How Outsourced Restaurant Accounting Improves Cash Flow Management

Running a restaurant is tough. Owners must pay staff, buy food, and cover bills while still making a profit. One of the hardest parts is tracking money. Outsourced restaurant accounting gives clear records and steady cash flow. It keeps finances in check, improves cash flow, and guides better money choices.

By hiring experts to handle books, payroll, and reports, owners can keep cash steady. They can also plan for growth and spend more time on daily work, not stress over numbers.

What is Outsourced Restaurant Accounting?

Outsourced restaurant accounting means hiring an outside team to do your books and reports. Instead of doing it in-house, the experts handle all money matters.

Key Functions of Outsourced Accounting

- Record daily sales and expenses

- Make financial reports

- Handle payroll

- File taxes and follow rules

Difference from In-House Accounting

- Experts work without hiring full-time staff

- Cost is lower than in-house

- They use tools to give clear, fast reports

The Importance of Cash Flow in Restaurants

Cash flow means the money that comes in and goes out of a business. For a restaurant, cash flow is very important. Even a busy restaurant can face trouble if money is not managed well.

Why Cash Flow Matters

- Money is needed for staff pay, bills, and food.

- Good cash flow keeps the restaurant running smoothly.

- It helps plan for slow months or extra costs.

Signs of Poor Cash Flow

- Paying bills late

- Borrowing often

- No money for new plans

With outsourced accounting, owners can see their cash clearly and plan better.

Top Benefits of Outsourced Restaurant Accounting

Running a restaurant is exciting, but it comes with financial challenges. Managing money, tracking costs, and ensuring smooth cash flow can be overwhelming. Outsourced restaurant accounting helps restaurant owners handle these tasks with ease and accuracy.

Accurate Financial Reports

Outsourced accounting gives clear and correct financial reports. Owners see exactly where money goes. This helps make smart choices and plan budgets.

Save Money and Work Fast

Hiring a full-time accountant can cost a lot. Outsourcing is cheaper and faster. Teams use tools to do routine work quickly, saving time and money.

Lower Risk of Mistakes and Fraud

Professional accountants follow strict rules. They catch mistakes early, stop fraud, and keep the restaurant safe from tax issues.

Make Better Decisions

Good financial reports help owners act fast. Whether choosing a menu, hiring staff, or planning ads, numbers guide every choice.

Focus on the Business

Outsourcing frees owners from financial work. They can spend time on food, service, and growing the business.

Control Cash Flow

Outsourced accountants track spending and income closely. They help restaurants avoid cash problems and plan for slow times.

Expert Advice

Accounting teams give tips on taxes, cutting costs, and growing the business. Owners get advice they may not get from in-house staff.

How Outsourced Accounting Helps Restaurants Grow

With outsourced restaurant accounting, growth gets easier. It gives clear information, saves time, and helps owners make good choices. With good money control, owners can focus on food, staff, and customers.

Plan for Growth

Accountants can help plan new steps. They can:

- Show which items sell well

- Show which brings more cash

- Help set budgets for food, staff, and tools

This helps owners spend the right amount and grow safely.

Help with Staff Costs

Staff pay is a big cost. Outsourced accounting can:

- Track staff hours

- Show when more or fewer staff are needed

- Help plan shifts to save cash

This keeps costs low and staff happy.

Track Menu Sales

Not all dishes make a profit. Accountants can:

- Show which dishes cost too much

- Suggest which items to keep or drop

- Watch trends for busy or slow seasons

This helps owners sell items that bring cash and keep customers pleased.

Manage Vendor Bills

Food and supplies cost a lot. Outsourced accountants can:

- Track bills and due dates

- Find discounts or deals

- Make sure bills are paid on time

This saves cash and keeps good vendor relations.

Give Real-Time Information

With cloud software, owners see cash info fast. They can:

- Spot issues early

- Adjust spend right away

- Make smart choices with real numbers

Help Marketing and Sales

Money info can guide ads and offers. Accountants can:

- Show how much to spend on ads

- Track if ads bring cash

- Help plan events to bring more customers

Reduce Stress

With cash tracked and safe, owners worry less. They can focus on food, staff, and guests. This leads to happy staff, more happy guests, and steady growth.

Tools Used in Outsourced Accounting

Tech helps make accounting fast and correct. Outsourced teams use modern tools to help restaurants.

- Accounting Software: Tools like QuickBooks, Xero, or restaurant software make bookkeeping easy.

- Cloud Access: Cloud systems let owners see money info from anywhere. Data is safe and always up to date.

- Automated Expense Tracking: Automation reduces manual work. Bills, purchases, and reports are done fast and right.

- Mobile Alerts: Some apps warn owners about low cash, late bills, or overspending.

- Data Insights: Tools track sales, staff costs, and food use. Owners see problems early and plan better.

- Digital Bills and Payments: Send invoices online and get payments fast. This keeps cash flow steady.

- POS System Integration: Linking POS systems to accounting tools records all sales automatically. This saves time and stops mistakes.

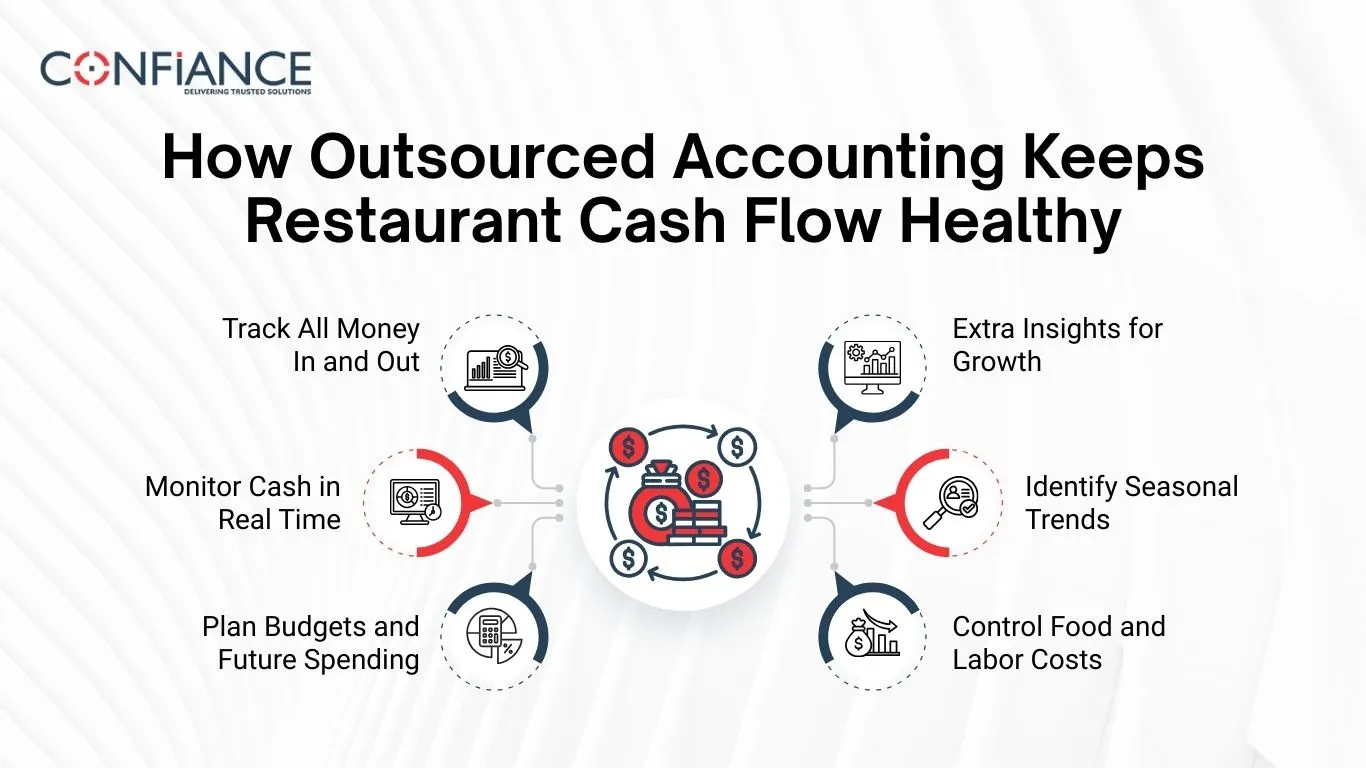

How Outsourced Accounting Keeps Restaurant Cash Flow Healthy

Managing cash is one of the hard parts of running a restaurant. Sales bring in money, but staff, food, rent, and taxes take it out. Outsourced accounts help track cash, stop gaps, and plan for growth. With expert help, owners keep cash flow smooth and spend more time on guests.

Late fees and missed bills are less of a risk. This way, the restaurant has the cash it needs each day.

Track All Money In and Out

Outsourced accountants watch every payment and expense. They make sure:

- Customers pay on time

- Vendors are paid on schedule

- Late fees or missed payments are avoided

This ensures the restaurant always has enough cash for daily needs.

Monitor Cash in Real Time

Cloud tools let owners see cash flow as it happens. Real-time updates mean owners can:

- Spot shortfalls early

- Act fast before problems grow

- Adjust spending quickly

This keeps the business on track even during busy or slow days.

Plan Budgets and Future Spending

Accounting experts can forecast income and costs. This helps restaurants:

- Budget for staff and food

- Plan promos and events

- Prepare for slow seasons

With a clear plan, owners make smart choices with less stress.

Control Food and Labor Costs

Food and staff are the largest costs for most restaurants. Outsourced teams can:

- Track daily food use

- Watch staff hours and overtime

- Find ways to cut costs without hurting service

When these costs stay in check, profits and cash flow stay strong.

Identify Seasonal Trends

Sales often vary with holidays, weekends, or tourist seasons. Outsourced accountants can:

- Spot peak and slow times

- Suggest stock adjustments

- Recommend changes to staff schedules

By understanding trends, restaurants can avoid shortages or overspending.

Extra Insights for Growth

Outsourced accounting also gives insight into opportunities to grow. Experts can:

- Show which menu items are most profitable

- Help owners plan new services or branches

- Provide simple reports to guide long-term decisions

With this support, restaurants can expand without risking cash flow.

Common Restaurant Accounting Problems Solved by Outsourcing

Restaurants face special challenges. Outsourcing makes these easier.

Seasonal Revenue Changes

Sales go up in holiday or tourist times and drop in slow months. Accountants plan for this to keep money flowing.

Labor and Food Costs

Staff and food are big expenses. Accountants watch costs and suggest ways to save.

Tax Rules

Taxes can be tricky. Outsourced teams file correctly and on time, avoiding fines.

Multiple Locations

Chains need data from all branches. Outsourced teams combine info for a clear picture.

Vendor Payments

Keeping track of bills, discounts, and terms can be hard. Accountants make payments on time and keep vendors happy.

Case Studies: Real Restaurants Using Outsourced Accounting

Seeing examples shows how outsourcing helps.

Small Restaurant

A small restaurant hired an outside team to manage the books. Daily errors were fixed, and cash flow improved. With more profit on hand, the owner put money into ads and local events.

Medium Chain

A mid-size chain got clear cash flow reports each week. These reports helped forecast costs, avoid shortages, and plan for growth with ease.

Multi-Location Restaurant

A chain with many sites used one system for all stores. This gave leaders a full view of money across each branch. Better data led to faster, smarter choices.

Outsourced accounting reduces stress. Financial decisions use correct data. Cash flow improves, letting restaurants grow.

Choosing the Right Outsourced Accounting Partner

Picking the right team is key. Consider:

Experience in Restaurants

Choose teams who know restaurant costs, staff, and seasonal sales.

Pricing and Service

Compare providers. Some charge per month, some per service.

Communication

Good partners answer questions fast and keep info updated.

References and Reviews

Check past clients and case studies for results.

Technology

Ensure the team uses modern tools, links to POS, and gives real-time reports.

At Confinace, we provide accounting services specially designed for restaurants. Our solutions help you manage finances and stay compliant. Our certified accountants handle your accounts so you get reliable support without extra staff. For any restaurant, small or large, professional accounting is not optional. It is the best way to avoid mistakes, manage cash, and ensure steady growth. Partner with us for trusted and expert accounting support.

FAQs

- What is outsourced restaurant accounting?

It means hiring an outside team to do bookkeeping, payroll, and reports. This saves time and lowers errors. - How can outsourced accounting improve cash flow?

It tracks money in and out, sends bill alerts, and helps plan income. This keeps cash ready for daily needs. - Is outsourced accounting cost-effective for small restaurants?

Yes. It cuts the need for full-time staff and pricey tools, making it cheaper than an in-house hire. - What tasks do outsourced accounting teams handle?

They handle bookkeeping, payroll, taxes, costs, and cash flow reports. They also give tips to save and plan. - Can outsourced accounting help with tax compliance?

Yes. Experts file taxes on time and the right way, cutting the risk of fines or errors.