Easily File Form 1065 Online for Free

In the beginning, filing partnership taxes can feel challenging. But, it is simple once you know how to do it correctly. .If you have a general partnership, limited partnership, or multi-member LLC, you likely need to file partnership form 1065 every year to report income, expenses, and how profits are split between partners. You might have always wondered how you can file Form 1065 online for free.

In this blog, we will let you know how you can file it online without paying a fee. Several IRS-approved platforms let you complete and submit it electronically at no cost. We will also cover what Form 1065 includes, what details you need, and how to file it online for free.

What is Form 1065?

Form 1065 is an IRS return for partnerships. It tells the IRS how much business income was earned or lost during the tax year. It also shows who the partners are and how profits are split. Unlike other returns, the partnership does not pay income tax directly. Instead, each partner has to pay taxes as per their share of the income.

If you have a general partnership, limited partnership, or LLC with more than one member, you likely need to file this form.

When is Form 1065 Due?

The IRS deadline for Form 1065 is March 15 for most partnerships, making it a key date in the partnership tax filing calendar. If there is a weekend or holiday on March 15, the deadline shifts to the next business day. You can easily request for a six-month extension using Form 7004. Even with an extension, partners still need their Schedule K-1 on time to file their income tax returns.

Can You File Form 1065 Online?

Yes. You can file Form 1065 online through the IRS Modernized e-File (MeF) system. The IRS allows approved tax software providers to send your return electronically. If your partnership has more than 100 partners, you must e-file.

Many online services support free filing, especially for smaller partnerships. You do not need to pay high fees or hire an accountant if your books are clean and you are comfortable entering the numbers yourself.

Who Does Not Need to File Form 1065

Not every business needs to file Form 1065. Here are cases where you may be exempt:

- Single-member LLCs file taxes using Schedule C with their personal return.

- Qualified joint ventures, like spouses running a business together in community property states, may avoid Form 1065.

- Inactive partnerships with no income, expenses, or business activity for the year usually do not need to file.

If you’re unsure, check IRS guidelines or talk to a tax advisor.

Requirements to file Form 1065 Online

Before you file 1065 online, gather these details:

- Your Employer Identification Number (EIN)

- Basic business info: address, start date, type of entity

- Financial statements: income, expenses, assets, and liabilities

- Partner details: names, addresses, ownership share

- Prior year tax return, if available

You will also need to complete Schedule K and K-1 tax forms for each partner. These forms show each partner’s share of income, credits, and deductions.

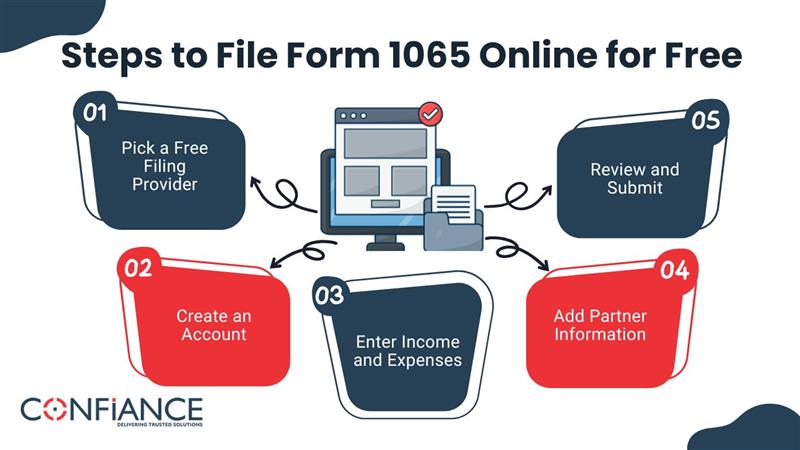

Steps to File Form 1065 Online for Free

Follow these steps to file it online:

1. Pick a Free Filing Provider

Search for a tax software company that supports 1065 e-filing. Some offer free versions for basic partnership returns. Make sure the provider is IRS-approved. Examples include FreeTaxUSA (for simpler returns), TaxAct, and others. Not all providers offer free filing, so check before you begin.

2. Create an Account

Sign up and enter your business info. Make sure names, addresses, and EIN match what the IRS has on file. If your information is incorrect, your return may be rejected.

3. Enter Income and Expenses

Use your bookkeeping records to enter gross partnership income and expenses. This includes sales, rent, salaries, utilities, and other costs. The software will do the math and generate totals for you.

4. Add Partner Information

Enter the name, address, and share percentage for each partner. The software will use this info to prepare each Schedule K-1. These forms go to each partner and the IRS.

5. Review and Submit

Once all data is entered, review the full return. Check every number and name. Fix any errors before submitting. When ready, send the return electronically through the platform.

You will get a confirmation email once the IRS accepts your filing.

Penalties for Not Filing Form 1065

Missing the Form 1065 deadline can cost your business.

- The IRS charges $235 per month per partner, up to 12 months.

- Even if your business had no income, the penalty still applies.

- You may also face late delivery penalties if you delay sending Schedule K-1s to partners.

- The IRS can reject late filings or send notices that delay partner filings.

To avoid these problems, file on time and make sure all forms are complete.

Where to File Form 1065 Online for Free

Here are a few places you can file form 1065 online for free or low cost:

- IRS Free File: Only for simple returns. Partnerships do not always qualify.

- FreeTaxUSA: Offers business tax software at low cost. May not remain free for all types of cases.

- TaxAct: Offers 1065 filing. Look for discounts or free versions.

- OLT.com (Online Taxes): IRS-approved and supports 1065 filing. Check for free options.

Always compare plans. Some let you start for free but charge when you file. Read the fine print before you begin.

Tips to Make Filing Easier

Filing Form 1065 online is simple if you stay organized. Here are tips to help:

- Use bookkeeping software to track income and expenses.

- Close your books before tax season starts.

- Reconcile all accounts and fix errors in advance.

- Assign one partner or accountant to handle the return.

- Send Schedule K-1s to partners early so they can file on time.

The fewer errors in your books, the smoother the filing process will be.

Common Mistakes to Avoid while filing Form 1065 Online

Some partnerships make small errors that cause IRS issues. Watch out for these:

- Entering the wrong EIN or business info

- Forgetting to sign the return (electronic signature)

- Skipping Schedule K-1s

- Using outdated software

- Missing the deadline

Always double-check your return before filing. The IRS may reject it for small reasons.

Comparison of Free Platforms That Support Form 1065

| Platform | Supports 1065 | Free Option | Notes |

| FreeTaxUSA | Yes | Limited | Free for federal, may charge for state |

| TaxAct | Yes | Yes/Varies | Good for small partnerships |

| OLT.com | Yes | Yes | Simple layout, IRS-approved |

| IRS Free File | No | No | Only for individuals, not for partnerships |

Always read the terms before filing. Some platforms start free but charge when you submit.

What Happens After You File Form 1065 Online?

After you file it, the IRS reviews your return. If accepted, you are done for now. Each partner must use their Schedule K-1 to file their personal or corporate tax return.

If there are errors or missing details, the IRS will contact you. You can amend the return using Form 1065X.

Keep copies of your completed Form 1065, all Schedules K-1, and the confirmation email. Save everything for at least seven years.

Do You Need a Tax Professional?

Any business with more than one partner requires Form 1065 to report its financials to the IRS. You can file it online without an accountant if your finances are simple. But if you have many partners, large assets, or complex deductions, it may be smart to hire help. Tax software makes filing easier, but it will not catch every issue.

If you have questions about partner equity, debt allocation, or tax credits, ask a tax advisor at Confiance. Get in touch with us and get the best tax services for your business.

FAQs

What is Form 1065?

It is the form used by partnerships to report income, expenses, and how profits are split.

Who should file Form 1065?

Any group doing business as a partnership or a multi-member LLC must file it.

Can I file Form 1065 online for free?

Yes. You can use IRS-approved tools to file it online for free.

What do I need to file Form 1065 online?

You need your EIN, business records, income, costs, and each partner’s share.

When is Form 1065 due?

Form 1065 is due by March 15. If that date is not a workday, it is due the next one.

Do I have to include Schedule K1?

Yes. One must be filled out for each partner and sent with the return.

Can I fix Form 1065 after I file it?

Yes. Use Form 1065X to make changes if you filed something wrong.