Online Bookkeeping Services for Managing Your Finances Virtually

Keeping track of your finances doesn’t have to be complicated. Online bookkeeping services let you monitor income, organize invoices, and manage expenses easily using the internet. With these tools, your accounts stay up-to-date, and financial tasks become quicker and less stressful. In this blog, we’ll explain how Virtual bookkeeping works, highlight its key benefits, and share tips to use it effectively.

What Are Online Bookkeeping Services?

Online bookkeeping services are online tools that help you track money, bills, and income. You do not need to visit an office. A virtual bookkeeper can handle tasks like bills, payments, and reports online.

How Virtual Bookkeeping Is Different

Traditional bookkeeping uses paper and takes more time. Virtual bookkeeping is faster, safer, and works online. Here is how it is different:

- Access Anytime: Check your money from anywhere.

- Save Time: Many tasks are automatic.

- Cost Less: No need to hire a full-time worker or rent space.

With online bookkeeping, you can see your money clearly and spend less time tracking it.

Benefits of Online Bookkeeping Services

Online bookkeeping Services have many benefits for people and businesses. Here are the main ones:

1. Easy and Flexible

With Virtual Bookkeeping, you can see and manage your money from any device. You do not need to handle paper bills or invoices.

2. Save Time

Manual bookkeeping is slow. Online bookkeeping can do tasks like entering data and checking accounts automatically. This frees up your time for other work.

3. Accurate and Clear

Online bookkeeping keeps your records correct and up to date. You can see reports that show your cash, spending, and profits anytime.

4. Low Cost

Virtual bookkeepers often cost less than full-time staff. You pay for what you need only.

5. Safe and Backed Up

Online bookkeeping stores your data safely and makes backups. You do not risk losing important information.

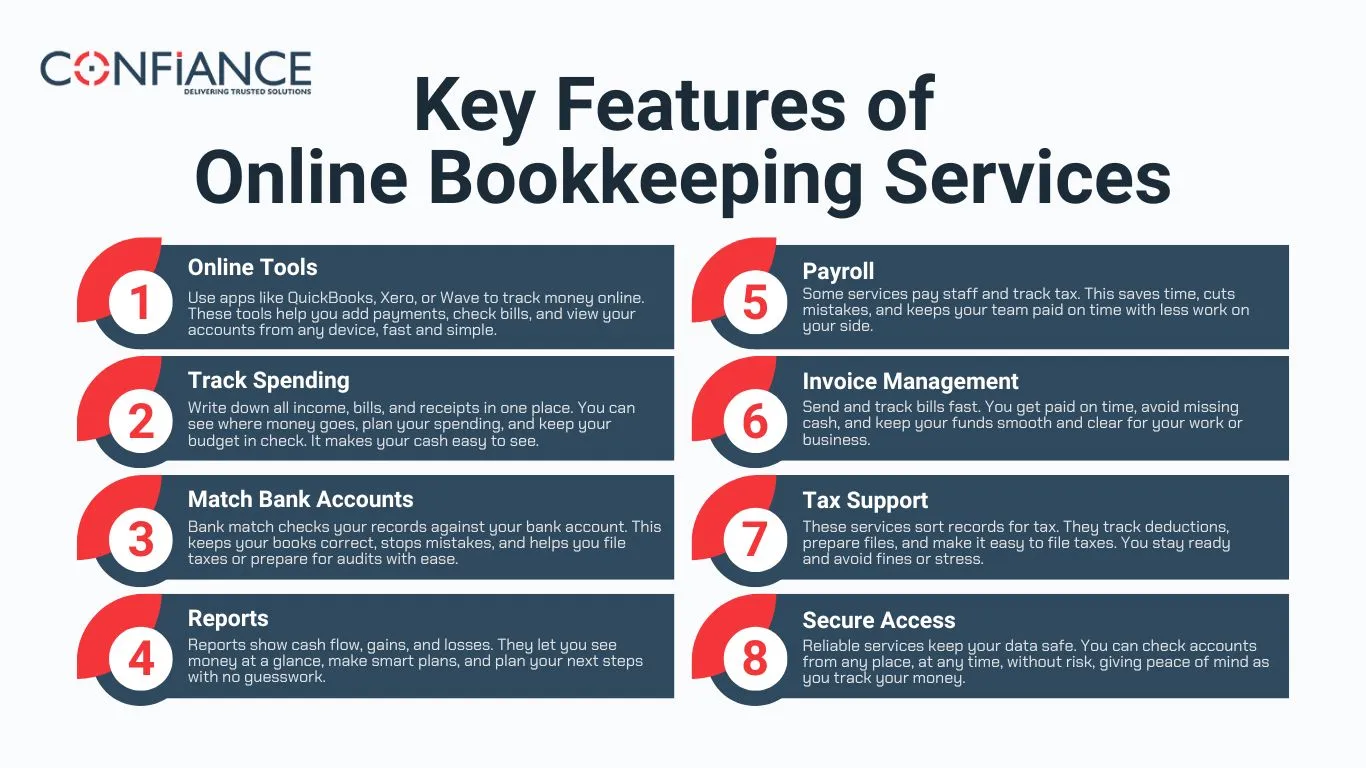

Key Features of Online Bookkeeping Services

Online bookkeeping helps you track money and keep your books neat. Good services let you log income, pay bills, and check your accounts. They save time, cut mistakes, and keep your finances clear.

1. Online Tools

Use apps like QuickBooks, Xero, or Wave to track money online. These tools help you add payments, check bills, and view your accounts from any device, fast and simple.

2. Track Spending

Write down all income, bills, and receipts in one place. You can see where money goes, plan your spending, and keep your budget in check. It makes your cash easy to see.

3. Match Bank Accounts

Bank match checks your records against your bank account. This keeps your books correct, stops mistakes, and helps you file taxes or prepare for audits with ease.

4. Reports

Reports show cash flow, gains, and losses. They let you see money at a glance, make smart plans, and plan your next steps with no guesswork.

5. Payroll

Some services pay staff and track tax. This saves time, cuts mistakes, and keeps your team paid on time with less work on your side.

6. Invoice Management

Send and track bills fast. You get paid on time, avoid missing cash, and keep your funds smooth and clear for your work or business.

7. Tax Support

These services sort records for tax. They track deductions, prepare files, and make it easy to file taxes. You stay ready and avoid fines or stress.

8. Secure Access

Reliable services keep your data safe. You can check accounts from any place, at any time, without risk, giving peace of mind as you track your money.

How to Choose the Right Service

Pick a service that works best for your needs. Look for these points:

- Skilled Staff: Choose a service with trained bookkeepers or accountants.

- Easy Software: The tools should be simple to use, even if you are not an expert.

- Custom Fit: Pick a service that can adjust to your business needs.

- Support: Good support helps you fix problems fast.

- Safety: Check if the service protects your data with passwords and encryption.

Tips to Use Online Bookkeeping Well

Here are tips to make Online bookkeeping services work for you:

1. Keep Records Neat

Upload invoices, bills, and receipts on time. This helps bookkeepers work faster.

2. Check Reports Often

Look at your reports each month to see cash flow and profits.

3. Use Other Tools

Link bookkeeping software with payment apps or expense trackers to save time.

4. Clear Contact

Decide how you will contact your bookkeeper. Clear chat or emails reduce mistakes.

5. Protect Data

Use strong passwords and security features to keep your money info safe.

Myths About Online Bookkeeping

Some people doubt online bookkeeping. Let’s clear up four myths and see the truth.

Myth 1: It Is Not Safe

Fact: Good services keep your data safe. They use secure servers and back up your files. Your money and records stay protected.

Myth 2: It Costs Too Much

Fact: Online bookkeeping can cost less than a full-time worker. You pay for what you use. It is cheap and fits your needs.

Myth 3: It Is Hard to Use

Fact: Most tools are simple. A bookkeeper helps you learn and guide you step by step. You can track your money with ease.

Myth 4: No Personal Help

Fact: Many services give you a bookkeeper. You get help and tips when you need them. This makes the service safe and easy.

Who Can Use Online Bookkeeping

Virtual bookkeeping is helpful for many people:

Small Businesses

Save time and money while keeping track of bills and income.

Freelancers

Track money and expenses without hiring a full accountant.

Startups

Focus on growth while someone else handles money and payroll.

Big Businesses

Get real-time reports and scale without hiring more staff.

Common Challenges in Online Bookkeeping

Online bookkeeping is simple and helpful, but some issues can still come up. Knowing them helps you stay ready and plan well.

1. Data Entry Mistakes

Errors can still occur when you enter data. Check invoices and receipts twice before you upload them. This keeps your records neat and correct.

2. Software Learning Curve

Some tools take time to use well. Start with the basics, then move to more features step by step. This makes learning smooth and less hard.

3. Internet Dependence

Online bookkeeping needs a strong web link. Poor speed or drops can slow work or stop updates. A stable line keeps your tasks on track.

4. Security Risks

Online data can face risks if you use weak passwords. Pick strong ones and turn on two-step checks to keep your accounts safe.

5. Limited Human Interaction

Some users miss live talks with a bookkeeper. You can fix this by setting up calls or chats often for clear advice and quick help.

6. Cost Concerns

Some small firms fear the cost of online tools. Yet many services have plans that scale. Choose one that fits your needs and budget, so you spend smart.

7. Data Migration Issues

Moving old records to new systems can cause errors. Check files before upload and test the software first. This ensures your data shifts smoothly and stays correct.

How to Maximize the Value of Online Bookkeeping

Follow these easy steps to use virtual bookkeeping services well:

1. Set Clear Goals

Know what you want. For example, track bills, see monthly reports, or pay staff on time.

2. Use Tools to Save Time

Let tools pay bills, send reminders, and check accounts. This cuts work and mistakes.

3. Keep Records Updated

Add new bills, receipts, and income each week. This keeps reports correct.

4. Check Reports Often

Look at reports every month. See where money comes from and goes.

5. Ask for Help

If unsure, ask your bookkeeper for tips on taxes, budgets, or using the software.

Future of Virtual Bookkeeping

The future looks bright for online bookkeeping. New tools and AI make tracking money faster and smarter. You can expect:

- Faster and more accurate tracking

- Clear reports for planning

- Easy to grow your business

- Safe storage for data

Using virtual bookkeeping now can help you stay ahead and manage money easily.

Online bookkeeping keeps your money clear and simple. With virtual bookkeeping, you save time, avoid mistakes, and track your cash easily. Confinace offers expert virtual bookkeeping services so you can manage your accounts online. From tracking costs to making reports, Confinace keeps your money safe, neat, and easy to reach. You can focus on growing your business while we handle the books.

FAQs

- What are Online bookkeeping services?

Online bookkeeping services are online tools that help track income, bills, and money records without visiting an office.

- How is online bookkeeping different from traditional bookkeeping?

Online bookkeeping works on the internet. It is faster, safer, and easier than manual paper bookkeeping.

- Can small businesses use virtual bookkeeping?

Yes. Small businesses can save time, cut costs, and see clear money reports with virtual bookkeeping.

- Is virtual bookkeeping safe?

Yes. Good services use secure servers, strong passwords, and backups to keep data safe.

- Do I need accounting knowledge to use online bookkeeping?

No. Most tools are easy, and bookkeepers guide you step by step.

- Can virtual bookkeeping services handle payroll?

Yes. Many services pay staff, track wages, and handle taxes online.

- Can I access virtual bookkeeping from my phone or tablet?

Yes. Most platforms work on phones, tablets, and computers, so you can check your money anytime.

- How often should I update my online bookkeeping?

It is best to add bills, receipts, and income every week. This keeps reports correct and up to date.