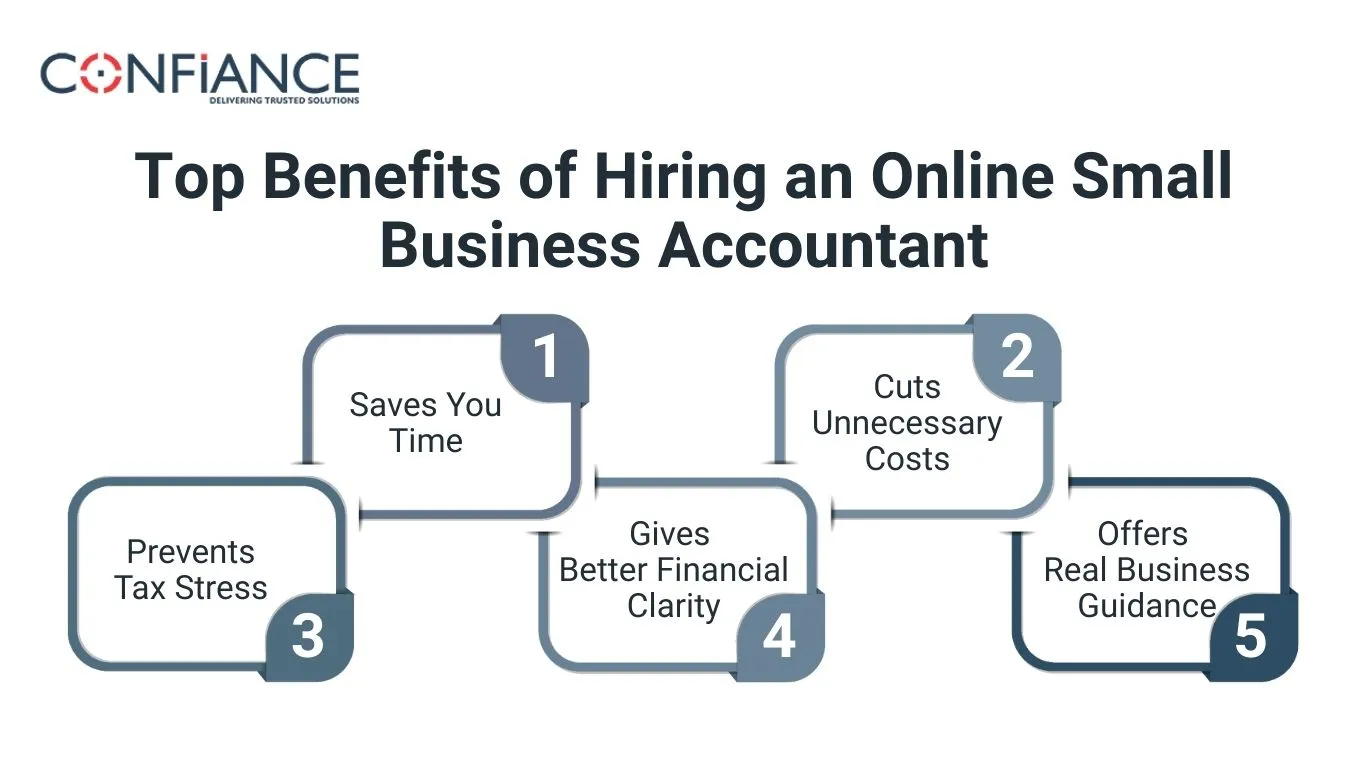

Top Benefits of Hiring an Online Small Business Accountant

Running a small business takes steady effort. Many owners enjoy selling, managing clients, or planning new products. Still, they often feel burdened by financial tasks. They try to manage invoices, receipts, and bank records in their spare time. This leads to stress and prevents them from focusing on the main goals.

A skilled online small business accountant can remove that pressure. This professional works remotely and handles all financial records. You receive steady reports and advice without needing to meet in person. Such a service helps you gain time and keeps your business stable.

Many owners feel relieved when someone steps in to keep financial records on track. That relief allows them to make better plans for sales, marketing, and customer service. Over time, business growth improves because the owner has a clear mind and has more energy to focus on serving clients. A strong financial partner often feels like the missing piece that allows the rest of the business to move forward.

The Real Struggle with Bookkeeping

Bookkeeping looks simple when business is small. It becomes complex as sales and costs grow. Each day brings new receipts, payments, and bills that need proper recording.

Why It Drains Time and Energy

- Owners lose time trying to record every expense

- Unclear records cause confusion during tax time

- Financial work often gets delayed

- Stress builds up with unpaid bills or missing entries

- Small mistakes lead to bigger problems later

- Books become messy without a routine system

Many owners feel guilty when they realize they have avoided updating their accounts for weeks. They know it matters, yet they delay it because it feels confusing or boring. That delay causes them to lose control over key numbers. As a result, important business decisions are based on guesses, not facts.

This strain affects focus and mood. It also prevents owners from planning the next step for growth. They may turn down new work or delay expansion, simply because their financial picture is not clear. This stops a business from reaching its full potential.

Why an Online Small Business Accountant Is the Perfect Solution

An online small business accountant handles the records with accuracy. You do not need to hire extra staff or buy new tools. All data is shared securely and updated on time.

How It Works

- You send reports, bills, and invoices through a secure system

- The accountant updates all records and shares reports

- You can ask questions any time

- Advice is based on your real numbers

- Files stay backed up and easy to access

- You receive follow-ups if a document is missing

What Makes It Better Than a Local Hire

- No need to travel or hold long meetings

- You only pay for work done

- No extra cost for tools or office space

- Service can grow with your business

- Support is flexible during busy seasons

- No need to handle office training or supervision

The process is simple and smooth. You receive reliable support without any heavy setup. Everything stays organized without changing your daily work. The owner only needs to upload invoices or confirm a few numbers. The accountant handles the rest. It feels like a real part of the team, even from a distance.

Key Benefits You Experience

a) Saves You Time

You can focus on customers and products instead of ledgers and spreadsheets. Time is one of your strongest assets in business. The more time you gain, the more you can direct your energy toward growth.

Time Saving Perks

- No late nights spent on accounts

- No need to learn software on your own

- Regular updates mean no surprise errors

- More time for client work or planning

- Fast access to reports instead of building them yourself

- Less frustration with paperwork and files

With this time saved, owners can hold more client meetings, improve the quality of their products, or run marketing campaigns. These tasks bring revenue, while accounting work only keeps the business stable. It makes sense to let someone else manage that part.

b) Cuts Unnecessary Costs

A full-time accountant can be expensive. Using an online small business accountant can reduce ongoing costs. Money saved on wages, training, or office space can be used for marketing, software, or staff development.

Cost Saving Advantages

- No salary or training expense

- Fewer mistakes mean fewer penalties

- No need to buy costly software

- Pay only for the help you require

- No overtime pay or extra admin fees

- Better financial control prevents overspending

When you know how much you will be charged each month, it helps you budget better. You no longer guess how much accounting will cost. Savings can be used to improve your product, grow your customer base, or invest in equipment.

c) Prevents Tax Stress

Tax rules are strict and can change often. A trained professional can manage it without delay. That saves mental stress and keeps your records sharp.

Smooth Tax Handling

- All data stays ready for filing

- Every valid deduction is included

- Returns are filed on time

- No stress about deadlines or notices

- Clean records reduce fear of audits

- Updates if tax laws change

Tax season becomes a normal part of business rather than a time of panic. You hand over the documents, and your online small business accountant manages the process. This keeps you focused on regular business tasks. You avoid heavy fines and stay in good standing with the tax office.

d) Gives Better Financial Clarity

Good reports show where the money comes in and where it goes out. It becomes easier to plan and make good choices. Over time, you start to see trends that help you improve your results.

Clarity Benefits

- Simple reports each month

- Clear cash flow detail

- Easy to track profit or loss

- Decisions based on facts

- Better control over spending

- Early warning signs when revenue dips

When you understand your numbers clearly, you can take action early. You can plan for slow months, adjust your prices if needed, or find ways to increase sales. A clear view of the numbers gives owners confidence and helps them avoid risky decisions.

e) Offers Real Business Guidance

A reliable online small business accountant also acts as an adviser. They review trends and explain how your business is doing. You gain a real partner who understands your business deeply.

Guidance You Can Use

- Advice on when to spend or save money

- Tips on fair pricing

- Support for long term planning

- Warnings if expenses grow too fast

- Advice on sales plans or new services

- Help in reviewing profit goals

Clients often say that guidance from an accountant helped them avoid big mistakes. They feel more confident when making changes because they have facts, not guesses. Good advice saves money and builds stronger plans.

Role in Long-Term Growth

A business grows best with clear data and the right help. Financial stability is key in each stage of growth. When your books are managed well, you feel ready to take bigger steps.

Planning for the Future

- Plan for lean months in advance

- Use reports to review past performance

- Set goals that match actual numbers

- Plan investment in staff or equipment

- Prepare for funding or loan requests

Adapts to Business Growth

- Adds payroll support if you hire staff

- Handles more records as sales increase

- Offers deeper analysis as needs change

- Helps during expansion to new regions

- Supports planning for new product lines

You keep using the same trusted service even as the business becomes larger. No need to change systems. Your online small business accountant becomes part of the long-term success plan. They understand your history and can guide future steps with more certainty.

Peace of Mind and Real Support

With a steady professional on your side, your financial stress reduces. You feel more free to think about growth. Confidence grows because you know everything is under control behind the scenes.

Reduces Stress and Mental Load

- Books are always updated

- No panic during tax season

- Confidence in each financial decision

- More mental space for creative work

- Better mood due to less pressure

- Easier time discussing finances with partners

Trusted Partnership

- Help is just a message away

- Advice is clear and direct

- Regular reports help you stay prepared

- Questions are answered with patience

- You build trust over time

- Communication stays smooth and friendly

You gain more control and calm with the right accountant handling your books. It feels like support rather than just a service. You no longer carry all the pressure alone.

It is hard to run a business and keep the books in perfect shape. Many owners try to manage everything and end up feeling tired and unsure. With help from a skilled online small business accountant, you can gain time, clarity, and peace of mind. At Confiance, we help you keep your records organized. Our business accounting services are worth more than it costs.

Our services are not only about keeping records. It is about keeping your business strong. When your books are in safe hands, you can turn your full attention to your clients, your service, and your plans. That is how a business grows in a real and consistent way.

FAQs

- Why should a small business hire an online small business accountant?

An online small business accountant saves time and reduces stress. Owners can focus on clients, sales, and service while an expert keeps financial records accurate. This support helps a business grow with steady control. - Why does bookkeeping become a struggle for small businesses?

Bookkeeping looks simple at first but becomes complex when sales and costs increase. Daily receipts and bills pile up and cause delays. Unclear records lead to mistakes and poor business decisions. - How does an online small business accountant work with clients?

Owners share invoices, receipts, and reports through a secure system. The accountant updates records, prepares reports, and answers questions. All files stay organized and easy to access at any time. - What makes an online small business accountant better than a local hire?

You do not need office space, training, or supervision. You only pay for work done. Services expand during busy seasons without extra expense. - How does outsourcing to an online small business accountant save money?

A full time hire comes with salary, training, and office costs. An online small business accountant removes these expenses. You pay for what you need and avoid penalties from errors. - How does an online small business accountant reduce tax stress?

All records stay ready for tax filing. Every deduction is included and returns are submitted on time. This prevents missed deadlines and lowers the risk of audits. - How can clear financial records support business growth?

Clear reports show profit, expenses, and cash flow. With facts in hand, owners can adjust prices, control costs, and plan for slow months. This clarity builds confidence in each decision.