Restaurant Accounting Services

The restaurant and food industry is one of the most active and growing parts of the economy. It plays a strong role in job creation and economic activity. But restaurants face constant financial pressure. Customer preferences change often. Food prices move up and down. Government rules can change anytime without notice. These factors make restaurant bookkeeping more complex. Confiance helps restaurant owners stay on top of these challenges with expert restaurant accounting services made for the food industry.

For any restaurant, having up to date books of accounts is essential. When your accounting is handled by someone with experience, you can serve your customers better. It does not matter if you run a new local spot or a large restaurant group with several branches. Every restaurant needs clean books and accurate reports. Without that, it becomes hard to manage cash, plan ahead, or make profits. We have been providing restaurant accounting services over the years and know how their operations work. That experience helps us deliver better results.

Restaurant bookkeeping is one of our strongest skills. At Confiance, we provide accounting services for restaurants across many formats. From cafés and quick service spots to high volume fine dining locations, our team has seen it all. We help owners save time, stay organized, and get a better view of their numbers. When you partner with us, you can stop worrying about accounting and focus fully on giving customers a great meal and service.

Key Restaurant Bookkeeping Tasks

Restaurant bookkeeping is essential to keep your business financially stable and well-managed. Accurate records help track income, manage costs, and support smarter decisions. These are the main tasks every restaurant should focus on:

- Recording Daily Sales and Expenses: TTrack daily revenue and spending to maintain accurate financial records.

- Managing Payroll and Employee Benefits: Handle payroll for hourly, salaried, and tipped staff. Ensure proper tax withholdings and manage employee benefits.

- Track Inventory and Cost of Goods Sold (COGS): Monitor food and beverage inventory to reduce waste and control food costs.

- Reconcile Bank Accounts and Credit Card Transactions: Match all transactions with bank and credit card statements to avoid errors.

- Handling Vendor Payments and Accounts Payable: Manage supplier invoices, monitor due dates, and make timely payments to avoid service disruptions.

- Managing Accounts Receivable: Track customer payments and stay on top of unpaid invoices.

- Calculate and File Sales Tax: Ensure sales taxes are calculated correctly and filed on time to stay compliant.

- Prepare Financial Statements: Generate profit and loss reports, balance sheets, and cash flow statements to review financial health.

- Create Budgets and Forecasts: 9. Create Budgets and Forecasts Set revenue targets and control expenses by building clear and realistic budgets.

- Stay Compliant with Tax Rules: Meet all local, state, and federal tax requirements. This includes payroll taxes, withholdings, and other filings.

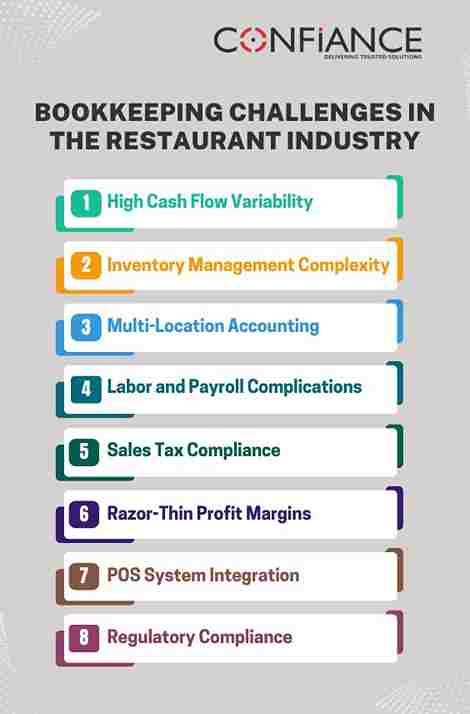

Restaurant Bookkeeping Challenges

Running a restaurant means dealing with constant financial pressure. Staying organized becomes difficult without appropriate restaurant accounting services or tools. Here are some of the most common restaurant bookkeeping challenges:

- Cash Flow Fluctuations: Daily changes in sales and spending make it hard to manage cash flow and plan ahead.

- Inventory Management: Tracking perishable items and preventing waste is critical to control costs.

- Multi-Location Accounting: Restaurants with more than one location need clear and combined financial reports for better control. Moreover, it also requires multi-location accounting systems.

- Payroll and Labor Tracking: Calculating wages, tips, and overtime correctly is key for payroll taxes and labor compliance.

- Sales Tax Compliance: Different tax rates and rules by state or city make filing sales tax a complex task.

- Low Profit Margins: Restaurants often operate with tight margins. Every cost needs to be tracked and managed wisely.

- POS System Integration: POS data should sync with restaurant bookkeeping services for clean and accurate records.

- Regulatory Compliance: Restaurants face a range of rules from health codes to labor laws and tax reporting. Missing one can lead to fines.

With the help of professional bookkeeping services for restaurants, these challenges become much easier to manage.

Our Accounting Services for Restaurants

Providing restaurant accounting services is our main area of expertise. We manage everything from daily transactions to tax compliance. Our goal is to make your accounting smooth and accurate. We offer a complete set of services built for restaurant operations.

Bookkeeping Services

- Record and sort daily sales and expenses

- Track all spending and match with bank records

- Set up chart of accounts specific to restaurant needs

- Report daily sales and manage customer payments

- Reconcile credit card and cash deposits

- Handle vendor bills and payments

- Match credit card charges to records

- Reconcile bank and credit card statements

- Track royalty payments and gift card balances

- Keep inventory records up to date

- Match transactions between locations or stores

- Adjust entries at month end and year end like depreciation, accruals, prepayments, and deferred revenue

Financial Reporting and Analysis

- Create monthly profit and loss statements

- Track and forecast cash flow

- Review costs and income

- Analyze general ledger entries

- Prepare monthly, quarterly, and year end closing reports

- Combine financials from multiple locations

- Analyze cost of goods sold and payroll expenses

- Break down revenue, costs, and profits by category

- Share key business reports for better decisions

Tax Compliance and Sales Tax Filing

- Calculate and file sales tax correctly

- Manage payroll tax responsibilities

- Prepare for year end tax filings

- Submit tax reports electronically

Fixed Assets and Cash Flow Management

- Track and manage fixed assets

- Monitor cash flow regularly

- Set up your accounting books properly

POS and Accounting Software Integration

- Connect with POS systems like Square, Toast, and Clover

- Support QuickBooks, Xero, Sage Intacct, and others

- Sync all data automatically for reliable reports

Payroll Processing

- Process payroll for salaried, hourly, and tipped staff

- Handle taxes and employee benefits

- Manage direct deposits

We stand by the quality of our services. We keep everything clear and professional. You can access your financial reports any time, day or night. This helps you stay in control of your numbers whenever you need.

Restaurant Accounting Solutions That Fit Your Business Size

Every restaurant is unique. Each one has its own size, business model, and customer base. At Confiance, we offer flexible accounting services designed to meet your specific needs. Whether you own a small café, manage a multi-location chain, or run a high-end fine dining restaurant, we have the right solution for you. Here’s how our services adjust to fit your restaurant size:

Small Restaurants and Cafés

- Simple bookkeeping to track sales and expenses

- Affordable payroll and tax services

- Help with cash flow and budgeting

- Basic inventory tracking for cost control

Fast Food and Quick Service Restaurants (QSRs)

- Integrate with POS systems for easy sales tracking

- Real-time reports to monitor profits

- Automated payroll and tip calculations

- Manage sales tax for multiple locations

Full-Service Restaurants and Fine Dining

- Detailed reports on profits and finances

- Manage vendor payments and accounts payable

- Optimize food and labor costs for better margins

- Combine financial data for multiple locations

Restaurant Chains and Franchises

- Consolidate financial reports across locations

- Handle royalty payments and franchise management

- Advanced tax planning and compliance

- Analyze profitability and optimize costs

No matter your restaurant's size, Confiance offers scalable solutions to manage finances, improve profits, and support long-term success.

How Our Restaurant Accounting Services Help Overcome Business Challenges

We know how restaurants run and what challenges they face. With our experience, we help owners focus on growing their business while we handle the finances. Here’s how our services can help:

- Automated Bookkeeping: We use technology to reduce errors and improve efficiency.

- Cost Control: We review your finances to find ways to save money and increase profits.

- Real-Time Reports: Our cloud-based system gives you up-to-date financial reports, so you can make better decisions.

- Compliance: We ensure your business stays compliant with tax and labor laws, avoiding costly fines.

Why Choose Confiance for Restaurant Accounting Services?

The right accounting partner is key to your restaurant’s success. Here’s why Confiance is the best choice:

- Expertise in Restaurants: We know restaurant finances inside and out.

- Tailored Solutions: We customize our services to fit your restaurant’s needs.

- Advanced Technology: We use top accounting software to increase efficiency.

- Personal Support: Our team offers one-on-one help whenever you need it.

- Affordable Pricing: Our services are cost-effective, helping you stay within budget.

Case Studies of Our Clients

See how our restaurant accounting services help real businesses solve real problems. Each case shows how we improve accuracy, cut costs, and boost profits through expert restaurant bookkeeping and accounting solutions.

Case Study 1: Cutting Payroll Errors and Labor Costs

Client: A 5-location restaurant chain in Texas

Problem: Payroll was handled manually. Errors were common. Overtime tracking was weak. Staff often got paid late.

Our Work: We installed a payroll system with time tracking to ensure accurate wages and tax deductions.

Results:

- Cut payroll time in half

- Followed labor laws fully

- Improved staff morale with timely pay

Case Study 2: Fixing Cash Flow for a Fine Dining Restaurant

Client: A fine dining restaurant in New York City

Problem: The restaurant struggled to track spending. Cash flow was tight. Vendors were paid late, causing supply issues.

Our Work: We set up real-time expense tracking, automated payments, and added a tool to forecast cash flow.

Results:

- Clear view of cash flow

- On-time vendor payments

- Costs reduced, profits improved

Case Study 3: Raising Profits with Smarter Menu Pricing

Client: A fast food restaurant

Problem: Ingredient prices kept changing. The menu wasn’t priced to protect margins.

Our Work: We introduced menu costing, tracking ingredient use and profit per dish. We also added regular financial reporting.

Results:

- Profit margins grew by 18%

- Low-profit items were removed

- Better data led to smarter choices

Case Study 4: Fixing Tax Problems for a Family-Owned Restaurant

Client: A family-run restaurant in Massachusetts

Problem: IRS penalties hit due to missed tax deadlines. Sales taxes were not recorded right.

Our Work: We corrected past filings, fixed the sales tax process, and automated future filings.

Results:

- Avoided $15,000 in IRS fines

- Built a compliant tax system

- Lowered risk and owner stress

Get Started with Confiance Today

Managing restaurant finances doesn’t have to be complicated. At Confiance, we handle all your accounting needs, so you can focus on providing great dining experiences. Contact us today for a free restaurant accounting consultation. Discover how our restaurant bookkeeping services can help make your restaurant more successful.

Landing Page

This will close in 100 seconds