Everything You Need to Know About Cost Accounting and Its Types

Cost tracking is an important way for any business to check costs. It shows how much it costs to make products, give services, or run daily work. With cost accounting, businesses can track spending and keep costs low. It helps managers see where money goes. It also shows simple ways to save. Cost tracking also helps in planning, setting prices, and checking if each product or service makes a profit. In this article, we will cover all you need to know about cost accounting and its types in clear and simple words.

What Is Cost Accounting?

Cost accounting is the process of tracking, recording, and reporting business costs. Unlike financial accounting, which shows profit or loss for the whole business, cost accounting focuses on each cost. It helps businesses know where money goes and how to cut waste.

Why It Matters

- Budget Tracking: Shows spending vs budget.

- Pricing Help: Helps set the right product price.

- Profit Plans: Shows which products make money.

- Better Use of Resources: Shows where money or materials are wasted.

Cost tracking gives a clear view of costs. This helps plan better, save money, and increase profit.

Main Goals of Cost Accounting

Cost accounting has four main goals. Each helps a firm track costs, save money, and make smart choices.

1. Finding Product Costs

It tracks costs for raw materials, labor, and overhead. This shows how much each product or service costs. It also helps managers see which items cost more and need changes to save money.

2. Controlling Costs

Cost tracking checks actual costs against planned costs. This helps find and fix waste. It also shows where staff, tools, or materials are used too much, so changes can be made fast.

3. Planning for Profit

Knowing costs helps managers plan for profit. They can decide which products to push or stop. It also helps set fair prices so each item or service adds to the gain.

4. Helping Decisions

Cost data helps management make choices about pricing, hiring, or buying. Without it, decisions can be guesses. It also helps lead to seeing which jobs or products are worth more work or less.

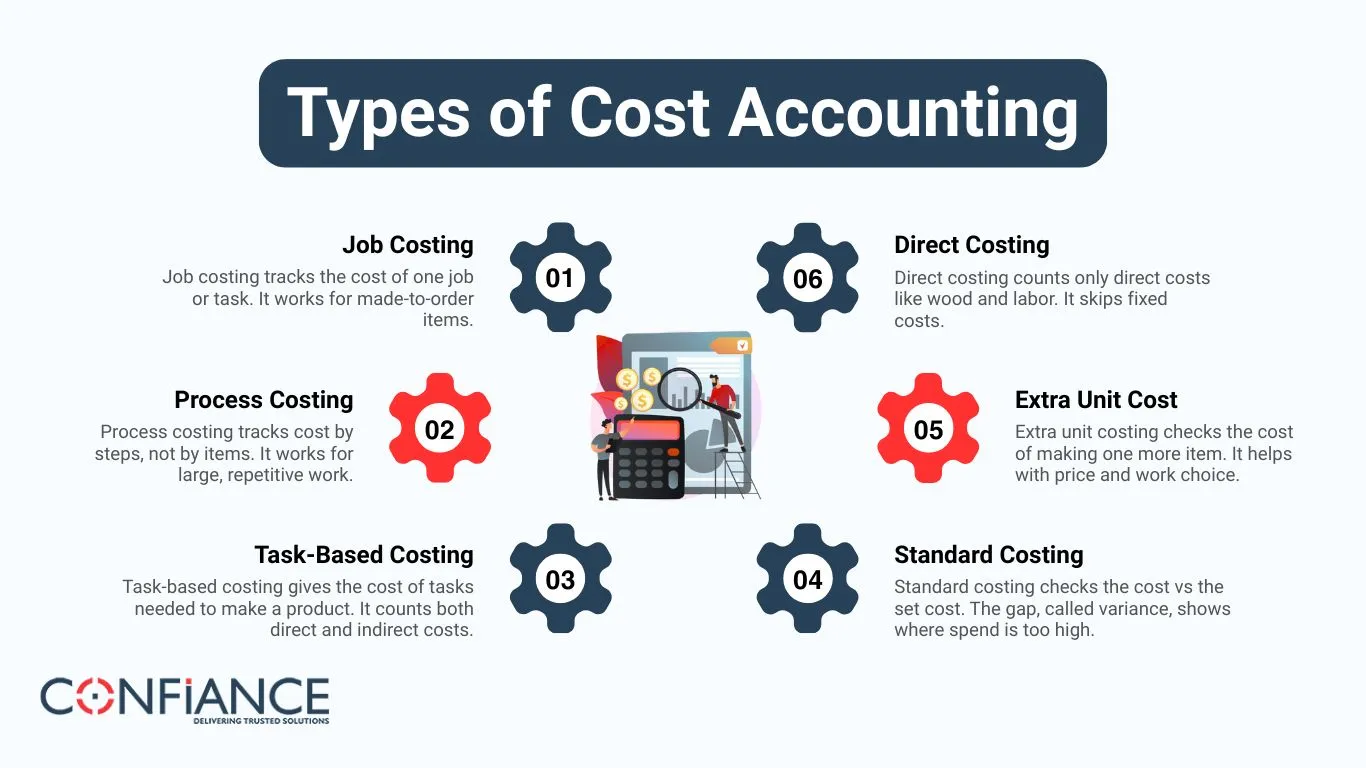

Types of Cost Accounting

There are many ways to do cost work. Each helps a firm see costs, save money, and plan work.

1. Job Costing

Job costing tracks the cost of one job or task. It works for made-to-order items.

- Example: A builder uses job costing to build one house. They check the cost of wood, tools, and work for this house.

- Benefit: Shows the exact cost of a job. Managers can set a fair price and gain from each project.

2. Process Costing

Process costing tracks cost by steps, not by items. It works for large, repetitive work.

- Example: A paint firm tracks the cost of each batch. They note the cost of paint, labor, and machines.

- Benefit: Makes costing easy for many units. Shows which steps cost more and where to save.

3. Task-Based Costing

Task-based costing gives the cost of tasks needed to make a product. It counts both direct and indirect costs.

- Example: A car firm tracks the cost for fit, paint, and check. Each task shows the cost it adds.

- Benefit: Gives a true view of product cost. Helps find tasks that cost too much and cut waste.

4. Standard Costing

Standard costing checks the cost vs the set cost. The gap, called variance, shows where spend is too high.

- Example: A bakery sets a cost for a cake and compares it to the real cost. They track flour, sugar, and work.

- Benefit: Shows waste and helps save money. Managers can adjust the process to cut extra costs.

5. Extra Unit Cost

Extra unit costing checks the cost of making one more item. It helps with price and work choice.

- Example: A factory makes 1,000 units and wants the cost of unit 1,001. They count only extra wood and labor.

- Benefit: Useful for short-term choices. Helps see if extra units bring more gain or loss.

6. Direct Costing

Direct costing counts only direct costs like wood and labor. It skips fixed costs.

- Example: A desk maker counts wood and labor only. Rent or power is not counted.

- Benefit: Simple and fast for a quick choice. Managers can set prices and see a gain quickly.

How Cost Accounting Works

It uses different ways to track and report costs. The choice depends on the business type and the needs of the manager. It helps plan, control, and save money while giving clear views of expenses.

1. Historical Costing

Records costs after they happen. Simple but may not reflect current prices. It is useful for seeing past spending and checking how money was used.

2. Estimated Costing

Predicts costs before production. Helps in planning and budgeting. This method allows managers to plan resources, avoid overspending, and set clear financial goals.

3. Standard Costing

Uses set costs for materials, labor, and overhead. Checks actual costs against these to find differences. It helps spot waste and see if products meet profit goals.

4. Marginal Costing

Focuses on the cost of one extra unit. Helps with pricing and profit planning. This method also shows how changes in production affect total cost and profit.

Benefits of Cost Tracking

Cost tracking helps businesses in many ways:

- Control Costs: Shows where money goes too fast. It helps managers spot waste and find simple ways to save more money.

- Set Prices Right: Makes sure products cover cost and earn profit. It helps set fair prices that are easy for customers and good for the business.

- Boost Profit: Focus on products that make money. Knowing costs and sales helps avoid loss and improve earnings.

- Better Decisions: Gives clear data for smart choices. Helps managers plan growth, hire staff, and invest in the right projects.

- Use Resources Well: Cuts waste of materials, labor, and time. Make sure staff, tools, and materials are used in the best way.

- Plan Budgets: Helps make clear and real budgets for projects, production, and daily work. Reduces the chances of spending too much.

- Track Performance: Shows which products, services, or projects do well and which need change. Helps make work more efficient.

Cost tracking is more than a finance tool. It helps managers run the business well, make smart choices, and grow profits step by step.

How Cost Tracking Is Used

Cost tracking works in many fields:

1. Manufacturing

Tracks raw materials, labor, and overhead to see which products make money.

2. Service Businesses

Tracks costs for each service or project.

3. Retail

Tracks product costs, stock, and profit margins.

4. Construction

Uses job costing to track project costs and manage budgets.

Cost Tracking Challenges

Cost tracking has some problems:

- Complex Methods: ABC or standard costing can be tricky.

- Data Must Be Right: Wrong numbers lead to bad decisions.

- Changing Costs: Prices change, making old data less useful.

- Extra Effort: Needs staff or software to run well.

Businesses should pick a method that is easy to use, accurate, and fits cost limits.

Tips for Better Cost Tracking

- Keep It Simple: Don’t track unnecessary details.

- Update Often: Track costs regularly.

- Use Software: Makes calculations and reports faster.

- Train Staff: Employees should know how to track costs.

- Check Differences: Review variances to reduce waste.

Cost accounting is essential to knowing expenses, saving money, and making a profit. Different types, like job costing, process costing, and ABC, serve different needs. By using cost tracking, managers make smart choices, control costs, and plan for growth.

At Confiance, we make this process easy with clear cost tracking, regular reports, and expert guidance. From job costing to process costing and activity-based costing, we help you choose the best method for your business needs. Partner with us to streamline cost accounting, improve budgeting, and strengthen profit control for your business.

FAQs

- What is cost accounting?

It is a way to track, write down, and check costs. It helps see where cash goes and how to earn more gain. - Why is cost tracking important?

It keeps costs low, sets the right price, plans gain, and helps make smart choices for growth. - What are the main types of cost accounting?

Job costing, process costing, task-based costing, set costing, extra unit costing, and direct costing. Each tracks and reports costs its own way. - How does job costing work?

Job costing tracks the cost of one job or task. Helps find the exact cost and set price. - How does task-based costing help?

Gives the cost of the tasks done to make an item. Shows clear cost per item or job. - Can small firms use cost tracking?

Yes. Small firms can track costs, keep cash low, and earn more gains in simple ways. - How can cost tracking help choices?

Shows which items or jobs make a gain and which cost too much. Helps make smart, clear choices. - How does cost accounting help plan work?

It helps make plans for jobs, work, and daily tasks. Avoids waste and uses cash well.