Looking for a Bookkeeper in California? Here Are Some Benefits of Outsourcing You Must Know

From sales to staff pay, running a firm takes time and care. In California, rules and costs add more weight. One task that many owners find tough is managing the books. If you spend hours checking sales, costs, and taxes, you know the stress. With help from a bookkeeper in California, you can focus on clients while records stay clean.

This blog will show why you need a bookkeeper, what they do, the top gains of outsourcing, and how it helps small and mid-size firms. We will also cover tax preparation, how to pick the right partner, and why Confiance is a smart choice for your needs.

Why You Need a Bookkeeper in California

Many new owners start by doing the books on their own. They track costs, sales, and pay using tools like Excel. At first, this seems fine. But as the firm grows, so does the mess.

Common Issues Without a Bookkeeper

You may spend nights fixing errors. Invoices pile up. Cash flow looks unclear. Tax forms are confusing and hard to manage. When you lack time and skill, small mistakes turn into big costs.

Why Local Help Matters

California has strict rules on taxes and staff pay. If you miss a rule, you may face a fine. A local bookkeeper knows these laws. They keep your books clean and help you stay safe.

Who Is a Bookkeeper in California and What Do They Do?

A bookkeeper is more than someone who writes numbers in a file. They track the life of your firm through clear, neat records.

Core Duties of a Bookkeeper

- A bookkeeper in California records daily sales, expenses, and payments. They reconcile bank statements and make sure your accounts match your actual funds.

- They prepare payroll, generate invoices, and track payments from clients. They also maintain records that are always ready for tax filing. These tasks may sound simple, but when done wrong, they can create big problems.

Why Their Role Matters

- Accurate books show the true financial health of your business. They let you see if you are making profits, spending too much, or falling behind on payments.

- Bookkeepers provide reports that guide your decisions, from hiring staff to cutting costs. In a state like California, where business expenses are high, their insights can be the difference between success and failure.

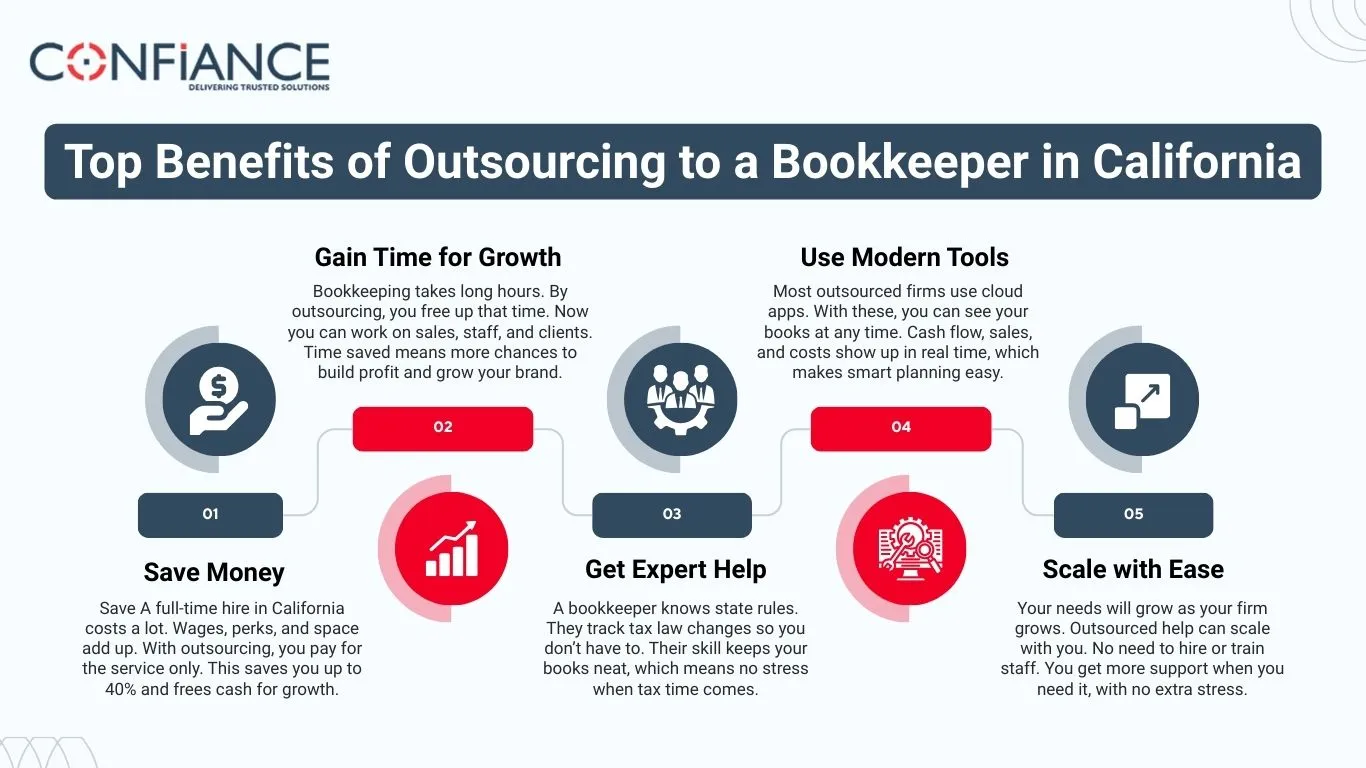

Top Benefits of Outsourcing to a Bookkeeper in California

Outsourcing your books is more than a way to save money. It gives your firm more time, less stress, and clear records. A skilled bookkeeper in California can handle daily sales, bills, and staff pay while keeping your accounts neat and ready for tax time.

1. Save Money

A full-time hire in California costs a lot. Wages, perks, and space add up. With outsourcing, you pay for the service only. This saves you up to 40% and frees cash for growth.

2. Gain Time for Growth

Bookkeeping takes long hours. By outsourcing, you free up that time. Now you can work on sales, staff, and clients. Time saved means more chances to build profit and grow your brand.

3. Get Expert Help

A bookkeeper knows state rules. They track tax law changes so you don’t have to. Their skill keeps your books neat, which means no stress when tax time comes.

4. Use Modern Tools

Most outsourced firms use cloud apps. With these, you can see your books at any time. Cash flow, sales, and costs show up in real time, which makes smart planning easy.

5. Scale with Ease

Your needs will grow as your firm grows. Outsourced help can scale with you. No need to hire or train staff. You get more support when you need it, with no extra stress.

Bookkeeper in California vs. In-House Hiring: Which Is Better?

Some owners think hiring in-house is best. Others prefer outsourcing. Each has pros and cons.

The In-House Path

An in-house hire sits in your office. You can ask them things face-to-face. But this comes at a high cost. Pay, perks, and space reduce the profits. In a state with high wages, this can hurt small firms.

The Outsourced Path

An outsourced bookkeeper is more cost-friendly. They give you expert care and tools for less. The only risk is trust. You must pick the right firm. Once you do, the gains beat the risks.

Pros and Cons of Outsourcing

No choice is perfect. Here is a clear look at the plus and minus points.

Pros

- Big savings on staff costs

- More time for sales and growth

- Expert help with state rules

- Real-time access to books

- Scales with your firm’s growth

Cons

- You must trust a third party with your data

- You may wait for replies if the firm is busy

But in most cases, the gains are far more than the downsides.

How Outsourced Bookkeepers in California Help You Stay Tax-Ready

Tax time is one of the hardest parts of running a firm. State rules change often, and forms pile up. Outsourced bookkeepers keep you ready all year.

Year-Round Order

They record data each day. By year's end, your books are set. No last-minute rush. No missing forms. No stress.

Avoid Fines and Stress

Late tax filing can bring big fines. A bookkeeper in California knows due dates. They file on time. They keep your books neat, so you pass audits with ease.

Choosing the Right Bookkeeper in California: Key Factors to Consider

Not all bookkeepers are the same. The right choice makes a big difference.

Pick one with strong skills in state laws. Make sure they use cloud tools for speed. Check that their fees are clear. Read reviews from past clients for proof of trust.

Check Their Experience

Look for a bookkeeper in California who has worked with similar businesses. Experience with local taxes and payroll ensures fewer errors and faster solutions for your day-to-day accounting needs.

Evaluate Communication

Your bookkeeper should respond quickly and explain numbers clearly. Strong communication keeps you aware of issues early and helps you make quick, smart business decisions without stress.

Technology and Tools

A modern bookkeeper uses cloud software, real-time dashboards, and mobile access. These tools let you track cash flow, send invoices, and see reports anytime, keeping your firm organized and ready.

Pricing and Flexibility

Make sure fees are clear and fair. Ask about flexible plans for growth. The right bookkeeper will scale with your business and provide extra help when the workload spikes.

Future of Outsourced Bookkeeping in California

The future is bright for outsourcing. Tech is making it even stronger.

New Technology in Bookkeeping

AI and automation now handle repetitive tasks fast and with fewer mistakes. Dashboards show cash flow live, making it easy to spot trends and plan budgets in real time.

Demand Will Grow

High costs and complex rules push more firms to outsource. Small and mid-size businesses will rely on skilled bookkeepers in California to keep books neat and save time and money.

Cloud and Remote Access

Cloud apps make it easy for business owners to check books from anywhere. Remote access allows outsourced bookkeepers to work efficiently without being in the office every day.

Skill Development

Outsourced bookkeepers now use new tools and strategies to improve accuracy. Firms gain expertise without hiring extra staff, ensuring books are always correct and compliant with laws.

Cost Efficiency

Outsourcing will continue to save firms money. Businesses avoid paying full salaries and perks, while gaining trained staff and software, making bookkeeping more efficient and reliable than ever.

A skilled bookkeeper in California does more than keep track of numbers. They make sure your books are correct and up to date. By hiring Confiance, small and mid size firms cut labor costs, save time, and get help with payroll, sales, and taxes. Using cloud tools and plans made for California businesses, Confiance makes bookkeeping easy, fast, and stress free. By partnering with us to handle your money, you can focus on growing your business while your records stay correct and ready for audits.

FAQs

- What does a bookkeeper in California do?

A bookkeeper in California keeps track of sales, bills, and staff pay. They check bank files and match them with your books. They also help with tax rules. Their job is to make sure your books stay neat and true. - Is it cheaper to outsource than hire in-house?

Yes, it is. A full-time hire means high pay, perks, and space costs. Outsource firms charge only for the work you need. This cuts costs and still gives you strong help. Small firms gain most from this plan. - How can outsourcing help during tax season?

When tax time comes, stress is high. Outsourced bookkeepers keep your books clean each day. At year’s end, you have neat files, no rush, no miss, and no risk of fines. This makes tax time much smoother. - Can small businesses benefit from outsourcing?

Yes. Small firms see the best gains. They save cash by not hiring staff full-time. They get skills at a fair rate. They also save hours each week, which they can use to grow and serve more clients. - What should I look for when choosing a bookkeeper in California?

Look for skill with state tax rules. Check if they use safe cloud apps. Make sure the price is clear. Read past client reviews. The right pick will scale with your firm and keep data safe. - Is my data safe with an outsourced bookkeeper?

Most good firms use strong locks for their data. They use cloud apps with codes and rules for safe use. Ask them how they guard your files. Pick one that is clear on its steps to keep you safe. - Can outsourced bookkeepers work with growing firms?

Yes, they can. Outsourced help can scale as your firm grows. You don’t need to hire or train more staff. You can add more support when you need it, with less cost and less stress.