Franchise Accounting Services

The franchise industry is growing fast. It is one of the quickest business models to expand. Franchising allows people to start a business with a brand that is already known and trusted. But long-term success relies on good accounting. Strong accounting services are key to growing a business.

Working with expert franchise accountants makes managing finances easier. At Confiance, we specialize in franchise accounting. Our goal is to help businesses grow smoothly. With clear reports and strong cash flow management, franchise owners can make smart choices and confidently expand their business.

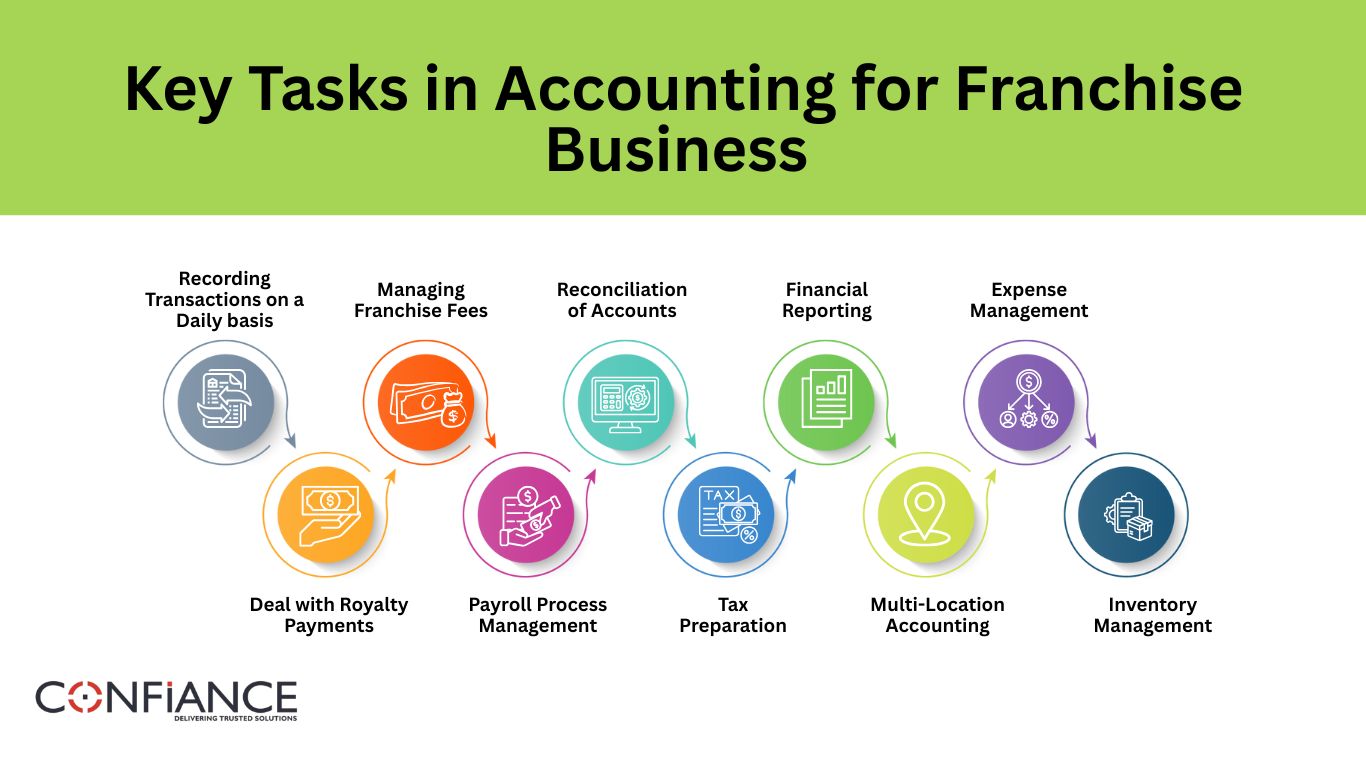

Key Tasks in Accounting for Franchise Business

Franchise businesses deal with many income sources, fees, and daily expenses. To manage them well, strong accounting practices are needed. Here are the key tasks for franchisors:

Daily Transaction Recording

Track all sales, expenses, and payments every day. Use software to avoid errors and get up-to-date financial data.

Royalty Payment Management

Send royalty payments on time. Keep accurate records to avoid disputes and penalties.

Franchise Fee Tracking

Record both initial and ongoing franchise fees. This ensures that contract terms are met and all financial commitments are clear.

Payroll Processing

Handle payroll for all employees. This includes calculating wages, taxes, and benefits for all staff.

Bank Reconciliation

Compare bank statements with your records to find errors or unauthorized transactions. Do this regularly to keep things accurate.

Tax Filing and Compliance

File taxes on time at the federal, state, and local levels. Take eligible deductions and stay compliant to avoid penalties.

Financial Reporting

Prepare reports like profit and loss statements, balance sheets, and cash flow summaries. These help track the business's health and guide decisions.

Multi-Unit Accounting

For franchises with multiple locations, combine financials to see overall performance. Separate reports for each location make comparisons easier.

Expense Management

Look at spending by category to find savings. Track costs consistently to improve profits.

Inventory Oversight

Keep an eye on inventory levels and the cost of goods sold. This helps reduce waste and control costs.

Each of these tasks is vital for strong financial management and helps franchise owners meet both short-term and long-term goals.

Both activities play important roles towards securing easeful operation in financial operations as well as for attaining the future goals in franchise operations.

Common Challenges in Accounting for Franchise Businesses

Managing finances in a franchise can be tough. Each location and fee adds complexity. Here are the common challenges:

1. Multi-Location Transactions

- Franchisors and franchisees need a simple way to track income and expenses at all locations. A single system helps make this easy.

2. Tracking Royalties and Fees

- Franchise businesses must track fees and royalties. Accuracy is key.

3. Cash Flow Issues

- Seasonal sales and changing costs can make it hard to keep cash flow steady across locations.

4. Payroll and Compliance

- Managing payroll at many locations and following tax and labor rules adds extra work.

5. Sales Tax by State

- Franchises must follow different sales tax rules in each state. This needs careful attention.

6. Inventory and Costs

- Tracking inventory and controlling costs is important for profits. Reducing waste can help keep costs down.

7. Software Integration

- When the POS system, accounting tools, and franchise software don’t work together, mistakes can happen. They need to sync properly.

8. Regulatory Compliance

- Franchises must follow industry rules and financial standards to avoid legal or financial issues.

These challenges show why franchises need a solid bookkeeping system. A clear, simple system helps with control, growth, and risk management.

Key Strategies We Implement for Efficient Franchise Accounting

We help franchise businesses stay organized with simple accounting practices at all locations. Here’s how we do it:

1. Standardized Financial Statements

- We use the same format at every location. This makes reporting easy and ensures compliance.

2. Regular Financial Reporting

- We provide reports every week, month, and year. This helps track how the business is doing.

3. Centralized Financial Database

- We store all financial data in one place. This makes it easy to access and make quick decisions.

4. Approved Vendor Use and Expense Control

- We track purchases from approved vendors and monitor expenses. This helps avoid price differences.

5. KPI Based Monitoring

- We use key performance indicators (KPIs) to spot problems early and find chances for growth.

Franchise accounting can be tough, but Confiance handles it all. From managing royalty payments to keeping the books for multiple locations, we’ve got it covered.

Our Bookkeeping & Accounting Services for Franchise Businesses

We offer full accounting services to help franchises grow and stay financially stable.

Bookkeeping Services

- Record daily transactions

- Track expenses and reconcile accounts

- Set up a chart of accounts for franchises

- Calculate and reconcile royalty fees

- Manage sales reports and accounts receivable for multiple locations

- Reconcile cash and credit card deposits

- Handle accounts payable

- Reconcile credit card charges

- Reconcile bank statements

- Reconcile gift card balances

- Track inventory balances for all locations

- Perform inter-franchise reconciliations

- Adjust accounts at the end of the month and year (depreciation, accruals, prepayments, etc.)

Accounts Receivable and Payable Management

- Reconcile cash and credit card deposits across all locations

- Monitor accounts payable to ensure bills are paid on time

- Track and match credit card charges for each franchise

- Complete bank and credit card reconciliations regularly

- Match gift card balances to maintain accurate records

- Maintain inventory balance records across locations

- Perform inter-franchise reconciliations to align internal accounts

- Record adjustments at month-end and year-end, including depreciation, accruals, prepayments, and deferred income

Payroll Processing

- Run payroll for all franchise locations

- Handle employee tax deductions, benefits, and compliance filings

- Process direct deposits and manage payroll taxes

- Track wages, overtime, and benefits for all employees

Financial Reporting and Analysis

- Deliver consolidated financial reports for every franchise unit

- Prepare monthly profit and loss statements

- Manage and forecast cash flow

- Create cost control and revenue improvement strategies

- Review general ledger entries across all locations

- Produce monthly, quarterly, and annual closing reports

- Report franchise fees and royalties accurately

- Break down revenue and expenses by location

- Analyze revenue, COGS, and gross profits by category

- Monitor KPIs and share performance insights

Tax Compliance and Sales Tax Filing

- Calculate and file sales tax in all required jurisdictions

- Manage payroll taxes for franchise employees

- Prepare year-end tax filings and required reports

- File multi-state and franchise-specific tax forms

Fixed Assets and Cash Flow Management

- Track fixed assets by location

- Plan and monitor cash flow to maintain financial health

- Set up and manage complete accounting records

Franchise Accounting Software and POS Integration

- Integrate with franchise management and POS systems

- Work with leading software such as QuickBooks, Xero, Sage Intacct, and NetSuite

- Sync data for real-time reporting

- Provide cloud access to all financial records

Franchise Accounting Solutions That Fit Your Business

Confiance provides accounting services designed for both franchisees and franchisors. Whether you own one location or run a large franchise network, we scale our support to match your operations.

Support for Single Unit Franchisees

- Clear and accurate bookkeeping

- Expense tracking to control spending

- Royalty fee calculation and payment management

- Payroll services with full compliance

- Tax planning and sales tax filing

Support for Multi Unit Operators

- Central financial reports for all locations

- Revenue tracking with cost control tools

- Real time cash flow updates and budget support

- Payroll and employee expense mangement

Support for Franchisors

- Royalty collection and accurate reconciliation

- Financial tracking across franchisees

- Help with compliance in different states

- Tax planning with forward looking forecasts

Confiance gives you the tools to manage your money, follow financial rules, and support long term growth. You grow the brand while we handle the numbers.

Why Choose Confiance for Franchise Accounting Services

Confiance supports franchise businesses across different industries and regions. Our team brings the right experience, tools, and support to keep your finances accurate and your business running smoothly. Here is why clients choose us:

1. Focused Expertise in Franchise Accounting

- Our team has years of hands-on experience working with franchise models. We understand the details of royalty tracking, location-based reporting, and compliance.

2. Flexible Financial Solutions

- Whether you run a single location or manage many, we adjust our services to fit your setup. Our approach works for both growing franchises and established brands.

3. Modern Tools and Cloud Systems

- We use top accounting software and cloud platforms to streamline your bookkeeping, reporting, and data access.

4. Reliable and Ongoing Support

- Our accountants work closely with you to solve problems early, stay compliant, and improve financial performance.

5. Cost Efficient and Easy to Scale

- We help you grow without extra pressure. Our pricing and systems support expansion while keeping costs in check.

Client Case Studies

Our franchise accounting services have helped many businesses improve accuracy, reduce costs, and stay compliant. These case studies show how the right accounting support can make a difference.

Case Study 1: Payroll and Labor Cost Management for a Fitness Franchise

Client: A multi-location gym franchise based in New York

Challenge:

The client struggled with payroll across different locations. The process was time-consuming and prone to errors, leading to incorrect payments and compliance issues.

Solution:

We implemented an automated payroll system with labor cost tracking. This ensured correct wage calculations, tax compliance, and better scheduling.

Results:

- Cut payroll processing time by 60 percent

- Improved compliance with labor and tax laws

- Gained better control over labor costs, improving profits by 12 percent

Case Study 2: Cash Flow and Inventory Management for a Retail Franchise

Client: A retail franchise with 20 locations across Massachusetts

Challenge:

Cash flow was unpredictable. Poor inventory tracking caused stock issues, missed sales, and late vendor payments.

Solution:

We introduced a cash flow forecasting system, automated vendor payments, and installed inventory tracking linked to their accounting software.

Results:

- Improved cash flow and reduced financial stress

- Prevented supply delays with timely vendor payments

- Cut inventory shortages by 35 percent, raising sales and customer satisfaction

Case Study 3: Tax Compliance and Royalty Accuracy for a Restaurant Franchisee

Client: A franchisee running multiple quick-service restaurant locations

Challenge:

The client received IRS penalties due to errors in sales tax reporting and royalty payments. Tax planning was also missing.

Solution:

We fixed past tax filings, automated sales tax calculations, and set up a system to track royalty payments accurately.

Results:

- Avoided $25,000 in tax penalties

- Ensured on-time and correct royalty payments

Reduced tax burden through proper planning and deductions

Get Started with Confiance Today

Focus on growth while we manage your numbers. Confiance offers franchise accounting services that help you increase revenue, track royalties, and improve cash flow across locations.

With years of experience supporting both franchisors and franchisees around the world, we understand the needs of different franchise models. Our team delivers accurate, scalable, and reliable accounting support so you can grow with confidence.

Landing Page

This will close in 100 seconds