Myths About Financial Accounting Outsourcing Services

Running a business takes time, money, and lots of hard work. A big part of any business is keeping track of money. This is called financial accounting. It means watching how money comes in and goes out. It includes jobs like writing down sales, paying bills, checking bank papers, and filing taxes. Today, many business owners use financial accounting outsourcing services. This means they hire trained people from outside the business to help with money tasks. This can save time, lower mistakes, and give better reports.

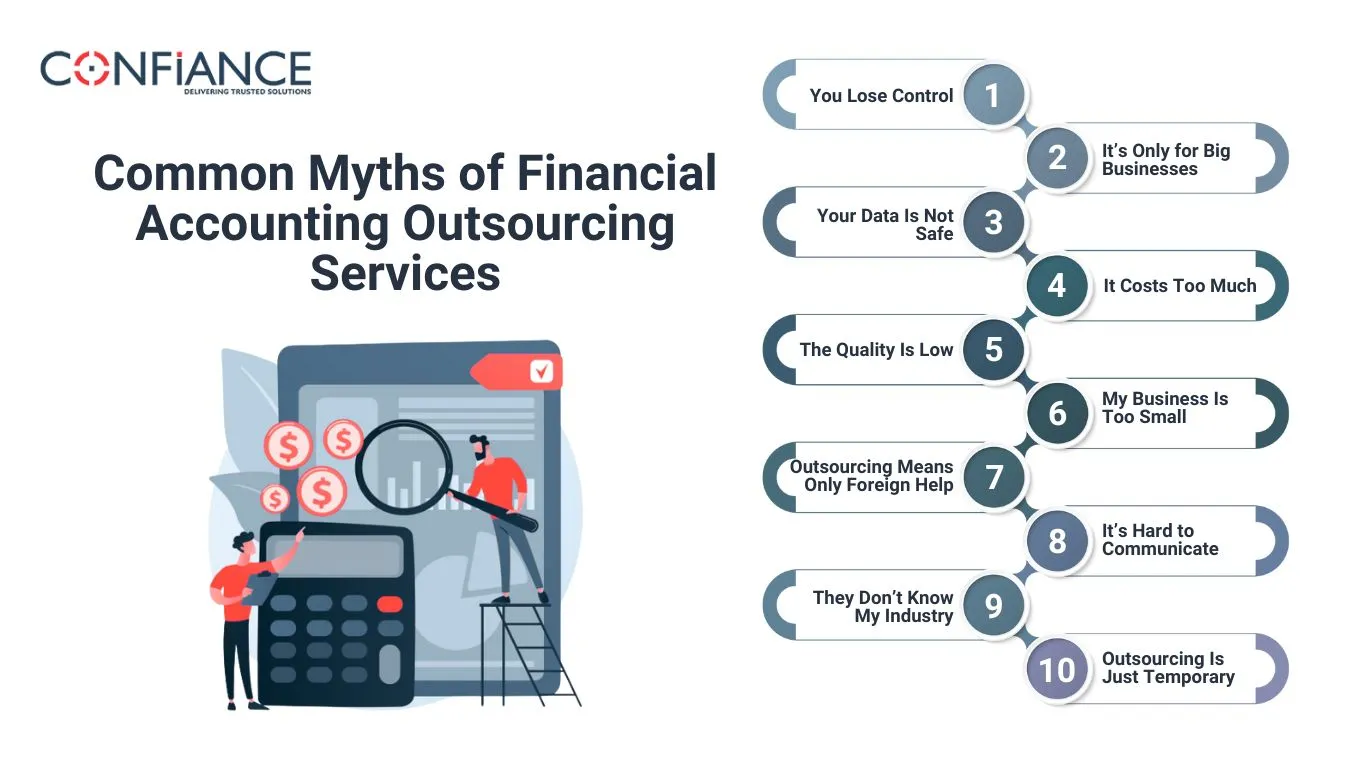

Still, some people feel unsure about outsourcing. Because they believe in myths, things that sound true but are not. These myths can stop a business from getting real help. Let’s look at these myths and learn the truth about financial accounting outsourcing services.

What is Financial Accounting Outsourcing?

Financial accounting outsourcing services help businesses keep track of their money. Instead of doing all the work on their own, business owners hire a team to help. These helpers can live nearby or in another country. They know how to do the job and make sure everything is clear and correct.

Outsourcing can include:

- Tracking income and expenses

- Making financial reports

- Filing taxes

- Handling payroll

- Checking bank records

- Giving advice on money matters

This helps owners focus on growing their business while skilled people manage the books.

Common Myths of Financial Accounting Outsourcing Services

Myth 1: You Lose Control

Some people think that if they outsource accounting, they will not know what’s going on. This is not true. With financial accounting outsourcing services, you still make all the big decisions. The service just does the work for you.

You can still see reports, ask questions, and change things. In fact, outsourcing gives you more control because you get clearer and faster reports.

Myth 2: It’s Only for Big Businesses

Many small business owners believe outsourcing is only for large companies. But this is not true. In fact, financial accounting outsourcing services are perfect for small and mid-size businesses.

Outsourcing lets you get expert help without hiring full-time staff. You only pay for the work you need. This makes it great for small budgets.

Myth 3: Your Data Is Not Safe

Some worry that sending money details outside the company is not safe. But most trusted outsourcing firms use strong safety tools. These include data encryption, passwords, and secure cloud systems.

Top companies follow rules like ISO standards and sign confidentiality agreements. This keeps your data private and protected.

Myth 4: It Costs Too Much

Outsourcing may sound fancy, but it often costs less than hiring in-house workers. When you outsource, you don’t need to pay for office space, full-time pay, or training.

You also avoid mistakes that can cost money later. So, using financial accounting outsourcing services can save money in the long run.

Myth 5: The Quality Is Low

People think that outsourced work is not done well. This can be true if you pick the wrong team. But many outsourcing firms hire trained and certified accountants.

With a good team, the work is done on time and without errors. They follow deadlines and use good software. You often get better quality than doing it all by yourself.

Myth 6: My Business Is Too Small

Some business owners say, “My company is too small to need help.” But even tiny businesses must track money, pay taxes, and keep clean records.

Financial accounting outsourcing services help even solo workers and family shops. No job is too small for a skilled accountant.

Myth 7: Outsourcing Means Only Foreign Help

People think outsourcing always means hiring someone from another country. That’s not always true. You can hire local or nearshore firms too.

What matters most is the skill of the team, not their location. Many trusted firms—both local and offshore offer great service.

Myth 8: It’s Hard to Communicate

Some worry they won’t understand the outsourced team or that the team won’t reply quickly. But today, we have tools like Zoom, email, chat, and cloud systems.

You can talk to your accounting team any time. Good firms give updates and answer fast.

Myth 9: They Don’t Know My Industry

Each business is different. That’s true. But many outsourcing firms work with many kinds of businesses.

Whether you run a shop, a salon, a gym, or a school, there’s a team that knows your industry. They ask the right questions and follow the rules your type of business needs.

Myth 10: Outsourcing Is Just Temporary

Some people believe outsourcing is only a short-term fix. But that’s not true. Many businesses work with outsourcing partners for years.

When you build trust with a good team, they learn your system and help you grow. It becomes a long-term partnership.

Facts About Financial Accounting Outsourcing Services

1. You Stay in Control

Some people think outsourcing means giving up control. But that’s not true.

With financial accounting outsourcing services, you are still the boss. You see reports, make choices, and set the rules. The team just helps you do the work faster and better.

2. It’s Great for Small Businesses

Outsourcing is not just for big companies.

Many small businesses use financial accounting outsourcing services to save time and money. Even solo workers and family shops can use them and grow.

3. It Saves Time and Reduces Stress

Doing all the money work on your own is hard and slow.

Outsourcing helps you focus on your business while the experts take care of the numbers. That’s why many people love financial accounting outsourcing services.

4. You Get Expert Help Without Hiring Full-Time

Hiring a full-time accountant costs a lot. You need to pay salary, taxes, and maybe even benefits.

With financial accounting outsourcing services, you only pay for what you need, nothing more. You still get help from trained and skilled people.

5. It’s Safer Than You Think

Trusted outsourcing companies use safe tools like passwords, encryption, and secure systems.

Most financial accounting outsourcing services also follow global rules like ISO to keep your data safe.

6. It Helps You Stay on Time

Late reports and tax filings can lead to problems and fines.

Outsourced teams send you regular updates and help you meet deadlines. With financial accounting outsourcing services, you stay ready all year.

7. It Costs Less Than You Expect

Some people think outsourcing is too pricey. But it often costs less than hiring someone in-house.

You don’t have to pay for office space, tools, or training. That’s why many choose financial accounting outsourcing services to save money.

8. You Can Scale Up or Down Easily

Outsourcing lets you add or remove support when needed. With financial accounting outsourcing services, you can adjust your plan as your work changes.

9. You Still Get Personal Support

Outsourced teams don’t feel far away. You can talk to them by email, chat, or video call.

Good financial accounting outsourcing services make sure you always feel heard and helped.

10. It’s a Smart Long-Term Choice

Outsourcing isn’t just for short tasks. Many companies work with the same team for years.

Financial accounting outsourcing services can become a trusted partner that grows with your business.

Financial accounting outsourcing services are not risky or unsafe. Some people worry because they trust myths, not facts. But when you pick the right team, outsourcing helps your business stay strong, save money, and grow faster.

At Confiance, we offer safe outsourcing services with our years of experience, expertise, and qualified staff. Whether your business is large or small, outsourcing saves time, cuts errors, and brings better results. Don’t let myths stop you from choosing outsourcing with confidence.

FAQs

- How do I pick the right outsourcing firm?

Look for experience, clear pricing, good reviews, and strong safety steps. Ask for a sample report or test task. - Can I switch back if I don’t like it?

Yes. Most firms allow you to cancel anytime. You can also keep your records and return to in-house work if needed. - Will I still need an accountant?

Yes, but only to check or guide. The outsourced team will do the daily work, and your accountant can review it. - What if I’m not good with numbers?

That’s okay! The outsourcing team explains things in a simple way. You don’t need to be a math expert. - How fast will I see results?

Most businesses see time savings and cleaner records in the first 1–2 months. Over time, you’ll notice better cash flow and fewer mistakes.