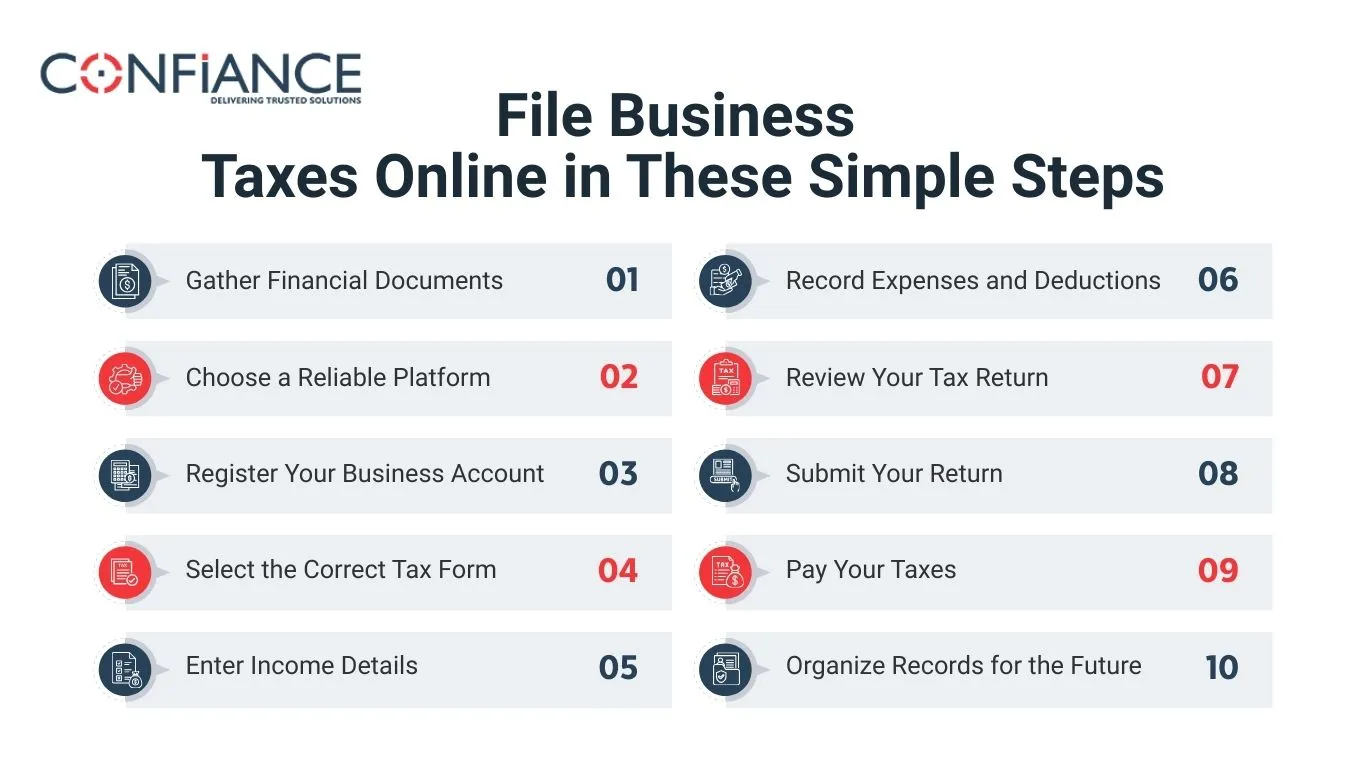

File Business Taxes Online in These Simple Steps

You can easily file business taxes online to save time and avoid mistakes. Many business owners still rely on paper forms. Paper filing can take several days or weeks. Also, mistakes are common when using manual methods. Online filing allows you to submit returns from anywhere. It gives instant confirmation and keeps records secure. In this blog, we will explain step-by-step instructions to file business taxes online correctly and efficiently.

Why Filing Taxes Online Matters

Filing taxes online is faster than paper submission. Errors are less likely with automatic calculations. Digital systems store your records safely. Authorities process online returns more quickly. All types of businesses benefit, both small and large. Online filing allows easy access to past records. It also simplifies future filings.

Online filing is reliable and convenient. It saves office resources like paper and printing. Business owners can focus more on operations. Online systems often provide help guides. Notifications remind you of deadlines. These advantages make the process smoother.

Step 1: Gather Financial Documents

Before filing, collect all records for the year. Important documents include:

- Bank statements

- Income statements

- Expense receipts

- Invoices

Sort documents by month or category. Organized records save time and reduce errors. Keep documents ready for verification if authorities request them. Accurate documents ensure the tax return is complete. Missing documents can cause delays.

Also, include previous year’s tax filings. Review recurring expenses and income. This helps identify overlooked entries. Maintaining detailed records improves compliance. Proper organization reduces stress during filing.

Step 2: Choose a Reliable Platform

Select an online platform that fits your business needs. Look for these features:

- Support for your business type

- Automatic tax calculations

- Error detection

- Secure data storage

Choose platforms approved by tax authorities. A reliable platform guides you step by step. It reduces mistakes and speeds up filing. Platforms often provide tips for common errors. Some platforms connect directly to bank accounts. This saves time during data entry.

Always check reviews and recommendations. Ensure customer support is available. A good platform helps you avoid penalties. Avoid using unverified or unsecure websites. Security is crucial for sensitive financial data.

Step 3: Register Your Business Account

Most platforms require account creation. Provide official business details such as:

- Business name

- Tax identification number

- Contact information

Verify your account via email or mobile. Registered accounts link filings to your business. They allow access to previous submissions. Registration helps during audits or reviews. A verified account increases system reliability.

Keep login credentials secure. Change passwords periodically. Avoid using shared devices for filing. Secure accounts prevent unauthorized access. Account verification confirms authenticity with authorities.

Step 4: Select the Correct Tax Form

Choose the form based on your business type:

- Sole proprietors use one form

- Partnerships have a different form

- Corporations use another form

Platforms usually suggest the correct form. Double-check before submitting. Using the wrong form can delay processing. Review the instructions carefully. Each form has specific fields for income and deductions.

If unsure, consult tax guides or professionals. Correct form selection ensures smooth submission. Avoid skipping sections in the form. Errors in selection may trigger audits. Proper form choice simplifies future filings.

Step 5: Enter Income Details

Report all income earned during the year. Include:

- Sales revenue

- Service fees

- Other sources

Platforms may allow spreadsheet uploads or bank connections. Accuracy is crucial to avoid penalties. Keep supporting documents ready for verification. Correct reporting ensures compliance.

Include occasional or irregular income. Check previous records for consistency. Review totals to confirm correctness. Double-check all numeric entries. Accurate income data is the foundation of correct taxes.

Step 6: Record Expenses and Deductions

Enter all eligible expenses:

- Rent

- Salaries

- Utilities

- Office supplies

Categorize each expense correctly. Platforms often suggest common deductions. Double-check entries for mistakes. Keep receipts for every deduction. Correct deductions lower taxable income.

Include recurring and one-time expenses. Review past tax returns for overlooked entries. Ensure all expenses are documented. Proper expense recording prevents audits. Accurate deduction records save money.

Step 7: Review Your Tax Return

Even if the system calculates automatically, check every entry. Verify:

- Total income

- Deductible expenses

- Final tax amount

Preview your return before submission. Correct errors early to avoid penalties. Ensuring accuracy provides peace of mind. Cross-check calculations manually if needed. Confirm all supporting documents are uploaded.

Review additional forms if needed. Confirm that totals match supporting records. Validate that deductions are allowed. Double-check for typos in amounts. Thorough review prevents costly mistakes.

Step 8: Submit Your Return

Submit your tax return online.

- Use electronic signature if required

- Save acknowledgment for records

- Confirm submission is complete

Online submission is faster than mailing forms. Authorities process digital returns quickly. Keep the confirmation for future reference. Some platforms send email notifications. Ensure your internet connection is stable.

Check that submission timestamps are recorded. Retain copies for audits. Verify that attachments are uploaded correctly. Re-submit if confirmation is missing. Submission verification ensures compliance.

Step 9: Pay Your Taxes

Pay taxes immediately after submission. Options include:

- Bank transfer

- Direct debit

- Online payment gateway

Confirm payment success. Timely payment avoids penalties or interest. Save payment confirmations for records. Review payment amounts carefully. Ensure bank details match records.

Keep proof of payment for audits. Check for payment errors promptly. Retain transaction IDs for reference. Confirm that the platform has marked payment as complete. Payment verification ensures full compliance.

Step 10: Organize Records for the Future

Store copies of tax return and documents:

- Use secure cloud storage or digital folders

- Organize files by year or type

- Keep receipts and acknowledgments

Organized records make audits easier. They simplify future filings. They help track business performance. Include digital and physical copies if needed. Label files clearly for quick reference.

Maintain backups on separate devices. Ensure files are readable and complete. Update storage regularly with new records. Proper record organization prevents loss. Efficient storage ensures readiness for inspections.

Tips for Smooth Online Filing

- Use secure internet connections

- Keep business and personal accounts separate

- Double-check all entries

- Update your platform regularly

- Stay aware of tax law changes

- Seek professional help for complex filings

Following these tips reduces errors and ensures faster processing. Preparation simplifies filing and prevents stress. Regular checks keep data accurate. Notifications help avoid missed deadlines. Planning ahead saves time and prevents penalties.

Common Mistakes to Avoid

- Selecting the wrong tax form

- Missing income or expense entries

- Filing or paying late

- Using unsecure platforms

- Ignoring confirmation receipts

Avoiding these mistakes prevents fines and delays. Careful review ensures accurate submission. Keep backup copies of all files. Double-check payment confirmations. Accurate entries protect your business.

Benefits of Filing Online

- Faster processing: Authorities review returns quickly

- Fewer mistakes: Automatic calculations reduce errors

- Time-saving: File from anywhere without travel

- Secure records: Digital files are safe and accessible

- Instant confirmation: Receive receipt immediately

Online filing improves efficiency for all businesses. It reduces stress and manual effort. Digital systems make record keeping easy. Returns can be tracked for reference. Filing online is a modern solution for businesses.

How Online Filing Helps Small Businesses

Small businesses often lack dedicated accounting staff. Online filing:

- Reduces paperwork

- Tracks income and expenses clearly

- Provides access to past returns

- Sends reminders for deadlines

This ensures compliance and saves time. Small owners can focus on operations. Notifications help meet deadlines. Automated calculations prevent errors. Efficient filing helps small businesses grow.

How Online Filing Helps Large Businesses

Large businesses handle complex transactions. Online filing:

- Integrates multiple accounts

- Reduces human errors

- Secures large volumes of data

- Allows simultaneous access for teams

This improves audit readiness and simplifies processing. Large companies can track multiple departments. Errors are minimized with automation. Platforms support team collaboration. Filing online saves resources and ensures compliance.

Step-by-Step Example

- Gather all income and expense documents

- Choose a reliable online platform

- Register account and verify details

- Select correct tax form

- Enter all income

- Enter deductible expenses

- Review the return carefully

- Submit online and save acknowledgment

- Pay taxes through secure methods

- Store all records for future use

Following these steps ensures accurate filing. Each step reduces mistakes and saves time. Digital filing streamlines the process. Documentation ensures transparency. At Confiance, we help filing taxes for businesses of all types. Contact us now for expert tax services and keep your business tax ready.

FAQs

- Can I file business taxes online for the first time?

Yes, new users can register and follow platform instructions easily. - Are online filings secure?

Yes, approved platforms use encryption to protect all data. - How long does online filing take?

It can take thirty minutes to a few hours depending on documents. - Can I correct mistakes after submission?

Most platforms allow amendments if errors are found. - Do I need professional help?

Not always, but experts can assist with complex calculations. - Is online filing legally recognized?

Yes, submissions through approved platforms are accepted by authorities. - How do I pay taxes online?

Payment options include secure bank transfer or online gateway.