How Financial Accounting Affects Business Plans and Decisions

Money drives every business, yet many owners feel lost when it comes to tracking it. Financial accounting is the tool that makes money simple to follow. It shows how cash affects your plans and goals. With clear numbers, owners and managers can plan well, avoid mistakes, and make smart choices. This guide explores how financial accounting guides business plans and decisions. By understanding the numbers, businesses can act with clarity and control, making growth easier

Understanding Financial Accounting

Financial accounting is how a business keeps track of money. It shows what money comes in and what goes out. It makes simple reports that show whether a business is earning or losing money.

Key Features:

- Accuracy: Records match real events. Every sale or bill should be noted.

- Clear Reports: The owner can see total income, costs, and profit at a glance.

- Follow Rules: Reports meet tax and business rules so banks and others can trust them.

- Same Method: Using the same method every month helps compare months easily.

These features give owners clear numbers. They can use the numbers to plan buying new items, hiring staff, or growing the business safely.

Key Financial Statements and Their Importance

Income Statement

Shows money earned and spent over time. Helps see profit or loss and plan future costs. For example, a small café can track how much it earns from coffee sales and what it spends on milk and beans.

Balance Sheet

Shows what the business owns, what it owes, and the owner’s share. This gives a clear view of financial health. For example, the café can see if it has enough cash to pay bills and buy new tables.

Cash Flow Statement

The statement tracks cash coming and going from the business. It is crucial for planning payments, investments, and managing shortages.

Statement of Changes in Owner’s Share

Shows how the owner’s share changes over time. Helps track profit kept in the business and money added by the owner.

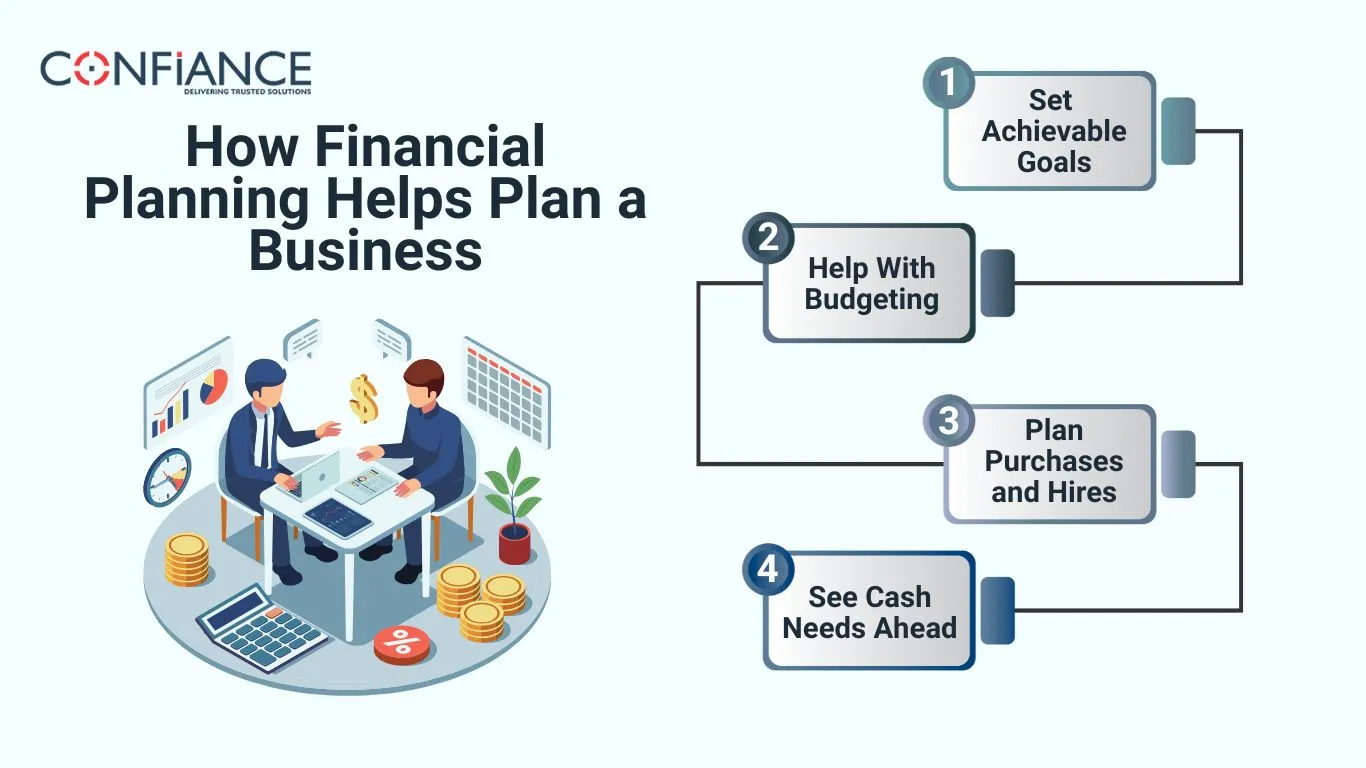

How Financial Planning Helps Plan a Business

Keeping track of money is more than writing numbers down. It shows what comes in and what goes out. This helps owners plan, set goals, and make smart choices. Clear numbers keep the business safe.

Set Achievable Goals

Looking at past income and costs helps owners set goals they can reach. They see what the business can afford, avoid spending too much, and plan steps that the business can actually follow.

Help With Budgeting

Money records help owners plan how to spend. They can track costs, set limits for bills, and make sure cash is enough for the next month. This helps keep the business steady and safe.

Plan Purchases and Hires

Owners can check if they have extra cash. They can decide to buy tools, hire staff, or start small projects. Clear numbers help them choose what is safe and avoid running out of cash.

See Cash Needs Ahead

Records show when money comes in and goes out. This helps owners plan for bills, wages, and other payments. They can make sure cash is ready so the business can run without problems.

The Impact of Financial Accounting on Decision-Making

Decisions are taken with clear and accurate information. Financial accounting provides the facts needed for smart choices.

1. Choosing Growth vs. Savings

Statements show whether it is better to reinvest in business or save for future needs.

2. Pricing and Product Decisions

Knowing production costs helps set prices to secure profits.

3. Risk Management

Identifying high costs or low income allows managers to avoid poor decisions.

4. Stakeholder Decisions

Investors, lenders, and employees depend on accurate financial reports to make funding, loan, or pay-related decisions.

Role of Financial Accounting in Business Planning

Financial accounting is more than keeping books. It guides business plans in many ways:

- Set Realistic Goals: Clear records help owners plan growth, sales, and costs. Seeing what money comes in and goes out makes goals real and practical.

- Guide Investment Decisions: Records show how much money is free. Owners can decide if they can buy tools, hire staff, or start small projects safely.

- Support Budgeting: Past record helps firms to plan their spending. Owners can set limits, track costs, and use money wisely based on those records.

- Plan for Cash Needs: Knowing when money comes and goes helps pay bills, wages, and other costs on time. It keeps the business running smoothly.

- Track Profit and Loss: Regular checks show which areas make money and which cost more. This helps owners focus on the most profitable parts.

- Manage Risks: Clear records show where money may be lost. Owners can fix problems early and avoid surprises.

- Aid Tax Planning: Proper records make tax work easy. Owners can prepare returns on time and avoid fines or mistakes.

How Financial Accounting Shapes Strategic Decisions

A business makes better choices when it knows its money. Records of cash in and out help owners plan and avoid mistakes.

- Grow or Save: If cash is left, owners can buy tools, hire staff, or keep money for the future. Clear numbers help make safe choices.

- Set Prices: Knowing what it costs to make a product helps set a price that brings profit. Owners can change prices if costs rise or fall.

- Avoid Losses: Records show that money is spent too fast, or income is low. Owners can act early to stop waste and save cash.

- Start New Work: Records help decide if the business can start new work, buy items, or grow without running out of money.

- See What Works: Owners can check which parts make money and which lose money. They can focus on strong areas and fix weak ones.

- Handle Loans: Banks need clear numbers. Records help owners show they can pay back money and manage growth safely.

Financial Accounting and Cash Flow Management

Cash flow is key for a business to run well. Money records show cash coming in and going out. They help owners make sure there is enough cash for day-to-day work.

Forecast Cash Needs

By looking at records, owners can see when cash will be needed. This helps plan for bills and wages in advance. It also stops shortages that could slow down the business.

Control Spending

Money records show that cash is spent too fast. Owners can cut extra costs or find cheaper ways to pay for things. This helps keep profit higher and cash on hand.

Plan for Emergencies

Unexpected costs can appear anytime. Clear records let owners save money for these events. They can set aside funds for emergencies without stopping normal work or harming the business.

How Money Records Affect Stakeholders

Money records are not just for owners. They also help investors, lenders, and staff make smart choices. Clear numbers build trust and guide key decisions.

Build Investor Trust

Accurate records help investors see how the business is doing. They can check if the business makes a profit and decide if their money is safe to invest.

Help Lender Decisions

Banks and lenders look at money records before giving loans. Good records help the business get loans faster and with better terms.

Guide Staff Planning

Owners can use money records to plan wages, benefits, and hiring. Clear data helps decide who to hire and how to spend money fairly for staff needs.

Common Challenges in Financial Accounting

Even with good systems, businesses face problems that can affect plans. Clear records help, but owners must watch for common issues.

Missing Records

If bills, invoices, or receipts are lost, numbers can be wrong. This may lead to bad choices. Keeping all papers safe and updated helps avoid mistakes.

Wrong Reading

Looking at reports without understanding can cause wrong steps. Owners and staff need simple training to read numbers correctly and make smart choices.

Overlooked Small Expenses

Small costs can add up fast. Not tracking them can reduce profit and hide true cash flow. Regular checks help spot and control these minor expenses.

Late Updates

Delays in recording sales or bills make reports less useful. Keeping records current ensures decisions are based on real numbers, not old or missing data.

Tips for Using Financial Accounting Effectively

Keep Records Current

Update financial data regularly to have accurate and timely information.

Use Accounting Software

Tools make recording and reporting faster and reduce errors.

Review Reports Frequently

Don’t wait for the month-end. Reviewing statements often helps spot trends and act early.

Train Staff

Employees who handle finances should understand basic accounting principles to avoid mistakes.

Financial accounting helps businesses grow by giving clear info to plan well, make smart choices, and keep good control of money. At Confiance, we help you use financial accounting in simple and useful ways. Our team makes sure all reports are right, easy to read, and follow the rules. We tailor our help to match your business size and goals. Plus, our safe systems keep your data secure and easy to get when you need it. With Confiance, financial accounting becomes a key tool for planning, budgeting, and guiding important business choices.

FAQs

- Why use money records for my business?

Money records show cash in and out. They help plan budgets, check profits, and make smart choices for the business. - How do I know reports are right?

Look for clear numbers and notes that match real events. Good reports track all cash and bills correctly. - Can money records help set goals?

Yes. They show trends in income and costs. Owners can then set goals that they can reach. - Which reports help most for decisions?

Income reports, balance sheets, and cash flow reports matter most. They show profits, what the business owns, what it owes, and cash on hand. - How often should I check reports?

Check at least once a month. This helps catch problems early, control spending, and plan new work. - Can small businesses use them too?

Yes. Even a small shop can track money, plan growth, and avoid losses with good records. - How do money records help with spending or projects?

They show how much cash is free, expected gains, and risks. Owners can then spend wisely or start projects safely.