Get investment gains and reduce tax burdens with Property Accounting Services

Table of Contents

- How Financial Management Affects Property Investments

- Key Performance Indicators in Property Management Business

- How Property Accounting Services Reduce Tax Burdens

- Boosting Investment Gains with Real Estate Accounting Services

- Why Choose Confiance for Expert Property Accounting Services?

- FAQs

How Financial Management Affects Property Investments

Effective financial management is crucial for any real estate investor or property manager. Without accurate records, investors may face tax penalties, cash flow issues, and even loss of profits. Property management bookkeeping ensures accurate financial records, maintains tax compliance, and allows investors to focus on expanding their portfolios.

When you have a well-organized financial system, you can track income, expenses, and profits more efficiently. This enables investors to make data-driven decisions, minimize risks, and maximize gains. Additionally, well-maintained records provide a clear audit trail, ensuring compliance with regulations.

Financial mismanagement can lead to missed opportunities. For example - Not claiming eligible tax deductions can lead to overpaying taxes. Poor cash flow management can make it hard to invest in new properties. With the right property accounting services, investors can ensure that their finances are in order, reducing financial stress and improving overall profitability.

Key Performance Indicators in Property Management Business

Key performance indicators (KPIs) help property managers and investors measure the success of their investments. Some essential KPIs include:

- Net Operating Income (NOI): The total income generated from a property after deducting operating expenses.

- Cash Flow: The net amount of cash moving in and out of the business.

- Occupancy Rates: The percentage of rented units compared to total available units.

- Capitalization Rate (Cap Rate): A measure of return on investment based on property income.

- Expense Ratio: The proportion of income spent on operating expenses.

- Return on Investment (ROI): A measure of profitability, showing how much return you get for every dollar invested.

- Debt Service Coverage Ratio (DSCR): The ability of a property to cover its debt obligations.

By monitoring these KPIs, property owners can identify inefficiencies and optimize their financial strategies. Property accounting services help track these KPIs, ensuring that financial decisions are backed by accurate data.

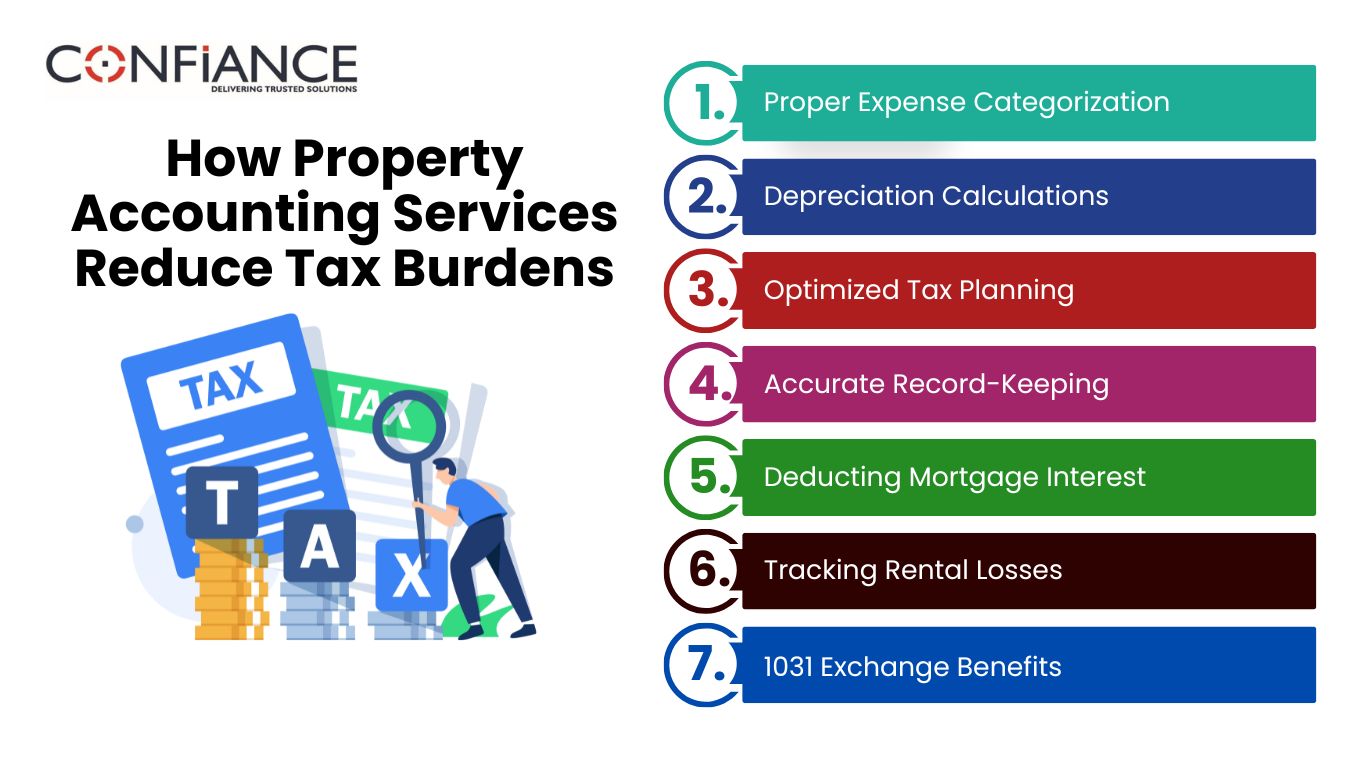

How Property Accounting Services Reduce Tax Burdens

Taxes can significantly impact a property investor’s profits. However, with expert property accounting services, tax liabilities can be minimized legally and efficiently. Here’s how:

- Proper Expense Categorization: By categorizing expenses correctly, property management bookkeeping services ensure that all eligible deductions are claimed, reducing taxable income.

- Depreciation Calculations: Real estate investors can deduct depreciation expenses, which lowers taxable income without affecting cash flow.

- Optimized Tax Planning: Professional accountants review financial data and recommend tax-saving strategies. These may include deferring income or using tax credits.

- Accurate Record-Keeping: Organized and accurate financial records help property owners avoid IRS penalties. We also ensure smooth tax filing.

- Deducting Mortgage Interest: Real estate accounting services help investors claim mortgage interest deductions, reducing the overall tax burden.

- Tracking Rental Losses: Losses incurred on rental properties can be offset against other income, reducing taxable income.

- 1031 Exchange Benefits: Property investors can defer capital gains taxes with 1031 exchanges. This applies when selling and reinvesting in similar properties.

Property owners can reduce tax liabilities by using deductions and exemptions. This ensures compliance with tax regulations. Additionally, working with experienced accountants helps property owners avoid common tax mistakes that could lead to audits or penalties.

Boosting Investment Gains with Real Estate Accounting Services

Accurate financial management directly impacts the profitability of real estate investments. Property accounting services provide essential insights that help property owners boost their investment gains. Here’s how:

- Enhanced Cash Flow Management: Professional bookkeeping tracks all income and expenses. This helps improve cash flow forecasting and management.

- Cost Control: By identifying areas where costs can be reduced, property management bookkeeping services help improve net profits.

- Accurate Profit Analysis: Investors can analyze profitability at the property level, making it easier to adjust rental rates or identify underperforming properties.

- Compliance with Financial Regulations: Proper accounting ensures financial reports follow local regulations. This reduces the chance of penalties and audits.

- Investment Forecasting: Real estate accounting services use historical data to provide accurate projections, helping investors make informed decisions about future property acquisitions.

- Maximizing Rental Income: Proper financial analysis allows investors to identify optimal rental pricing strategies and tenant retention techniques.

- Identifying High-Performing Properties: By analyzing financial reports, investors can determine which properties generate the highest returns and expand their portfolio accordingly.

- Reducing Risk Exposure: Real estate accounting services help investors identify financial risks before they become major issues, allowing for proactive decision-making.

With efficient accounting services, real estate investors can increase revenue, reduce unnecessary expenses, and make informed investment decisions. Ultimately, well-managed finances enable property owners to build long-term wealth through planned real estate investments.

Why Choose Confiance for Expert Property Accounting Services?

Managing property finances requires expertise, accuracy, and strategic planning. Confiance has been serving the real estate industry for years. With our property, we help property managers, and landlords grow their investment portfolios.

- Experienced Professionals: Our team has extensive knowledge of real estate accounting, tax regulations, and financial management.

- Tailored Solutions: We customize our services based on your specific property management needs.

- Advanced Technology: We use modern accounting tools to ensure accuracy and efficiency.

- Tax Optimization Strategies: Our tax experts help you minimize liabilities and maximize deductions.

- Transparent Reporting: We provide clear and detailed financial reports, giving you complete control over your property investments.

- Cost-Effective Services: Our accounting solutions help property owners save money by identifying inefficiencies and optimizing expenses.

- Dedicated Support: We offer personalized support to ensure that all your property accounting needs are met efficiently.

Conclusion

Investing in expert property accounting services not only reduces tax burdens but also enhances overall investment performance. By utilizing accurate financial management, property owners can maximize profits and achieve long-term success in real estate. Partner with us for trusted accounting support to confidently grow your real estate investments. Whether you own one rental property or a large portfolio, our team helps you increase profits.

FAQs

1. Why are property management bookkeeping services important?

Ans: Property management bookkeeping services help track income, expenses, and financial performance. They ensure compliance with tax regulations and assist in making informed investment decisions.

2. How do property accounting services help reduce tax burdens?

Ans: Property accounting services help categorize expenses correctly, calculate depreciation, and optimize tax deductions, ensuring minimal tax liabilities.

3. Can real estate accounting services improve investment profitability?

Ans: Yes. Real estate accounting services provide accurate financial data, helping investors manage cash flow, reduce costs, and maximize profits.

4. How often should I review my financial records?

Ans: It is recommended to review financial records monthly or quarterly to ensure accurate financial tracking and timely tax planning.

5. Why should I choose Confiance for property accounting services?

Ans: Confiance offers expert accounting solutions tailored to real estate investors. Our team ensures tax efficiency, financial compliance, and strategic investment planning.