Double-Entry Accounting vs. Single Entry: Which Is Right for Your Business?

When you start a business, keeping track of money is vital. Some owners use a basic system. Others choose a more detailed one. The choice often comes down to single-entry or double-entry accounting. Both work in their own way. But one may be better for your business.

In this guide, we will explore both systems. You will learn how they work, their pros and cons, and which one fits your business best.

What Is Single Entry Accounting?

Single-entry is the simplest way to track money. You record one side of each deal. For example, if you sell an item, you record only the sale. If you pay rent, you record only the payment.

This system looks much like a personal checkbook. You write down income and spending. It shows your cash flow, but not the full story of your money.

Key Features of Single Entry

- One record per deal

- Works like a cash book

- Simple to learn and use

- Tracks money in and out

Pros of Single Entry

- Easy setup for small firms

- Quick to record each deal

- Low cost, no need for complex tools

- Good for solo owners or small shops

Cons of Single Entry

- Hard to spot errors

- No full view of assets and debts

- Not accepted by banks or investors

- Limited for tax and reports

What Is Double-Entry Accounting?

Double-entry accounting is more advanced. Each deal has two sides: debit and credit. This means you record where the money comes from and where it goes.

For example, if you buy stock, you record stock as a debit. At the same time, you record cash or debt as a credit. This keeps your books balanced at all times.

Key Features of Dual Entry Accounting

- Each deal has two records.

- Based on the rule: assets = debts + equity

- Tracks money, assets, and debts

- Creates full financial reports

Pros of Dual-Entry Accounting

- Clear and accurate records

- Shows a full view of your firm’s health

- Helps find errors and fraud

- Needed for growth and tax needs

- Trusted by banks and investors

Cons of Dual-Entry Accounting

- More complex to learn

- Needs proper tools or software

- It may cost more to set up

- Takes more time to record

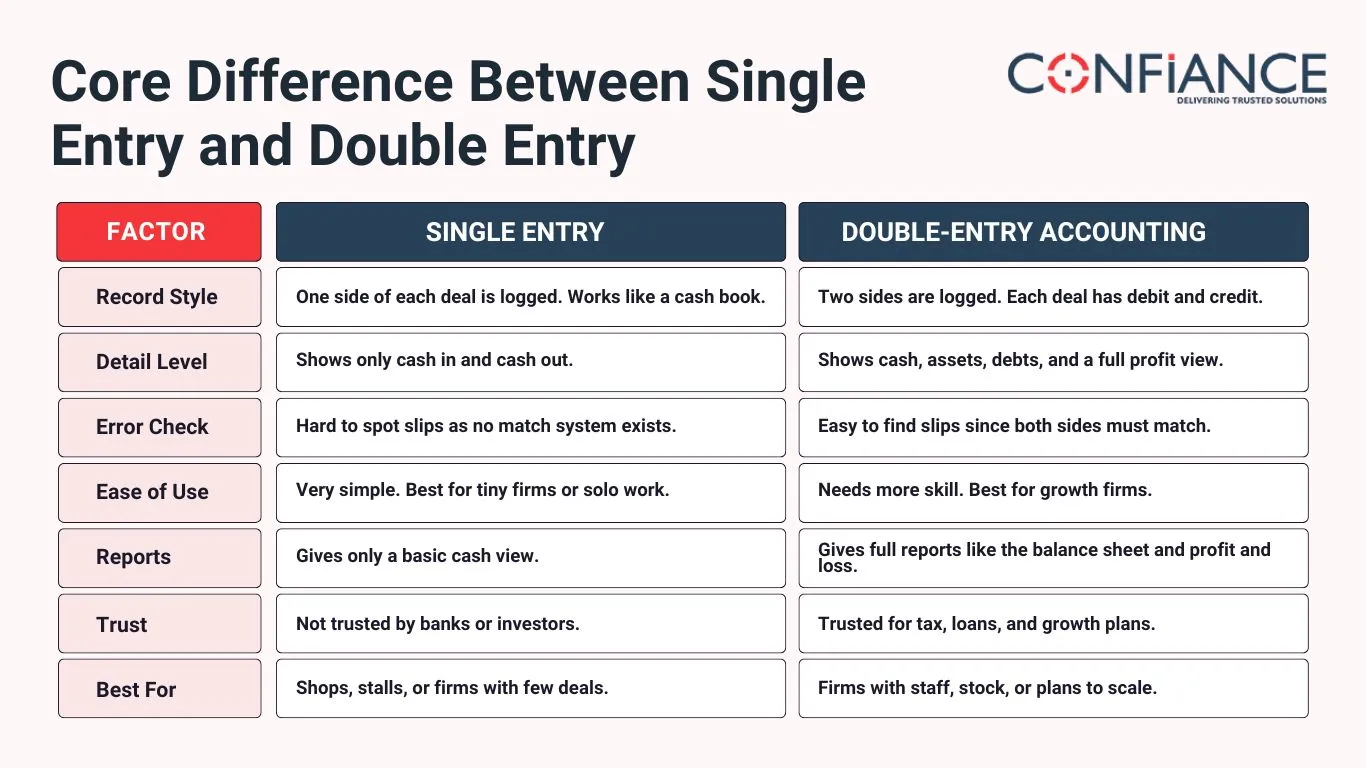

Core Difference Between Single Entry and Double Entry

| Factor | Single Entry | Double-Entry Accounting |

| Record Style | One side of each deal is logged. Works like a cash book. | Two sides are logged. Each deal has debit and credit. |

| Detail Level | Shows only cash in and cash out. | Shows cash, assets, debts, and a full profit view. |

| Error Check | Hard to spot slips as no match system exists. | Easy to find slips since both sides must match. |

| Ease of Use | Very simple. Best for tiny firms or solo work. | Needs more skill. Best for growth firms. |

| Reports | Gives only a basic cash view. | Gives full reports like the balance sheet and profit and loss. |

| Trust | Not trusted by banks or investors. | Trusted for tax, loans, and growth plans. |

| Best For | Shops, stalls, or firms with few deals. | Firms with staff, stock, or plans to scale. |

Single entry gives a simple cash view. Double-entry accounting gives a full, detailed view.

Which System Fits Small Businesses?

Many small firms start with a single entry. It works for a side hustle, a shop, or a solo worker. If you only need to know how much cash you have, it may be enough.

But if you plan to grow, need a loan, or work with investors, Double-Entry Accounting is better. It builds trust and keeps your books clear.

When Single Entry Works Best

- Very small firms with few deals

- No outside investors

- Cash-based shops or stalls

- Owners who just want cash flow info

When Double Entry Works Best

- Firms with more staff or stock

- Need for bank loans or funds

- Growth plans or scaling up

- Firms that want detailed reports

Why Double-Entry Accounting Matters

Dual-entry accounting is not just about rules. It supports informed and strategic choices. It shows not only what you earn and spend, but also what you own and owe.

This helps you:

- See if your firm makes real profit

- Plan for growth with solid data

- Avoid tax issues

- Gain trust with banks and partners

Without it, you may not know your true bottom line. A firm may look rich in cash, but if it owes more than it owns, it is not strong.

Real-Life Example

Let’s say you own a small cafe. You sell coffee, snacks, and cold drinks. You also pay rent, wages, and suppliers. How you record this money flow changes based on the system you use.

- Single entry: You write sales for the day and rent paid. At month-end, you see if you made more than you spent. But you cannot tell your full profit, your debts, or your stock value.

- Double entry: You record sales as income, rent as expense, stock as assets, and loans as debts. At month-end, you get a full report: net profit, net worth, and what you owe.

The second method gives a bigger, clearer view of your cafe. It helps you plan, get a loan, and prove to partners that your business is strong. This is why most firms that aim to grow choose Dual-Entry Accounting.

Tools That Make It Easy

In the past, Dual-Entry Accounting needed books and manual records. Today, software makes it simple. Tools like QuickBooks, Xero, and FreshBooks handle debits and credits in the background.

Here are some tools that help:

QuickBooks

One of the most well-known tools. It tracks sales, costs, and tax. It also gives reports like profit and loss or cash flow. Many small firms use it for ease.

Xero

This tool is web-based. It links with bank accounts and updates records in real time. It helps firms that want real-time access to data.

FreshBooks

Best for solo owners or service firms. It handles billing, time logs, and costs. It also has simple double-entry features.

Zoho Books

Part of the Zoho suite. It is low-cost but has strong features. It works well for small to mid-sized firms.

Wave

A free tool with basic double-entry features. Great for startups or very small firms that want to cut costs.

Why Software Helps

- Saves time with auto records

- Cuts down on human error

- Gives clear, instant reports

- Easy to scale as your firm grows

Common Mistakes to Avoid

Even with the right tool, some mistakes can hurt your records. These are common but easy to fix with care.

Forgetting to Record Both Sides

With double-entry, each deal needs two sides. If you forget one side, the books will not match. This can cause wrong reports.

Mixing Personal and Business Funds

Many small owners use the same account for both personal and business needs. This makes it hard to track costs and profit. Always keep them apart.

Not Checking Balances Often

If you do not check your trial balance, errors can pile up. A monthly review helps find and fix slips fast.

Skipping Monthly Reports

Some owners just track cash flow. But skipping reports like profit and loss or balance sheet hides the real health of the firm.

Not Backing Up Data

When you use software, it is key to back up records. A lost file or crash can wipe months of work. Use cloud tools or storage.

Ignoring Training

Even simple tools need some skill. Owners who skip training may use the tool wrong. A short guide or course can make a big change.

A good system and habit of review can help avoid these mistakes.

How to Switch from Single to Double Entry

If you are ready to move up, here are the steps:

- Pick a tool: Choose software that fits your firm's size.

- Learn basics: Know terms like debit, credit, asset, and equity.

- Hire help if needed: A part-time bookkeeper can guide the shift.

- Transfer records: Move your cash book data into the new system.

- Review often: Check reports each month to build trust in the system.

The Long-Term Value of Double-Entry Accounting

While single-entry may be fine for a small setup, double-entry accounting builds a base for growth. It helps firms plan, raise funds, and stay on track.

Think of it as the frame of a house. Without it, the house may stand for a while. But with it, the house is strong and ready to grow.

Choosing between single-entry and dual-entry accounting depends on the stage of your firm. If you run a very small shop or are just starting, single-entry may be the best fit. It gives a quick view of cash in and out. But if you plan to grow, deal with stock, or seek a loan, Double-Entry Accounting is the best choice. It gives a full, clear view of your profit, debts, and worth.

At Confinace, we provide expert accounting services built on strong and proven systems. Our team runs your books with care, so you can focus on growing your firm. We follow best practices in Double-Entry Accounting to give you clear, error-free records and full reports.

- We manage your books with trusted tools

- We give accurate and timely reports

- We ensure compliance and reduce errors

If you want reliable accounting services and a clear view of your firm’s health, Confinace is the smart choice.

FAQs

1. What is the main difference between single-entry and double-entry?

Single-entry logs one side of each deal, while Double-Entry Accounting logs both sides, debit and credit.

2. Is single-entry good for small firms?

Yes, for very small firms or solo owners with few deals, single-entry can work. But it has limits and does not show the full health of the firm.

3. Why is double-entry more trusted?

Because it shows full data assets, debts, and profit. Banks, tax offices, and investors all rely on this system.

4. Does double-entry take more time?

It may seem so, but with software, it is fast. The tool records both sides in one step when you add a deal.

5. Can I switch from single to double entry later?

Yes, you can. With the right tool or help from experts, you can shift with ease.

6. Which system helps with tax filing?

Double-entry accounting works best, since it gives full reports like a balance sheet and profit and loss. These are key for tax.