Corporate Accounting Services for Businesses of All Sizes

As your business grows, managing finances becomes more complex. Bookkeeping and accounting are no longer just about keeping records. Even small businesses now need a structured approach. Handling everything in-house takes time and effort, especially when dealing with multiple vendors. Choosing professional corporate accounting services can solve most of your accounting and bookkeeping problems. Working with a certified public accountant ensures accuracy, compliance, and professional oversight.

We provide certified business accounting services for businesses of all sizes. Whether you run a large firm or are one of many small business owners, our team helps you maintain accurate records, improve tax planning, and increase financial efficiency.

We cut out unnecessary steps from your process by applying proven accounting methods that suit your business.

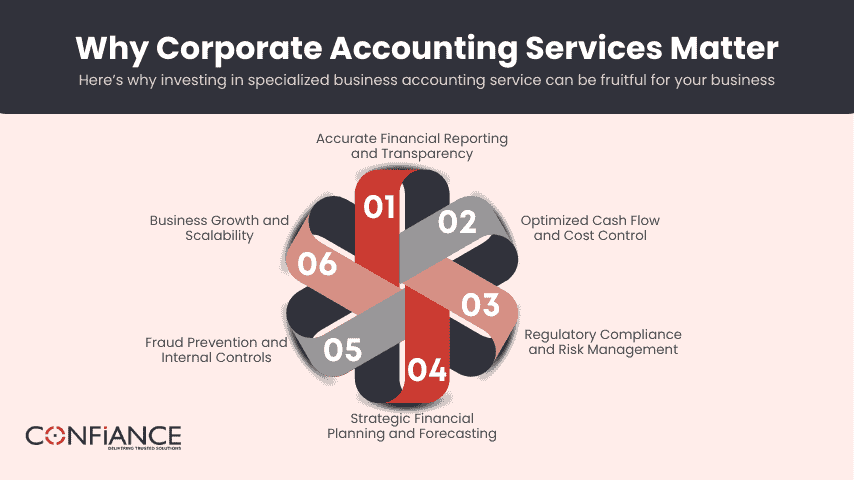

Why Corporate Accounting Services Matter

Every business owner wants better financial performance. To get there, you need to keep your operations efficient, your records accurate, and your taxes in order. Here’s how professional corporate accounting services can help:

1. Accurate Financial Reporting and Transparency

- Maintain updated, precise records.

- Follow standards like GAAP or IFRS.

- Build trust with investors, lenders, and regulators.

Accurate reporting also supports better financial analysis, helping businesses identify strengths and weaknesses.

2. Better Cash Flow and Cost Control

- Track cash flow closely.

- Find ways to reduce costs and manage spending.

- Use your resources wisely and keep your business running smoothly.

3. Compliance and Risk Management

- Meet tax laws, accounting rules, and industry requirements.

- Avoid fines, audits, and legal issues.

4. Financial Planning and Forecasting

- Set budgets, plan ahead, and prepare for different outcomes.

- Make informed choices about growth, investments, and long-term goals.

5. Fraud Prevention and Internal Controls

- Set up strong internal checks and regular audits.

- Lower the chance of fraud and protect your company’s money.

6. Support for Growth and Expansion

- Handle growth, manage multiple locations, and process international transactions.

Automate key tasks to scale faster.

At Confiance, we provide full accounting support for both small and large businesses. Whether you need help with bookkeeping, payroll, taxes, or reporting, our corporate accounting services cover it all.

Accounting Services for Small Businesses

We help small and mid-sized businesses stay financially stable, manage cash flow, and meet tax requirements. Our business accounting services include:

Bookkeeping and Financial Records

We handle your daily records so you can focus on running your business.

- Transaction Recording: All revenues and expenses are recorded and sorted properly to ensure accuracy.

- Accounts Receivables Management: We track and manage outstanding customer invoices, follow up on collections, and keep your cash flow healthy.

- Bank and Credit Card Reconciliation: We match your records with statements to avoid errors.

- Financial Statement Prep: Get clear reports such as balance sheets, income statements, and a detailed cash flow statement that shows where money is coming from and going.

Tax Filing and Compliance

Avoid surprises during tax season with accurate filings.

- Tax Prep and Filing: We file federal, state, and local taxes on time.

- Deductions and Credits: We find every deduction you qualify for to reduce taxes.

- IRS and Regulation Compliance: Stay on the right side of tax laws and avoid penalties.

Payroll Processing

Make sure your team is paid correctly and on time.

- Salary and Wage Processing: We calculate and send out paychecks without delay.

- Tax Withholding: We handle income tax, Social Security, and benefits deductions.

- Labor Law Compliance: We help you follow all employment rules and tax regulations.

Budgeting and Cash Flow Management

Make informed choices with solid financial planning that strengthens your business’s financial health.

- Budget Planning: Allocate funds smartly across your business.

- Cash Flow Forecasting: Predict ups and downs in cash so you’re prepared.

- Expense Tracking: Watch spending closely and find ways to cut costs.

ERP and Software Integration

We connect your business tools for smoother operations.

- ERP System Support: We work with platforms like SAP, Oracle NetSuite, and Microsoft Dynamics.

- Accounting Software Support: We support QuickBooks, Xero, Sage, and more.

- Real-Time Sync: Keep financial data accurate and up to date.

Accounting Services for Corporate Firms

We offer accounting solutions built for large businesses. Our team handles complex reporting, taxes, and compliance across multiple units and countries. Here’s what we do:

Corporate Tax Planning:

- Follow tax laws.

- Cut tax costs with smart planning.

- Handle complex structures with ease.

Our advisory services also provide strategies to optimize tax efficiency across business units.

Financial Reporting and Auditing:

- Create clear reports that follow GAAP or IFRS.

- Support audits and investor updates.

- Build trust with accurate data.

Multi-Entity and Global Accounting:

- Manage accounts across divisions and countries.

- Combine reports into one view.

- Handle currency, tax, and local rules.

Fraud Control and Risk Management:

- Set up checks to stop errors and fraud.

- Watch for unusual activity.

- Protect your financial data.

Why Choose Confiance for Your Corporate Accounting Needs

Here’s why Confiance stands out from other bookkeeping firms:

Top Professionals, Always

We hire only skilled and experienced accountants.

Each team member meets high industry standards.

You get qualified experts from day one.

Focused on Efficiency

We assign the right people to the right tasks.

This saves time and improves output.

You stay focused on results, not paperwork.

Experts Who Know Your Industry

Our team understands your tools and workflows.

We bring years of hands-on experience.

You get advice that fits your business.

Corporate Accounting Solutions for Your Business

Confiance helps companies of all sizes manage their finances. Our services are built to match your structure, industry, and goals. Whether you're growing fast or managing multiple entities, we keep your numbers in check.

For Small and Mid-Sized Businesses

We record every transaction.

We prepare clear financial reports.

Payroll and taxes are filed on time.

Cash flow and budgets stay on track.

We also handle your bills and customer payments.

For Large Companies

Reports are combined from all locations.

Our team follows GAAP or IFRS rules.

Tax plans are built to lower your costs.

We add checks to catch errors and reduce risk.

For Holding and Investment Firms

We track funds and monitor portfolios.

Subsidiary accounts are combined in one view.

Capital is planned and structured with care.

All reports meet current legal standards.

For Global Businesses

We manage accounts in different currencies.

Foreign tax plans are built to stay compliant.

We handle reporting in each country.

You can see performance across all regions.

Client Success Stories

Case Study 1: Automated Reporting for a Multi-Entity Corporation

Client: A manufacturing company with several subsidiaries

Problem: Reports from different units were hard to combine. Budgeting and revenue tracking took too much time and often had errors.

What We Did:

We set up one cloud-based system for all their units. Reports became automated. The client could now access real-time data from every location.

What Changed:

- Errors in financial data dropped by 85%

- Budgeting became faster and more accurate

- Profit margins were easier to measure

- Teams had instant access to financial updates

Case Study 2: Payroll Optimization for a Large Corporation

Client: A firm with 500+ employees across different states

Challenge:

Managing payroll was complex due to different state tax laws and employee benefits. It took a lot of time and effort.

Solution:

We introduced an automated payroll system. This system handled taxes and payroll accurately and made benefits management easier.

Results:

- Payroll processing time reduced by 70%

- Full compliance with state and federal taxes

- Easier benefits tracking, leading to higher employee satisfaction

Case Study 3: Cash Flow & Financial Planning for a Growing Tech Company

Client: A tech company expanding through acquisitions

Challenge:

The company struggled with fluctuating cash flow, poor expense tracking, and limited financial visibility. This caused funding issues.

Solution:

We set up automated expense tracking and financial planning tools. This helped improve cash flow and gave the company a clear view of its finances.

Results:

- Cash flow became more stable

- Expense tracking improved

- Unnecessary costs were reduced by over 20%

- Strong financial planning supported future expansion

Case Study 4: Tax Planning for a Retail Chain

Client: A national retail chain with complex tax requirements

Challenge:

The business faced IRS audits due to errors in sales tax, poor tax structure, and failure to keep up with changing tax laws.

Solution:

We conducted a tax audit, fixed past mistakes, automated sales tax calculations, and created a long-term tax strategy.

Results:

- Saved over $10,000 in tax penalties

- Fully compliant with corporate tax laws

- Reduced tax liability with optimized deductions and credits

FAQs

How do I get started with Confiance’s corporate accounting services?

Getting started is simple! Just reach out to us for a free consultation, and we’ll discuss your

needs. From there, we’ll create a tailored plan to help streamline your financial processes.

What industries do you serve?

We work with businesses of all sizes across a range of industries, including retail,

manufacturing, professional services, tech, real estate, and more. Our services are

customizable to meet the specific needs of each industry.

How can Confiance help with tax planning?

Our tax planning services include identifying deductions, optimizing tax strategies, and ensuring

compliance with state and federal tax laws. We help minimize your tax liability and reduce the

risk of penalties or audits.

What types of businesses do you typically work with?

We serve small businesses, mid-sized firms, and large enterprises. Whether you're a startup or

a well-established company, we offer scalable solutions that grow with your business.

Is my financial data safe with Confiance?

Absolutely. We use secure, cloud-based platforms that protect your data. Our systems are

designed with top-tier encryption to ensure your financial information remains confidential and

safe.

How often will I receive financial reports?

We offer customizable reporting schedules. Whether you need daily, weekly, or monthly reports,

we can set up a reporting plan that suits your business needs.

Can you help with both accounting and bookkeeping?

Yes, we offer full-service accounting and bookkeeping. Our team can manage everything from

day-to-day bookkeeping tasks to advanced financial reporting and tax planning.

Will Confiance handle all of my payroll needs?

Yes! We offer comprehensive payroll services, including salary calculations, tax withholdings,

and compliance with federal and state regulations. Our goal is to ensure your employees are

paid on time, every time.

How do you help with budgeting and cash flow management?

Our team helps create strategic budgets, forecasts cash flow, and tracks expenses. We identify

areas to optimize cash flow and ensure you have the liquidity needed to run your business

smoothly.

Do you provide services for international businesses?

Yes, we work with global businesses. We offer multi-currency accounting, international tax

planning, and support for cross-border compliance and reporting.

Get Started with Confiance Today

Managing business finances takes time and effort. We make it easier. At Confiance, our accounting team helps you stay organized so you can focus on growing your business. Contact us today to see how our bookkeeping support can improve the way you manage money.

Landing Page

This will close in 100 seconds