Top Features of Gusto Accounting You Should Know

Managing payroll and employee benefits is often a challenge for small businesses. Traditional payroll tools can feel complex and time consuming. This is where Gusto Accounting stands out. It simplifies payroll while adding strong accounting support. Many professionals also use Gusto for accountants because it connects payroll with bookkeeping and reporting in one system.

In this blog, we will explore the top features of Gusto Accounting in detail. Each section explains why businesses and accountants choose Gusto and how it supports accurate payroll and financial tasks.

Introduction to Gusto Accounting Software

Gusto Accounting is more than payroll software. It combines payroll, benefits, tax filing, compliance, and financial reporting in one platform. Small businesses trust it because it saves time and improves accuracy. Accountants recommend it because it creates clean records that fit directly into financial reports.

For firms offering payroll support, Gusto for accountants provides tools to manage multiple clients, automate tasks, and keep everything organized. Instead of juggling separate tools, Gusto centralizes key functions in one system.

Why Businesses Choose Gusto Accounting

Businesses adopt Gusto Accounting because it reduces manual work. Payroll can run with a few clicks. Taxes file automatically without extra steps. Employee benefits integrate without outside systems. Reports generate instantly.

Using Gusto for accountants is useful because it removes duplicate data entry. Payroll data flows directly into books. Reports show exact expenses for wages, benefits, and taxes. Clients see clear financial snapshots at any time.

Core Features of Gusto Accounting

Below are the most important features of Gusto Accounting. Each section explains what makes it effective for both businesses and accountants.

1. Full-Service Payroll

Payroll is the core of Gusto Accounting. The system runs payroll in minutes. Business owners can set schedules, add hours, and pay employees or contractors. Direct deposit ensures quick payments.

- Gusto calculates wages with accuracy.

- Federal, state, and local taxes calculate automatically.

- Tax forms file on time without extra effort.

- Contractors receive 1099 forms prepared automatically.

Accountants benefit because payroll data stays clean. No need to enter figures manually. Everything syncs with books for accurate reports.

2. Automatic Tax Filing

Tax compliance is stressful for small businesses. Gusto Accounting removes this burden.

- Federal and state payroll taxes calculate in real time.

- Gusto files tax forms automatically with authorities.

- Annual filings like W-2 and 1099 generate and send to employees.

- Accountants can review filings anytime.

With Gusto for accountants, firms reduce errors and save hours during tax season. Clients get peace of mind knowing taxes are accurate and on time.

3. Employee Benefits Integration

A strong workplace offers benefits like health insurance, retirement plans, and more. Gusto Accounting makes benefits part of payroll without extra software.

- Medical, dental, and vision benefits link directly with payroll.

- 401(k) and retirement contributions update automatically.

- Employee accounts allow self-service for enrollment.

- Benefits show in payroll reports with full detail.

This feature supports businesses that want to keep employees happy while staying compliant. For accountants, integrated benefits mean accurate cost tracking.

4. Compliance Management

Payroll and benefits come with strict rules. Gusto Accounting helps businesses stay compliant.

- New hire reports file with state agencies automatically.

- I-9 and W-4 forms stay stored digitally.

- State-specific rules like workers’ compensation integrate directly.

- Automatic alerts show deadlines or compliance updates.

Using Gusto for accountants ensures that firms never miss compliance tasks for their clients. This feature reduces legal risks and keeps records audit ready.

5. HR Tools and Employee Self Service

Gusto Accounting is not just payroll. It also provides simple HR features.

- Businesses can create offer letters and onboard new employees online.

- Employees log in to update personal details, download pay stubs, and manage tax forms.

- Time tracking links with payroll for hourly workers.

- Performance review tools support employee management.

These features cut down on manual HR tasks. Accountants appreciate that employees handle their own updates, reducing errors in payroll data.

6. Reporting and Insights

Financial data is valuable only when it is clear. Gusto Accounting provides strong reporting features.

- Payroll reports show wages, benefits, and taxes by employee or department.

- Custom reports help businesses review labor costs.

- Accountants can export payroll data into accounting software.

- Year-end summaries give a clear view of expenses.

Gusto for accountants allows firms to share simple reports with clients. This builds trust and supports better financial planning.

7. Integration with Accounting Software

Most businesses use accounting software like QuickBooks or Xero. Gusto Accounting connects with these tools directly.

- Payroll data flows into accounting books automatically.

- Wage expenses and tax entries sync without manual input.

- Contractors and vendor payments map correctly.

- Reports remain consistent across platforms.

For accountants, integration removes the need for cross-checking. Financial records stay accurate at all times.

8. Contractor Payments

Many businesses work with contractors. Gusto Accounting supports both employees and contractors.

- Contractors can be paid with direct deposit.

- No separate system is needed for contractors.

- 1099 forms generate and file automatically.

- Expenses remain clear in payroll records.

Gusto for accountants makes it easy to manage clients who rely heavily on contractors. Clean contractor records save time during tax filing.

9. Multi-State Payroll

Some businesses operate across states. Managing payroll for different states can be complex. Gusto Accounting handles this with ease.

- State tax rules apply automatically based on employee location.

- Gusto registers new states for payroll when needed.

- Tax filings cover all states accurately.

This feature supports growth without adding stress. For accountants, multi-state support means accurate filings no matter where employees live or work.

10. Accountant Tools and Partner Program

Gusto for accountants offers unique benefits. Firms that support multiple clients get special features.

- A dashboard allows accountants to view and manage all clients in one place.

- Firms can run payroll for clients or allow clients to run it with guidance.

- Partner perks include discounts, training, and marketing resources.

- Dedicated support ensures firms get quick help when needed.

This feature turns Gusto into a complete solution for accountants who want to offer payroll as part of their services.

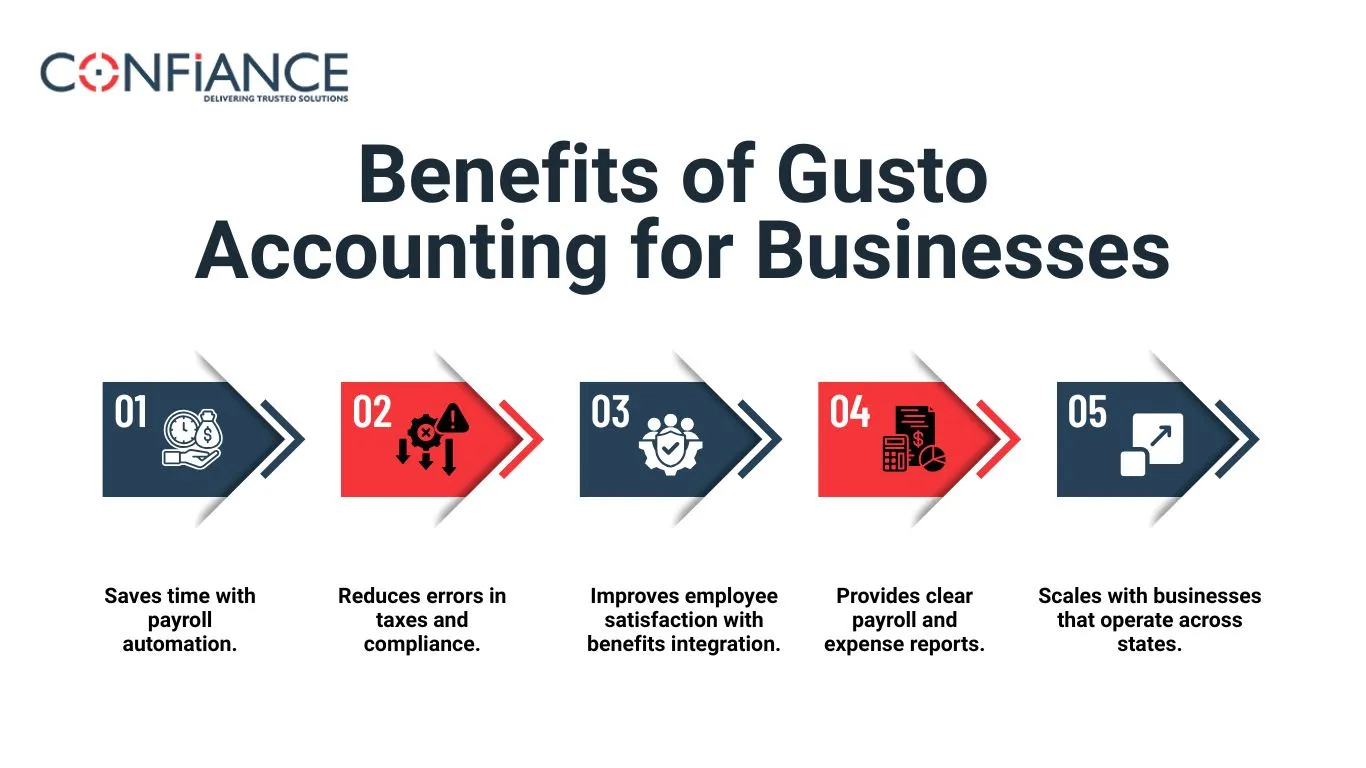

Benefits of Gusto Accounting for Businesses

Choosing Gusto Accounting brings clear benefits:

- Saves time with payroll automation.

- Reduces errors in taxes and compliance.

- Improves employee satisfaction with benefits integration.

- Provides clear payroll and expense reports.

- Scales with businesses that operate across states.

Businesses appreciate that they can manage payroll, benefits, and compliance from one system. This simplicity is one of the main reasons Gusto Accounting is popular.

Benefits of Gusto for Accountants

Accountants gain direct value from using Gusto Accounting software:

- Access multiple client accounts from one dashboard.

- Reduce manual data entry through integration with accounting software.

- Save hours during tax season with automated forms.

- Provide clients with clear payroll and expense reports.

- Build stronger client relationships with reliable payroll support.

Accountants often add Gusto as part of their service package. This adds value to clients while improving workflow efficiency.

How Gusto Accounting Supports Growth

Small businesses want tools that grow with them. Gusto Accounting supports growth in several ways:

- Handles payroll from one to hundreds of employees.

- Supports contractors and full-time staff together.

- Adds benefits as businesses expand.

- Works across multiple states without extra steps.

Accountants also grow with Gusto. As firms add new clients, the Gusto for accountants dashboard keeps everything organized.

Security and Data Protection

Payroll and accounting data must stay secure. Gusto Accounting applies strong protections.

- Data is encrypted during transfer and storage.

- Multi-factor authentication protects logins.

- Secure servers ensure safe access to payroll records.

- Employee information remains confidential.

For accountants, data security builds trust with clients. Clients feel safe knowing their payroll data is protected.

Customer Support and Resources

Support matters when using payroll and accounting software. Gusto Accounting offers strong resources.

- Live chat and phone support guide businesses and accountants.

- A help center provides articles and tutorials.

- Webinars and training help firms use features effectively.

- Partner program resources support accountants with clients.

This support system ensures users never feel lost while using Gusto.

Gusto Accounting is a strong choice for small businesses and accountants. It combines payroll, benefits, compliance, and reporting in one platform. Businesses can save a lot of time and improve efficiency by using immersive features of Gusto.

At Confiance, we provide everything from payroll automation to benefits integration, compliance management, reporting, and multi-state support using Gusto Accounting Software.

If you want payroll and accounting to work together smoothly, contact us now and get efficient workflows. We ensure a complete solution for payroll and financial management of your business.

FAQs

- Why should I use Gusto for my business?

Gusto makes payroll easy. You don’t have to jump between apps. Taxes, benefits, and reports are all in one place. It just saves a lot of time. - Does it handle taxes on its own?

Yes, mostly. Gusto calculates and files the forms. You still check them, but you don’t have to worry about missing dates. - Can employees manage their own benefits?

They can. They log in, update info, see pay stubs. It cuts down questions to HR and keeps things simple. - Can accountants handle multiple clients easily?

Yes. There’s a dashboard for all clients. You can check payroll and reports without switching accounts or tools. - Will it save hours during tax season?

For sure. Forms like W-2s and 1099s get made automatically. You just review and approve. It’s much faster than doing it by hand. - Can I pay contractors and staff in the same system?

Yes. You don’t need a separate tool. 1099 forms are made automatically too. - What about employees in different states?

Gusto handles it. State taxes apply automatically. You don’t need to figure it out yourself. - Can I connect it with QuickBooks or Xero?

Absolutely. Payroll info goes straight to accounting books. No double entry. Numbers stay clean. - Can I see benefit costs clearly?

Yes. Health, dental, vision, 401(k) — all show up in reports. You get a clear picture in one place. - Is my payroll data safe?

Yes. Gusto uses encryption and secure servers. Multi-factor login adds extra protection. You can feel safe. - Can I make custom reports?

Yes. Reports can be by employee, team, or dates. You see what matters without extra work. - Does Gusto remind me about deadlines?

It does. Payroll, benefits, tax filing — you get alerts. You don’t have to keep a separate calendar. - What if I get stuck using it?

Support is easy to reach. There’s chat, phone, guides, and webinars. You can fix problems fast. - Will it grow as my business grows?

Yes. Add more staff, contractors, or states anytime. It scales with you, so you don’t have to switch later.