IRS Form 7004 Instructions Made Simple for Business Owners

Filing business tax returns requires time, records, and accuracy. Many business owners need more time before they can file their official tax forms. If your company cannot meet the original due date, you can file IRS Form 7004. This form gives you an automatic extension to file certain federal business returns. It does not give you more time to pay, but it gives you more time to prepare. In this blog, we provide Form 7004 instructions in a simple and easy way.

These IRS Form 7004 instructions will help you know when to file, how to fill it out, and how to avoid common mistakes. Many businesses use this option every year. It is a standard part of tax planning. Filing this form is easy if you follow the steps. These form 7004 instructions outline everything you need to know.

What Is IRS Form 7004?

IRS Form 7004 is the Application for Automatic Extension of Time To file certain business Income Tax, information, and other returns. When you submit it by the deadline, the IRS grants an automatic extension. You do not need to explain why you need more time. This extension gives your business extra time to file the official tax return form, such as Form 1065 or Form 1120.

These IRS Form 7004 instructions do not extend the time to pay. You must estimate and pay any tax owed by the normal due date. If you do not pay on time, the IRS may charge penalties and interest. Many business owners file Form 7004 to avoid the stress of rushing. These form 7004 instructions help make that process smooth and reliable.

When to Use Form 7004

Many business owners use Form 7004 when they know they cannot meet the original tax filing deadline. Tax reporting often requires bank statements, expense lists, and partner reports. That information may not be complete by the due date. These form 7004 instructions help you gain more time to gather these items.

You can file this form up to the due date of the return you are extending. When filed on time, the extension is automatic and accepted unless there is a major issue. These IRS Form 7004 instructions apply to several different business types. This includes partnerships, corporations, S corporations, and some trust or estate returns.

Types of Returns Covered

Here are some common types of business returns covered by Form 7004:

- Partnership returns (Form 1065)

- S corporation returns (Form 1120-S)

- C corporation returns (Form 1120)

- Some trust and estate returns

These instructions require a specific code for the return you are extending. Using the correct code helps the IRS process your request quickly. Filing the wrong code may cause delays. Follow these IRS Form 7004 instructions to select the right one from the official list.

Deadlines to Keep in Mind

Different types of businesses have different filing due dates. Knowing these dates is important when using these form 7004 instructions. You must submit your extension request by the original due date of the return.

Common Filing Due Dates

- Partnerships must file Form 1065 by March 15.

- S corporations must file Form 1120 S by March 15.

- C corporations must file Form 1120 by April 15 if they follow a calendar year.

- Some trusts and estates must file by April 15.

If the due date is on a weekend or a holiday, it moves to the next business day. These IRS Form 7004 instructions only work if you file on or before the correct deadline.

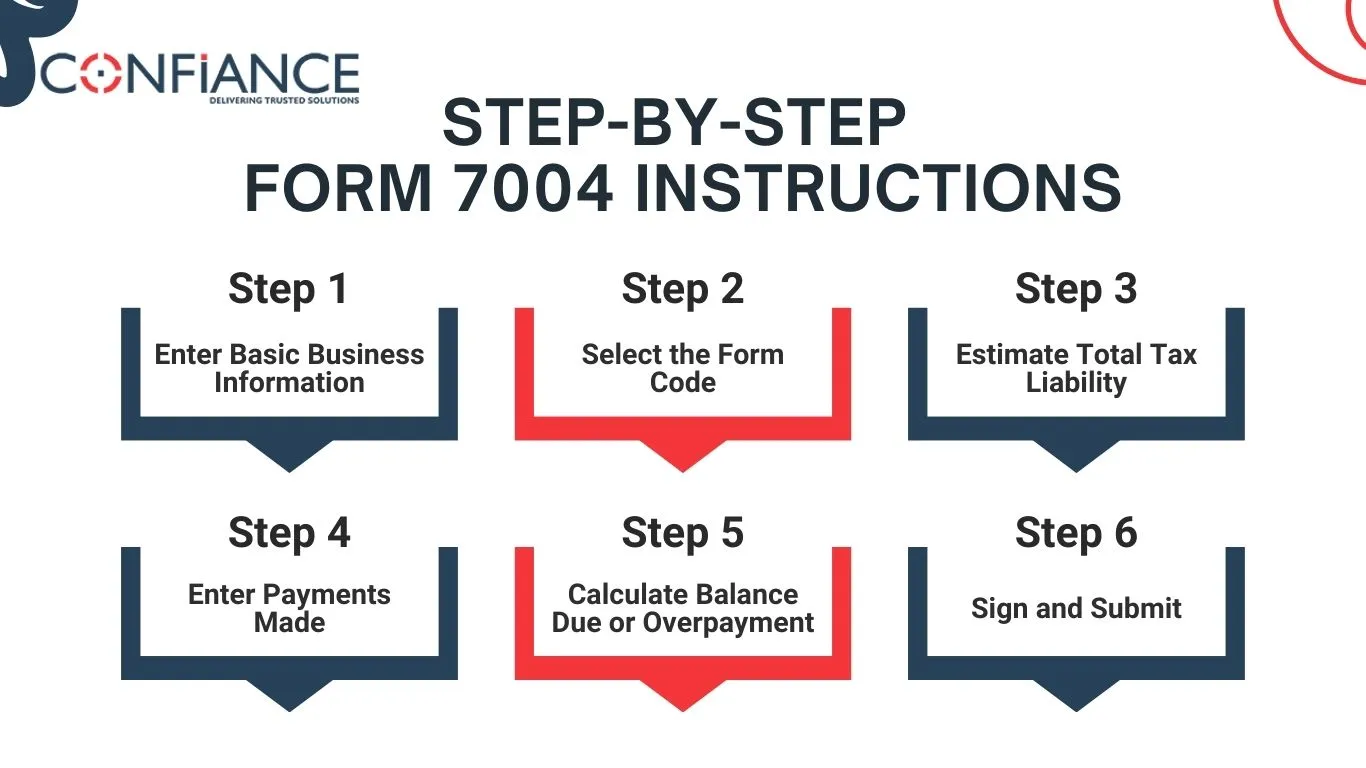

Step-by-Step Form 7004 Instructions

Step 1: Enter Basic Business Information

- Enter your legal business name, address, and Employer Identification Number.

- The IRS Form 7004 instructions say this information must match IRS records.

- A mismatch may cause a delay.

Step 2: Select the Form Code

- Choose the code that matches the tax return you want to extend.

- These form 7004 instructions list each code in the official IRS guide.

- Check the list with care.

Step 3: Estimate Total Tax Liability

Even though you are asking for more time to file, you still need to estimate the total taxes owed. Enter the estimated total tax liability in the box provided.

Step 4: Enter Payments Made

If you made any payments during the year or paid estimated quarterly taxes, list those payments. Subtract them from your estimated tax liability.

Step 5: Calculate Balance Due or Overpayment

Compute the difference between liability and payments made. If you owe a balance, pay that amount when filing Form 7004. You can pay electronically or by check. These form 7004 instructions note that not paying may result in penalties.

Step 6: Sign and Submit

If filing by mail, sign the form before sending it. If filing electronically, follow the prompts.

How to File IRS Form 7004

You can file Form 7004 either electronically or by mailing a paper form. These form 7004 instructions explain both methods.

Electronic Filing (e-file)

Most businesses choose to e-file because it is faster and provides confirmation. Authorized IRS software or tax professionals can handle this process.

Paper Filing

If you prefer paper, print the form, fill it out, and mail it to the correct IRS address listed in the instructions. The address depends on your business type and location. These IRS Form 7004 instructions emphasize mailing early, as mail delays could cause it to arrive late.

Common Errors to Avoid

Many delays happen because of errors. These form 7004 instructions list common mistakes to avoid:

- Using the wrong form code

- Entering the wrong EIN or address

- Forgetting to sign the paper form

- Failing to pay the estimated tax owed

- Filing the form after the deadline

Review these items before submitting. These IRS Form 7004 instructions highlight that a few extra minutes of review can prevent processing problems.

Benefits of Filing Form 7004

There are many strong reasons to follow these form 7004 instructions and file for an extension:

- More time to gather documents

- Reduced pressure during tax filing season

- Ability to avoid late filing penalties

- Time to seek help from a tax professional if needed

These IRS Form 7004 instructions support a calm, organized tax filing process. Many owners file this form even if they expect to finish on time, just to be sure.

Important Reminder: Extension to File Does Not Extend Time to Pay

These IRS Form 7004 instructions are clear on this point: the extension only gives more time to file the return, not more time to pay taxes owed. You must estimate your tax and pay it by the regular due date. Interest and penalties may apply if you do not pay on time.

Who Should File?

These form 7004 instructions apply to many business types. Below are explanations for each:

Partnerships

Partnerships file Form 1065. If more time is needed, Form 7004 can extend the filing deadline. It gives up to six extra months.

Corporations

S corporations and C corporations both use Form 7004 for filing extensions. They must choose the correct code and follow these IRS Form 7004 instructions.

Trusts and Estates

Some trusts and estates also qualify for an extension using Form 7004. Check the official list in the instructions to confirm your type.

Using these Form 7004 instructions helps business owners file a valid extension request on time. IRS Form 7004 is a useful tool when tax documents are not yet prepared. If you do not want to get into these tasks and want someone to do it on your behalf, you can outsource it to Confiance. We help you file, pay estimated tax, and allow you more time to complete your return. Contact us now file IRS Form 7004 with ease.

FAQs

- What is IRS Form 7004?

IRS Form 7004 gives more time to file business tax returns. These form 7004 instructions allow businesses to file later while keeping the process simple. - Does it extend time to pay tax?

No. These IRS Form 7004 instructions only extend time to file. You must still pay estimated tax on time. - Who can use Form 7004?

These form 7004 instructions apply to corporations, partnerships, and some trusts or estates. - When must I file it?

These IRS Form 7004 instructions require you to file by the due date of the business return. If you file late, the extension is not valid. - What steps do these form 7004 instructions include?

You add business details, select form code, estimate tax, list prior payments, sign, and submit. - Can I e-file it?

Yes. These IRS Form 7004 instructions allow electronic filing through approved software. - What errors should I avoid?

These form 7004 instructions warn against wrong codes, wrong EIN, late filing, and unpaid estimated tax.