How to Select a Tax Accountant Who Can Handle Your Tax Return Efficiently

Picking the right tax accountant is a key step for anyone during tax season. Many people feel worried and stressed when it is time to file a tax return. The forms look hard, the rules feel unclear, and even small mistakes can cause fines. With the right help, these steps can be clear and smooth.

A skilled tax expert does more than fill out forms. They check your records, explain each step, and make sure your return is done on time. They also spot ways to cut costs that you may not see on your own. This saves you hours of work and helps you keep more of your money.

This guide will walk you through how to find the right tax expert. You will learn why you may need one, what traits to look for, and how to build a good working link with them. With these steps, you can choose a person who will handle your taxes with care and skill.

Why You Need a Tax Accountant

Hiring a tax accountant is not only for big companies or wealthy people. Anyone who earns, spends, or invests can benefit. A good accountant helps you:

- Stay compliant with tax laws

- Avoid mistakes in your tax return

- Save time and stress

- Get advice for future planning

When You Should Seek Help

- If you own a small business

- If you have multiple income sources

- If you invest in stocks or property

- If you find tax forms confusing

Traits to Look for in a Tax Accountant

Not every expert is the same. Choosing the right tax accountant is about more than checking papers or titles. The right person should have skills, trust, and care for your needs. Below are key traits to look for when making your choice.

Strong Knowledge

A good accountant must know both local and national tax rules. They should also stay current as laws change each year. This ensures your tax return is correct and safe from errors.

Clear Communication

Taxes can be hard to grasp, but your accountant should make them simple. They must explain each step in plain terms so you feel sure and calm when signing your return.

Problem-Solving Skills

Tax issues are not always simple. A skilled expert should know how to find quick and clear answers for tough cases. They should guide you in a way that saves time and lowers stress.

Attention to Detail

A missed number or skipped form can cause fines or delays. A strong accountant should have a sharp eye for detail to make sure all forms are right and on time.

Reliability and Trust

You share private money data with your accountant. Trust is key. Look for someone who is honest, keeps your info safe, and values your trust as much as their skill.

Time Management

During tax season, deadlines matter. Your accountant must be able to plan well and meet every due date. This trait helps you avoid late fees and last-minute stress.

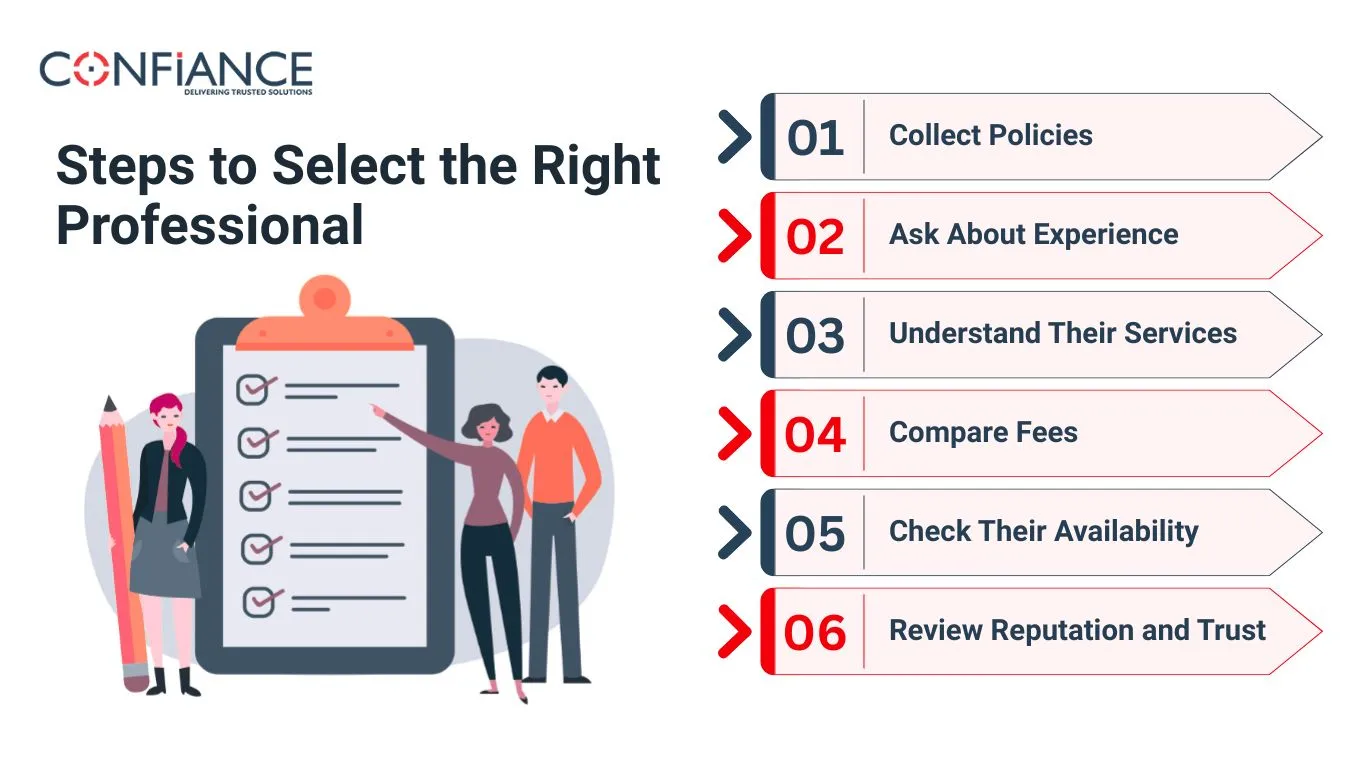

Steps to Select the Right Professional

1: Check Credentials

- Look for licensed professionals

- Verify their certifications

- Make sure they are allowed to file returns.

2: Ask About Experience

An experienced accountant has handled many cases before. This makes them better at spotting errors and opportunities.

3: Understand Their Services

Some professionals only file basic returns. Others give complete services like audits, planning, and advice. Know what you need before you hire.

4: Compare Fees

The cost should be clear and fair. Avoid people who give vague answers about charges.

5: Check Their Availability

During peak tax months, some accountants may take on more clients than they can handle. This can lead to rushed work or less time for your case.

- Ask how many clients they manage at the same time.

- Check how fast they reply to calls or emails.

- Make sure they can meet with you if you need advice.

A good accountant should have enough time to review your files with care. They should also be ready to guide you with clear advice, not just fill forms in a hurry. When they are available, you gain both peace of mind and better service.

6: Review Reputation and Trust

Reputation matters as much as skill. A trusted expert will have proof of good work from past clients.

- Look for reviews online or on their website.

- Ask for the names of clients who can share their experience.

- Speak with friends, peers, or business contacts for referrals.

A tax accountant with a strong record values clients and delivers steady results. Trust also comes from how they treat you. If they listen with care and answer questions with respect, that is a sign of a reliable partner.

Common Mistakes to Avoid When Choosing a Tax Expert

Many people rush during tax season. They hire the first person they meet. Avoid these mistakes:

Ignoring Reviews

Check feedback and references before you trust someone with your tax filing.

Choosing Only by Price

Low fees do not always mean good service. Quality matters more than cost.

Not Checking Availability

Some professionals get too busy during tax season. Make sure your accountant has time for you.

Benefits of Working With the Right Tax Expert

When you choose wisely, the rewards are clear:

Saves You Time

You can focus on work, family, or business while the expert handles your taxes.

Reduces Stress

No need to fear penalties or errors in your tax filings.

Helps You Save Money

A skilled accountant often spots deductions or credits you might miss.

How to Build a Strong Relationship

Working with a tax accountant should not just be once a year. Build a strong bond so they understand your needs.

Stay in Touch

Update them about changes in income, property, or investments.

Be Honest

Share all details so they can prepare an accurate tax return.

Ask for Advice

Use their knowledge to plan ahead and not just to file forms.

Online vs Local Tax Accountants

Technology has made it easier to work with professionals online. But is it the right choice for you?

Online Services

- Convenient and often cheaper

- Great for a simple tax return

- Easy to upload documents

Local Professionals

- Better if you prefer face-to-face meetings

- Useful for complex cases

- Easier to build long-term trust

Red Flags You Should Not Ignore

Some signs show a person may not be right for you.

Vague Promises

If they promise huge refunds without details, be careful.

Lack of Transparency

If they avoid clear answers about fees or services, this is a warning.

No Credentials

Never hire someone who cannot prove their license or skills.

Tips for a Smooth Tax Season

Stay Sorted

Keep all slips, bills, and forms in one file. Clear records save time and help your accountant do the work with ease.

Start Early

Do not wait for the last week. Reach your accountant early so they have time to plan and file your tax return with care.

Check Before You File

Always read the return before it goes in. Even with help, you should know what is filed under your name.

Keep Online Copies

Save scans of your slips and bills on a safe drive or cloud. Online files are easy to share and help you avoid lost papers.

At Confiance, we make taxes easy for people and businesses. We know filing taxes can be hard. Our team of certified tax accountants gives clear, fast, and reliable help.

We keep up with tax rules to make sure your filings are correct. We offer services that fit your needs and goals. You get help all year, not just during tax season, with planning, saving, and following the law.

All work is done safely, with secure systems to protect your data. By choosing Confiance, you get a team that values trust, accuracy, and long-term success.`

FAQ

- Why should I hire a tax accountant instead of filing on my own?

An accountant saves time and cuts errors. They also find tax breaks you may miss. With expert help, your tax return will follow the rules and be done on time.

- How do I know if a tax accountant is the right fit for me?

Ask about their work with people like you. Check if they know the tax rules for your job or business. A good match will make your tax filing smoother and less stressful.

- Do accountants work with both individuals and businesses?

Yes. Many accountants help both people and firms. They can adjust their work to match the needs of each client.

- How much does it cost to hire a tax accountant?

The price depends on the type of work. Some charge a flat fee, while others bill by the hour. A good accountant will give clear rates with no hidden costs.

- Can an accountant help with tax planning as well as filing?

Yes. Accountants often give both services. They can guide you on saving, spending, and money plans that may lower taxes in the years ahead.

- How safe is my personal and financial data with an accountant?

A trusted accountant will keep your data safe. Ask how they store and share your files. Most use secure tools to guard their records.

- What is the best way to talk with a tax accountant?

Pick the way that works best for you. Some like email, some use calls, and others meet in person. Clear talk makes the tax return process faster and less stressful.