How to Calculate and Pay Franchise Tax for Your Business

What Is Franchise Tax?

Franchise tax is a fee some states charge businesses for the right to operate within their borders. It does not depend on how much profit your business makes. Instead, it is tied to your business’s presence and registration in that state. States like California, Delaware, and Texas require this tax from corporations, limited liability companies, and other registered entities.

This tax helps states manage their business records and ensure companies meet their local rules. Each state sets its own tax rules and payment methods. Some charge a flat amount, while others base the tax on business size or income figures. These differences mean franchise tax rates can vary widely from one state to another. Because rules differ, you must understand your state’s requirements before filing.

Who Must Pay Franchise Tax?

Most states apply franchise tax to businesses registered with their state agency, treating it as the cost of the privilege of doing business under state law. These are the common types of entities that must file and pay:

- Corporations: Both domestic and foreign corporations must file if they are registered or doing business in the state.

- Limited Liability Companies (LLCs): Even if an LLC has little or no income, it may still owe the franchise tax. By contrast, income taxes may be reduced or eliminated if a business reports no taxable profit.

- Limited Partnerships: These also often fall under franchise tax rules, depending on where they are registered.

- Other Entities: Some states include business trusts, joint ventures, or similar types under their rules.

Always check your state’s requirements. What applies in one state may not apply in another. Your business type and registration status both matter.

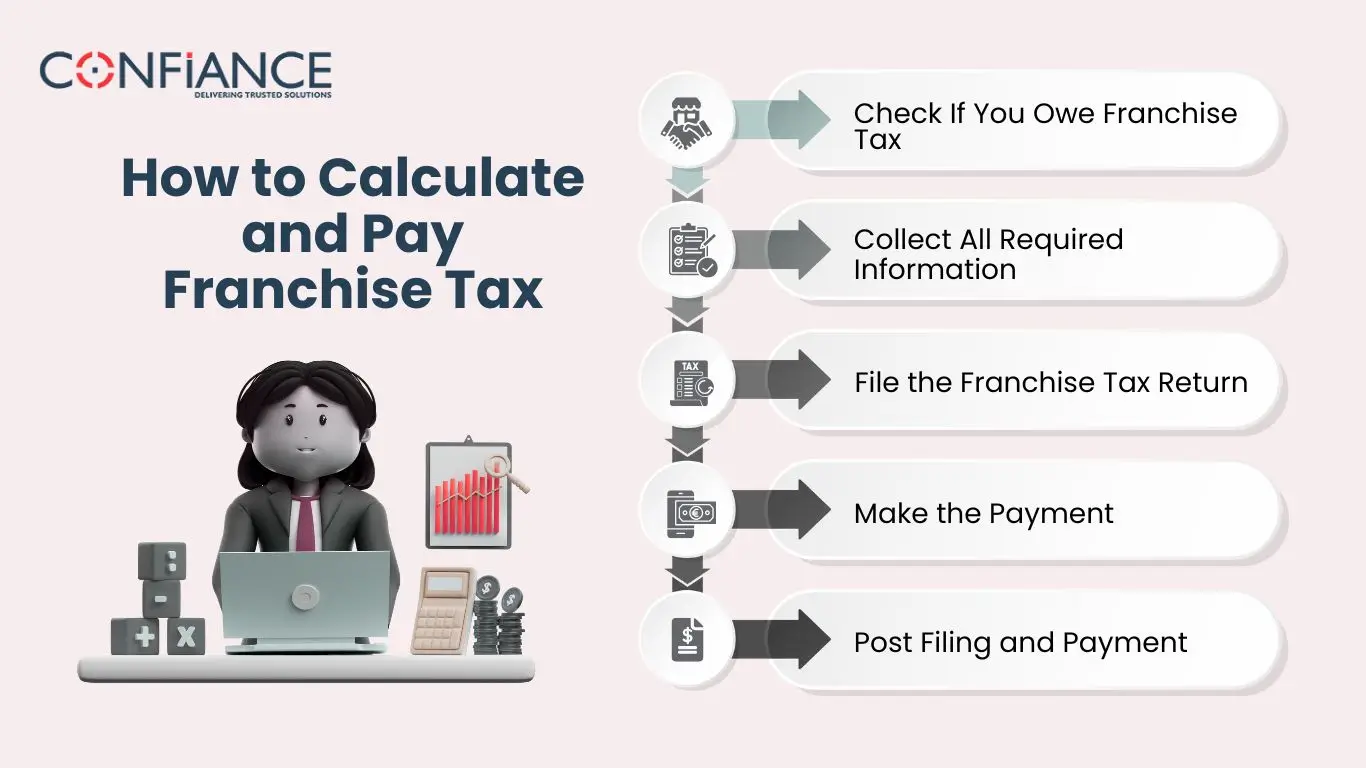

How to Calculate and Pay Franchise Tax

Below is a clear step-by-step guide to help you calculate and pay franchise tax without missing key steps.

Step 1: Check If You Owe Franchise Tax

First, confirm whether your business is required to pay this tax. Look at where your company is registered and what kind of entity it is. If your business exists in a state that collects franchise tax, you will likely owe at least a minimum amount.

States may use different ways to calculate the tax. These include:

- Gross receipts: The total amount of money your business brings in.

- Capital stock value: The worth of your company based on assets and shares.

- Flat fees: A set fee that applies no matter the business size or income.

Your state may offer a calculator or online tool. If not, use official documents or contact your state tax board for guidance.

Step 2: Collect All Required Information

To avoid delays or mistakes, gather everything you need before starting your tax filing. This usually includes:

- Basic business details: Business name, entity type, and registration or tax ID number.

- Financial records: These may include recent income statements and balance sheets.

- Annual report filings: Some states require a separate report that updates business information.

- State-specific forms: Certain states ask for additional data or use unique formats.

It is better to prepare all needed documents early. That way, you can complete the filing on time without stress.

Step 3: File the Franchise Tax Return

Most states let you file online through the website of their tax department or franchise tax board. Others still allow paper forms. You can choose the method that works best for you, but online filing is usually faster and easier to track.

- Online filing: Visit the official state site, select your business type, and follow the prompts. Upload documents or enter details as asked.

- Mail filing: Download the correct form, fill it out fully, and mail it to the address listed on the form. Include any payment and required documents.

Some states also offer free or paid software to help you calculate your tax and submit your return.

Step 4: Make the Payment

Once you finish the filing, pay the tax before the deadline. Missing the payment may lead to late fees or interest.

Most states offer the following options:

- Online payment: Use a credit card, debit card, or direct bank transfer through the tax site.

- Mail payment: If you filed by paper, you may need to send a check or money order with the correct amount.

Be sure to confirm the payment method accepted in your state. Also, double-check that your payment matches the amount owed.

Step 5: Post Filing and Payment

Once you submit your return and pay the tax, take these final steps to stay organized:

- Keep records: Save copies of your filings, payment receipts, and any state confirmation emails. Keep them for at least three to five years.

- Mark your calendar: Most franchise taxes are due every year. Set reminders well in advance of the next due date.

- Watch for changes: State rules may shift from year to year. Check your state’s tax board website for updates or sign up for alerts.

By keeping track of deadlines and storing records, you can avoid issues and make next year’s filing easier.

Get Help With Franchise Tax Filing Through Confiance

Franchise tax filing takes time and close attention. If you miss a detail, you may face extra fees or delays. That’s where Confiance can help. We offer tax filing and bookkeeping services designed for businesses of all sizes, including those subject to franchise tax.

Here is how we support your business:

- Accurate filings: Our team prepares and files your franchise tax return correctly, based on your state’s specific rules.

- On-time service: We handle filing and payment schedules, so you do not miss a deadline or face penalties.

- State-by-state guidance: Our team is familiar with filing requirements across all states. We adjust our approach to fit your state’s laws.

Let Confiance take care of your tax filings, so you can focus on growing your business with less stress.

FAQ's

1. What is Franchise Tax?

- It is a tax some states charge businesses for being registered and operating there, essentially a fee for the privilege of doing business within state borders.

2. Which businesses must pay franchise tax?

- Any registered entity in a state with franchise tax rules may need to pay. This includes corporations, LLCs, partnerships, and in some states, even nonprofit organizations, unless they qualify for an exemption.

3. How is franchise tax calculated?

- Each state uses its own method. Some base it on gross receipts, others on capital stock, net worth, or fixed amounts. Check your state’s instructions to be sure.

4. How do I file franchise tax?

- Most states let you file online. You can also mail paper forms in some cases. Choose the option that works best for your situation.

5. What happens if I do not pay?

- You may face fines, added interest, or even have your business suspended. Timely filing and payment help avoid those problems.