A Complete Guide to Medical Bookkeeping – 2025

Medical practices need accurate financial records to stay compliant and profitable. From solo practitioners to multi-specialty clinics, bookkeeping is vital for smooth operations. This guide explains what medical bookkeeping involves, how it differs from general accounting, and why it matters for healthcare providers.

What Is Medical Bookkeeping?

Medical bookkeeping involves recording, organizing, and tracking financial transactions within a healthcare setting. This includes revenue from patient visits, insurance payments, payroll, equipment purchases, and general overhead.

While it shares basics with general bookkeeping, it requires extra care because of insurance claims, medical billing codes, and strict privacy rules. Medical bookkeeping also helps providers understand their cash flow and prepare for audits.

Why Is Medical Bookkeeping Important?

Every healthcare provider must follow tax rules, manage revenue cycles, and keep patient data secure. Inaccurate records can lead to billing errors, tax issues, and legal problems.

Clear and timely bookkeeping helps you:

- Know your practice’s financial health

- Pay taxes on time with proper reports

- Track money owed by insurance and patients

- Control spending on equipment and staff

- Avoid fines from audits or compliance checks

These records support larger financial tasks that fall under medical accounting, such as preparing reports, filing taxes, and making long-term plans.

Bookkeeping vs. Medical Accounting

Medical bookkeeping and medical accounting are not the same, though they work together.

Bookkeeping handles the day-to-day tasks like:

- Recording payments

- Logging expenses

- Posting entries to the general ledger

- Reconciliations with bank accounts

Medical accounting uses that data to:

- Prepare financial statements

- Handle tax planning and filing

- Set budgets

- Analyze costs and profits

- Advise on business growth

In short, bookkeeping collects and organizes the data. Accounting uses that data to make decisions.

Key Tasks in Medical Bookkeeping

Here are the core activities every medical bookkeeper must manage:

1. Patient Billing and Payments

Medical practices must bill patients and insurance companies correctly. Bookkeepers track when claims are sent, when payments arrive, and how much remains unpaid.

They must stay current with:

- Insurance codes

- Payment schedules

- Co-pays and deductibles

- Denied or delayed claims

2. Accounts Receivable

This refers to money owed by patients and insurance companies. Bookkeepers record every pending payment and follow up as needed. A delay in receivables can strain cash flow.

3. Accounts Payable

Healthcare practices have regular expenses like rent, software, salaries, and supplies. Bookkeepers must record and pay each bill on time. Delayed payments can affect vendor relationships.

4. Payroll

Doctors, nurses, and support staff must be paid on time. Medical bookkeeping includes managing salaries, benefits, and payroll taxes. Errors here can lead to penalties or missed deadlines.

5. Bank Reconciliation

This task checks your books against your bank statements. It helps catch errors or fraud. It should be done monthly to ensure nothing is missed.

6. Tax Preparation

Bookkeepers gather the data accountants need to file taxes. Clean books reduce errors, missed deductions, and filing delays.

7. Financial Reports

Bookkeepers prepare regular reports like:

- Profit and loss statements

- Expense summaries

- Monthly revenue trends

These reports guide decisions about hiring, expansion, or cost-cutting.

Bookkeeping Systems Used in Medical Practices

Most healthcare practices use software to handle bookkeeping tasks. The right tool depends on the size and structure of the business.

1. Practice Management Software

This software helps with scheduling, billing, and patient records. Some also offer basic bookkeeping features. Examples include Kareo, Athenahealth, and AdvancedMD.

2. Accounting Software

QuickBooks, Xero, and FreshBooks are popular tools for bookkeeping. They track income, expenses, bank accounts, and payroll. Many of these can integrate with medical billing systems.

3. Hybrid Systems

Some clinics use both practice management and accounting tools. These systems share data to give a full view of operations.

When set up correctly, software can:

- Cut down on manual errors

- Save time on data entry

- Make reports easier to generate

- Improve tracking of receivables and payables

Best Practices in Medical Bookkeeping

Following a few basic rules can improve accuracy and reduce stress during audits or tax season.

Keep Records Updated

Always record transactions as they happen. Waiting too long leads to errors and forgotten entries.

Use Separate Accounts

Keep personal and business finances apart. Use separate credit cards and bank accounts for the practice.

Review Reports Regularly

Set a fixed time each month to review reports. This helps you spot problems early.

Back Up Data

Use cloud storage or regular backups to protect your records. This is vital for compliance and recovery in case of loss.

Train Staff

Make sure your team understands billing rules and basic data entry. A small mistake can grow into a bigger problem if left unchecked.

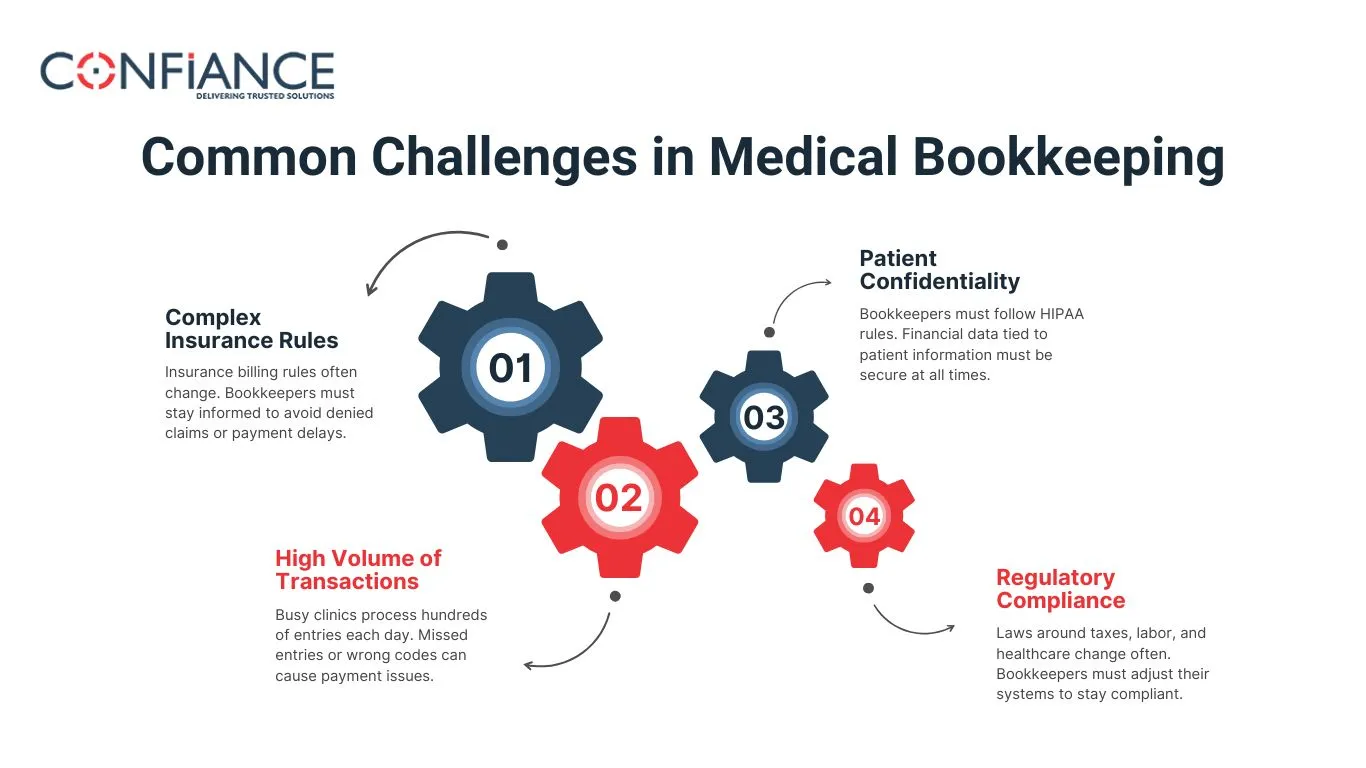

Common Challenges in Medical Bookkeeping

Even with software, medical bookkeeping has its own set of problems.

Complex Insurance Rules

Insurance billing rules often change. Bookkeepers must stay informed to avoid denied claims or payment delays.

High Volume of Transactions

Busy clinics process hundreds of entries each day. Missed entries or wrong codes can cause payment issues.

Patient Confidentiality

Bookkeepers must follow HIPAA rules. Financial data tied to patient information must be secure at all times.

Regulatory Compliance

Laws around taxes, labor, and healthcare change often. Bookkeepers must adjust their systems to stay compliant.

Hiring a Medical Bookkeeper

You can handle bookkeeping in-house or outsource it. Each option has its pros and cons.

In-House Bookkeeping

Hiring staff gives you control and quicker access. But it adds cost through salary, training, and benefits.

Outsourced Bookkeeping

Outsourcing gives you access to trained experts. You also reduce the cost of hiring and software. But you must choose a firm that knows medical accounting.

When hiring, look for:

- Experience in healthcare

- Knowledge of billing and coding

- Familiarity with practice management software

- Strong privacy and security measures

Medical Bookkeeping and Taxes

Taxes in healthcare can be complex. Medical bookkeeping helps keep track of deductible expenses like:

- Staff wages and benefits

- Office supplies and equipment

- Insurance premiums

- Continuing education and training

- Rent and utilities

Clean records help your accountant find these deductions and reduce tax liability. It also avoids delays and penalties during filing.

When to Use a CPA or Medical Accountant

A certified public accountant (CPA) or medical accountant goes beyond bookkeeping. You should use one when:

- Planning to grow or open new locations

- Preparing for a loan or investor review

- Needing support during audits

- Setting up new systems

- Filing taxes for larger or multi-state practices

They also help with forecasting and cost control, which is vital in a field with thin profit margins.

Transitioning to Digital Bookkeeping

Moving from paper records to software can improve accuracy and speed. Start with these steps:

- Pick software suited for medical use.

- Set up your chart of accounts with help from a specialist.

- Train staff on data entry and privacy rules.

- Migrate past records carefully.

- Set a schedule for data review and backups.

Digital systems reduce errors and allow easy access from anywhere. They also make audits and tax filing easier.

Medical bookkeeping keeps your practice organized and compliant. It tracks income, controls costs, and prepares your business for growth. While software can help, skilled bookkeepers and accountants are key to avoiding costly errors.

Whether you manage a solo practice or a large clinic, consistent and accurate bookkeeping supports every part of your financial plan. Make it a core part of your daily workflow, not just something you deal with during tax season. At Confiance, we have a dedicated medical bookkeeping department that specializes in every medical context. Contact us now if you need further assistance with your medical practice.

FAQs

- Do small medical practices really need a bookkeeper?

Yes. Even solo practitioners deal with insurance, billing, payroll, and taxes. A bookkeeper keeps all records clean and up to date. - How is medical bookkeeping different from regular bookkeeping?

Medical bookkeeping tracks insurance claims, patient payments, billing codes, and compliance rules that general businesses don’t deal with. - Can I use regular accounting software for my clinic?

Basic software can work, but medical accounting tools save time by syncing with billing systems and handling claims more smoothly. - How often should I update my books?

At least once a week. Waiting longer risks missed payments, late fees, and inaccurate reports. - What’s the risk of handling bookkeeping myself?

You might miss billing errors, misreport income, or delay payments. These mistakes can lead to cash flow problems or tax issues. - Do I need separate software for billing and bookkeeping?

Not always. Many tools combine both. Just make sure the system handles claims, tracks payments, and keeps financial records accurate.