Future Trends of Bookkeeping in California Every Business Must Know

Managing cash, bills, and pay is a key task for all firms. Keeping these records right can be hard and take a lot of time. In California, firms are adopting these changes to track money better, avoid mistakes, and plan for growth. If a firm does not track its funds well, it can face big problems. In this blog, we show the trends that help firms manage bookkeeping in California better. We will also show how firms can stay up to date with the new ways to manage money.

Why Bookkeeping Trends in California are Changing

Over the past ten years, bookkeeping in California has changed. Firms now use new tools and smart services to track cash, bills, and payroll more efficiently. Old ways of bookkeeping take too much time and can lead to mistakes. Today, firms want tools that are fast, safe, and smart.

Technology Makes Bookkeeping Easier

Tools now help firms keep track of money in a fast and safe way. These tools reduce mistakes and save time. Firms can now focus on plans and growth instead of only writing down bills and cash.

- Cloud Tools: Cloud tools let firms see their cash flow and bills from any place. They can log in and check records at any time.

- Auto Work: Tasks like sending bills or tracking payments can be done by tools. This saves time for staff.

- Smart Tools: AI tools can check for mistakes and give tips. They can see trends and help firms plan for the future.

Major Trends in Bookkeeping Services in California

In California, bookkeeping services have changed to fit modern business needs. They help firms work fast and avoid mistakes. Firms that use these trends can grow and stay ahead of the rest.

1. Virtual Bookkeeping

Virtual bookkeeping means staff do not need to be in one place. Firms can hire experts who work from home.

- Benefits: Firms save money. They get help from trained staff. They can check their records any time.

- Future: More firms will use virtual bookkeeping as remote work grows.

2. Fast Reports

Firms want to see their cash and bills in real time. They cannot wait weeks for a report.

- Tools: Tools like QuickBooks Online or Xero show cash and bills right away.

- Impact: Firms can make fast choices and fix problems quickly.

3. AI in Bookkeeping

AI tools can do work that once took hours. They can track cash, check bills, and give tips.

- Use: AI can check for wrong entries, show trends, and help with plans.

- Benefit: Firms save time and make fewer errors.

4. Safe and Legal Work

Firms must follow laws and keep data safe.

- Trends: Cloud storage with locks, safe payment tracking, and regular checks are key.

- Gain: Firms avoid fines and build trust with clients.

How Firms Can Adjust to New Bookkeeping Trends

Firms that adopt new trends will grow. Here are the steps to stay up to date.

1. Pick the Right Bookkeeping Services in California

Good services make work simple and fast. Look for ones that have:

- Cloud tools

- Virtual staff

- AI or auto tools

- Knowledge of law and taxes

2. Use New Tools

Tools make work simple. Firms should use tools to track bills, cash, and staff pay.

- Examples: QuickBooks Online, Xero, Zoho Books

- Result: Work is faster, fewer mistakes, and data is ready faster.

3. Train Staff

Staff need to know how to use new tools.

- Learn: Cloud tools, auto work, AI help, and law rules.

- Outcome: Staff can handle cash and bills correctly and fast.

4. Plan with Bookkeeping

Bookkeeping is not just for bills. Firms can use data to plan growth.

- Smart Use: Track cash, watch bills, and plan next steps.

- Help: Firms can save money, grow sales, and avoid waste.

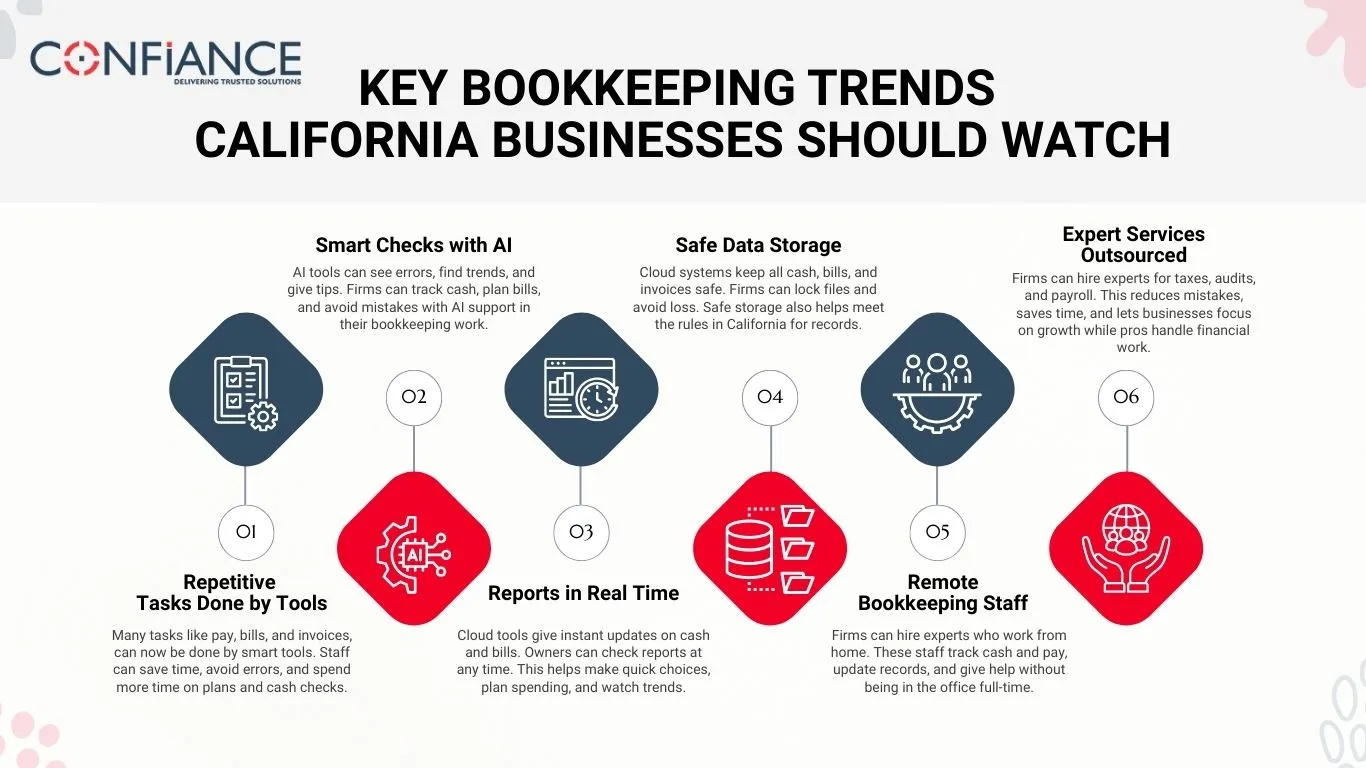

Key Bookkeeping Trends California Businesses Should Watch

Bookkeeping is changing fast in California. Firms must adopt new ways to save time, track cash, and reduce mistakes. Here are the key trends that every business should know.

1. Repetitive Tasks Done by Tools

Many tasks like pay, bills, and invoices, can now be done by smart tools. Staff can save time, avoid errors, and spend more time on plans and cash checks.

2. Smart Checks with AI

AI tools can see errors, find trends, and give tips. Firms can track cash, plan bills, and avoid mistakes with AI support in their bookkeeping work.

3. Reports in Real Time

Cloud tools give instant updates on cash and bills. Owners can check reports at any time. This helps make quick choices, plan spending, and watch trends.

4. Safe Data Storage

Cloud systems keep all cash, bills, and invoices safe. Firms can lock files and avoid loss. Safe storage also helps meet the rules in California for records.

5. Remote Bookkeeping Staff

Firms can hire experts who work from home. These staff track cash and pay, update records, and give help without being in the office full-time.

6. Expert Services Outsourced

Firms can hire experts for taxes, audits, and payroll. This reduces mistakes, saves time, and lets businesses focus on growth while pros handle financial work.

Emerging Technologies Shaping Bookkeeping in California

Firms in California now use tools to make bookkeeping fast and safe. Here are the key technologies that help track cash, bills, and pay efficiently.

1. Cloud Platforms for Money

Cloud tools let firms see cash, bills, and payroll from any place. Records update fast, and staff can check or fix them at any time.

2. Mobile Apps for Bookkeeping

Apps on phones or tablets let staff and owners check cash, bills, and pay anytime. Quick updates make work fast and keep records correct.

3. AI Tools for Insight

AI checks cash and bills to see trends and find errors. Firms can plan, spend, track growth, and make fast choices with AI help.

4. Auto Bank Matching

Bank deposits, invoices, and pay can be matched automatically. Firms save hours, reduce mistakes, and keep records correct and up to date.

5. Online Invoice Tracking

Firms can create, send, and track invoices online. Payments arrive on time, and overdue accounts are easy to spot, keeping cash flow smooth.

6. Tax Software Links

Bookkeeping tools link with tax programs. This helps firms prepare taxes, stay legal in California, and reduce errors while saving time.

The Role of Outsourced Bookkeeping Services

Outsourcing bookkeeping is common in California. Small and mid-size firms get help without hiring full staff.

Advantages of Outsourced Bookkeeping

- Cost-Effective: Reduces overhead costs related to hiring full-time staff.

- Expertise: Access to experienced professionals familiar with California laws and regulations.

- Scalability: Services can grow with your business needs without the hassle of training new employees.

- Efficiency: Faster turnaround for financial reports and payroll processing.

- Fast: Reports and paychecks are ready on time.

With outsourced bookkeeping services in California, firms can spend more time on business growth while experts track cash, bills, and payroll to reduce mistakes and save time.

The Future Outlook for Bookkeeping in California

With new trends, bookkeeping is now faster and more reliable in California. Firms that use these tools can stay ahead and manage their finances better.

Key Predictions

- More Automation: Repetitive tasks will be almost entirely automated, freeing up time for strategic planning.

- AI-Driven Insights: Predictive analytics will guide financial decisions, helping businesses anticipate market trends.

- Remote and Flexible Services: Virtual bookkeeping will become the norm, providing businesses with flexibility and reduced costs.

- Enhanced Security Measures: Data protection and compliance will continue to be a top priority.

How to Prepare for the Future

Businesses must stay updated with the latest bookkeeping technologies and practices. Adopting innovative services, investing in training, and using expert support will be critical for long-term success.

Bookkeeping practices in California are advancing quickly. Cloud tools, AI, and virtual services help firms manage cash, bills, and payroll with greater accuracy and speed. Adopting these trends allows businesses to save time, reduce errors, and make smarter decisions for growth. Staying updated is key to remaining competitive and compliant.

Confiance provides expert bookkeeping services designed for each firm’s needs across California. Using cloud tools, AI, and streamlined processes, our team ensures financial records are handled safely and efficiently. Partner with Confiance to focus on growth while gaining clear insights, improving planning, and building long-term stability.

FAQs

1: What is bookkeeping in California?

Bookkeeping in California is the work of tracking cash, bills, pay, and other money matters. Firms use it to stay safe, plan spending, and make sure their records are right at all times.

2: Why should firms use bookkeeping services in California?

These services help firms save time, keep records right, and meet law rules. They also help staff plan cash, check pay, and make reports with less risk of error.

3: Can small firms use virtual bookkeeping?

Yes. Small firms can hire remote bookkeepers who track cash, bills, and pay. This saves cost, gives expert help, and keeps records up to date without in-house staff.

4: Is cloud bookkeeping safe?

Yes. Cloud tools lock data, track cash, pay, and bills safely, and stop loss or hacks. Firms can check data anytime and meet California rules for secure records.

5: How does AI help bookkeeping?

AI spots errors, shows trends, and helps plan cash flow. It lets staff make fast and smart choices, check bills, and track growth while cutting mistakes.

6: What are the top trends in bookkeeping for California businesses?

Key trends include real-time reports, AI checks, cloud tools, mobile apps, and remote staff. Firms can save time, plan cash, reduce mistakes, and grow with smart bookkeeping.