Law Firm Bookkeeping Basics: What Every Firm Should Know

Good bookkeeping is not optional for a law firm. It is required by law, needed for compliance, and essential for financial clarity. Whether you run a solo practice or manage a growing legal team, the basics stay the same. This blog explains law firm bookkeeping basics in simple terms.

What Is Bookkeeping in a Law Firm?

Bookkeeping tracks all the money coming in and going out of your firm. It covers client payments, business expenses, salaries, taxes, and everything else tied to your finances. The process should be timely and accurate.

Unlike regular businesses, law firms handle client funds in trust. These are not firm assets. This creates extra rules and responsibilities that firms must follow to stay compliant. Understanding these law firm bookkeeping basics matter a lot for the future.

Why Bookkeeping Matters for Law Firms

Bookkeeping supports every financial decision your firm makes. It helps avoid errors, stay compliant with your state bar, and prepare for audits. It also keeps client funds safe and separate.

Bad bookkeeping can cause penalties, damage your license, and ruin trust. Good bookkeeping helps you grow with confidence.

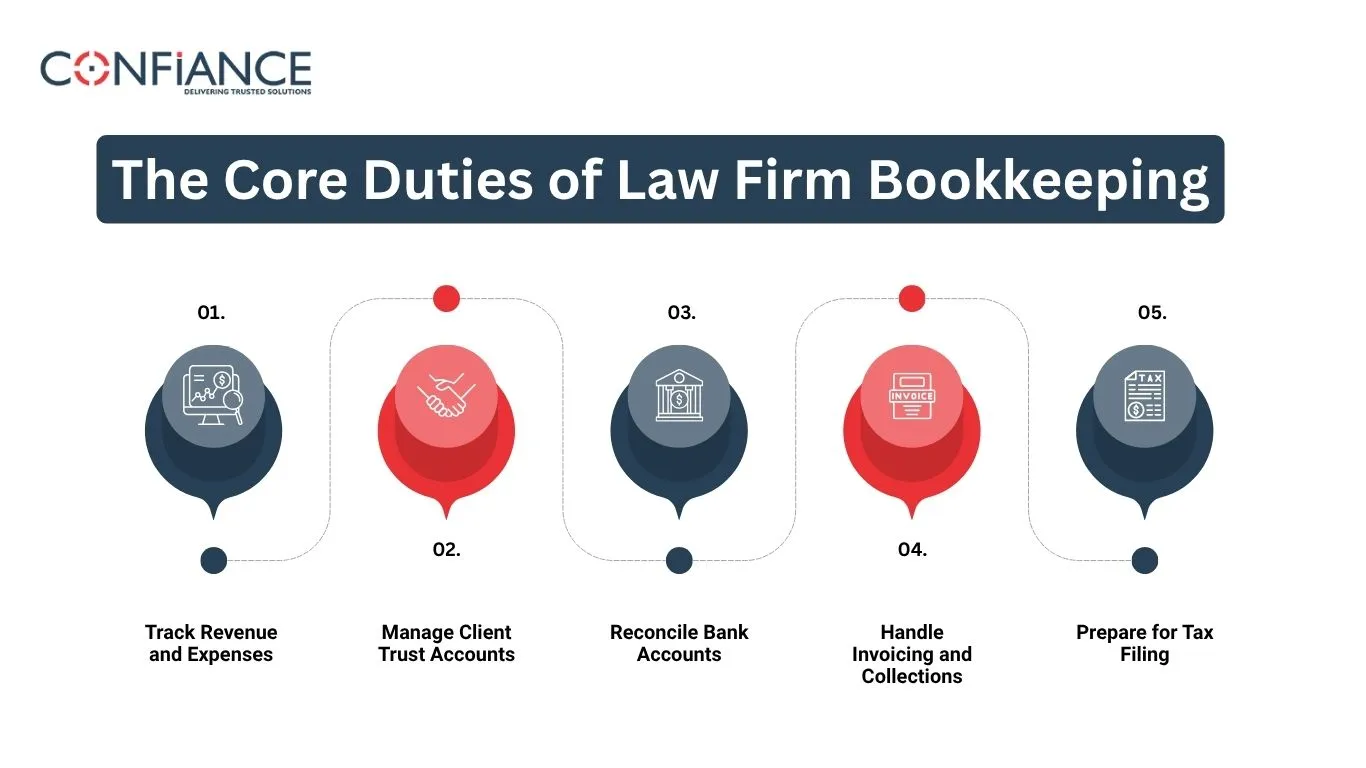

The Core Duties of Law Firm Bookkeeping

Here are the main tasks your bookkeeper or accountant must handle:

1. Track Revenue and Expenses

All income, such as legal fees and reimbursements, must be logged. All expenses, such as rent, software, travel, and supplies, need to be tracked and categorized. This keeps your profit and loss statements accurate.

2. Manage Client Trust Accounts

Client funds must be stored in a trust or IOLTA account. You cannot mix these with firm money. Every transaction must be recorded. Each client’s balance must be tracked separately.

3. Reconcile Bank Accounts

You must match your bank records with your accounting records. This includes operating accounts, trust accounts, and payroll accounts. Do this at least monthly.

4. Handle Invoicing and Collections

Billing and invoicing for lawyers is a key part of firm operations. You must issue bills clearly, follow up on unpaid invoices, and apply payments correctly. Misapplied payments can violate trust account rules.

5. Prepare for Tax Filing

Bookkeeping supports tax readiness. A clean chart of accounts, accurate records, and organized receipts make year-end much easier. You also need proper tracking for payroll, contractor payments, and deductible expenses.

Law Firm Accounting Requirements

Law firms must follow strict accounting guidelines. Many of these rules come from the state bar, not just tax law. These include:

- Trust accounting rules: Trust funds must be tracked by client and kept separate from firm funds.

- Double entry bookkeeping: Each transaction affects at least two accounts, ensuring your books stay balanced.

- Cash or accrual basis: Choose one method and stay consistent. Most small firms use cash basis, but accrual can show a clearer financial picture.

- Client ledgers: You must maintain a ledger for each client whose funds you hold.

- Monthly reconciliation: Trust accounts must be reconciled every month to avoid errors or misappropriation.

Violating these rules can lead to discipline, fines, or disbarment.

How to Set Up a Law Firm Bookkeeping System

You need the right structure from the start. Here are key steps.

Choose the Right Accounting Software

Use software that supports law firm accounting requirements. It must separate trust and operating funds and track client balances. Tools like QuickBooks, Clio, Xero with LeanLaw, or CosmoLex are built for law firms.

Set Up a Chart of Accounts

A chart of accounts is a list of all your financial categories. It includes:

- Operating revenue

- Cost of services

- Office expenses

- Trust liabilities

- Client advances

- Retainers

Group them clearly so you can spot issues fast and create reliable reports.

Open Separate Bank Accounts

At a minimum, open:

- One operating account

- One trust account (IOLTA)

- One account for payroll, if you have staff

Never use trust funds for firm expenses. Never move funds without clear records.

Assign Roles and Controls

Limit who can access trust funds. Separate duties so no one person controls every step. A second set of eyes helps catch errors or fraud.

Billing and Invoicing for Lawyers

Law firm billing can be complex. You must be transparent, detailed, and timely. Poor billing causes client disputes and cash flow problems.

Best Practices for Legal Billing

- Track time daily. Don’t rely on memory.

- Use billing codes to categorize services.

- Send bills promptly, usually monthly.

- Include details so clients know what they are paying for.

- Avoid vague terms like “legal services rendered.”

- Clearly show prior balance, new charges, and trust transfers.

- Offer multiple ways to pay.

Accepting Payments

Modern clients expect easy payments. Use online payment tools that support legal billing rules. Payment processors like LawPay and Gravity Legal can help you stay compliant.

Managing Trust Accounts

Trust accounts are not optional. If you hold unearned fees or third-party funds, you need one.

What Goes Into a Trust Account

- Retainers

- Settlement funds

- Advanced court costs

What Stays Out

- Earned fees

- Your firm’s income

- Business expenses

Tips for Compliance

- Never mix trust and operating funds.

- Log each deposit with client name and matter.

- Transfer earned fees only after work is done and invoiced.

- Reconcile accounts monthly.

- Keep backup records for every transaction.

Use a three-way reconciliation that compares your bank statement, client ledger, and internal trust balance. All three must match.

Common Law Firm Bookkeeping Mistakes

Many firms get in trouble by ignoring small details. Watch for these common errors.

Commingling Funds

This means mixing client money with firm money. It is a serious violation. Keep all client funds in trust until earned and billed.

Mislabeling Expenses

Use the right categories. Mislabeling travel as meals or fees as income can affect taxes and reports. It also creates confusion if you get audited.

Skipping Reconciliations

Monthly reconciliations catch problems early. Skipping even one month can lead to large errors later.

Delaying Invoice Follow-Ups

Waiting too long to follow up on unpaid bills reduces your chances of getting paid. It also hurts cash flow. Have a clear follow-up system.

Outsourcing Bookkeeping for Law Firms

If you don’t have time to handle bookkeeping, you can hire a bookkeeper who understands legal accounting. They can work part-time or full-time depending on your needs.

Look for someone who:

- Understands your state bar rules

- Has experience with legal software

- Can communicate clearly with your team

- Is reliable and detail-focused

Outsourcing helps you focus on legal work while keeping your books clean and your trust accounts safe.

Reports Every Law Firm Should Track

Accurate records allow you to generate useful reports. These show how well your firm is doing and help with planning.

Key Financial Reports

- Profit and loss statement: Shows income, expenses, and profit

- Balance sheet: Shows assets, liabilities, and equity

- Cash flow statement: Tracks money in and out

- Trust ledger: Lists all client trust balances

- Aged receivables: Shows unpaid client invoices

Review these monthly to spot problems early.

When to Bring in a Law Firm Accountant

Bookkeepers handle day-to-day entries. Accountants help with strategy, reporting, and compliance. You need an accountant when:

- You have complex finances

- You need tax planning

- You are preparing for a state audit

- You want to grow and need help with budgets and forecasts

A good accountant understands law firm accounting requirements and helps you stay compliant and profitable.

Bookkeeping is not just record keeping. It is part of running a responsible and ethical firm. From managing trust funds to sending invoices, every step matters. Set up clear systems, stay consistent, and follow the rules.

Even small firms must follow strict accounting practices. Do not cut corners. Keep trust accounts clean, records updated, and reports ready. Whether you manage it in-house or choose to outsource, bookkeeping protects your firm, your clients, and your license. At Confiance, we have been providing law firm bookkeeping services since ages. Our expertise and experience in the field can help your firm to a great extent.

FAQs

- What is the difference between law firm bookkeeping and accounting?

Bookkeeping records daily transactions. Accounting analyzes those records, prepares reports, and helps with taxes and planning. - Can lawyers do their own bookkeeping?

Yes, but they must follow strict trust accounting rules. Most lawyers hire a professional to avoid errors. - Why are trust accounts important for law firms?

Trust accounts hold client money. Misusing them can lead to penalties or loss of license. - What should law firm invoices include?

Invoices should show the date, service description, time spent, rate, total charge, and trust transfers if any. - How often should law firms reconcile trust accounts?

At least once per month. Many state bars require monthly reconciliation by rule. - What happens if a firm mixes client funds with firm funds?

This is called commingling. It can result in fines, audits, or disciplinary action from the state bar.