Common Mistakes Businesses Make in Cash Flow Statements

Cash flow statements are one of the most vital parts of business finance. They show how money flows in and out of the company. Many owners check profit and loss, but often skip a close look at cash flow. This creates errors that can harm growth. If a business does not read statements correctly, it can misjudge its real strength.

In this blog, we will explore common mistakes businesses make in cash flow statements, why they happen, and how to avoid them. By the end, you will know how to handle this financial tool with ease.

Why Cash Flow Statements Matter

Cash flow statements act as a health check for your business. They track the money moving in and out and help you see if the company can meet short-term needs.

A Snapshot of Business Health

Unlike profit reports, Cash reports show real cash. This tells you if you can pay staff, suppliers, or debts on time.

A Guide for Better Decisions

Investors, lenders, and even partners rely on cash flow reports to judge risk. A clear record makes it easier to plan for growth, expansion, or borrowing.

Monitoring Daily Operations

Cash reports show daily money movement. You can see what bills are due and what cash is coming in, keeping the work smooth.

Planning for Growth and Stability

Cash flow reports highlight trends over time. They help forecast shortfalls, set budgets, and prepare for slow seasons. Proper planning ensures your business grows steadily and safely.

Supporting Decision Making

Accurate cash records help you decide on hiring, buying, or other moves. Knowing real cash stops risky actions that harm the business's finances.

Building Financial Confidence

When cash flow is clear, owners feel more confident. Transparent records reduce stress, improve planning, and help communicate stability to banks, investors, and partners.

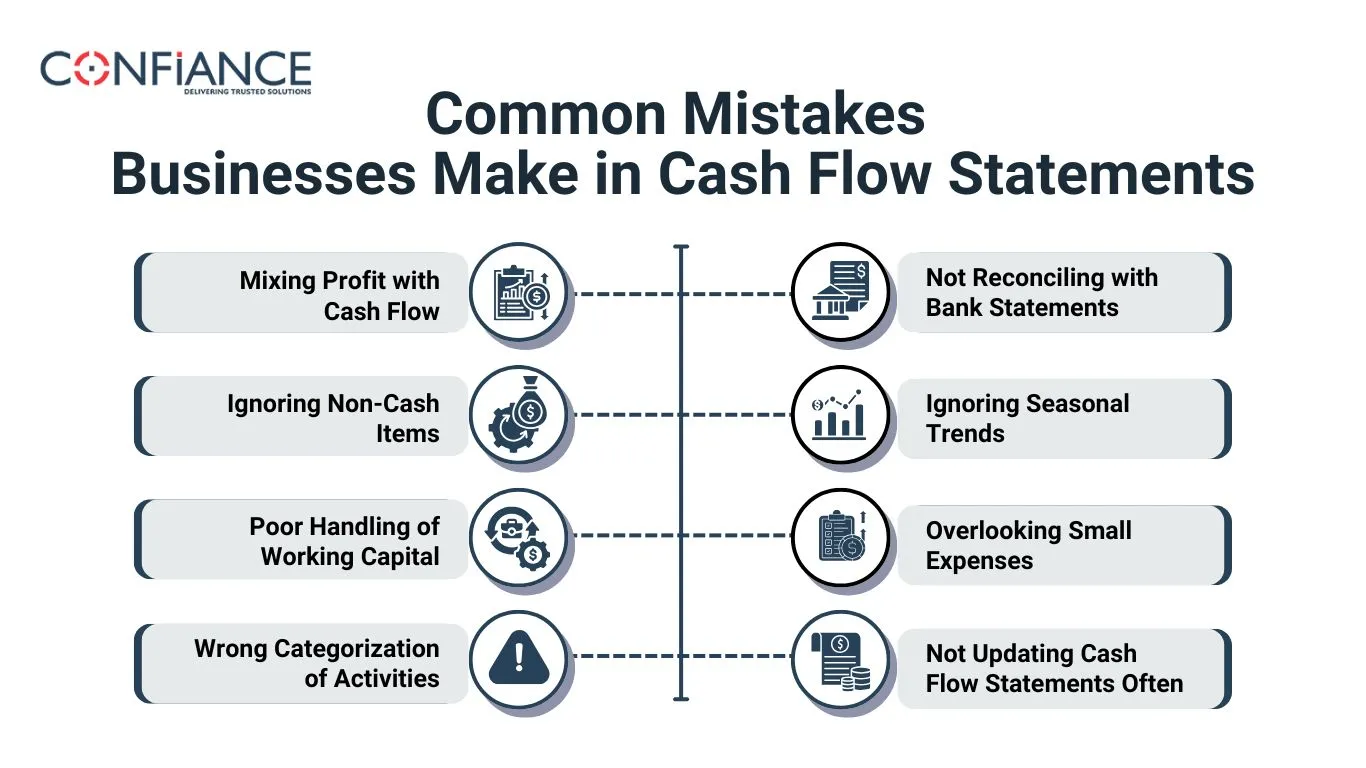

Common Mistakes in Cash Flow Statements

Many businesses make errors that change how their financial picture looks. Let’s look at the most frequent ones and how they affect results.

Mistake 1: Mixing Profit with Cash Flow

Owners often think profit equals cash, but this is not true. You may have high profit but weak cash flow if clients pay late.

Why This Happens

Confusing profit with cash flow happens when managers focus only on sales growth or margins without tracking real cash in hand.

How to Fix It

Keep separate checks on net profit and actual money collected. Cash flow statements must reflect real cash, not just paper profit.

Mistake 2: Ignoring Non-Cash Items

Depreciation, amortization, or asset write-offs are not cash expenses. Yet, some firms wrongly count them in their flow.

Why This Matters

If you treat non-cash items as outflow, it looks like the business is weaker than it is.

Solution

List non-cash items in notes or separate sections. Cash flow reports should show only real inflows and outflows.

Mistake 3: Poor Handling of Working Capital

Working capital means current assets minus current debts. Mismanaging this leads to wrong figures in cash flow statements.

Issues in Accounts Receivable

Late payments from clients delay inflows. Overestimating collection speed can create a false sense of security.

Issues in Inventory

Too much stock ties up cash. Many owners forget to factor this in when reviewing cash flow reports.

Solution

Track receivables, payables, and stock with care. Use systems to keep working capital healthy.

Mistake 4: Wrong Categorization of Activities

Cash flow has three parts: operating, investing, and financing. Putting items in the wrong place can cause confusion.

Example:

Loan payments go under financing, not operations. Buying machines goes under investing, not operating.

Fix:

Follow these simple rules:

- Operating: Money from daily business, like sales or bills.

- Investing: Money used to buy or sell long-term items.

- Financing: Money from loans, repayments, or owner’s funds.

Mistake 5: Not Reconciling with Bank Statements

Many small firms do not match their cash flow report with bank records. This leads to mismatched numbers.

Risk

You may think you have more cash than you really do. Or worse, miss errors in banking records.

Solution

Always reconcile monthly. Align your cash flow report with actual bank balances.

Mistake 6: Ignoring Seasonal Trends

Some firms forget that sales and cash flow vary by season. They plan based on one strong month, but cash dries up later.

Example

A retail shop may have high sales in December but slow sales in March. If cash flow statements do not reflect this, it can cause problems.

Solution

Plan for peaks and dips. Build cash reserves from good months to cover slow ones.

Mistake 7: Overlooking Small Expenses

It’s common to miss petty cash, small supplier costs, or short fees. When ignored, these add up.

Result

Cash flow looks stronger than they are, giving a false image.

Fix

Track even small outflows. Use apps or tools that record every transaction.

Mistake 8: Not Updating Cash Flow Statements Often

Some firms make a cash flow report only once a year. This leaves them blind during the year.

Why It Hurts

A late review means you may spot issues only after damage is done.

Best Practice

Update Cash records monthly or even weekly for small firms. This keeps you alert to shifts.

How to Avoid These Mistakes

Build a Routine

Check your reports often. Set fixed dates each month to review cash flow. This builds good habits and helps you spot gaps early.

Use the Right Tools

Cloud tools show cash in real time. They cut human error and give clear reports. With these, you can make fast and smart moves.

Train Your Team

Teach staff about cash basics. When the team knows how sales, costs, and receivables link, they work better and avoid common errors.

Plan for Seasons

Study sales peaks and dips. Build a small cash reserve for low times. This stops you from facing gaps when sales fall.

Watch Working Capital

Track receivables, payables, and stock closely. Do not let stock or late payments tie up funds. This keeps your flow smooth.

Reconcile Bank Records

Match your bank records each month with your reports. This shows errors fast and ensures your data is both real and clean.

Keep Reports Simple

Avoid long, complex files. Use short, clear formats that show inflows and outflows. Simple reports make reviews faster and more useful.

Benefits of Accurate Cash Flow Statements

Strong Growth Base

Correct records show when you can hire, expand, or invest. This gives you the right push for safe and steady growth.

Better Cash Control

Accurate reports give clear insight into what comes in and goes out. You stay ready for both short-term needs and long-term plans.

Trust with Investors

Clean reports build trust with banks and investors. They prefer firms that share honest data. This makes funding and deals much easier.

Fewer Risks

When records are right, you avoid late fees, cash gaps, or missed bills. It lowers stress and keeps your firm safe.

Smart Decisions

With updated reports, you can see trends early. This helps in cutting costs, boosting sales, or fixing weak areas on time.

Higher Survival Chance

Many firms fail from poor cash flow, not profit. Good reports give you the advantage to last longer and handle tough times.

Easy Planning

Clear records make budget planning simple. You know what you have, what you need, and how to reach your business goals.

Common Signs Your Cash Flow Statements Need Attention

Even well-managed businesses can miss early warning signs in their cash flow statements. Recognizing these signs helps prevent problems before they grow.

Bank Account Often Low

If your bank goes below zero often, money in and out may not match, even if the firm shows a profit.

Clients Pay Late

Late payments from clients reduce cash. Check statements to see if money from sales comes in slower than expected.

Using Too Many Loans

Relying on loans to pay bills shows cash trouble. Clear statements help spot this issue early.

Cash Drops Fast

Big falls in cash may show missed bills, unpaid costs, or slow sales periods.

Unclear Spending Patterns

If you cannot easily track where cash is going, your reports may be incomplete or inaccurate. Simplifying tracking helps identify waste.

Repeated Budget Shortfalls

Falling short of planned spending or reserves signals your statements may not reflect real cash availability.

Cash flow statements are more than just numbers on paper. They are the real mirror of your business health. Mistakes in cash flow often come from mixing profit with cash, misplacing items, or ignoring small but important details. By fixing these, you can avoid cash gaps, build trust, and plan for growth.

At Confiance, we use modern tools to track inflows and outflows in real time, which reduces the risk of mixing profit with cash. We provide updated reports each month. This means no delay or gaps in records. Our team knows how to place each item in the right section, so you don't worry about wrong entries or poor working capital checks. With us, you avoid the usual errors in the cash flow report. You get more time to plan and grow your business without stress.

FAQs

- What is a cash flow statement in simple words?

It shows how much money comes in and goes out of your business during a set time.

- Why is cash flow more important than profit?

Profit may look good on paper, but you need real cash to pay bills, staff, and suppliers.

- How often should I update my cash flow report?

It’s best to check it each month. Small firms may even track it weekly.

- Can late payments hurt my cash flow?

Yes. When clients pay late, you may lack money for short-term needs.

- What tools help with tracking?

Cloud systems, finance apps, and expert support help to make tracking easy.

- Why do businesses fail even if they make a profit?

They fail when cash runs out. Poor tracking or missed trends in flow often cause this.