Comparing Local vs Offshore Bookkeeping Services

Bookkeeping is how businesses keep track of their money. It means writing down what they earn, what they spend, and what they owe. Some businesses use people in the same country to help with this. Others hire bookkeepers from another country. This is called offshore bookkeeping services.

In this blog, we will explain the differences between local and offshore bookkeeping services. You will learn what each one does best and which one may be right for your business.

Understanding Local vs Offshore Bookkeeping Services

Bookkeeping is used by businesses to keep track of their money. There are two ways to do it: local and offshore.

Local bookkeeping means the bookkeeper is in the same country or city as the business. This makes it easy to talk, meet, and follow the same rules. But, it can cost more because of higher pay and office rent.

Offshore bookkeeping means the work is done in another country, like India or the Philippines. This can save money because workers in those places get paid less. They can still do a good job using the internet and tools like cloud software.

Both types help keep money records clean. The right choice depends on your budget, needs, and how much help you want.

Local Bookkeeping Services Pros and Cons

These are services from people who live and work in the same country as your business.

Pros:

- Easy to talk to – They speak your language and are in your time zone.

- Know local rules – They understand local taxes and business laws.

- Face-to-face help – You can meet them in person when needed.

- Good for private work – Best for health, legal, or other work that needs strong privacy.

- Fast to fix mistakes – If something is wrong, it’s easier to solve it quickly.

- Trust builds easier – Seeing and knowing the person makes trust easier.

Cons:

- More costly – They cost more because of wages, rent, and office needs.

- Hard to find experts – Special skills may not be easy to find nearby.

- Takes time to grow – Adding more help takes time and more money.

- Not open 24/7 – They work only during local hours, not always when you need them.

- Office visits needed – Some things may need a visit, which can take time.

Offshore Bookkeeping Services: Pros and Cons

These are services from people in other countries who help your business from far away.

Pros:

- Save money – You can save 40% to 70% compared to local workers.

- Lots of experts – Places like India have many trained bookkeepers.

- Work all day – Time zones help you get work done while you sleep.

- Great for busy work – Good for handling bills, payments, and reports.

- Easy to grow – You can add more people quickly when your business grows.

- Online tools help – Cloud software makes sharing and working easy.

Cons:

- Takes time to start – You need to train them in your way of working.

- Time zone delays – Replies may take time due to different work hours.

- Needs strong systems – You must use safe tools to protect your money data.

- Less face time – You don’t get to meet them in person.

- Language gaps – Sometimes, language or culture differences may cause confusion.

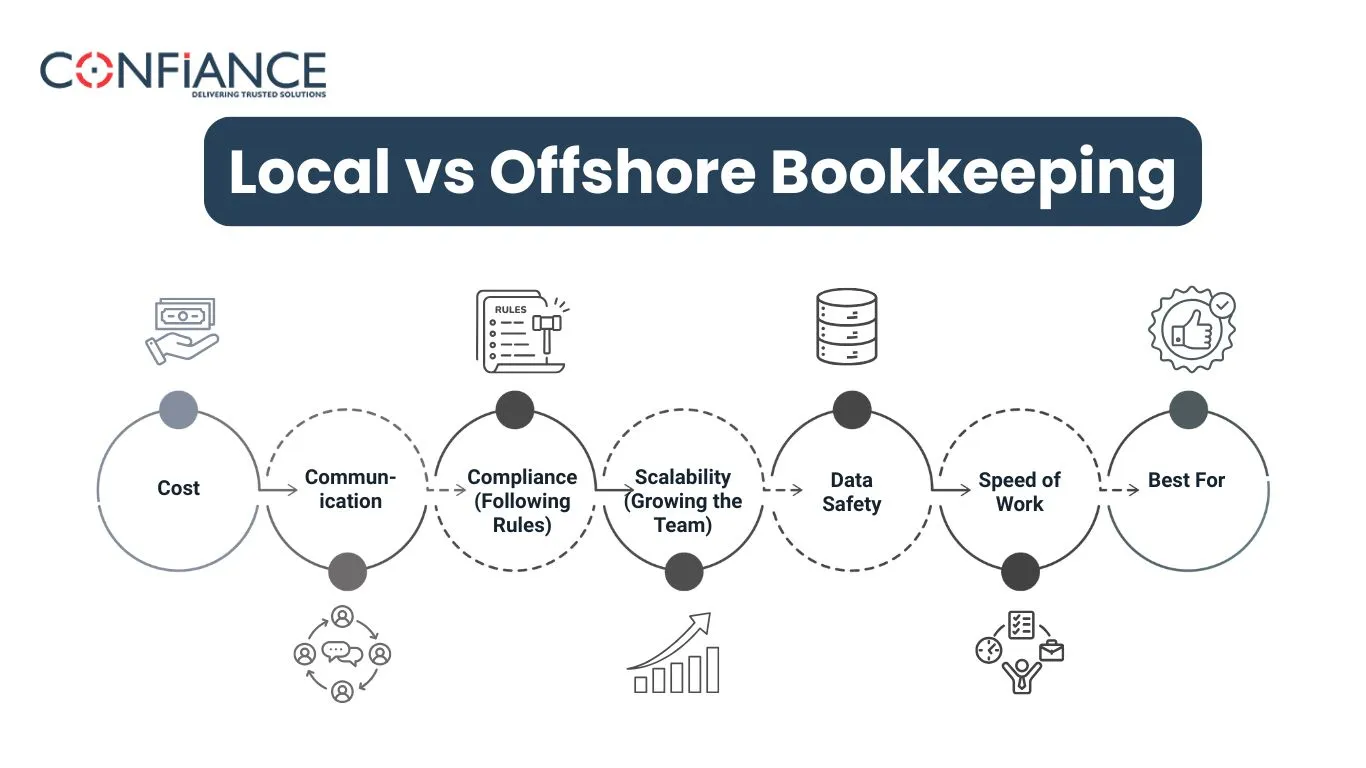

Key Aspects in Local vs Offshore Bookkeeping Services

1. Cost

- Local: Bookkeeping in your own country costs more. This is because local workers get paid higher wages. Also, they may need an office, which adds to the cost.

- Offshore: Bookkeeping from another country costs less. In places like India, workers are paid less, so you save 40% to 70%.

2. Communication

- Local: Talking is easy. You both speak the same language and live in the same time zone. You can call or meet them during the day.

- Offshore: Sometimes, it takes longer to get answers because of time zone differences. But with a good team, they can work even when you are sleeping.

3. Compliance (Following Rules)

- Local: They know the tax laws, business rules, and safety laws of your country. This makes it easier to follow the rules.

- Offshore: They may not know your country’s rules right away. But many offshore firms are trained and can learn quickly.

4. Scalability (Growing the Team)

- Local: It’s harder to add more people fast. Hiring more local staff can take time and money.

- Offshore: It’s easier to grow your team. You can hire more offshore helpers quickly when your work increases.

5. Data Safety

- Local: They follow your country’s data laws. This is good for keeping your money and customer details safe.

- Offshore: Safety depends on the company. Top offshore firms use strong safety rules like ISO to protect your data.

6. Speed of Work

- Local: They work during normal office hours in your country. They stop working after hours and on holidays.

- Offshore: They can keep working after your day ends. This helps get more work done overnight.

7. Best For

- Local: Best for jobs where you need to meet in person or follow strict rules—like doctors, lawyers, or banks.

- Offshore: Great for startups, growing businesses, or busy teams that want to save money and work faster.

Choosing the Right Bookkeeping Service

1. Saving Money

- Choose: Offshore

- Reason: Offshore bookkeeping Services cost much less. Workers in other countries like India get paid lower wages. You also don’t need to pay for office space or extra supplies. This helps your business save 40% to 70% in costs.

2. Fast and Real-Time Work

- Choose: Local or Nearshore

- Reason: Local bookkeepers live in your country or close by. They work during the same hours as you. It’s easy to call them or meet in person when you need help. This makes things move faster.

3. Following Local Rules

- Choose: Local

- Reason: Local bookkeepers already know your country’s tax laws and business rules. They don’t need much training. This helps your business follow the law and avoid problems with the government.

4. Growing Your Team Quickly

- Choose: Offshore bookkeeping services or a Mix of Both

- Reason: Offshore teams have many trained workers. You can add more people fast when your business grows. This helps you get more work done without spending too much money. Some businesses also mix local and offshore help for better results.

5. Skills in Local Laws and Taxes

- Choose: Local

- Reason: Local workers know your country’s rules very well. They understand tax forms, business laws, and what the government needs. This saves you time and reduces mistakes.

6. Help All Day and Night

- Choose: Offshore bookkeeping services

- Reason: Offshore teams live in other time zones. They can keep working while you are sleeping. This helps your business work 24/7 and get more things done faster.

Both local and offshore bookkeeping services can help your business grow. If you need someone close by who knows your local tax rules, a local bookkeeper may be best. But if you want to save money, work with skilled people from around the world, and get work done even anytime, offshore bookkeeping services are a smart choice.

A trusted team like Confiance can help. We understand both local and offshore bookkeeping services and can guide you to what works best for your goals. Contact Confiance to save time, cut costs, and grow smarter.

FAQs

- What are offshore bookkeeping services?

They are money-keeping services done from another country. They help with billing, payments, and reports. - Are offshore bookkeeping services safe?

Yes, if you pick the right firm. Look for ones that use strong safety rules like ISO 27001. - Can I use both local and offshore services together?

Yes! Some companies use both. Local for taxes and offshore for daily work. - Will I lose control of my books?

No. A good offshore team sends reports and checks with you often. You stay in charge. - How do I start using offshore bookkeeping?

You can ask experts like Confiance to help. They make it easy and safe to begin.