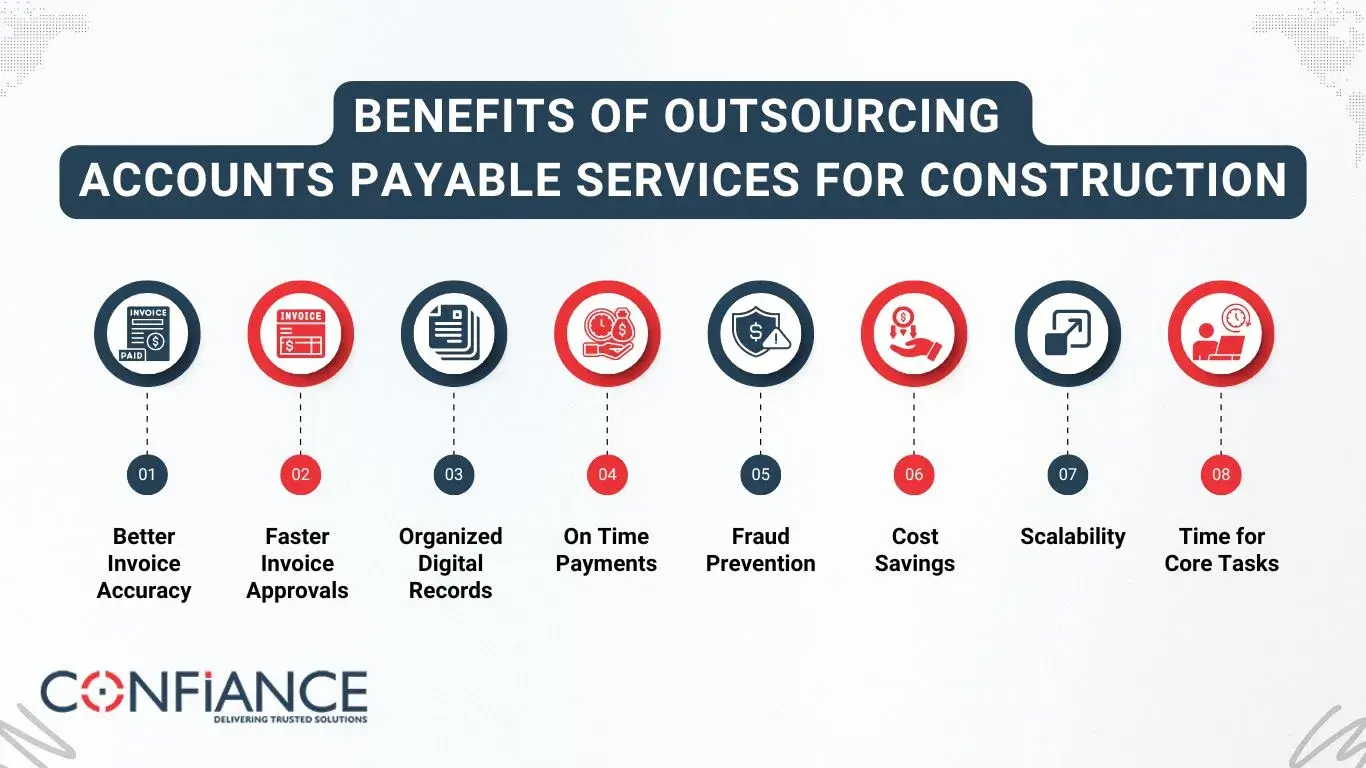

Benefits of Outsourcing Accounts Payable Services for Construction

Outsourcing accounts payable services for construction is more than a cost saving move. It creates structure and reliability. Here’s how it helps.

1. Better Invoice Accuracy

- Outsourced teams use tools to read, track, and file invoices without manual errors. They cross check details, flag duplicates, and verify amounts. This improves accuracy and reduces payment issues.

2. Faster Invoice Approvals

- Outsourced providers set up workflows that speed up approvals. They notify the right people at the right time. Delays shrink, and payments go out on schedule.

3. Organized Digital Records

- No more file cabinets or lost papers. Every invoice and approval is stored in one system. You can find past payments, check status, and pull reports with a few clicks.

4. On Time Payments

- Vendors expect to be paid on time. Outsourced teams track due dates and send payments when scheduled. This improves your credit terms and keeps your vendor relationships strong.

5. Fraud Prevention

- Experienced AP providers use checks to spot fraud, like fake vendors or altered invoices. This adds a layer of protection that many in-house teams cannot match.

6. Cost Savings

- Hiring full time staff to manage AP costs more than outsourcing. You save on salaries, training, and software. Most providers offer monthly plans based on invoice volume, making costs predictable.

7. Scalability

- As your business grows, the AP workload increases. Instead of hiring more people, you can scale your outsourced service. They adjust based on the number of invoices you process.

8. Time for Core Tasks

- Construction companies need to focus on job sites, clients, and crew management. Outsourcing AP frees up time and mental space so your team can handle what matters most.

What an Outsourced Accounts Payable Service Does

When you outsource accounts payable services for construction, the service provider manages everything tied to vendor payments. Here’s what that usually includes:

- Receiving invoices from vendors and subcontractors

- Extracting and entering invoice data

- Matching invoices to purchase orders or contracts

- Routing invoices for approval

- Verifying payment terms

- Scheduling payments

- Managing vendor records

- Creating reports for cash flow and project budgets

Some providers also offer software access so you can view status, reports, and documents anytime.

How Outsourcing Helps with Job Costing

Job costing is critical in construction. You need to know how much each part of a job costs in real time. Late or missing invoices make job costing inaccurate. When AP is outsourced, invoices are processed faster, and job data stays current. This helps you track expenses and stay within budget.

You can also spot cost overruns early. If labor or material costs rise on a project, the data shows up in real time. This helps you make adjustments before it’s too late.

Choosing the Right Accounts Payable Partner

Not every AP service fits construction needs. Choose a partner that knows the industry and understands its challenges. Here’s what to look for:

1. Industry Experience

- Pick a provider with experience in construction. They’ll know how to read job numbers, deal with subcontractors, and manage changing invoice formats.

2. Scalable Services

- Your AP needs change as projects come and go. Look for a partner that can scale services up or down without hassle.

3. Clear Processes

- Ask how they handle approvals, disputes, and late invoices. A good provider should walk you through their process step by step.

4. Data Access

- Make sure you can access reports and records anytime. You should be able to track payments, view pending approvals, and export data when needed.

5. Integration Options

- If you use software like QuickBooks, Sage, or Procore, check if the AP provider can connect with it. This makes data flow easier and avoids double entry.

Myths About Outsourcing Accounts Payable in Construction

Some construction owners worry about losing control or increasing risk when they outsource. Here’s why those fears are often not true.

Myth 1: “I’ll lose control of my payments.”

- You stay in control. You approve payments, and nothing moves without your OK. The provider just handles the heavy lifting.

Myth 2: “It’s only for big companies.”

- Small and mid size construction firms benefit just as much. If you process 50 or more invoices per month, outsourcing can save time and money.

Myth 3: “My data won’t be safe.”

- Reputable AP firms use encryption and secure servers. In most cases, your data is safer than it is in an office drawer.

Myth 4: “It’s expensive.”

- Compared to hiring in-house staff, outsourcing is often cheaper. You also avoid the cost of errors, delays, and vendor disputes.

How to Start Outsourcing Your Accounts Payable

If you’re ready to outsource accounts payable services for construction, start with a few steps.

Step 1: Review Your Current Process

- List out how you handle invoices now. Who receives them? Who approves them? What delays occur? This helps you explain your needs.

Step 2: Choose a Service Provider

- Look for one with solid construction experience. Ask for references or case studies. Make sure they are clear about how they work and what they charge.

Step 3: Define the Workflow

- Work with the provider to map out how invoices will be received, approved, and paid. Set approval limits, define payment rules, and test the process with a few invoices.

Step 4: Train Your Team

- Your project managers, bookkeepers, and admin staff should know the new process. The provider should help train your team or offer support.

Step 5: Monitor and Adjust

- Start small. Monitor results for the first month. Review reports, check for errors, and give feedback. Good providers will adjust to fit your needs.

Long Term Benefits of Outsourcing AP in Construction

Outsourcing accounts payable services for construction creates long term value. Over time, it helps your company grow without growing overhead.

More Bids, Less Admin

When your team spends less time on paperwork, they have more time to chase bids, visit job sites, and work with clients.

Stronger Vendor Relationships

Vendors appreciate on time payments and clear communication. This builds trust and can lead to better terms or priority service.

Better Financial Decisions

Accurate, real time data helps you make smart choices. You can plan for cash flow, track project spend, and prepare for audits with ease.

Easier Audits and Compliance

Digital records make audits less painful. You can pull reports and find backup documents without digging through stacks of paper.

Peace of Mind

Outsourcing creates a system you can rely on. It reduces errors, avoids disputes, and lets your team sleep better at night.

Construction companies work hard to keep projects on track and under budget. But messy accounts payable processes can throw everything off. That’s why it makes sense to outsource accounts payable services for construction.

If your construction business struggles with late payments, invoice backlogs, or cash flow blind spots, it’s time to rethink your AP process. Outsourcing may be the fix you need. Contact Confiance now to outsource your construction business bookkeeping.

FAQs

- How do outsourced AP services improve compliance for construction firms?

Outsourced providers follow accounting standards and maintain digital records that support audits. This reduces the risk of non-compliance and lowers the chances of penalties. - Can outsourced accounts payable services handle multi-project operations?

Yes. These services can track payables across multiple job sites, allocate costs correctly, and provide reports for each project to support financial planning. - What types of invoices can an AP outsourcing partner process for construction companies?

They handle vendor bills, subcontractor invoices, utility charges, lease payments, and equipment rentals. Their systems support varied formats and billing terms common in construction. - How does outsourcing affect payment approval control in construction businesses?

You stay in full control. Most providers set up custom approval workflows that match your internal rules and hierarchy, so nothing is paid without your consent. - What kind of reports do AP outsourcing services generate for construction companies?

You get real-time reports on payables aging, cash flow forecasts, invoice status, job cost allocation, and exception tracking to support better decision making. - Do outsourced AP providers offer mobile access for field managers?

Some do. They offer apps or portals where project leads can review and approve invoices from job sites, speeding up processing time.