How Much Does It Cost to Hire Online Accountants for Small Business?

Financial management is vital for any small business. Many owners find bookkeeping, tax preparation, and financial tracking hard and time-consuming. Online accountants for small business offer expert help at prices often lower than traditional firms. But how much does it cost to hire online accountants for small business? This blog covers key factors that affect pricing, common payment types, and how to pick the best accountant for your budget.

Managing money well helps you avoid costly mistakes and tax problems. Hiring online accountants for small business means you get expert help without full-time staff. This lets you focus on your work while your accounts stay up to date.

Why Small Businesses Choose Online Accountants

Online accountants for small business work remotely using the internet and cloud software. They handle your accounts without coming to your office. This cuts costs and lets them offer lower fees.

They handle bookkeeping, payroll, tax filing, and reports. Their work is flexible. You pay only for what you need. This fits small businesses that want expert help without big fees or long contracts.

They also save time. They reply quickly by email or chat. You avoid meetings that take extra time. Fast answers help you make smart business choices.

Many online accountants for small business use software that lets you see your accounts anytime. This gives control and peace of mind.

What Affects the Cost to Hire Online Accountants for Small Business?

Several things affect how much you pay for online accountants for small business. Knowing these helps you plan your budget.

Services You Need

The kind of work you want matters. Basic bookkeeping for daily sales and expenses costs less. Payroll, tax filing, and advice raise the price.

Bookkeeping is the cheapest. Full accounting with tax help costs more because it needs more time and skill.

Some businesses may want help with audits or managing stock. These add to the cost.

Size and Transactions of Your Business

Your business size counts. More sales and bills mean more work for the accountant. This raises fees.

Small businesses with few transactions pay less than ones with many daily sales and bills.

Bigger businesses often have complex records. This costs more.

How Often You Need Help

How often you want service changes the price. Weekly bookkeeping takes more time than monthly or quarterly work.

Pick a schedule that fits your business and budget. More reports help control cash but cost more.

Some start with quarterly service and add more as they grow. This keeps costs low at first.

Experience and Location of Accountant

Experienced accountants or those with certificates charge more. Their skill helps avoid mistakes.

Where the accountant works matters too. Accountants in big cities or rich countries often charge higher rates than those in smaller towns or low-cost countries.

If you hire online accountants for small business overseas, check they know your tax laws.

Experience in your business area helps too. These accountants work faster and spot problems sooner.

Software and Licensing Costs

Most online accountants for small business use cloud software like QuickBooks, Xero, or FreshBooks. Some include software fees. Others want you to pay separately.

Software fees add to costs. Choose software that fits your business.

Many platforms have free trials or tiered pricing. You can pick plans that suit your needs.

Pricing Type: Fixed or Hourly

Accountants charge fixed monthly fees or hourly rates.

Fixed fees mean steady costs. But if work grows, fees may rise.

Hourly rates may be cheaper if work is light. They get costly with more transactions.

Some offer mixed plans: fixed base plus hourly for extra work.

Common Pricing Models for Online Accountants for Small Business

Monthly Packages

Most online accountants for small business have monthly plans.

Basic bookkeeping costs $100 to $300 per month.

Mid-level plans with payroll or tax help cost $300 to $700 per month.

Full plans with advice, tax filing, and reports cost $700 to $1500 or more.

Prices depend on services and transaction volume.

Monthly plans help you budget with steady costs. They may include software and support.

Hourly Rates

Some online accountants for small business charge by the hour.

Junior bookkeepers charge $30 to $50 per hour.

Experienced accountants or CPAs charge $75 to $150 per hour.

Hourly rates work for occasional or seasonal needs.

Project Fees

For one-time jobs, some charge fixed fees.

Tax return preparation costs $200 to $600.

Payroll setup or cleanup costs $100 to $500.

Financial reports or audits cost $300 to $1000 depending on work.

Project fees suit businesses needing occasional help.

Online Accountants for Small Business vs Traditional Firms

Traditional accountants often cost more because of office and travel expenses.

They charge $75 to $250 per hour.

Monthly fees for small businesses can run $500 to $2000 or more.

Online accountants for small business usually cost less and offer flexible plans. This saves you hundreds or thousands each year.

Traditional firms may offer in-person support. But this comes with higher costs.

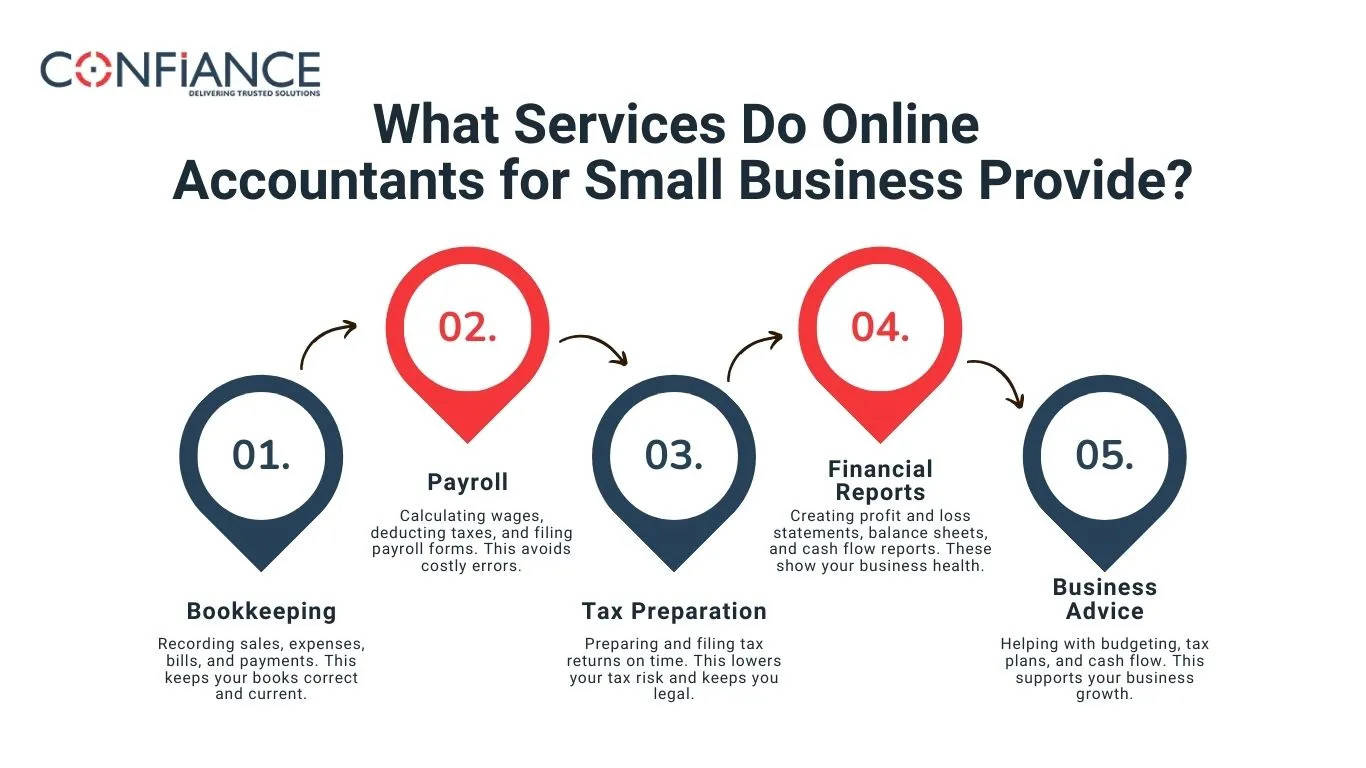

What Services Do Online Accountants for Small Business Provide?

Bookkeeping

Recording sales, expenses, bills, and payments. This keeps your books correct and current.

Payroll

Calculating wages, deducting taxes, and filing payroll forms. This avoids costly errors.

Tax Preparation

Preparing and filing tax returns on time. This lowers your tax risk and keeps you legal.

Financial Reports

Creating profit and loss statements, balance sheets, and cash flow reports. These show your business health.

Business Advice

Helping with budgeting, tax plans, and cash flow. This supports your business growth.

Some accountants help with cash forecasts and budgets. This helps you plan ahead.

How to Choose the Right Online Accountants for Small Business

Check Experience and Credentials

Pick accountants with experience in your business type. Look for certificates like CPA or ACCA.

Read Reviews and Ask for References

Reviews show trustworthiness. Ask for references and speak to past clients.

Understand Fees and Contracts

Know all fees, payment terms, and contract details. Avoid hidden charges.

Confirm Software Used

Make sure the accountant uses software that fits your business.

Test Communication

Good communication matters. The accountant should reply fast and explain clearly. Consider a trial period.

Choosing online accountants for small business is about trust and clear talks.

Tips to Save Money When Hiring Online Accountants for Small Business

- Pay only for the services you use.

- Keep your records neat and organized.

- Use hourly rates if work is light.

- Look for package deals.

- Use affordable software.

- Consider outsourcing to lower-cost areas.

Good records cut the time accountants need. This lowers your fees.

Hiring online accountants for small businesses gives expert help at fair prices. Costs depend on services, business size, work frequency, and experience. At Confiance, you get online accountants for small businesses that cost less than traditional firms. We offer flexible plans. Easily pick an accountant that fits your business and budget. Contact us now to keep your finances strong as your business grows.

FAQs

- What is the average monthly cost to hire online accountants for small business?

Basic bookkeeping costs $100 to $300 per month while full service plans run from $700 to $1500 or more. - How do online accountants for small business charge for their services?

They use fixed monthly fees, hourly rates, or set project fees. - What factors raise the price of online accountants for small business?

More transactions, complex records, frequent service, and certified staff raise the price. - When is hourly billing better than a monthly plan?

Hourly billing fits light or occasional work and can cost less for small tasks. - How do online accountants for small business differ from traditional firms?

Online accountants work remotely, cut office and travel costs, and charge less. - What tasks do online accountants for small business handle?

They handle bookkeeping, payroll, tax filing, financial reports, and business advice. - How can small businesses reduce their accounting costs?

Keep records tidy, pay only for needed tasks, pick affordable software, and use package deals. - What should you check before hiring online accountants for small business?

Check experience, certificates like CPA or ACCA, client reviews, the software they use, and response time.