How to Analyze Cash Flow Statements for Better Financial Decisions

Cash Flow statements are one of the important tools for business owners and managers. They help to see how your money moves in and out of your business. Understanding these statements is vital to making smart financial decisions and planning for growth. In this guide, we will break down how to analyze cash flow reports in a simple and practical way.

Understanding Cash Flow Statements

Cash Flow statements show cash in your business over a specific period. They are different from income statements because they focus only on actual cash, not profits. The Cash flow section covers three main sections:

Operating Activities

This section shows cash from regular business operations. Sales, payments to suppliers, and salaries are included here.

Investing Activities

Cash used or earned from buying or selling assets like machines, buildings, or investments appears here.

Financing Activities

This is about how businesses get cash from outside sources. It includes taking a loan from the bank, getting money from owners or paying back a loan.

Each section helps you understand where cash comes from and where it goes.

Why Cash Flow Statements Matter

Cash flow statements show more than numbers. They reveal the real state of your firm's money and help you see how cash moves in and out.

Spotting Cash Shortages

Even if your firm makes a profit, cash can be low. A cash flow sheet shows whether you can pay bills. This includes pay, rent, and power. It helps you plan ahead and keeps your firm safe.

Planning for Growth

To grow, you need cash. A cash report shows if you can hire staff, buy equipment, or expand safely. It helps you plan growth without risking your money.

Making Smarter Decisions

Cash flow reports act like a map. They help you know when to invest, cut costs, or take a loan. Using them correctly leads to better financial choices.

Forecasting Future Needs

Cash flow reports make it easier to predict money needs. You can plan for slow seasons, extra costs, or unexpected changes. This keeps your firm prepared.

Building Investor Trust

Investors look at cash flow. Clear sheets show you handle cash well. This makes it easier to get loans or funds.

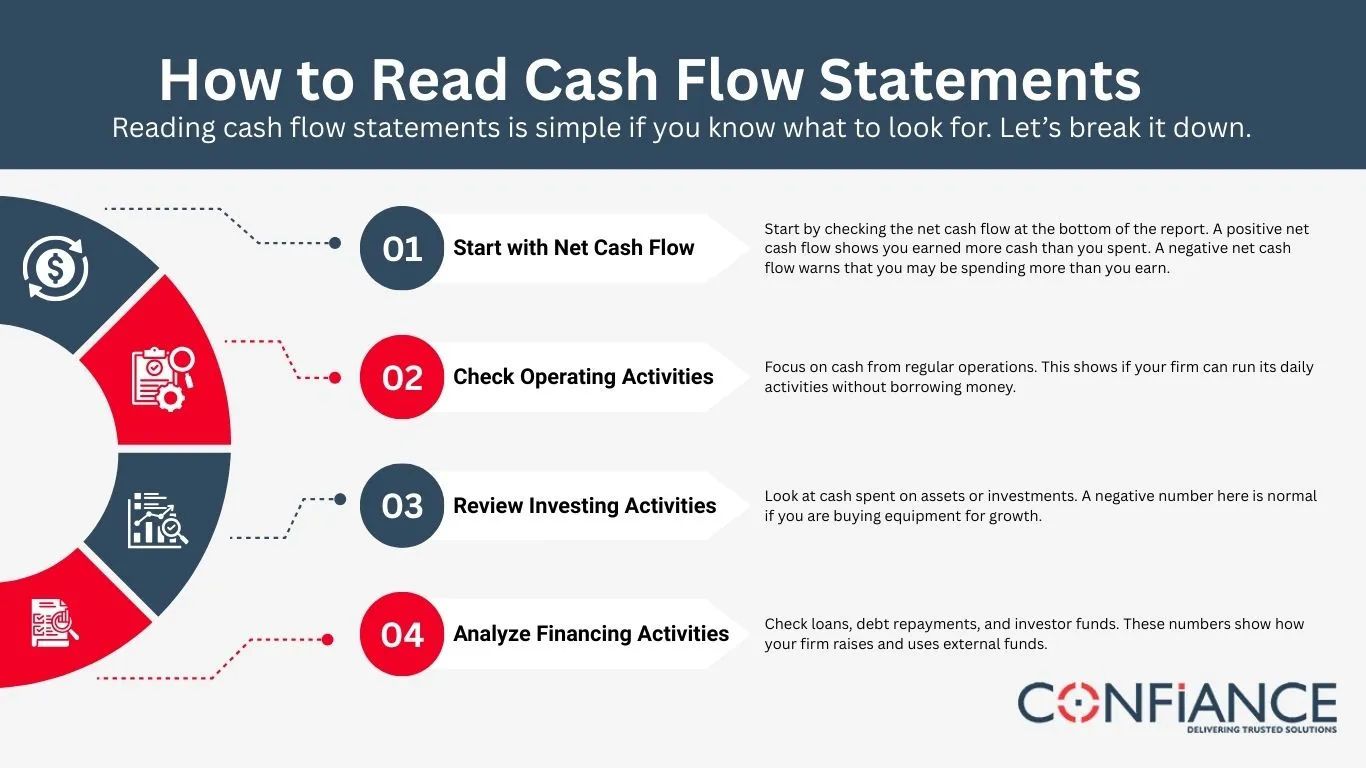

How to Read Cash Flow Statements

Reading cash flow statements is simple if you know what to look for. Let’s break it down.

Step 1: Start with Net Cash Flow

Start by checking the net cash flow at the bottom of the report. A positive net cash flow shows you earned more cash than you spent. A negative net cash flow warns that you may be spending more than you earn.

Step 2: Check Operating Activities

Focus on cash from regular operations. This shows if your firm can run its daily activities without borrowing money.

Step 3: Review Investing Activities

Look at cash spent on assets or investments. A negative number here is normal if you are buying equipment for growth.

Step 4: Analyze Financing Activities

Check loans, debt repayments, and investor funds. These numbers show how your firm raises and uses external funds.

Common Mistakes to Avoid

Even a simple liquidity report can mislead if not read carefully.

Ignoring Timing Differences

Sales may be recorded before payment arrives. Always check if the reported cash matches the real cash in the bank.

Overlooking Non-Cash Items

Cash flow reports focus on cash only. Don’t confuse them with profit statements that include non-cash items.

Mixing Personal and Business Finances

Keep business cash separate. Mixing funds can distort the real cash position.

Failing to Update Regularly

Old statements are less useful. Analyze statements monthly to catch issues early.

Ignoring Financing Details

Loans or repayments can impact cash significantly. Always review financing activities closely.

Misreading Growth Spending

Cash spent on new tools or stock is not always bad. It can mean you are investing for growth. View such outflows in context.

Not Reviewing Seasonality

Some firms earn more in certain seasons. Ignoring this leads to poor planning. Always review seasonal highs and lows.

Tips for Analyzing Cash Flow Statements

Analyzing cash flow statements is not just about reading numbers. You need to find meaning behind the inflows and outflows. A clear method makes analysis easy and useful.

Compare Periods

Compare statements from different months or years. Look for trends in cash inflow and outflow. Rising expenses or falling income can signal trouble.

Calculate Ratios

- Operating Cash Flow Ratio = Cash from operations ÷ Current liabilities.

Shows if your firm can cover short-term debts. - Free Cash Flow = Cash from operations − Capital expenditures.

Indicates how much money is left after investments.

Focus on Patterns

Don’t just look at totals. Watch patterns. Are certain months always short on cash? Are there unexpected spikes in spending?

Use Graphs and Charts

Visualizing data helps spot trends quickly. Many software tools can create cash flow charts for easier analysis.

Benchmark Against Industry

Compare your cash flow with other firms in your sector. If your outflows are higher than peers, it may be a warning sign.

Link Cash Flow to Strategy

Do not just record. Use data to guide moves. For example, if operations bring in steady cash, you can expand. If not, focus on fixing operations first.

Tools to Make Cash Flow Analysis Easy

Several tools help firms analyze liquidity reports without stress.

QuickBooks

Tracks income, expenses, and generates cash flow reports. It’s easy for small firms to use.

Xero

Web-based tool that updates cash flow in real time. Useful for firms that need data on the go.

FreshBooks

Designed for service firms and freelancers. Handles billing, expenses, and cash reports.

Zoho Books

Low-cost tool with strong cash flow features. Works well for small to mid-sized firms.

Wave

Free tool for startups or small firms. It provides basic cash flow tracking and reports.

Why Software Helps

- Saves time with automated entries

- Reduces errors in calculations

- Generates clear, instant reports

- Helps visualize cash trends for decisions

Forecasting Cash Flow for Better Financial Planning

Analyzing cash flow statements shows the past, but forecasting looks ahead. Forecasting predicts future cash coming in and going out. It helps firms plan growth, manage costs, and avoid cash shortfalls.

1. Why Forecasting Matters

Forecasting helps you:

- Prepare for slow months when cash may be low

- Plan big purchases or expansion without risk

- Avoid relying too much on loans or credit

- Make smart, data-backed decisions

2. How to Forecast Cash Flow

Use Past Data

Start with past cash flow statements. Look at income, costs, and trends over months or years. This sets a baseline for the future.

Project Sales and Income

Estimate sales based on trends, seasons, and market conditions. Be realistic, overestimating cash coming in can cause problems.

Plan Costs

Include regular costs like wages, rent, and utilities. Also, add seasonal or one-time costs like bonuses, taxes, or repairs.

Include Financing

If you plan loans, repayments, or outside funds, add them to your forecast. This shows how extra money affects cash.

3. Benefits of Cash Flow Forecasting

Cash flow forecasting helps your firm see the future. It shows how money will come in and go out, so you can plan well and avoid problems.

Avoid Cash Shortages

Forecasts show money gaps before they happen. You can plan for bills, paychecks, or rent ahead of time. This keeps your firm safe from running out of cash.

Make Better Decisions

A clear forecast helps you decide when to spend, save, or invest. It acts like a guide for your daily choices and keeps your business on track.

Support Business Growth

Cash forecasts make it easier to grow. You can plan for new hires, buy tools, or start projects safely. This keeps growth steady and avoids money stress.

Build Trust with Investors and Banks

Accurate forecasts show you control your money. Banks and investors trust firms that plan well. This makes it easier to get loans or funding.

Prepare for Surprises

Forecasts also help with emergencies. If extra costs come up, you know how much cash is free. You can act fast and keep your business secure.

4. Tips for Better Forecasting

- Review forecasts each month and update with real results

- Use software that links to your accounting system

- Keep cautious estimates for key expenses

At Confinace, we provide expert accounting services and run strong accounting systems. Our team manages your cash flow and other accounting records carefully. This helps firms make timely, informed financial decisions.

- We generate accurate cash flow statements

- We provide clear reports for decision-making

- We monitor cash trends to avoid risks

- We help build trust with banks and investors

With Confinace, you get reliable accounting services and a clear view of your financial position.

FAQs

- What are cash flow statements?

They are reports showing the cash coming in and going out of a firm during a period.

- Why are cash flow reports important?

They help track real cash, plan expenses, manage investments, and make financial decisions.

- How often should cash flow statements be prepared?

Monthly is best. Regular updates prevent surprises and support planning.

- Can cash flow statements show profit?

Not exactly. They show actual cash, not accounting profit. Profit statements include non-cash items.

- What is free cash flow?

It’s cash left after paying for operations and investments. It shows money available for growth or debt repayment.

- How can I improve cash flow?

Collect receivables faster, manage expenses carefully, and plan major spending around months with positive cash flow.