Financial Advisor Vs. Accountant: What’s The Difference?

Handling money well often needs help, yet many are not sure who to ask. A financial advisor helps with saving, growth, and planning for the future. An accountant works on taxes, files, and keeps your money right. Knowing the difference, often seen in discussions about Financial Advisor Vs. Accountant helps you pick the right professional. The right guidance can save time, cut stress, and give better results, letting you plan and protect your money with confidence. Strong financial planning depends on using both roles effectively.

Why Understanding the Difference Matters

Understanding the difference between a financial advisor and an accountant helps you choose the right expert. The wrong choice can cost money or lead to mistakes.

Clear Roles

A financial advisor focuses on growing your money and planning for the future. An accountant handles taxes, reports, and records.

Avoiding Mistakes

Mixing their roles can cause errors, like asking an accountant for investment advice..

Better Planning

Understanding the difference gives you the right help for daily money and long-term goals.

Saving Time and Stress

Choosing the right professional reduces extra work and worry, making money management simpler.

Peace of Mind

When each expert handles their role, you can feel secure about your finances and future.

What a Financial Advisor Does

A financial advisor helps you grow and protect your money. They give advice for the future and guide you in choices that fit your needs.

Investment Planning

Advisors make plans to invest money safely and meet goals. They also review your portfolio to keep it on track.

Retirement Planning

They help you save for retirement with plans like IRAs and 401(k)s. They also show how much to save each year.

Insurance and Risk

Advisors suggest insurance to protect your money and family. They show you how to reduce losses from unexpected events.

Goal Setting

From buying a house to saving for school, they make a plan to reach their goals. They also help you set steps to stay on track.

Tax Advice

They give tips to reduce taxes on your investments. They explain tax rules in simple terms to help you plan better.

What an Accountant Does

An accountant helps you keep your finances correct and organized. They make sure your records and reports are accurate and follow the law.

Bookkeeping

Accountants record all income and expenses. They keep your books up to date so you always know your financial position.

Tax Preparation

They prepare and file taxes for you or your business. They also find ways to reduce tax payments legally.

Financial Reporting

Accountants create reports that show how money is earned and spent. These reports help you make smart business and personal decisions.

Compliance

They ensure you follow financial rules and laws. This helps avoid fines or legal problems.

Payroll Management

Accountants manage employee pay and deductions. They make sure everyone is paid correctly and on time.

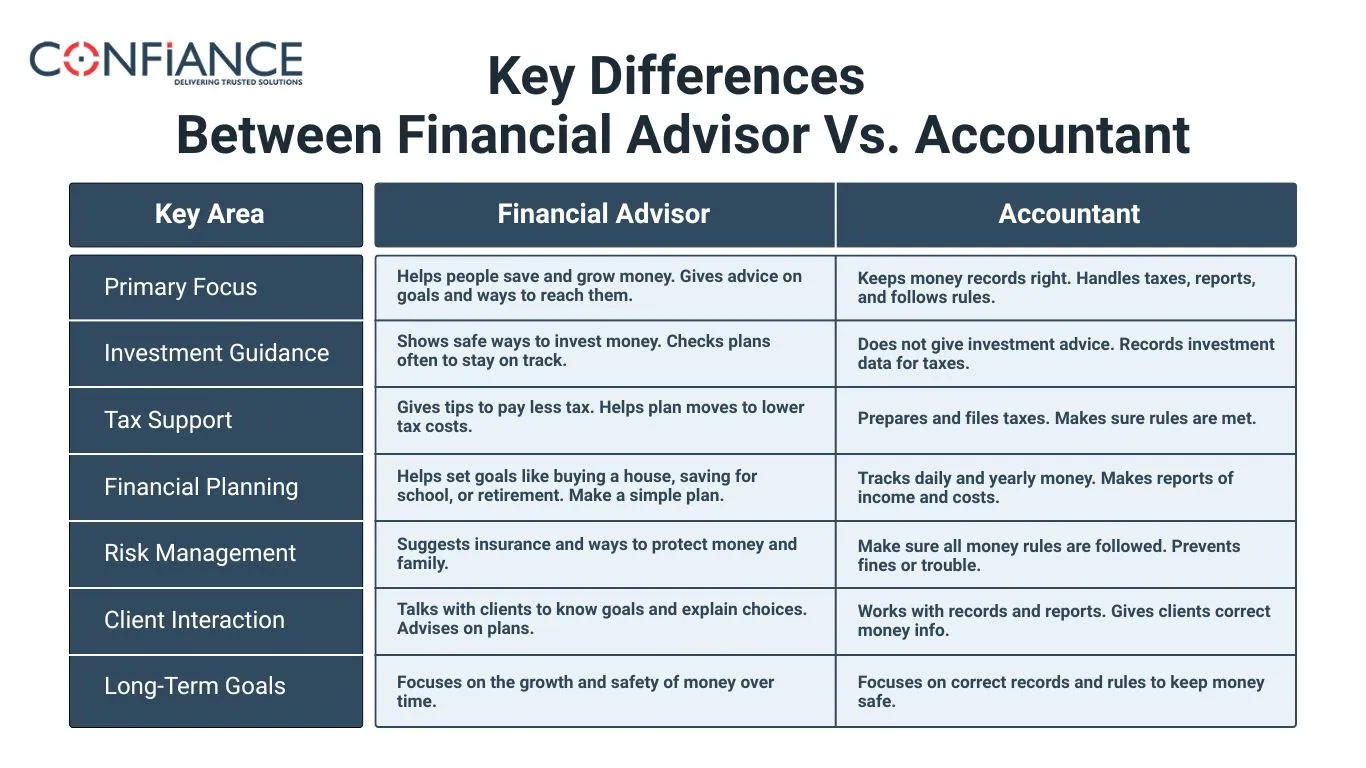

Key Differences Between Financial Advisor Vs. Accountant

Understanding the main points in a Financial Advisor Vs. Accountant can help you pick the right expert for your money and goals. The table below shows what each does:

| Key Area | Financial Advisor | Accountant |

| Primary Focus | Helps people save and grow money. Gives advice on goals and ways to reach them. | Keeps money records right. Handles taxes, reports, and follows rules. |

| Investment Guidance | Shows safe ways to invest money. Checks plans often to stay on track. | Does not give investment advice. Records investment data for taxes. |

| Tax Support | Gives tips to pay less tax. Helps plan moves to lower tax costs. | Prepares and files taxes. Makes sure rules are met. |

| Financial Planning | Helps set goals like buying a house, saving for school, or retirement. Make a simple plan. | Tracks daily and yearly money. Makes reports of income and costs. |

| Risk Management | Suggests insurance and ways to protect money and family. | Make sure all money rules are followed. Prevents fines or trouble. |

| Client Interaction | Talks with clients to know goals and explain choices. Advises on plans. | Works with records and reports. Gives clients correct money info. |

| Long-Term Goals | Focuses on the growth and safety of money over time. | Focuses on correct records and rules to keep money safe. |

When to Hire a Financial Advisor

Hire an advisor when you want help with long-term growth and planning.

Retirement Plans

They make sure you save enough to retire safely.

Investing Money

They guide you on stocks, funds, and safe investments.

Big Life Events

Buying a house, starting a business, or inheriting money may need an advisor.

Full Financial Plans

Advisors combine taxes, investments, insurance, and goals in one plan.

When to Hire an Accountant

Accountants help when you need accurate records and taxes done right.

Tax Time

They make sure taxes are correct and legal.

Business Help

Accountants track money, payroll, and reports for your business.

Audits

They prepare records for reviews or audits.

Budgets

They help keep budgets realistic and manage cash flow.

Mistakes to Avoid with Financial Experts

Even with the right help, mistakes can cut their value. Avoiding these common errors gives better results in both money planning and accounting.

1. Confusing Roles

Many people mix them up. Advisors help grow money and plan for the future. Accountants handle taxes and keep records.

2. Delaying Decisions

Waiting too long to hire an advisor or accountant can lead to missed chances in investments or errors in taxes.

3. Ignoring Communication

Not talking often with your advisor or accountant can cause confusion and gaps in your financial plan.

4. Focusing Only on Cost

Picking only by price may lead to poor service. Skill and experience matter more than low fees.

5. Overlooking Certificates

Make sure your accountant is a CPA and your advisor is a CFP. This helps keep your money safe.

6. Not Sharing Information

If your accountant and advisor do not work together, your financial plan may not work as well.

Tips for Choosing the Right Expert

Picking the right expert helps you manage your money well and stay safe.

1. Check Certificates

Make sure they are certified. Accountants should be CPAs, and advisors should be CFPs. This shows they have the right skills.

2. Ask About Experience

Choose someone who has worked with situations like yours—business, personal, or investments.

3. Look at Communication

Pick someone who explains things clearly and answers your questions quickly.

4. Know the Fees

Find out if they charge a flat fee, an hourly rate, or part of your money. This helps avoid surprises.

5. Choose Someone You Trust

Work with someone you feel safe sharing your money details with.

6. Check References or Reviews

Ask for past client references or read reviews to see if they deliver good results.

How Financial Planning Connects Both Roles

Strong financial planning works best when a financial advisor and an accountant work together.. Each plays a clear role to help you save, grow, and protect money.

Work Together

Accountants keep records clean and up to date. Advisors use this data to plan growth and guide you on safe money moves.

Reduce Taxes

Advisors plan smart steps to pay less tax. Accountants make sure all rules are met and reports are correct.

Better Decisions

Accurate numbers from accountants help advisors pick the right investments. This gives a clear view of how money grows and risks are managed.

Secure Future

Together, they show past, present, and future money health. This joint view makes planning for goals, emergencies, and retirement much easier.

Effective financial planning links both roles. Using each expert’s skills can help you save, invest, and keep money safe while reaching your long-term goals.

Knowing what a financial advisor does vs. an accountant can help you make smart money choices. Accountants keep your records and handle taxes. Advisors help you grow your money and plan. Using both gives you a full and clear view of your money.

At Confiance, we give hands-on support for all your finances. We handle taxes and bookkeeping so your records are accurate and up to date. We also create simple, clear plans to help you save, invest, and reach your goals. With Confiance, your money is safe, your goals are clear, and you have a trusted partner guiding you every step of the way.

FAQs

1. Can an advisor do taxes?

No. A financial advisor helps you plan money, save, and grow it. They do not file taxes. An accountant does that job.

2. Do I need both?

Yes. Financial Advisor Vs. Accountant shows why. An accountant keeps your money records right and files taxes. An advisor helps you plan and grow your money.

3. How often should I meet an advisor?

You should meet at least once or twice a year. Meet more often if big changes happen, like buying a house, starting work, or saving for later. This helps keep your financial planning on track.

4. What skills should I look for?

Accountants should be CPAs. They track money and do taxes. Advisors should have a CFP or CFA. They help you plan, save, and invest.

5. Are financial advisors costly?

Costs differ. Some take a small part of your money. Others charge a flat fee. A good advisor can help you save, plan, and grow your money.

6. How do I pick the right one?

Think what you need. Taxes and books = accountant. Money plans and growth = advisor. Many people use both to cover all their money needs.